Streamline Tax Compliance with Sleek Bill's Effortless Assistance in Managing GST Composition Scheme.

*Free & Easy - no hidden fees.

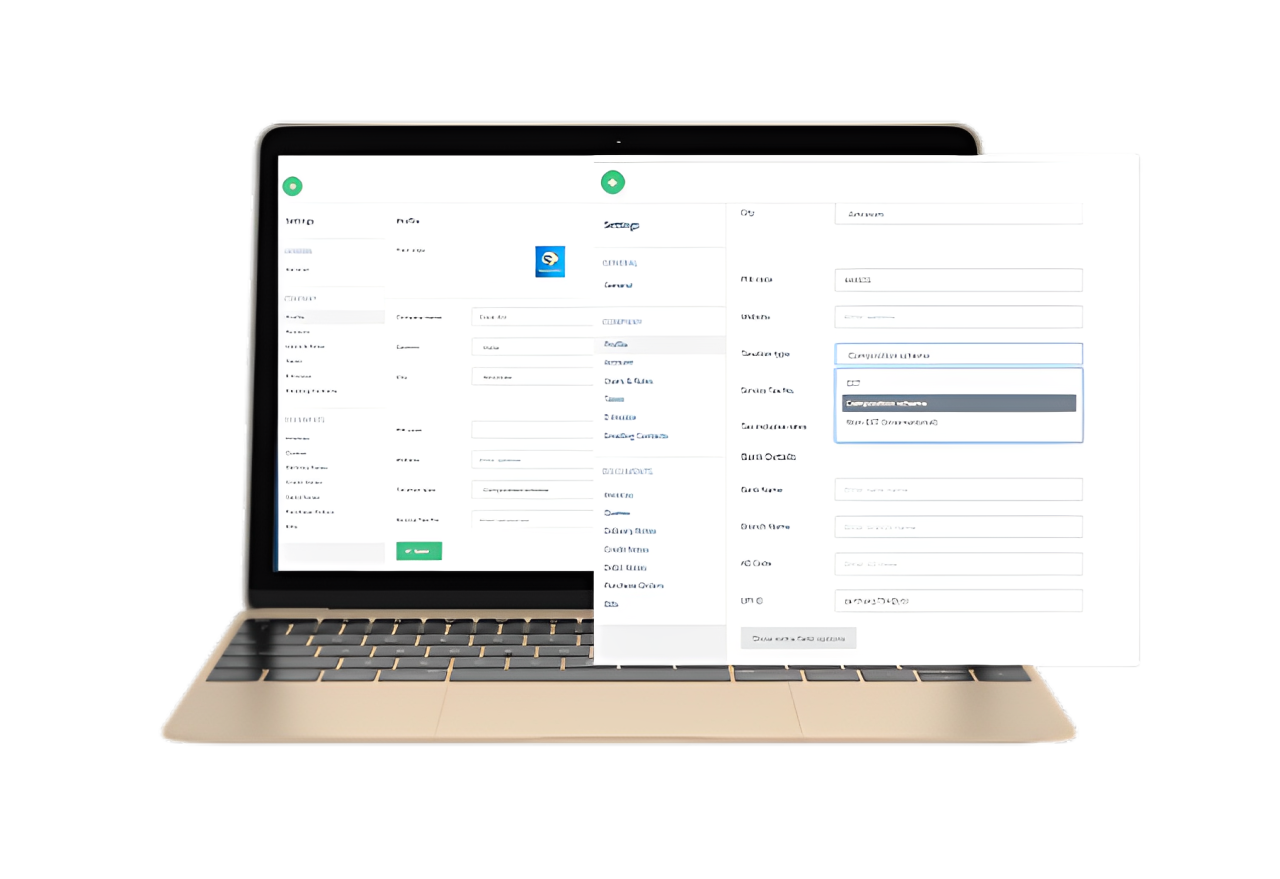

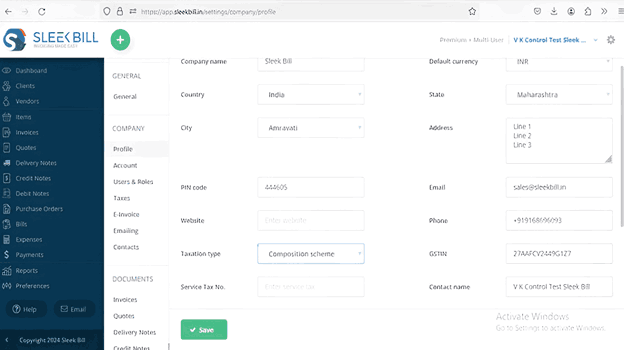

Signup or Login into www.sleekbill.in

Signup or Login into www.sleekbill.in

Click on Company

Click on Company

Go in Profile Section and click on profile.

Go in Profile Section and click on profile.

Upload your logo, Fill-up company name, country, City, Pin, Website

Upload your logo, Fill-up company name, country, City, Pin, Website

Select Taxation Type- Composition scheme

Select Taxation Type- Composition scheme

Enter service tax number.

Enter service tax number.

Make on the tax inclusive rates.

Make on the tax inclusive rates.

Fill up Bank Details

Fill up Bank Details

Fill up the rest of information in right collum which is essential.

Fill up the rest of information in right collum which is essential.

Click on Save Button.

Click on Save Button.

In the vast realm of taxation and invoicing, the Goods and Services Tax (GST) Composition Scheme emerges as a beacon for small and medium businesses. Designed to simplify the tax mechanism, the scheme offers a way for taxpayers to be free from intricate GST formalities and instead pay tax at a fixed rate.

At Sleekbills.in, we recognize the importance of this scheme for many Indian businesses. With our solutions, not only do we provide an efficient platform for managing the nuances of the GST Composition Scheme, but we also guide businesses through its essentials, benefits, and best practices.

In the vast landscape of GST, the Composition Scheme emerges as a beacon of simplicity and convenience. Aimed to benefit the taxpayers, it's an initiative that reflects the commitment to make the GST regime more taxpayer-friendly. Let's delve deeper into what makes the Composition Scheme a preferred choice for many.

