In GST regime process of taxation and invoicing, Composition Scheme is a simple and easy introduce under GST for small businesses. This scheme simplifies the tax process. This scheme offers a way for small businesses to free from submit GST formalities into single complicated way other than pay GST at fixed rate.

In Sleek Bill billing software recognize the importance of this composition scheme for many small and medium businesses in India. With Sleek Bill billing software not only provide an efficient platform for manages the variations of GST composition scheme, in this page we guide essentials, benefits and good practices.

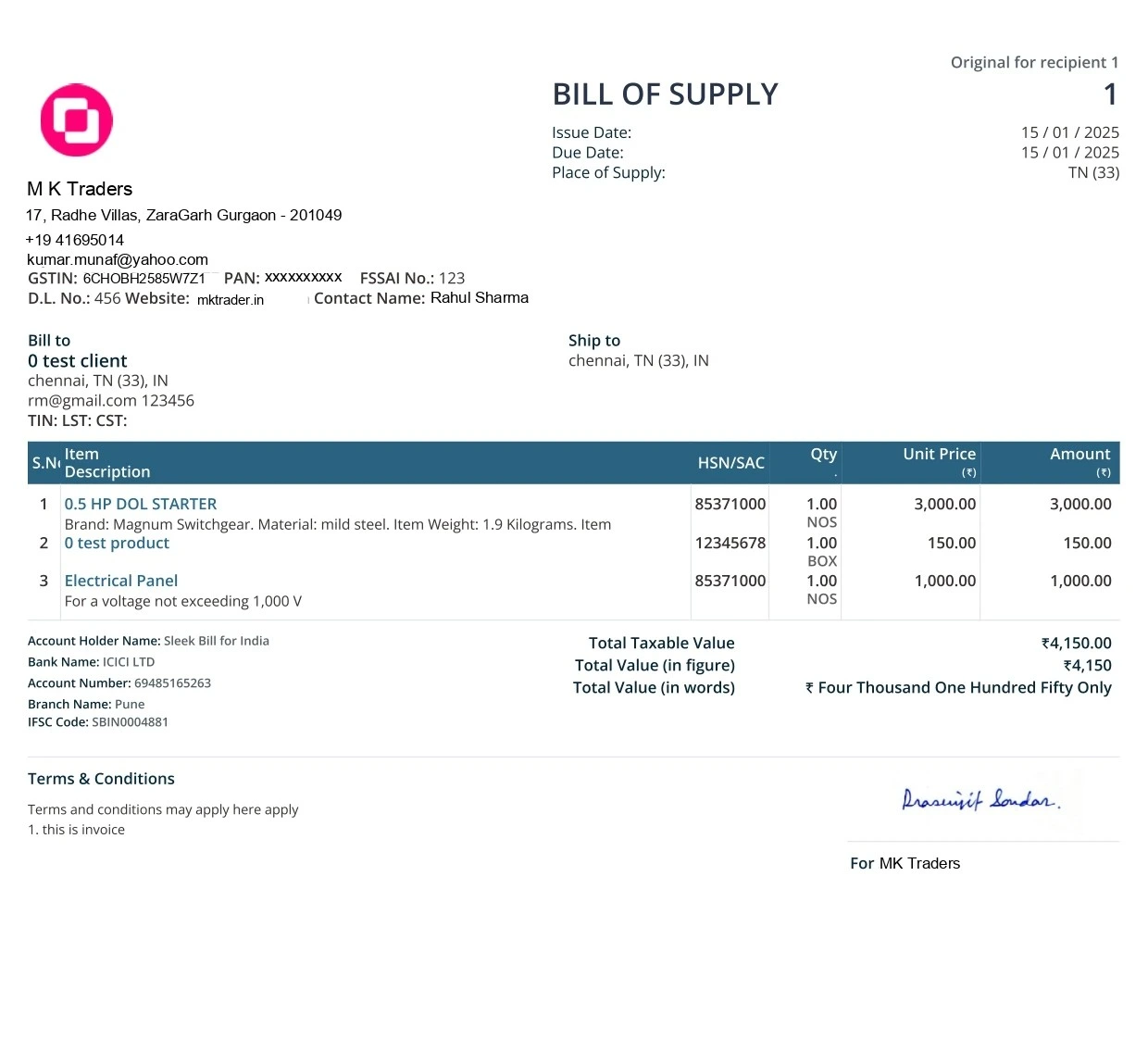

One of the pivotal elements for businesses under the GST Composition Scheme is the "Bill of Supply" format. Unlike regular GST invoices, composition dealers cannot charge GST from their customers and, therefore, need to issue a Bill of Supply. Sleekbills offers an optimized bill format that complies with the GST Composition Scheme requirements:

Mandatory Declaration: Every bill of supply issued by a composition dealer must prominently feature the statement – “Composition Taxable Person, Not Eligible to Collect Tax on Supplies.” This ensures clarity and transparency between the dealer and the customer.

Essential Components: The Bill of Supply format is structured to capture all the necessary transaction details, ensuring that both the dealer and the customer have a clear record of the sale. Here are the essential components that should be included.

