Essential Guide to Crafting Professional Receipts

Proof of any business transaction is incomplete without a receipt format. The receipt format contains all the relevant details and assists in keeping proper records. A good receipt template helps reinforce brand image and makes it easier to maintain the transactions. In this page we will discuss the most essential elements of a receipt format template, oftenly used in general business practices. Its advantages and Explore why digital receipts are becoming a viable alternative for businesses in this new era.

What is a Receipt Format?

Receipt format is a pattern developed to create a receipt accordingly to the payment type. Which is a document used to prove that a particular service or goods have been provided and paid for this. This usually consists of elements such as the date, name of the party(client, customer, or vendor supplier), amount invoice or bill number, client customer detail address. Any payment mode For example, cash, check, bank transfer, UPI.and the way it was paid. Receipts fall into four primary category:

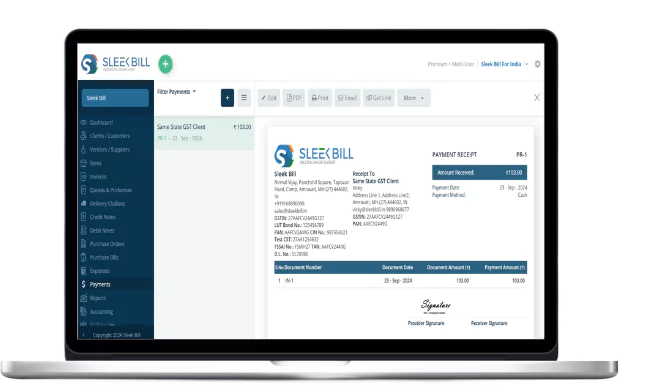

Payment Received Receipt: when sell goods and provided invoice to customer then the payment in terms of cash, cheque, bank transfer in any ways. Then we can generate the payment received receipt.

Payment Made Receipt:

When we bought any service or goods from vendor or supplier. And vendor and supplier raise the invoice which or which we call these bills.

So for the per against the purchase bill, we made the payment to our vendor or supplier so that we can generate the receipt for making payment to vendor our supplier. It's called payment made receipt.

