Making export invoices with multi-currency billing is now easier with our

GST compliant export invoice format.

*Free & Easy - no hidden fees.

![]() Call For Demo 9168696091/92/93

Call For Demo 9168696091/92/93

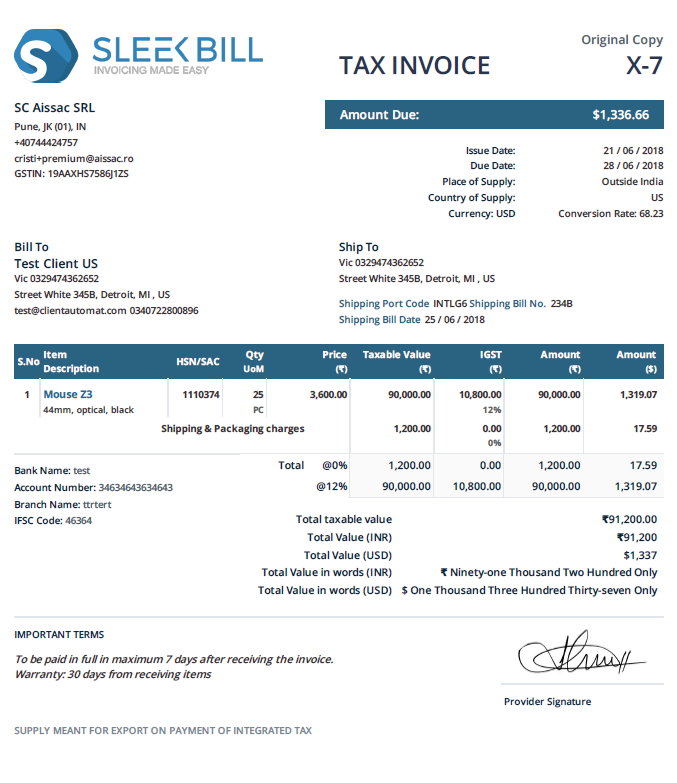

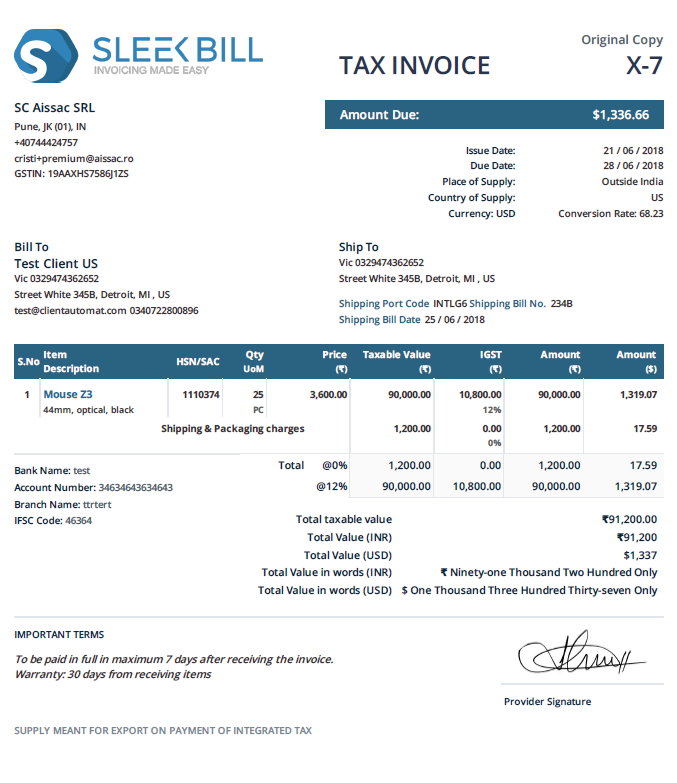

By now, most businesses are familiar with the specific type of invoice needed in GST, the tax invoice, which we discussed in depth here. However, what to do if you also trade with businesses outside of India who ask for invoices in a different currency? In that case, you would need to create an invoice for export, which will still have to respect the same GST tax invoice rules. We’ll be looking at how to make one and it’s particularities.

An export invoice is a GST tax invoice that you create for clients that are outside of India and request an invoice with a different currency on it. It has the same format and requirements as a normal GST tax invoice, but it needs some extra details that will be discussed below.

An invoice for export must contain the following:

Name, address and GSTIN of supplier - your details just as a tax invoice for India contains them.

Invoice number (just as before, a numeric series specific for a financial year)

Date of issue

Due date

Now, here is where a tax invoice for export becomes different:

Name, billing address and if different, shipping address of the recipient - as the country of the recipient is different than India, your place of supply will be “Outside India”

Next, you will need to add the type of export.

There are 3 types of export, let’s try to understand each one:

Export under Bond/ LUT - supply of goods, services or both, under bond or letter of undertaking, without paying IGST, and them claiming a refund of unutilized ITC on purchases of inputs used for supplying the respective exported goods or services

Export with IGST - Any exporter, the UN, any Embassy or other agencies who supply goods or services, paying IGST, can claim a refund on the IGST paid on the supplied goods or services

SEZ with IGST - Since the supply of goods or services to SEZ is treated as a zero-rated supply, no IGST will be paid on such supply. If you enter the GSTIN of their receiver, the country of supply will be selected as India and the currency of the invoice will be INR.

Your invoice should contain a line, usually at the bottom, that mentions which of these types of export the invoice falls under. Example: Supply meant for export on payment of integrated tax.