Supplier's Details: This section should clearly mention the supplier's name, address, and their unique GST Identification Number (GSTIN).

Serial Number: Each bill of supply should be sequentially numbered and identified by a unique bill of supply number.

Product Classification: The Harmonized System of Nomenclature (HSN) code corresponding to the goods being supplied should be mentioned.

Product/Service Details: A clear description and quantity of the goods or services being supplied should be outlined.

Value of Supply: The total value of the goods/services supplied, adjusted for any discounts or rebates, should be clearly stated.

Authentication: The bill should be authenticated with the signature or digital signature of the supplier or their authorized representative.

Who Cannot Opt for the GST Composition Scheme?

While the Composition Scheme under GST offers numerous benefits and simplifications, it's not a one-size-fits-all solution. There are specific exclusions to ensure the scheme's integrity and prevent misuse. If you're considering opting for this scheme, it's essential to be aware of the exceptions.

Specific Manufacturers: Some manufactures like those who sale ice cream, pan masala or tobacco are excluded from composition scheme. Manufactures who producing these items cannot avail the GST composition scheme. These products have their own complexities and taxation rates, making incompatible with simplified structure of composition scheme.

Inter-State Suppliers: GST Composition Scheme is designed for businesses that operate primarily within a single state. If you're engaged in inter-state supplies, this scheme is off the table. Essence of GST Composition Scheme lies in its simplicity.

Non-resident Taxable Persons: Those classified as casual taxable business or non-resident taxable individuals are not eligible for the GST Composition Scheme. These categories of taxpayers typically have distinct operational patterns, making them unsuitable for the simplified framework of the Composition Scheme.

Opting for the Composition Scheme

Depending on the project and industry, different types of estimates may be used to provide clients with the most relevant information:

One significant limitation of the GST Composition Scheme is that it confines businesses to their home state. Composition dealers cannot expand their reach beyond state boundaries, which can be a significant impediment for businesses looking to grow and tap into markets across states.

Directly linked to the territorial restriction is the inability of composition dealers to conduct inter-state sales. This can be especially challenging for businesses that have potential clients or a market base in other states.

Composition dealers face limitations in the kinds of products they can sell. They cannot supply non-taxable goods under GST, like alcohol. Additionally, The growing e-commerce space can be challenge as dealers can not supply goods though e-commerce platforms.

Deales who has registered under GST composition scheme cannot claim Input tax credit (ITC) on purchase. This means they have to bear the full cost of inputs, which can raise the overall expenses for producing goods or services. As a result, these increased costs may reflect in the final prices, making it harder for businesses to stay competitive in the market.