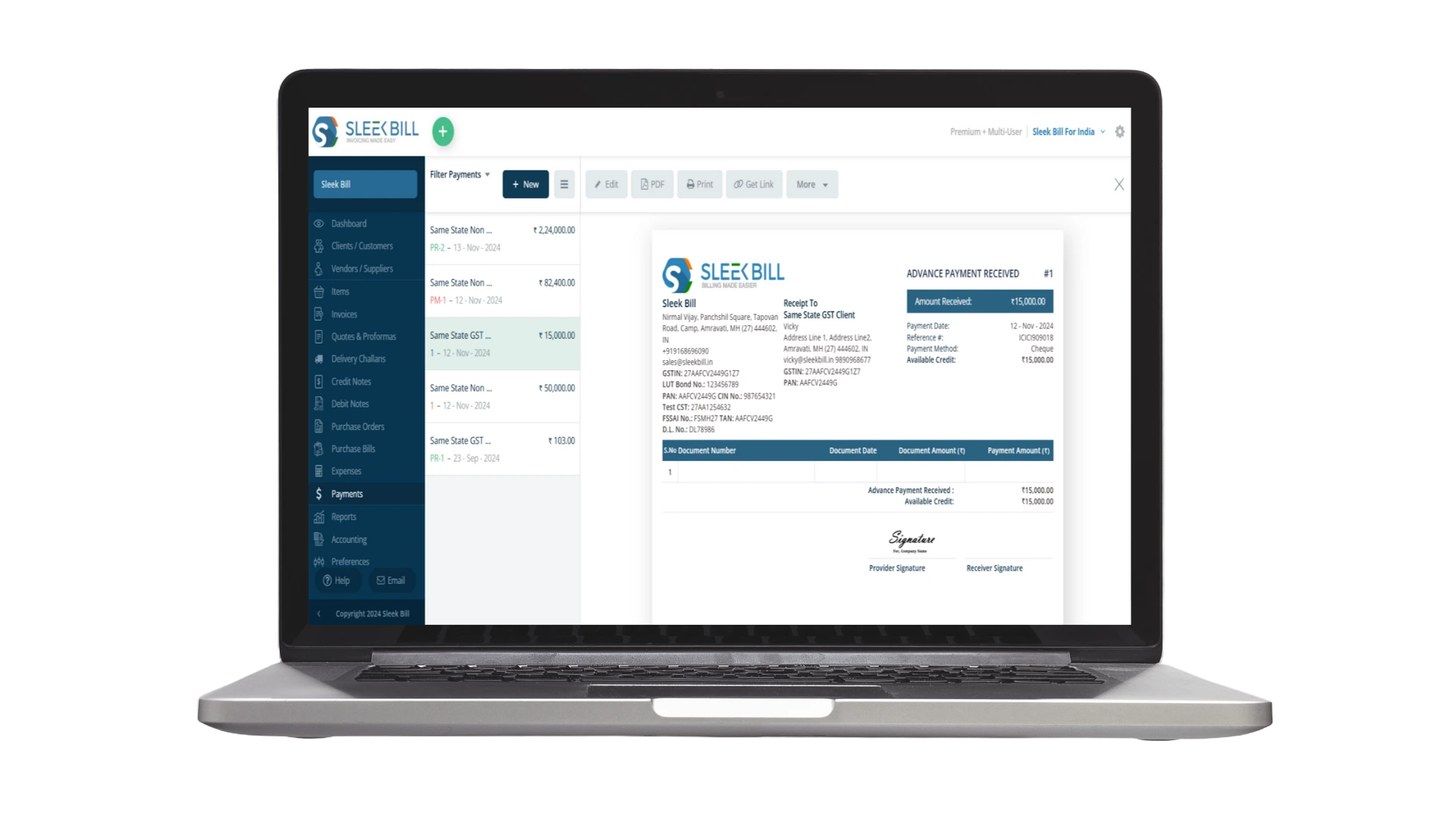

Advanced payment received receipt: When any prospect customer or prospect client inquire to us and they ask for the quotation after quotation approval from the client, they made the payment for, say, goods or service into the quotation or they ask for the pro form a invoice for making the advance payment. So that after receiving the advance payment, we should generate the advanced payment receipt.

Note: The advanced payment receipt is generated before creating the invoice or tax invoice.

Advanced payment made: Advanced payment made receipt is provided to the vendor or supplier along with the purchase order. If we gate gate or or received the quotation or pro form a invoice from vendor or supplier and if our supplier ask for the advanced payment, so against the pro form a invoice, we can pay the advance payment to our vendor or supplier. It's called advance payment made.

Note: Advanced payment made, received the should, receive should generated before getting the invoice from vendor or supplier. That is this before receiving the purchase bill.

Payment Received Receipt vs. Payment Made Receipt

Understanding the difference between these receipt format types is very simple for accurate financial recording:

After generating the invoice when we receive when we receive the payment, then payment receipt payment receipt will generated or created.

The payment received may add the payment or may collect the payment from the clients or customers in full in terms of full payment of the invoice, partial payment of the invoice.

Payment receipt should include the customer details and payment mode.

Payment received is consider under the revenue / income.

Similarly, we can generate the advanced payment received receipt.

Similarly, after receiving the purchase bill from the vendor or supplier, we when we pay against the purchase bill, then we will generate the payment made received and given to the supplier or vendor along with the payment.

- The payment made receipt is generated for full payment for the vendor against the purchase bill or partial payment of the purchase bill.

- Payment made receipt should include the customer details and payment mode.

Payment received is consider under the expenses / liabilities.

It's a if we pay the advanced payment without taking the purchase bill, then we can generate the advance payment made receipt.

Why Should You Opt for Online Receipts?

With digital transformation reshaping business processes, online receipts offer several advantages:

- Accessibility: With cloud storage, digital receipts can be stored, structured, and retrieved with ease making the storage of records element or issue-free.

- Cost-Effective: Eliminates the use of paper, ink, as well as printing machines, thus minimizing the running costs.

- Saves Space: Enhances orderliness and minimizes the use of space associated with paper based receipts as storage of receipts in soft copies is limited.

- Mobility: Access receipts from anywhere, and email them to clients instantly, ideal for remote or on-the-go business operations.

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

GST Online Advantages

GST Online Advantages

GST Credit Note

GST Credit Note

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about