A Comprehensive Guide for GST Tax Invoice

*Free & Easy - no hidden fees.

Tax invoices under GST are more than just paperwork; they are the backbone of the GST framework, facilitating transparent transactions and ensuring compliance. Our guide aims to demystify the complexities of tax invoices under GST making them accessible to all business entities.

● Essential Documentation: A tax invoice under GST is a crucial document for any GST-registered dealer. It's not just a bill but a comprehensive list detailing the goods supplied or services rendered.

● Detailed Breakdown: The invoice encompasses specifics like the items or services provided and their corresponding monetary value, ensuring clarity and accountability in every transaction.

● Transparency & Compliance: The foremost objective of a GST invoice is to maintain a clear and legal record of sales and purchases. It acts as a pivotal document in the GST regime, enabling both parties to view transaction details transparently.

● ITC & Liability Calculation: A tax invoice is indispensable for claiming Input Tax Credit, a critical aspect that aids businesses in offsetting their GST liabilities. It ensures accuracy in the calculation and payment of GST dues.

● Mandatory for Registered Dealers: The responsibility of generating GST-compliant invoices falls on the shoulders of registered dealers. It's an essential step in aligning with GST regulations. ● Sleek Bill Billing Software: To streamline this process, Sleek Bill Billing Software emerges as a user-friendly solution. It's designed to assist businesses in creating tax invoices under GST with ease, offering a cost-effective method to comply with GST norms.

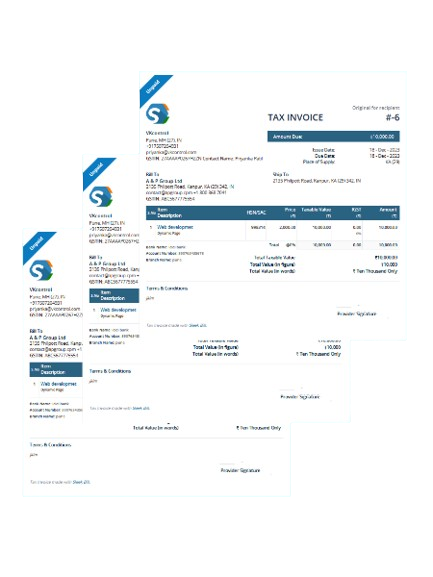

● Essential Details: A GST tax invoice encompasses critical elements like the names and addresses of the seller and buyer, their GSTINs, invoice number, and date.

● Itemization and Pricing: It meticulously itemizes each good or service offered, detailing quantities and prices. This clear breakdown aids in transparent dealings between parties.

● Adherence to Regulations: Compliance with GST laws is non-negotiable. A tax invoices under GST must conform to the stipulations outlined in the GST framework. ● Critical for Business Flow: Legal compliance is not just a mandate but a necessity for smooth business operations and to leverage benefits like Input Tax Credit.

● Cost-Effective Solution: Emphasizing affordability, Sleek Bill Billing Software is presented as a cost-free tool for creating tax invoices under GST. ● User-Friendly Features: The software stands out for its ease of use, offering functionalities that streamline the invoicing process for GST-registered dealers.

Sleek Bill Billing Software is highly recommended for its efficiency and cost-effectiveness, making it a valuable asset for businesses navigating the GST landscape.

Tailor your invoicing effortlessly to meet the diverse needs of sectors such as goods transportation, passenger services, and e-commerce, ensuring seamless compliance with the GST framework.

*Free & Easy - no hidden fees.

● Mandatory Practice: GST-registered entities must issue GST-compliant invoices for all sales of goods and services.

● Regulatory Adherence: Issuing these invoices is not just a formality but a critical compliance requirement under GST laws.

● Detailed Documentation: tax invoices under GST issued to clients must encompass all essential details, including both parties' information, GSTINs, invoice specifics, and a comprehensive description of the products or services offered.

● Ensuring Accuracy: The accuracy of these tax invoices under GST is vital for the correct computation and submission of taxes.

● Beyond Business Norms: Providing GST-compliant invoices transcends standard business practice and enters the realm of legal duty.

● Facilitating Tax Calculation: These invoices are integral to maintaining transactional transparency and precise tax calculations.

● Receiving Compliant Invoices: Businesses also obtain GST-compliant purchase invoices from vendors, detailing the purchases made.

● Purchase Invoice Essentials: These invoices should list the vendor’s details, GSTIN, invoice number and date, description of goods or services, and the taxes applied.

● Crucial for Input Tax Credit: Purchase invoices from GST-registered vendors are indispensable for claiming Input Tax Credit (ITC), which is a vital aspect of the GST framework.

● Offsetting Tax Liabilities: ITC enables businesses to reduce their net tax liability by offsetting the GST paid on purchases against the tax on sales.