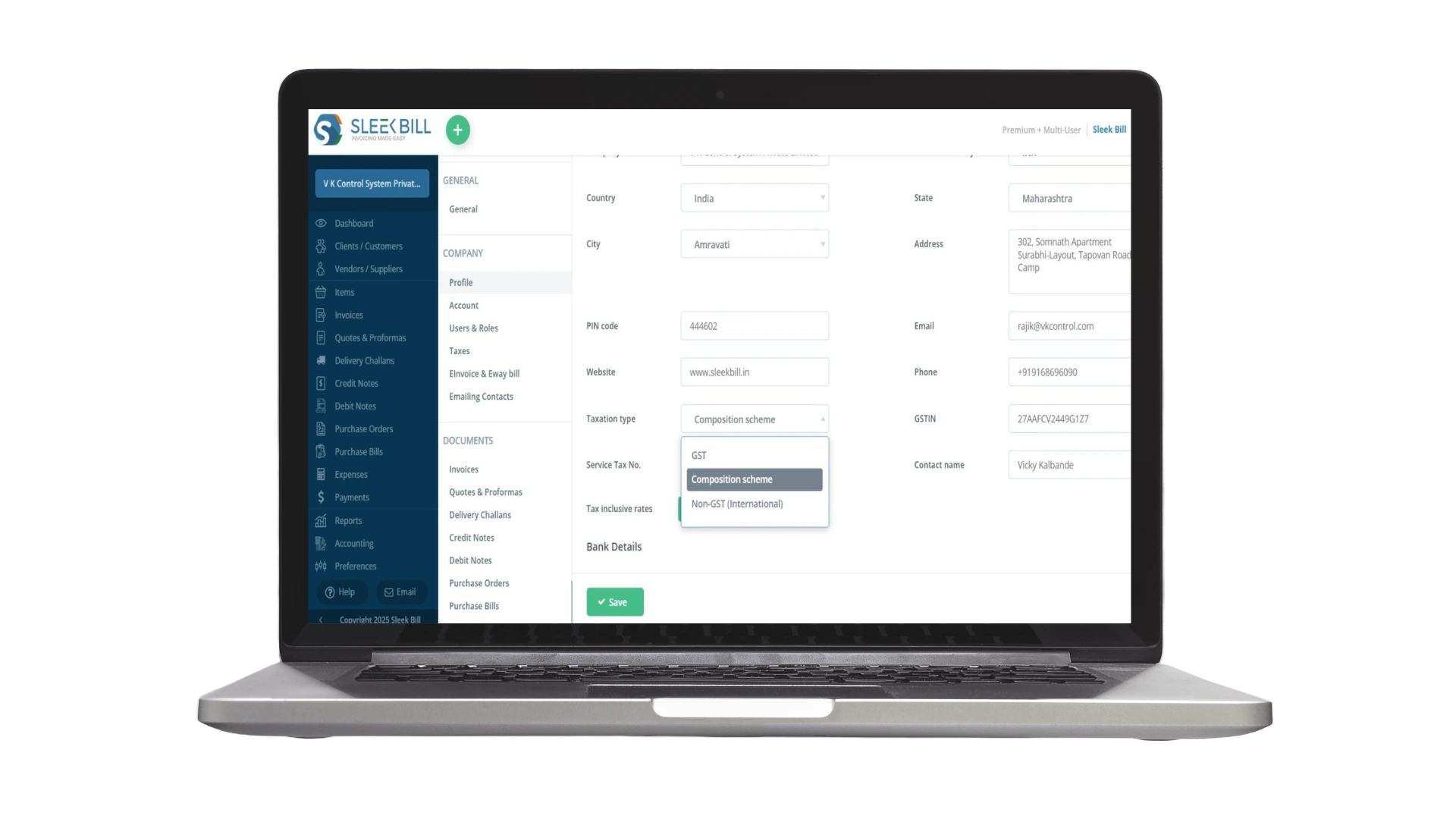

How to Create Invoice with GST comosition scheme in Sleek Bill?

Step 1: Open browser and sleekbill.in then enter username and password in login page if account is not create then signup.

