GSTR-1 is a monthly statement done by all normal registered

taxpayers that summarizes outward supplies. Find out all about filling,

format and rules.

*Free & Easy - no hidden fees.

The government has approved of a new GST Return format and has made some changes to ease the process of compliance for all taxpayers that fall under GST. We'll have a broader look on what GSTR-1 is, who files it, when to file, what it should include and what does e-filing mean.

1. What is GSTR-1?

2. Who has to file GSTR-1?

3. When is GSTR-1 due?

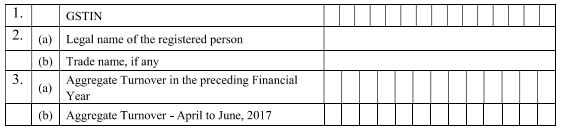

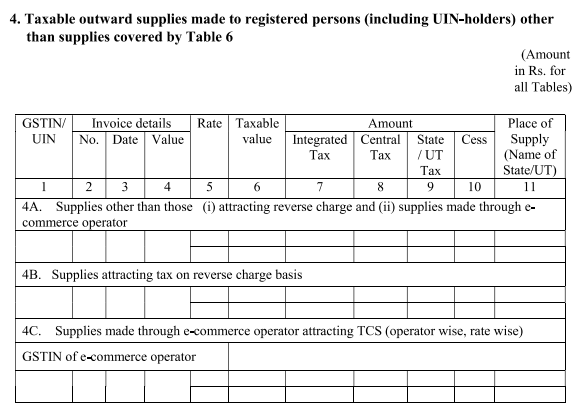

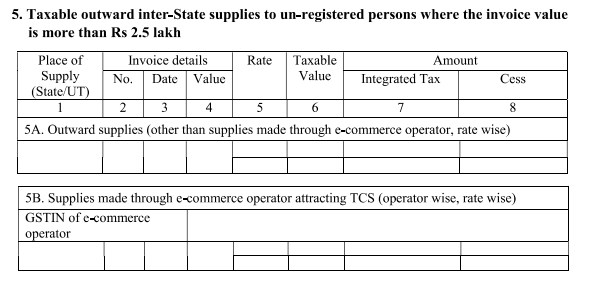

