Sleek Bill helps you make invoices for SEZ. Read along to find out more about

supply to SEZ under bond, LUT or by paying IGST.

*Free & Easy - no hidden fees.

GST rules state that supplies to and by SEZ units have to be treated as inter-state supplies, which means IGST at the appropriate rate should be charged on them.

Under GST, supplies made to SEZ from a domestic tariff area can be made at 0 rate, however, the other way around, from a SEZ unit to a domestic tariff area are subjected to the applicability of GST. DTA units who are under composition scheme are not able to supply to SEZ units due to their treatment as inter-state supply - composition scheme dealers are restricted from making inter-state supplies.

We'll be looking further into supplies made by and to SEZ units.

As stated in section 2 (19) of IGST Act, a Special Economic Zone will have the same meaning as defined in clause (za) of Section 2 of the Special Economic Zones Act, 2005. According to this clause, Special Economic Zone means each SEZ notified under the proviso of sub-section (4) of section 4 (including Free Trade and Warehousing Zone) and includes existing Special Economic Zones.

As stated under section 2 (i), DTA is defined as "the whole of India but does not include the area of the special economic zones."

As per the GST rules, the supply of goods or services to SEZ are treated as zero-rated supplies.

According to section 16 (1) of the IGST act, 2017, zero-rated supplies include any of the following:

- Exports of goods, services or both, or

- Supply of goods, services or both to a SEZ developer or a SEZ unit

As stated in section 16 (2) of IGST Act, Input tax credit is available for making zero-rated supplies.

As dictated by the GST rules, there are two possibilities for supplying goods and/ or services to SEZ:

- Supplying goods or services to SEZ without paying IGST or

- Supplying goods or services to SEZ and paying IGST.

In order to supply to SEZ without paying IGST, a business has two options: supplying under LUT (letter of undertaking) or bond.

In order to supply under LUT, according to notification no. 16/2017 of central tax, the supplying registered person has to meet these conditions:

- A status holder as specified in paragraph 5 of the Foreign Trade Policy 2015 - 2020, or

- A taxpayer who has received the due foreign inward remittances amounting to a minimum of 10% of the export turnover, which should not be less than one crore rupees in the preceding financial year,

- and who has not been prosecuted for any offence under the Central Goods and Services Tax Act, 2017 (12 of 2017) or under any of the existing laws where the amount of tax evaded exceeds two hundred and fifty lakh rupees.

LUT is accepted by the assistant or deputy commissioner and has a validity period of 12 months. Under LUT, only in the case of a breach of the letter of undertaking, there would be a need for a bank guarantee, as opposed to bond where the bank guarantee is mandatory, which makes LUT an easier option.

The supplier can use input tax credits against any other supplies. When supplying to SEZ under LUT, on the invoice it should be mentioned clearly "Supply meant for SEZ under LUT without payment of integrated tax".

As of the end of February 2018, online filling of LUT has been enabled and can be furnished in form GST RFD 11.

When supplying goods or services under bond to a SEZ unit, without paying IGST, the following conditions apply:

- The supplier executing the bond can use the input tax credit on all other domestic supplies;

- An indemnity bond in format GST RFD-11 on a non-judicial stamp is needed;

- A bank guarantee in the form of security is needed while executing the bond;

- The bank guarantee amount cannot exceed 15% of the bond amount;

- The Bond will be accepted by the assistant or deputy commissioner.

On the invoice supplied to SEZ under bond, it should be clearly stated "Supply meant for SEZ under bond without payment of integrated tax."

Supplying goods or services to SEZ can be done also by paying IGST. In this case, a supplier's invoice must have a clear statement that says "Supply meant for SEZ with payment of integrated tax".

Suppliers who cannot use LUT for any reason can opt for charging IGST, as stated under section 16 (3) of the IGST Act. The respective amount of IGST can be claimed as a refund by the supplier and they can also ask the SEZ unit to claim a refund of IGST charged, in case the supplier cannot claim it himself.

According to rule 47 of the Special Economic Zones Rules, 2006, the supply of goods from SEZ is liable for payment of customs duty based on terms found in section 30 of the Special Economic Zone Act, 2005. As per section 30 of the Special Economic Zone Act, 2005, goods removed from SEZ will be chargeable to duties of customs.

Based on the above rules, supplies made by SEZ to domestic tariff areas should be treated as imports into India, which means that customs duties have to be paid by the importer when receiving the goods, under the Customs Tariff Act, 1975, including integrated tax.

As per the rules of section 3 (7) of the Customs Tariff Act, "any article which is imported into India, shall, in addition, be liable to integrated tax at such rate, not exceeding 40% as is liable under section 5 of the Integrated Goods and Services Tax Act, 2017".