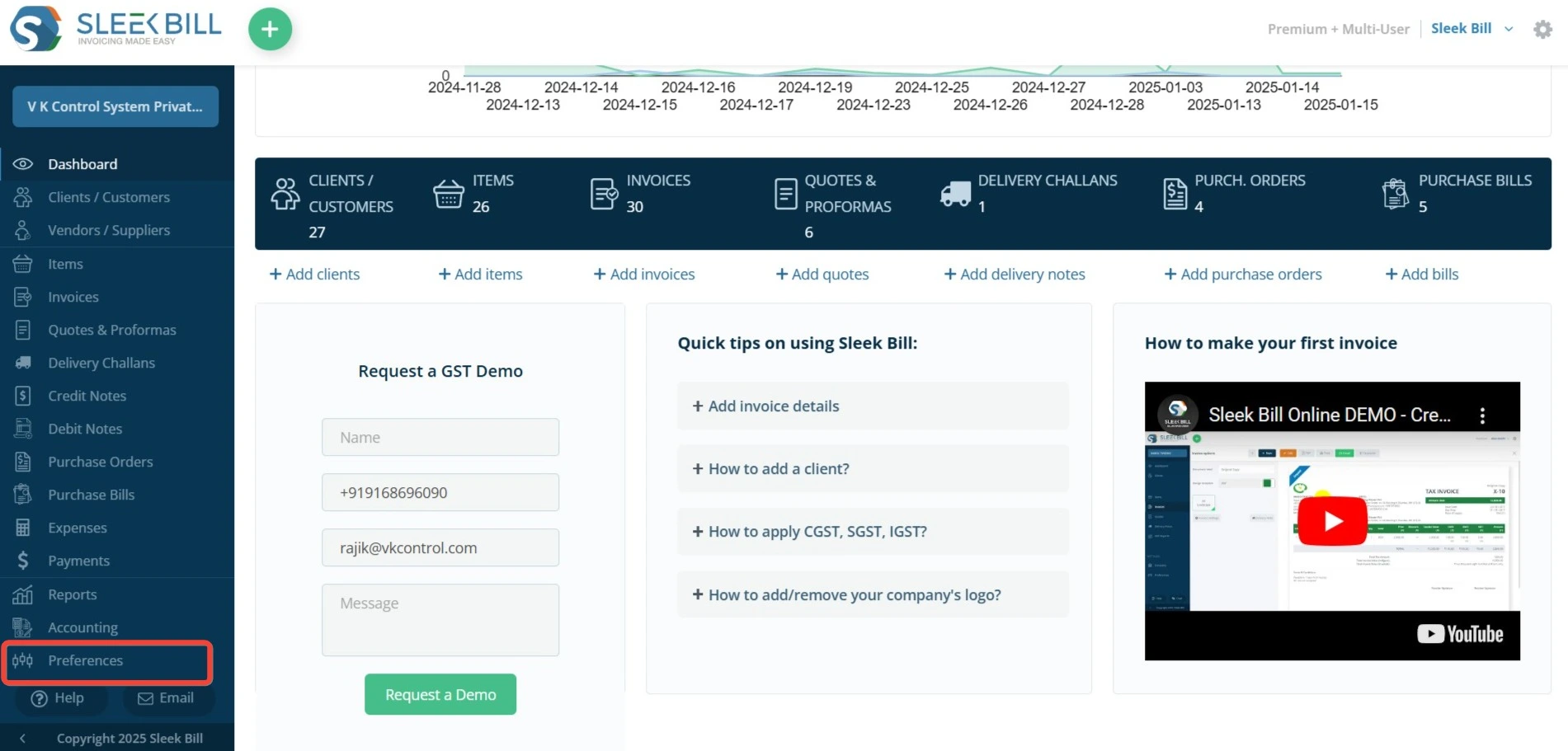

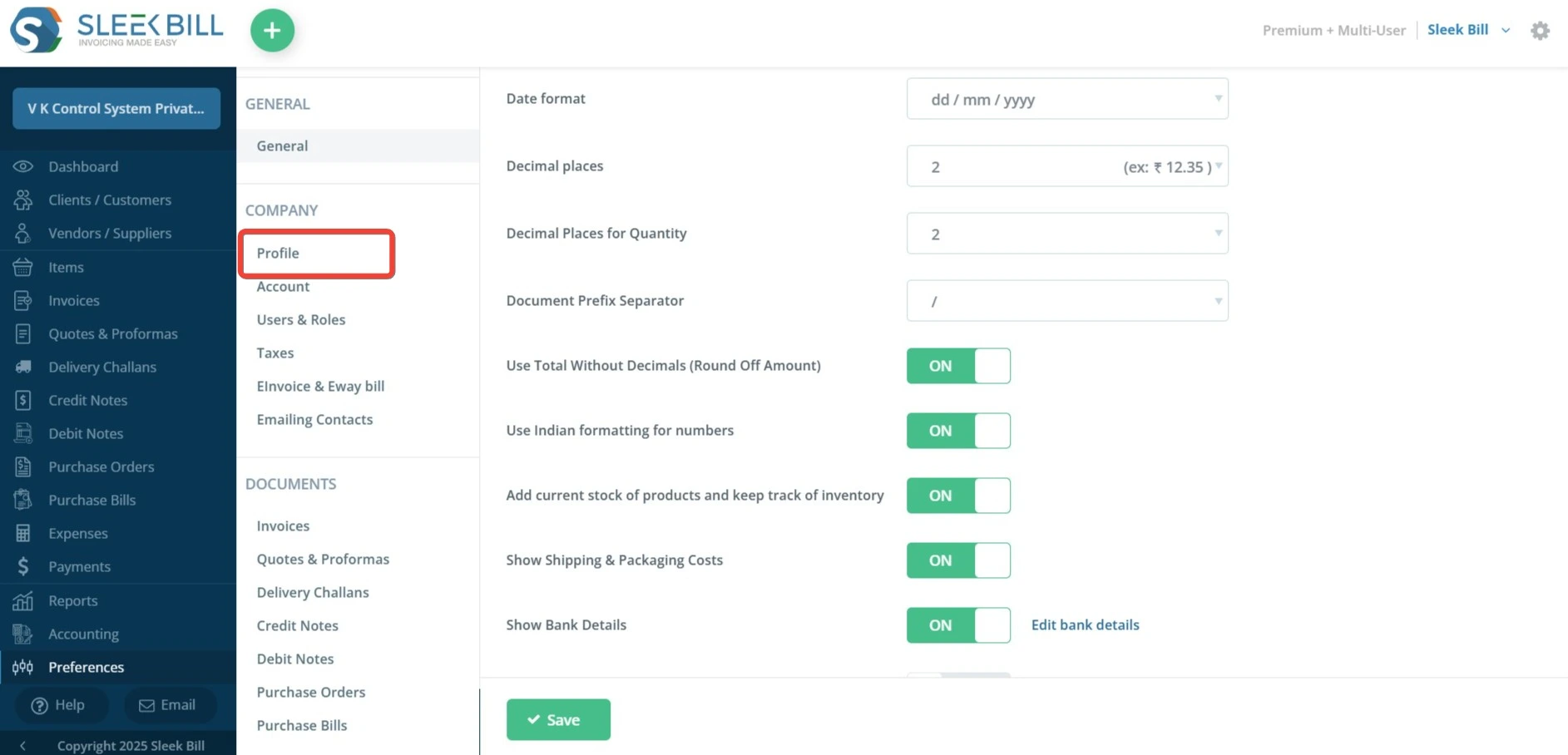

Step 2: Click on Preference on dashboard.