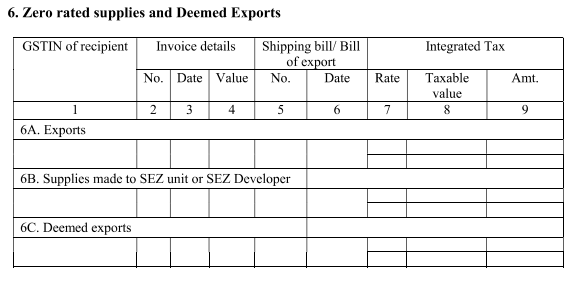

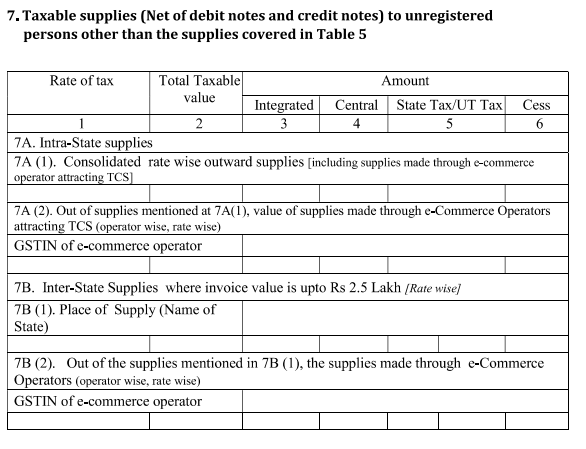

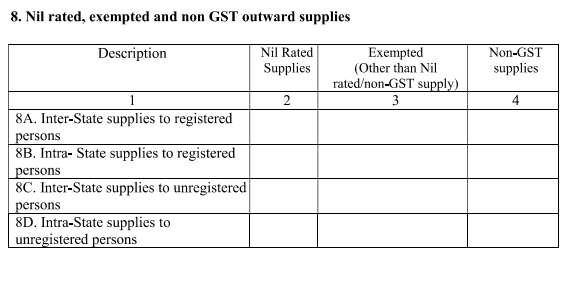

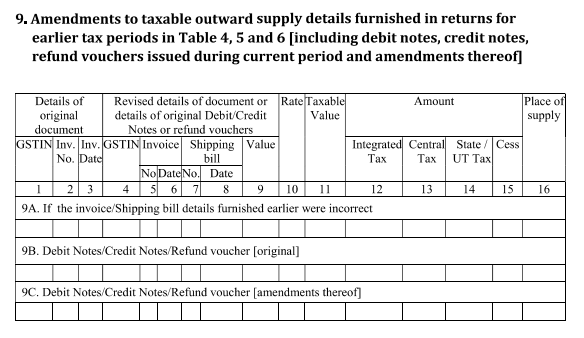

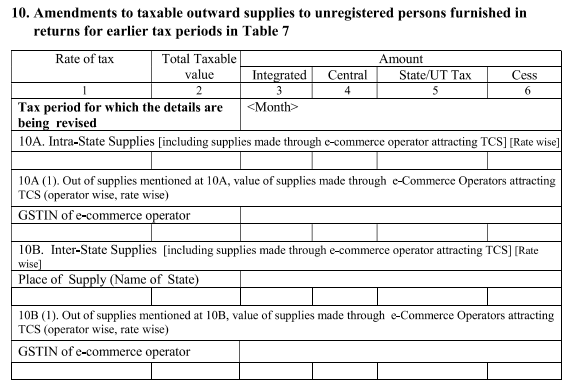

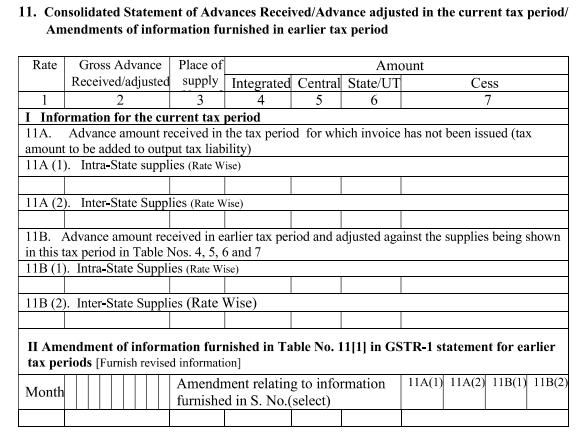

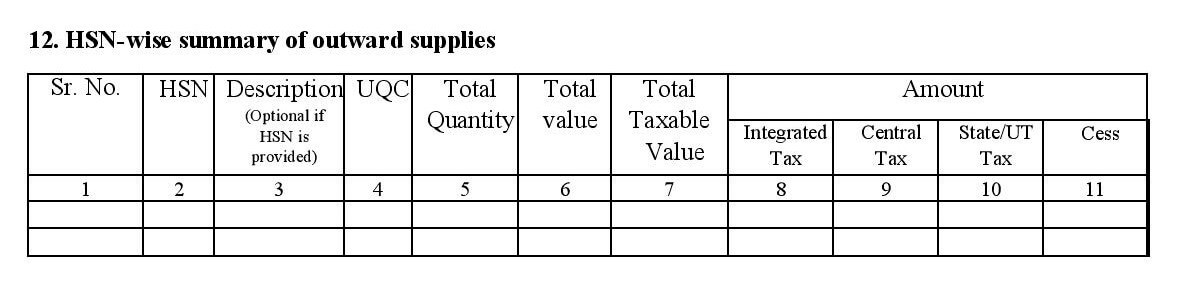

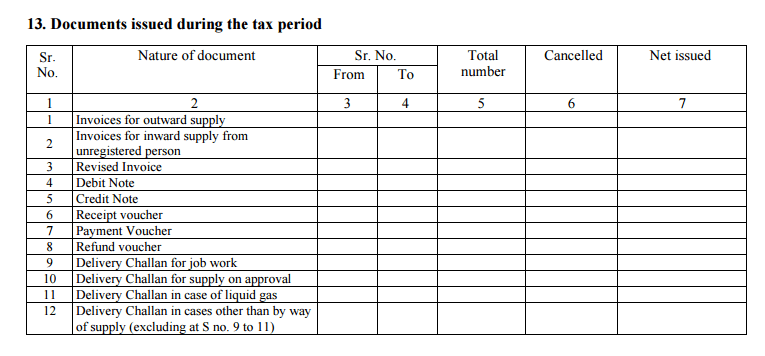

4. What details should GSTR-1 contain?

5. How to file GSTR-1 on Sleek Bill software?

GSTR-1 is a monthly report done by all regular and casual registered taxpayers that needs to include details about the outward supplies for the taxable period. In layman terms, GSTR 1 contains details about all the sales transactions that a registered dealer has done in a month.