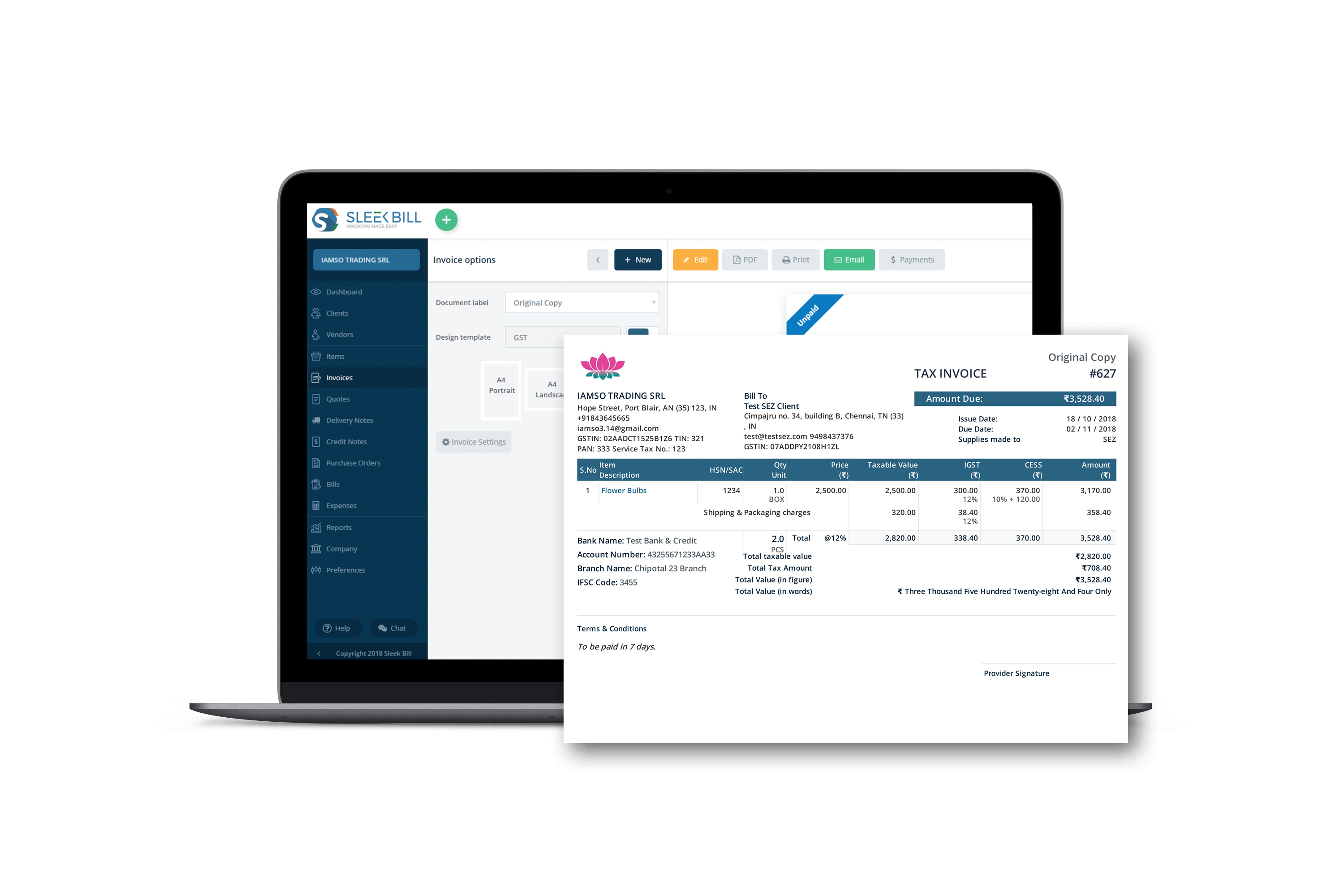

In Sleek Bill it's easy to make an invoice to a client in SEZ. You need to do 2 things to make sure you are doing it the right way:

A modern business that wishes to thrive in the GST era can no longer spend large amounts of time on billing and spreadsheets.

Be GST ready and chose a billing software that evolves as per your business�s needs.

*Free & Easy - no hidden fees.

Anyone can use this for their billing from the first day of installation. I personally like to use this high-tech billing software for its billing pattern and the customization options. I've been using Sleek Bill for the last 2 years and I am happy with the telephone & online support [...]. I would like to thank team Sleek Bill for best, on time support and I recommend this billing software for every small business.

It has very good options for creating quotations and invoices. Our work got simplified and we don't have to waste our time so much. Also, we got good support from your team in the initial stages when we really needed it. We would definitely recommend to our friends.

This really is an awesome software. It's quite easy to use and economical, at a very attractive price. Support from the team was quite impressive. I think any person who wants computerized billing should use Sleek Bill software.