Step 4: Upload your logo, Fill-up company name, country, City, Pin, Website

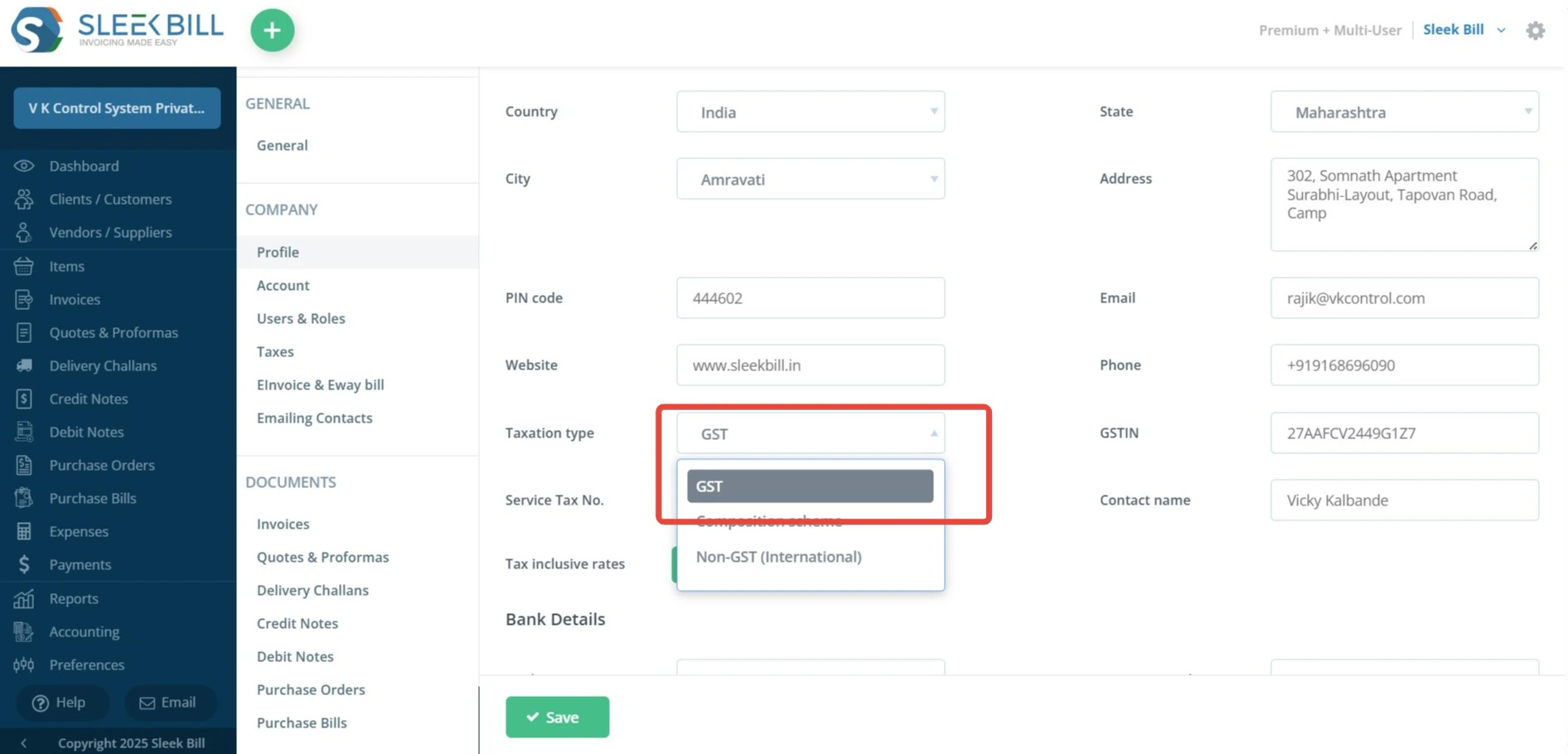