The GST Composition Scheme is a specially crafted scheme under GST that caters to taxpayers seeking a simplified process. It's a testament to the understanding that not all businesses operate on the same scale, and there's a need for varied approaches. With sleekbills.in, understanding and leveraging the benefits of this scheme becomes even more straightforward.

One of the significant attractions of the Composition Scheme is its ability to eliminate cumbersome GST formalities. It's designed for those who want to be GST-compliant without getting entangled in its intricate web. And with sleekbills.in by your side, navigating the nuances of GST becomes a walk in the park.

Transparency is the hallmark of the GST Composition Scheme. Taxpayers under this scheme are privy to a fixed rate of turnover, ensuring they're always in the know, with no hidden surprises. It's a system of clarity and predictability, qualities that sleekbills.in champions in its offerings.

The Composition Scheme under GST is tailored for a particular segment of taxpayers, ensuring they benefit from a simplified taxation process. If you are wondering if this plan is right for your business, here's a breakdown of the eligibility criteria:

The primary eligibility revolves around the turnover. Only taxpayers whose annual turnover doesn't exceed Rs 1.5 crore can opt for the GST Composition Scheme. It's designed specifically to aid smaller businesses and traders, ensuring they can navigate the GST world without feeling overwhelmed.

While primarily aimed at traders and manufacturers, the GST Composition Scheme does provide some leeway for service providers. A composition dealer can offer services, limited to 10% of turnover or Rs. 5 lakhs, ensuring small-scale service providers enjoy the benefits of the scheme.

The ever-evolving nature of the GST landscape means regular updates and changes. On 10th January 2019, during its 32nd meeting, the GST Council proposed an increase in the limit for service providers opting for the GST Composition Scheme, further broadening the scheme's scope and appeal.