● Mandatory Compliance: Tax invoices under GST, both issued and received, must conform to GST rules, ensuring all specified particulars are accurately captured.

● Avoiding Legal Issues: Adhering to Tax invoice Under GST regulations is critical for uninterrupted business operations and to prevent potential legal challenges.

● Essential for Audits and Returns: Maintaining detailed records of all tax invoices under GST is a cornerstone of GST compliance, facilitating efficient audits and accurate return filing.

● Promoting Transparency: Proper invoice management underlines a transparent approach to business dealings and supports compliance with tax laws.

● Claiming ITC: Accurate record-keeping is a prerequisite for claiming Input Tax Credit, making it a financial imperative for businesses.

Number of Copies for Goods:

Number of Copies for Goods: Number of Copies for Services

Number of Copies for Services Purpose of Multiple Copies

Purpose of Multiple Copies Record-Keeping and Compliance:

Record-Keeping and Compliance: Simplifying Transaction Processes:

Simplifying Transaction Processes: Consistency Across Industries:

Consistency Across Industries:Adhering to the GST mandate of issuing multiple copies of tax invoices under GST for goods and services is crucial for efficient record-keeping, compliance, and simplifying the transaction process across industries.

Ensure regulatory compliance and streamline business processes with timely GST tax invoices. Whether in goods or services, meeting stipulated timelines guarantees accurate documentation and legal adherence, reflecting the true nature of your transactions.

*Free & Easy - no hidden fees.

Mandatory Fields for a Tax Invoice Under GST:

Mandatory Fields for a Tax Invoice Under GST:

● Essential Details: A GST tax invoice must include specific information, such as:

● Invoice number and date.

● Customer's name.

● Shipping and billing addresses.

● GSTIN of the customer and taxpayer (if registered).

● Place of supply.

● HSN code/SAC code for items or services.

● Item details, including description, quantity, unit, and total value.

● Taxable value, discounts, and the rate and amount of taxes (CGST, SGST, IGST).

● Indication if GST is on a reverse charge basis.

● Supplier's signature.

Purpose of Tax Invoice Under GST:

Purpose of Tax Invoice Under GST:

● Facilitates Taxation and ITC: A tax invoice in GST is pivotal for charging tax and enabling the transfer of Input Tax Credit (ITC), playing a crucial role in the GST framework.

Importance of Invoice Details:

Importance of Invoice Details:

● Compliance and Record-Keeping: These mandatory fields ensure adherence to GST regulations, thereby facilitating accurate record-keeping and compliance.

Input Tax Credit (ITC):

Input Tax Credit (ITC):

● Crucial for Offsetting Tax Liability: The proper issuance of a tax invoice under GST is essential for businesses to claim and transfer ITC, effectively reducing the tax burden.

Record of Place of Supply:

Record of Place of Supply:

● Determining Tax Application: The place of supply is crucial in a GST invoice as it influences the tax rates and the jurisdiction under which the transaction falls.

Supplier’s Signature:

Supplier’s Signature:

● Authenticity and Validation: The supplier's signature on the invoice validates the document, serving as a legal acknowledgment of the transaction.

Additional Requirements for Unregistered Recipients:

Additional Requirements for Unregistered Recipients:

● For Transactions Over Rs. 50,000: When dealing with unregistered recipients and invoice values exceed Rs. 50,000, additional details are necessary:

● Recipient’s name and address.

● Delivery address.

● State name and code.

Reverse Charge Basis:

Reverse Charge Basis:

● Indication of Tax Liability: The invoice must clearly indicate if GST is applicable on a reverse charge basis, making it clear who bears the tax responsibility.

Legal Compliance:

Legal Compliance:

● Adherence to Regulations: Including all mandatory fields in a tax invoice under GST is not just a good practice but a legal necessity, ensuring compliance with GST laws.

Threshold for Additional Recipient Information:

Threshold for Additional Recipient Information:

● Mandatory for Higher-Value Invoices: For transactions exceeding Rs. 50,000 with unregistered recipients, additional details like the recipient's name, address, and the delivery location become essential.

Goods (Normal Case):

● Immediate Documentation Required: For the typical supply of goods, tax invoices under GST need to be generated either at the time of or prior to the removal/delivery of the goods.

● Aligning Invoice with Goods Movement: This ensures legal compliance and aids in tracking the movement of goods with the appropriate paperwork.

Goods (Continuous Supply):

● Billing Cycle Compliance: In cases of ongoing supplies, tax invoices under GST should be issued in line with account statements or at the time of payment.

● Tailoring to Transactional Nature: This approach takes into account the recurring or periodic nature of the goods supply.