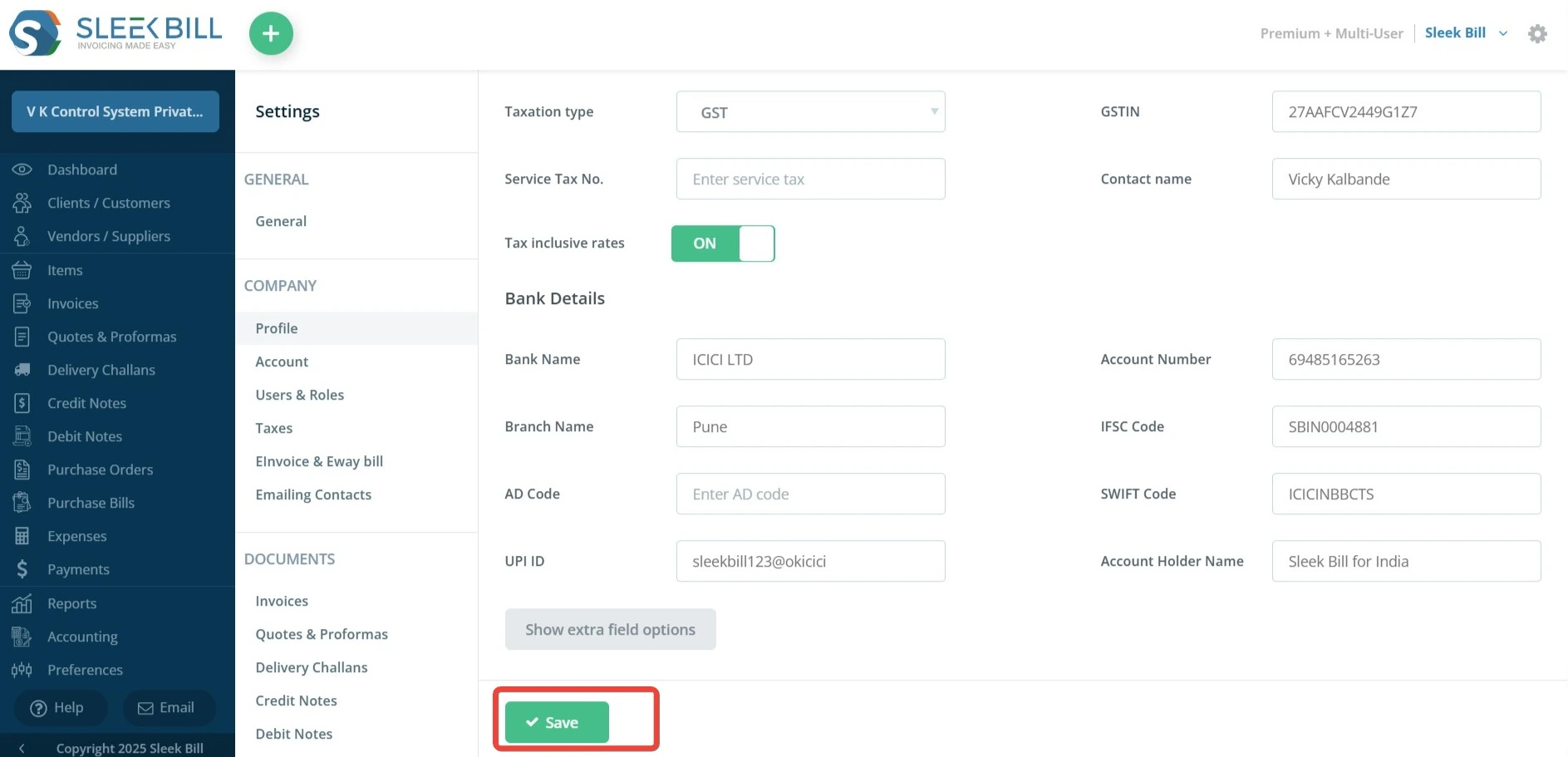

Step 5: Select Taxation Type- Composition scheme.