GSTR-1 contains details about:

The GSTR 1 that a registered dealer files is used by the government to auto complete GSTR 3 for said dealer and GSTR 2A for dealers to whom the respective supplies have been made.

GSTR-1 has to be filed even in situations where there is no business activity in a given taxable period.

All GST registered suppliers are required to file GSTR 1, no matter if they have done any business transactions during the reporting month or not. They can do this though the government GST online portal, the offline portal that is provided specially for returns or through a GST Suvidha Provider (GSP).

There are some categories of registered persons who are exempted from filing GSTR 1, these include:

LATEST UPDATE: 6th of October 2017

As per the 22nd GST Council meeting the following has been decided:

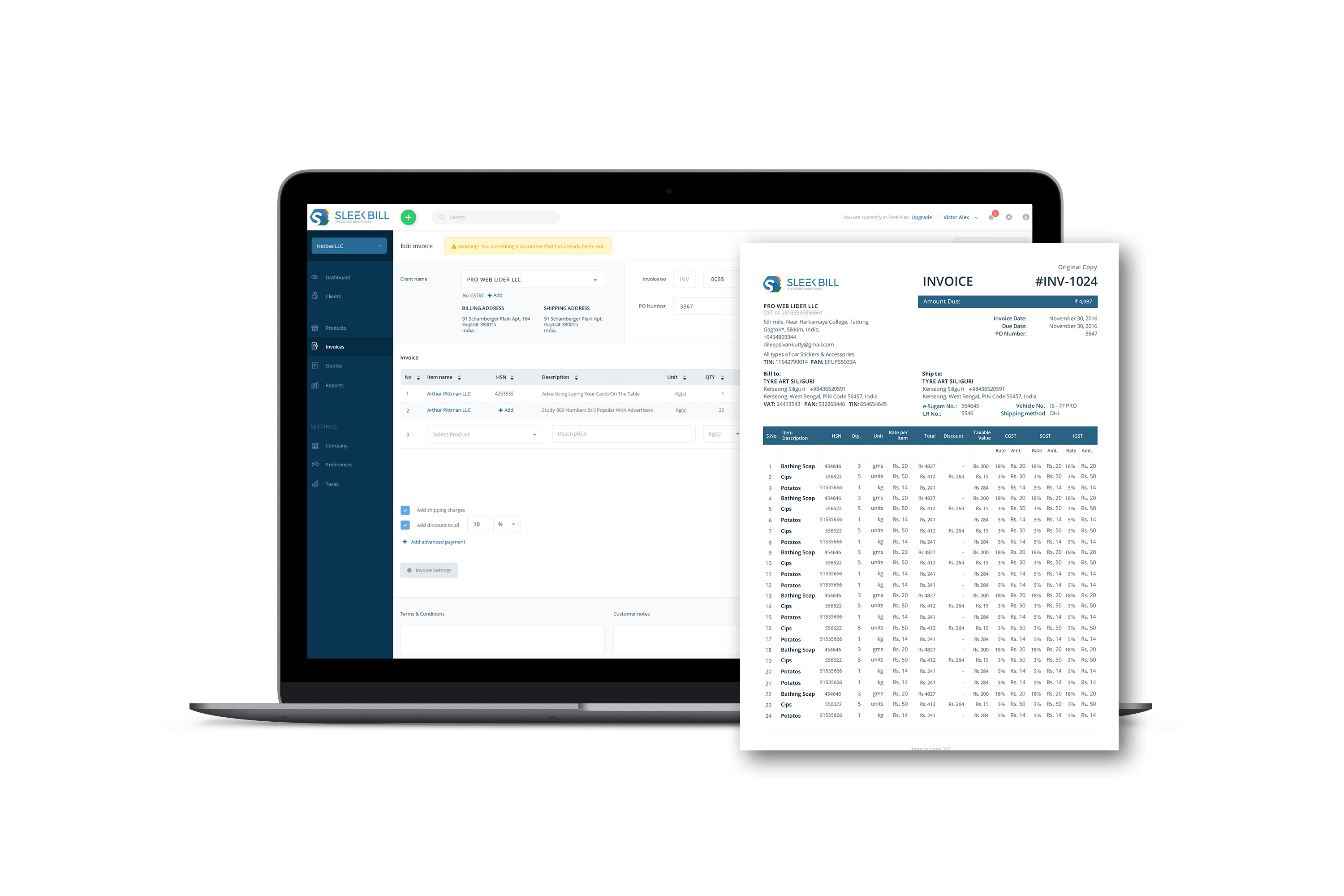

First you need to have an account in Sleek Bill Online, where all your invoicing data can be kept. Then in 3 simple clicks you are ready to file your GSTR-1 report.

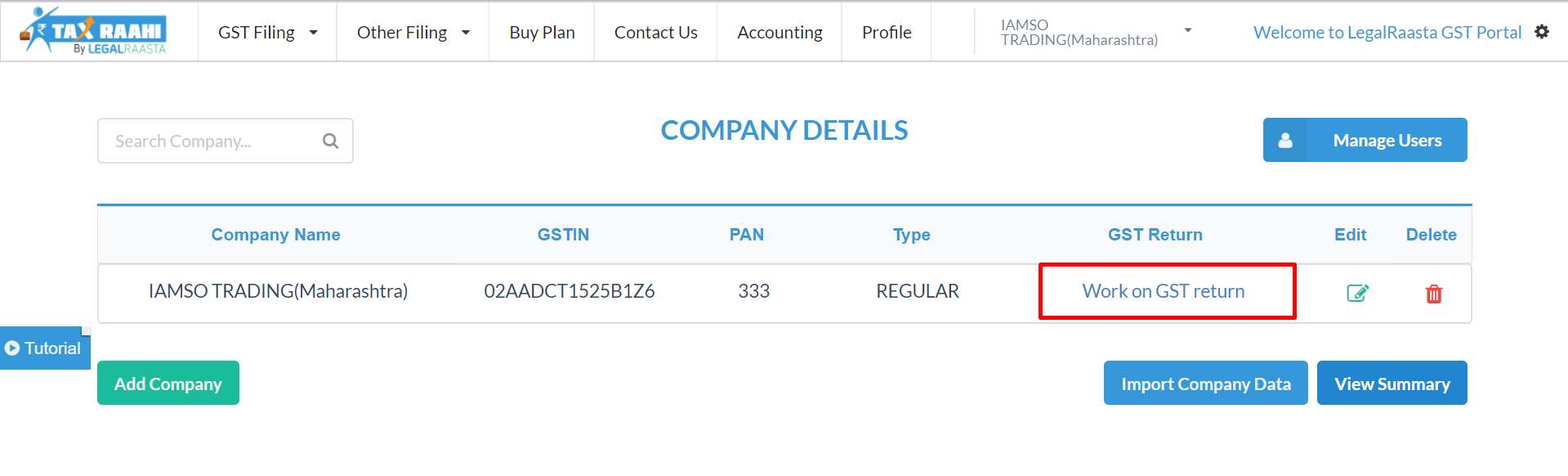

All you need to do is go into your account, go to the "GST Reports" section and choose "Sync Data to LegalRaasta" (LegalRaasta is our GSP partner that helps us and you file GSTR reports online with ease).

This way your GSTR-1 data is safely uploaded to their website and an account on LegalRaasta is automatically created for you. You can login to your LegalRaasta account straight from the Sleek Bill Online interface, review your data and file it.

Learn more about Filing GSTR-1 from Sleek Bill.

Alternatively you can file your GST Report using the government offline tool https://www.gst.gov.in/download/returns (free of charge)

Don't waste your time with complicated excel spreadsheets, choose GST billing software that evolves with your business needs.

*Free & Easy - no hidden fees.

Anyone can use this for their billing from the first day of installation. I personally like to use this high-tech billing software for its billing pattern and the customization options. I've been using Sleek Bill for the last 2 years and I am happy with the telephone & online support [...]. I would like to thank team Sleek Bill for best, on time support and I recommend this billing software for every small business.

I've been using Sleek Bill for 4 months now and I love it. It is very User friendly and easy to setup. It's a complete software where you can easily create invoices, quotations etc. The customer support was very good and helpful. The value of this program is one of the best around.

I have found the best invoicing software for my business. A big thank you to the team for helping us throughout the process and answering our questions.