It's essential to note that when determining the turnover threshold, one needs to consider the turnover of all businesses registered under the same PAN. It ensures that the scheme's benefits aren't misused by segmenting a larger business into smaller entities.

While the Composition Scheme under GST offers numerous benefits and simplifications, it's not a one-size-fits-all solution. There are specific exclusions to ensure the scheme's integrity and prevent misuse. If you're considering opting for this scheme, it's essential to be aware of the exceptions.

Certain manufacturers, like those of Ice Cream, Pan Masala, or Tobacco, are excluded from the GST Composition Scheme. Manufacturers producing these items cannot avail of the GST Composition Scheme. These products have their own set of complexities and taxation rates, making them incompatible with the simplified structure of the Composition Scheme.

The GST Composition Scheme is tailored for businesses that operate primarily within a single state. If you're engaged in inter-state supplies, this scheme is off the table. The essence of the GST Composition Scheme lies in its simplicity, and inter-state transactions introduce complexities that don't align with this scheme's philosophy.

Those classified as casual taxable persons or non-resident taxable individuals are not eligible for the GST Composition Scheme. These categories of taxpayers typically have distinct operational patterns, making them unsuitable for the simplified framework of the Composition Scheme.

Evaluate its benefits against limitations to align seamlessly with your long-term goals. Get insights for strategic business decisions!

*Free & Easy - no hidden fees.

For small taxpayers who wish to simplify their GST procedures, the GST Composition Scheme offers an excellent alternative. However, one can't simply start availing of the benefits of this scheme without intimating the authorities. The procedure for opting into the Composition Scheme is laid out in a structured manner to ensure compliance. Here's how a taxpayer can choose the GST Composition Scheme:

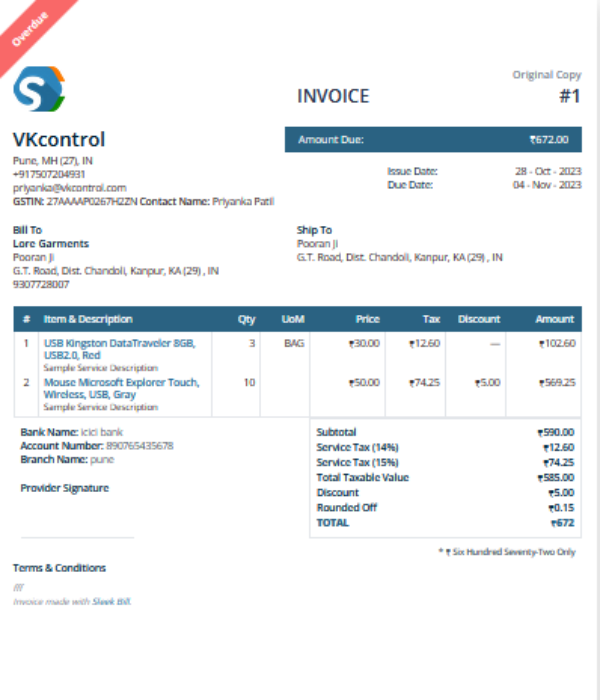

Professionalism: A well-structured invoice format exudes professionalism, building trust with clients and stakeholders.

Professionalism: A well-structured invoice format exudes professionalism, building trust with clients and stakeholders.

While the GST Composition Scheme has its set of advantages, it's essential to understand its limitations to make an informed decision. Sleekbills.in highlights the primary challenges associated with this scheme to provide businesses with a comprehensive understanding.

1. Restricted Business Territory: One significant limitation of the GST Composition Scheme is that it confines businesses to their home state. Composition dealers cannot expand their reach beyond state boundaries, which can be a significant impediment for businesses looking to grow and tap into markets across states.

3. No Inter-State Transactions: Directly linked to the territorial restriction is the inability of composition dealers to conduct inter-state sales. This can be especially challenging for businesses that have potential clients or a market base in other states.