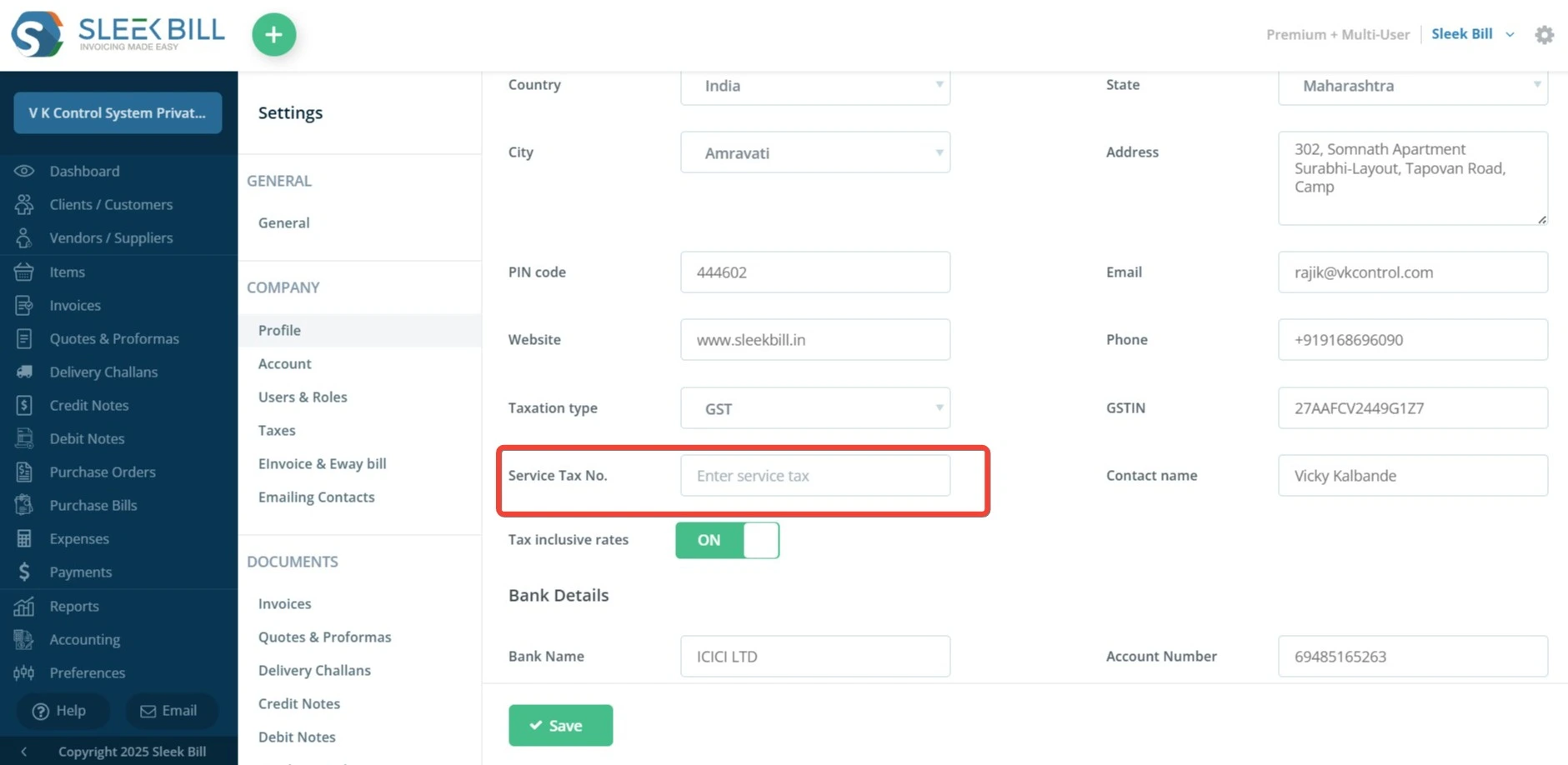

Step 6: Enter service tax number.

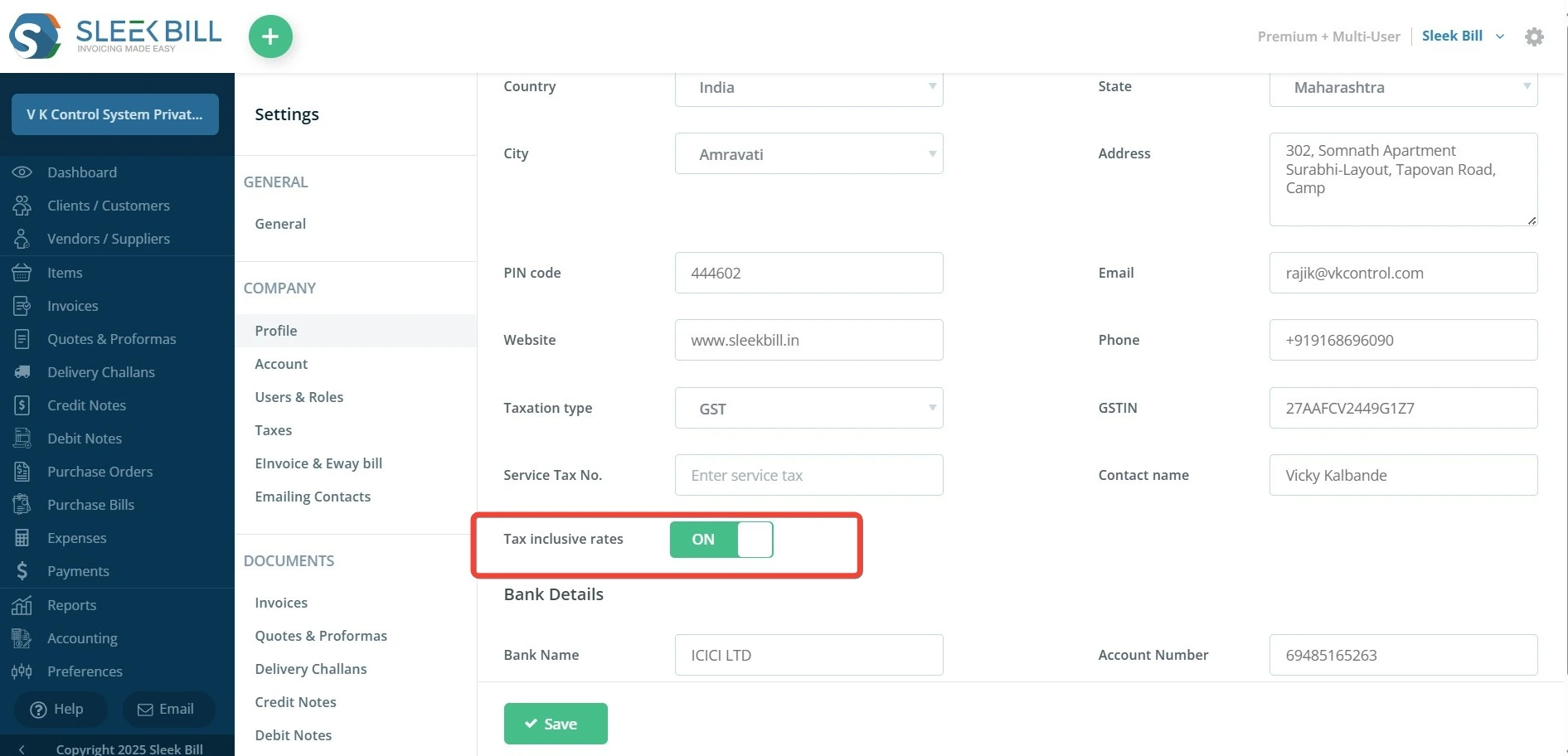

Step 7: Make on the tax inclusive rates.