Services (Banks & NBFCs):

● Billing Cycle Compliance: In cases of ongoing supplies, tax invoices under GST should be issued in line with account statements or at the time of payment.

● Tailoring to Transactional Nature: This approach takes into account the recurring or periodic nature of the goods supply.

Services (General Case):

● Extended Timeframe for Financial Services: Banks and NBFCs are given a 45-day period to issue tax invoices under GST post-service provision.

● Accommodating Financial Transaction Complexities: Recognizing the intricate nature of financial services, this extended period allows for detailed processing and compliance.

Provisional Registration:

● Transition to GST: Prior to getting a permanent GST registration, dealers must apply for provisional registration as they transition from the previous tax system to GST.

Timeline for Invoicing under GST:

● Covering the Transition: Tax invoices under GST created between the GST implementation date and when a permanent GST registration is received are subject to revision under GST rules.

Issuance of Revised Invoice:

● Mandatory Revision: For tax invoices under GST issued in the transitional phase, a revised invoice must be generated within one month of receiving the permanent GST registration.

● Aligning with GST: This ensures that all transactions in this period comply with GST norms.

Applicability to All Invoices:

● Broad Applicability: All tax invoices under GST made between the commencement of GST and the receipt of the GST registration certificate must be revised.

Compliance Period:

● One-Month Compliance Window: There is a mandatory one-month period for revising invoices, designed to help businesses smoothly transition to the GST system.

Navigating the world of GST becomes a breeze with meticulous invoicing practices. It's not just about following the rules; it's a strategic move for business success. Why? Because it ensures you get those Input Tax Credits, helps calculate taxes accurately, and keeps your records audit-ready.

Creating a GST tax invoice is like crafting a masterpiece – attention to detail is key. From reverse charge indications to legal compliance, supplier verification, and more, each element plays a role. It's not just about following the law; it's about transparency and efficiency in the GST framework.

Stick to Timelines:

Stick to Timelines: Industry Timeframes:

Industry Timeframes: Transitioning to GST? Don't forget to revise your old invoices. It's like giving them a makeover to fit into the new tax era. This isn't just a rule; it's a way to make sure your past transactions align with the regulations, keeping your business in the clear.

General Invoice Requirements:

● GST Invoice Guidelines: Regularly, suppliers issue tax invoices under GST to recipients in a format that complies with GST regulations.

● Adaptability in Certain Cases: There are specific scenarios where GST laws allow for exceptions or modifications to the standard invoice format and issuance timings.

Passenger Transporter Services:

● Ticket as a Tax Invoice: For passenger transportation services, the tax invoice can be issued in the form of a ticket.

● Optional Information: Details like serial number and recipient's address are not compulsory for passenger transport invoices.

Exceptions for ISD (Banking, Financial Institutions, NBFC):

● Relaxed Norms for Certain Sectors: ISD invoices from banking companies, financial institutions, and NBFCs are not required to be serially numbered.

● Credit Transfer Invoices: In cases where the registered person shares the same PAN and State code as the ISD, specific invoices or notes can be issued to transfer credit for common input services.

e-Commerce Operator/Supplier of OIDAR Services:

● Invoicing for e-Commerce and OIDAR Services: e-Commerce operators or OIDAR service providers must include comprehensive recipient details, PIN code, and state name in invoices for unregistered buyers.

● Address Assumptions: The address provided in such tax invoices under GST is considered the official address on record for the recipient. All other necessary tax invoice information must also be included.

.png)

Uniform Invoice Requirements:

● Consistent Invoice Elements: Invoices in all special scenarios must adhere to the standard GST invoice guidelines.

● Mandatory Details: Key information such as the names, addresses, and GSTINs of parties involved, invoice date, taxable value, rate and amount of taxes, along with the authorized person's signature, must be present in every tax invoice.

.png)

Goods Transport Agency (GTA):

● Invoice Requirements for GTAs: GTAs, while providing road transport services, are mandated to issue a tax invoice or a similar document.

● Document Essentials: The invoice should detail the gross weight, sender and receiver's information, vehicle registration number, goods' specifics, origin and destination of the transport, and GSTIN of the party responsible for the tax.

Input Service Distributor (ISD):

● ISD Invoice Details: Tax invoices under GST from an ISD include essential details like the ISD's name, address, and GSTIN, along with unique serial numbers for each financial year.

● Content Specifics: They should also detail the name, address, GSTIN of the credit recipient, the amount of credit, and requisite authentication.

Insurance/Banking/Financial Institutions:

● Consolidated Invoicing: Entities like insurers, banks, financial institutions, and NBFCs may opt to issue a consolidated tax invoice or document at each month's end.

● Invoice Content: These documents must contain all vital information, although certain elements like serial numbers and the recipient's address might be optional.