2. Restrictions on Product Portfolio: Composition dealers face limitations in the kinds of products they can sell. They cannot supply non-taxable goods under GST, like alcohol. Additionally, leveraging the ever-growing e-commerce space can be a challenge, as these dealers cannot supply goods through e-commerce platforms.

4. Ineligibility for Input Tax Credit: The GST Composition Scheme's structure means that dealers cannot claim Input Tax Credit (ITC) on their purchases. This can increase the cost of inputs and, consequently, the cost of the final product or service, potentially affecting competitiveness in the market.

In the final step, input the transportation details to ensure the e-Way Bill reflects all the necessary information for the transit of goods:

1.Mandatory Declaration:

Every bill of supply issued by a composition dealer must prominently feature the statement – “Composition Taxable Person, Not Eligible to Collect Tax on Supplies.” This ensures clarity and transparency between the dealer and the customer.

2.Essential Components:

The Bill of Supply format is structured to capture all the necessary transaction details, ensuring that both the dealer and the customer have a clear record of the sale. Here are the essential components that should be included.

3 Supplier's Details:

This section should clearly mention the supplier's name, address, and their unique GST Identification Number (GSTIN).

4 Serial Number:

Each bill of supply should be sequentially numbered and identified by a unique bill of supply number.

5 Product Classification:

The Harmonized System of Nomenclature (HSN) code corresponding to the goods being supplied should be mentioned.

6 Product/Service Details:

A clear description and quantity of the goods or services being supplied should be outlined.

7 Value of Supply:

The total value of the goods/services supplied, adjusted for any discounts or rebates, should be clearly stated.

8 Authentication:

The bill should be authenticated with the signature or digital signature of the supplier or their authorized representative.

The GST Composition Scheme offers several advantages, especially for small businesses and traders. By understanding these benefits, businesses can make an informed decision about whether this scheme aligns with their operational needs. Sleekbills.in outlines the core advantages of this scheme to facilitate better decision-making.

Simplified Compliance:

One of the primary attractions of the GST Composition Scheme is its reduced compliance requirements. Businesses registered under this scheme don't have to grapple with the complexities of multiple return filings. Moreover, the intricacies of maintaining detailed books of records and issuing GST-compliant invoices are eliminated, making the whole taxation process much more straightforward.

Reduced Tax Burden:

The Composition Scheme has been strategically crafted to mitigate the tax burden faced by small businesses. In contrast to the intricate system of multiple tax rates prevalent in the standard GST regime, composition dealers are afforded the advantage of a fixed and nominal tax rate. This approach proves advantageous for their cash flows and overall profitability, providing a streamlined and simplified taxation framework.

Enhanced Liquidity:

Due to the reduced tax rate facilitated by the GST composition scheme, businesses have increased cash flow at their disposal. This increased liquidity not only represents a surplus in working capital, providing avenues for reinvestment to fuel growth and expansion, but also acts as a safety net, ensuring that the business is equipped to face any unexpected expenses that may arise during the course of the business.

The Composition Scheme under GST offers a simplified taxation process, but businesses operating under this scheme still have certain tax obligations. For composition dealers, it's essential to understand how the GST payment process works to ensure compliance and accurate payment.

Components of GST Payment

A composition dealer's GST payment is not a simple percentage of turnover, unlike regular dealers; it involves a combination of various factors. This complexity distinguishes it within the framework of the Composition Scheme.

Supplies-Made GST Implications Unveiled

The GST payment centers on taxing supplies at a fixed rate under the Composition Scheme. Manufacturers pay a set percentage of turnover, and service providers have their own fixed percentage.

Reverse Charge Taxation Explained

In certain cases, recipients, not suppliers, handle GST payments through the Reverse Charge Mechanism (RCM). Composition dealers, like other taxpayers, must meet tax obligations for goods, services received under RCM.