Step 8: Click on "Save" button

Conditions for Availing GST Composition Scheme

-

Bill of Supply Specification:

Every bill issued must prominently state "composition taxable person" to ensure transparency and compliance with the Composition Scheme.

-

Unified Business Registration:

All business segments under a single PAN must either be registered under the Composition Scheme or excluded entirely.

-

No Supply of Non-Taxable Goods:

Composition dealers cannot supply non-taxable goods, such as alcoholic beverages, to remain eligible for the scheme.

-

Composition Tax Display:

Businesses must prominently display "composition taxable person" at their premises for transparency.

-

Reverse Charge Mechanism (RCM) Compliance:

Tax under RCM must be paid at standard GST rates, even for composition dealers.

-

No Input Tax Credit (ITC):

Composition dealers cannot claim ITC, meaning they pay taxes without offsets for input costs.

Benefits of Opting for the Composition Scheme

Simplified Compliance: GST Composition Scheme reduces compliance by eliminating the need for detailed record-keeping and multiple return filings, making tax processes simpler for small businesses.

Reduced Tax Burden: With a fixed, lower tax rate, the scheme lightens the financial load on small businesses, improving cash flow and profitability.

Enhanced Liquidity: Lower taxes lead to better cash flow, enabling businesses to reinvest, grow, and handle unexpected expenses more effectively.

Challenges of the Composition Scheme

While the GST Composition Scheme has its set of advantages, it's essential to understand its limitations to make an informed decision. Sleekbills highlights the primary challenges associated with this scheme to provide businesses with a comprehensive understanding.

Restricted Business Territory:

Restricted Business Territory:

One significant limitation of the GST Composition Scheme is that it confines businesses to their home state. Composition dealers cannot expand their reach beyond state boundaries, which can be a significant impediment for businesses looking to grow and tap into markets across states.

Restrictions on Product Portfolio:

Restrictions on Product Portfolio:

Composition dealers face limitations in the kinds of products they can sell. They cannot supply non-taxable goods under GST, like alcohol. Additionally, leveraging the ever-growing e-commerce space can be a challenge, as these dealers cannot supply goods through e-commerce platforms.

No Inter-State Transactions:

No Inter-State Transactions:

Directly linked to the territorial restriction is the inability of composition dealers to conduct inter-state sales. This can be especially challenging for businesses that have potential clients or a market base in other states.

Ineligibility for Input Tax Credit:

Ineligibility for Input Tax Credit:

The GST Composition Scheme's structure means that dealers cannot claim Input Tax Credit (ITC) on their purchases. This can increase the cost of inputs and, consequently, the cost of the final product or service, potentially affecting competitiveness in the market.

Payment of GST by Composition Dealers

GST payment for composition dealers involves a fixed percentage of turnover, tailored to the type of business, such as manufacturers or service providers.

Manufacturers and service providers under the Composition Scheme pay GST at fixed rates based on their turnover, simplifying tax calculations.

Composition dealers must comply with RCM, paying GST on goods or services received where the supplier is unregistered or under specific conditions.

When buying from unregistered suppliers, composition dealers must pay GST on their behalf, ensuring seamless integration into the GST system.

Billing Process for a Composition Dealer

For businesses operating under the GST Composition Scheme, the billing process differs from regular taxpayers. While they benefit from simplified tax procedures and reduced tax rates, they also have specific restrictions. One of the notable distinctions is how a Composition Dealer raises a bill:

Self-Paid Tax:

Composition dealers bear the GST themselves, factoring it into pricing and financial planning.

No Tax Invoice:

Composition dealers cannot issue tax invoices as they do not collect GST from customers.

Issuing Bill of Supply: Instead of tax invoices, dealers issue a "Bill of Supply," which excludes tax amounts.

No Tax Collection:

Simplified taxation under the Composition Scheme prohibits tax collection from customers.

No Tax Collection:

Simplified taxation under the Composition Scheme prohibits tax collection from customers.

Mandatory Mention on Bill:

Each Bill of Supply must state: “composition taxable person, not eligible to collect tax on supplies.”

Limited Business Scope:Dealers must adhere to restrictions on goods or services to maintain eligibility under the scheme.

Simplifying GST Composition Scheme with Sleek Bills

The GST Composition Scheme, with its unique features and benefits, aims to reduce the tax burden on small businesses, making their financial operations more straightforward. However, navigating the intricacies of this scheme requires clear understanding and a system that supports its implementation.

In Sleekbills, we're dedicated to ensuring that businesses get the best out of the GST Composition Scheme. Our tailored solutions, from optimized bill formats to comprehensive guides, ensure that businesses remain compliant, efficient, and productive. Choose Sleekbills, and let us be your partner in mastering the GST Composition Scheme.

Restricted Business Territory:

Restricted Business Territory:

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

GST Bill of Supply

GST Bill of Supply

GST Billing Software

GST Billing Software

GST Online Advantages

GST Online Advantages

GST Credit Note

GST Credit Note