Add Shipping Bill information, such as date, number and port code. If you do not have these details, you can still create an export invoice but you will need this information when applying to claim refund of taxes paid.

Then, you will need to set the conversion rate, from INR to the selected currency of your client. This rate will be mentioned on the bill of export issued by the custom authorities.

Enter items details with quantity, units of measurements, description

Tax rate for each item, with tax amount shown in separate columns (ex. IGST, CESS if applicable)

Signature (or digital signature) of the supplier or an authorized person

At the end of the invoice, you should have your total value of the bill in terms of INR and the foreign currency.

As stated under section 2 (i), DTA is defined as "the whole of India but does not include the area of the special economic zones."

In short, when you create a new tax invoice in Sleek Bill and select a non-India client, you will be able to add the currency of your invoice, information for your shipping bill and the type of export. Currently, the system supports three types of export: Export under Bond/LUT, Export with IGST, SEZ with IGST.

This export invoice template is designed to be GST compliant and each one that you create is automatically entered in GSTR1.

If you want to find out more details about how can do this in Sleek Bill, we wrote a step by step how to article to help you out.

International shipments require a packing list to guard against incorrect cargo. This document supports goods being shipped from one business to another.

Seek bill offer three option use in currency

You can use your own country currency

You can use your own country currency

You can use both you.

Imagine you're making shirts to sell abroad. You buy cloth, buttons,threads etc., paying GST on them. When you export the shirt, you can claim a refund for the GST paid on that input. Here's how:

Export the goods/services: First, you actually need to export!

Submit GST returns on time by filing GSTR-1 and GSTR-3B to report your export sales. With Sleek Bill, you can easily create GSTR-1 and GSTR-3B reports. There are two Types of refunds options:

IGST refund on exports with IGST payment: Pay IGST on your exports and then claim a refund for the amount paid. This is generally faster.

Refund of Input Tax Credit (ITC): when you export without paying IGST (under a Letter of Undertaking or Bond).You claim on refund of the ITC collected on the inputs used for exports.

Online process: The entire refund process is mostly online through the GST portal.

Verification: Tax authorities will verify your claim.

Refund disbursement: If everything is fine, the refund will be credited in to your business bank account.

To be considered a valid export under GST and claim refunds, you generally need to meet these conditions:

Goods must be sent out of India: This is the most basic condition.

Services must be provided to a recipient outside of India: The receiver of your service must be located outside India.

You must receive payment in a foreign currency that can be easily converted.

Additionally, you need to have all the required documents, such as invoices and shipping bills, to show proof of the export.

Exporting services under GST has some specific points:

Place of supplier and recipient: The supplier must be in India, and the recipient of service or goods must be outside of India.

Place of supply: The place of supply should be outside India.

No establishment in India: The recipient of the service should not have an establishment in India.

IT services provided to a company in the US.

Consultancy services given to a client in the UK.

The refund process depends on the type of refund you applying for refund ITC :

IGST Refund for Exports: If you paid IGST while exporting goods or services, you can claim it get a refund.

Input Tax Credit (ITC) Refund: This is calculated using a formula where your export turnover is multiplied by the eligible ITC and then divided by your total adjusted turnover.

Net ITC: Input Tax Credit available.

Adjusted Total Turnover: Total turnover minus exempt supplies.

Time limits: There are time limits to claim refunds, so don't delay.

Professional help: GST can be complex. Consider consulting a tax professional for specific guidance.

I hope this explanation is helpful! If you have more specific questions, feel free to ask.

A GST export invoice is similar to a regular GST invoice with some additional details specific to exports:

Invoice Number: Use a unique and sequential numbering system for the invoice.

Mention "Export Supply": Clearly indicate that the invoice is for export.

Currency: Select The client currency or owner currency.

Shipping Details: Mention the shipping bill number, port code, and the country where the goods originate.

Exporter’s GSTIN: Enter the GST Identification Number (GSTIN).

Zero-Rated Supply: Mention that the supply is categorized as zero-rated under GST regulations.

Export Type: If exporting under a Letter of Undertaking (LUT) select Export type Export Under LUT/Bond.

Key Details to Include in an Export Invoice: Buyer's name and address (foreign buyer). Invoice number and date.

Description of goods or services. Quantity and value in foreign currency. Total invoice value in foreign currency.

Shipping bill number and date (if applicable). Port code and country of origin. Exporter’s GSTIN. LUT/Bond number and date (if applicable).

Exports are classified as "zero-rated supplies," No, GST is not charged on export invoices. However, you can claim a refund of the Input Tax Credit (ITC) paid on inputs used for these exports.

Yes, GST rules outline the mandatory fields that must appear on invoices. While the format can vary based on your accounting software or billing system, these fields are required: Place of supply. Invoice number and date. Supplier's GSTIN, name and address, contact. Recipient's name, address, and GSTIN Description of goods or services. HSN code or SAC code. Quantity, unit, and total value. GST rate (zero for exports) and GST amount (zero for exports).

When the export is under Letter of Undertaking (LUT), you don't need to pay IGST advance. Here's what to do:

Obtain an LUT:Apply for an LUT from GST authorities.

Mention LUT Details: Include the LUT number and date on your export invoice.

No IGST: Do not charge IGST on the invoice. The tax amount will be zero.

Follow Export Invoice Requirements: Include all the necessary export invoice details mentioned earlier.

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about Security & Privacy

Serious about Security & Privacy100% GST approved for your exporting needs. Seamlessly add export type (LUT, BOND, SEZ), shipping bill info and foreign currency.

*Free & Easy - no hidden fees.