Unregistered Dealer Purchase Tax

If composition dealer purchases from non-GST registered supplier, they assume responsibility of paying GST on behalf of unregistered supplier, sure integration of all transactions with suppliers into GST framework.

The Composition Scheme under GST is designed to simplify tax procedures for small taxpayers. However, there are specific conditions that businesses must meet to avail of this scheme. Let's delve into the conditions set by the GST Council to ensure the scheme's proper and fair utilization:

Bill of Supply Specification:

It is crucial for each bill of supply issued by a composition dealer to explicitly feature the designation 'composition taxable person.' This incorporation is vital for differentiating these bills from regular tax invoices, ensuring clear identification, transparency, and compliance with the distinctive attributes of transactions under the composition scheme.

No Supply of Non-taxable Goods:

A composition dealer is prohibited from supplying goods that are not taxable under GST. For instance, supplying alcoholic beverages, which are outside the purview of GST, disqualifies a dealer from the Composition Scheme.

Transactions under Reverse Charge Mechanism:

For transactions governed by the Reverse Charge Mechanism (RCM), taxpayers have to pay tax at the standard rates, even if they are under the Composition Scheme.

Unified Registration for Multiple Business Segments:

If a taxable person operates multiple business segments under a single PAN (like textiles, groceries, electronic accessories, etc.), they must either register all these businesses under the Composition Scheme or opt out entirely. Splitting some businesses under the scheme and others under regular GST is not allowed.

Prominent Display of 'Composition Taxable Person':

Businesses under this scheme must display the words ‘composition taxable person’ prominently on every sign board or notice at their place of business. This ensures transparency and informs customers of the business's tax status.

No Claim for Input Tax Credit:

Businesses that choose the GST Composition Scheme cannot claim the Input Tax Credit (ITC). This means they can't reduce their tax liability by claiming credits for the GST paid on inputs.

For businesses operating under the GST Composition Scheme, the billing process differs from regular taxpayers. While they benefit from simplified tax procedures and reduced tax rates, they also have specific restrictions. One of the notable distinctions is how a Composition Dealer raises a bill:

Self-Paid Tax:

Since a Composition Dealer can't collect tax from customers, the tax amount is borne by the dealer. This means that they pay the GST from their own revenues, making it crucial for them to factor this into their pricing and financial planning.

Issuing Bill of Supply:

In the absence of tax invoices, Composition Dealers are required to issue a "Bill of Supply." This document serves as evidence of the sale but does not include any tax amount, given the scheme's constraints.

Mandatory Mention on Bill:

To ensure transparency and compliance, every Bill of Supply issued by a Composition Dealer must prominently display the phrase “composition taxable person, not eligible to collect tax on supplies” at its top.

No Tax Invoice:

Unlike regular GST dealers, a Composition Dealer is not permitted to issue a tax invoice. This stems from the inherent nature of the Composition Scheme, where the taxpayer can't collect GST from their customers.

No Tax Collection:

The Composition Scheme is designed to simplify tax processes for small businesses. As a result, these dealers cannot charge GST to their customers. Instead, they bear the tax burden themselves.

Limited Business Scope:

Composition Dealers must follow restrictions on goods or services under the Composition Scheme, ensuring eligibility compliance and careful consideration of the business model for regulatory adherence.

"Gain clarity on eligibility criteria and align your business operations effortlessly. Experience GST simplicity – choose Sleekbills.in for informed decisions on the Composition Scheme."

*Free & Easy - no hidden fees.

The GST Composition Scheme, with its unique features and benefits, aims to reduce the tax burden on small businesses, making their financial operations more straightforward. However, navigating the intricacies of this scheme requires clear understanding and a system that supports its implementation.

At Sleekbills.in, we're dedicated to ensuring that businesses get the best out of the GST Composition Scheme. Our tailored solutions, from optimized bill formats to comprehensive guides, ensure that businesses remain compliant, efficient, and productive. Choose Sleekbills.in, and let us be your partner in mastering the GST Composition Scheme.