Goods Transport Agency (GTA)

Under the Reverse Charge Mechanism (RCM), the recipient of services provided by a Goods Transport Agency is liable to pay GST on freight charges for transporting goods via road..

How It Works and What It Means for Your Business

*Free & Easy - no hidden fees.

Various means for a perfect collection and compliance have been established to ensure the GST Regime their efficiency. A method to rear charge mediums (RCM) Under the RCM system, duty liability under RCM is transferred from supplier of goods or services to patron. The next section aims at bringing out the inter-relations in RCM and what it entails for firms.

When it is applicable under the reverse charge mechanism (RCM) then whoever receiving goods or service has to deposit GST in place of supplier. The supplier must gather and pay duty under forward charge. In specific situations set by the government like dealing with unregistered suppliers or some declared goods and services, RCM makes sure that GST is gathered well.

GST is paid directly to the government by the recipient under RCM.

A tone-tab is required for purchases made from unrecorded suppliers.

According to RCM, when an unregistered trader buys something from another state, they have to pay Integrated Goods and Service Tax (IGST).

In situations where services are provided by an overseas provider, the person receiving these services in India is liable for paying IGST under the Reverse Charge Mechanism.

The recipient has responsibility for paying IGST under RCM when they get any supply from an international supplier except for particular exceptions.

When there is a transaction between related parties or distinct entities such as branches within same business group but located in different countries . This kind of operation may cause transfer pricing issues; it will be subject to Reverse Charge Mechanism.

The mechanism of Reverse Charge applies if a registered company buys specific goods or services from an unregistered dealer inside country boundaries. Then the buyer holds responsibility for paying taxes on this purchase based on relevant rates and rules.

Government can specify particular goods or types of service where tax liability falls on receiver's side using Rule 86A. If one individual gets invoiced with more than Rupees 50 lakh without paying tax earlier, they hold duty of discharging tax at reverse charge rate as per rule 86A's provisions until date specified by authorities (not exceeding one year).

The person who gets the goods or services has to pay GST when they are brought into India.

Paying the tax on purchases from sellers who aren't registered.

The government has identified some goods and services that should follow the RCM model.

If you buy goods from suppliers who are not registered under the GST, the recipient must pay for them.

The duty to pay taxes moves from the provider to the person who gets the goods or services.

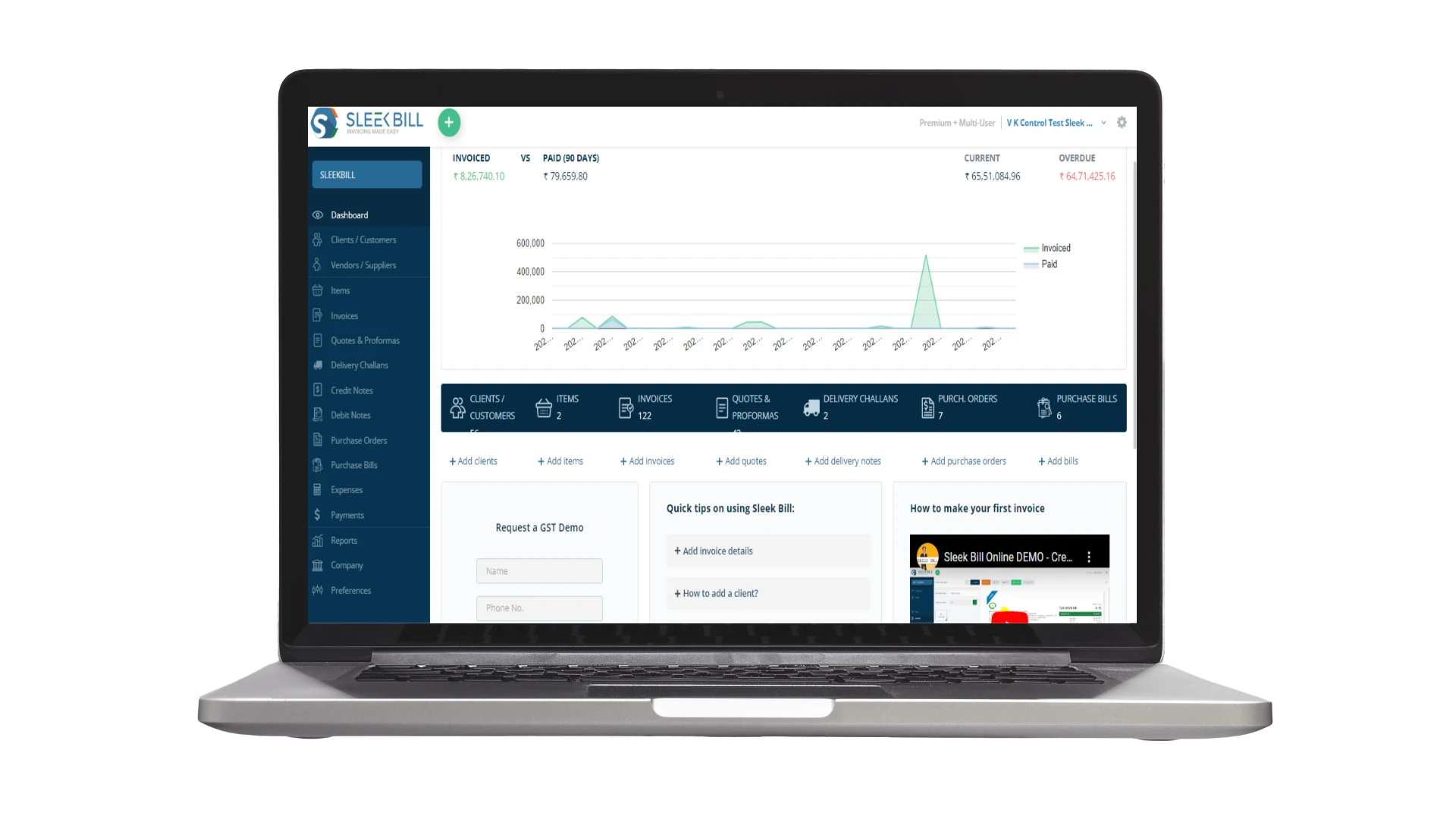

In today's fast-paced business landscape, a robust and versatile tool for creating quotations is indispensable. Sleek Bill, with its cutting-edge features, ensures that businesses always stay ahead of the curve.

RCM is applicable in service tax for services like insurance agents, manpower supply, and goods transport agencies (GTA).

Under RCM, there is no concept of partial reverse charge; the recipient must pay 100% of the tax on the supply.

No Input Tax Credit (ITC) for Supplier: If the supplier is registered and the goods or services come under RCM, the supplier cannot claim ITC. Instead, the recipient pays the taxes.

Taxes on Imports: For importers, taxes must be paid under RCM to the government, in addition to any import duties.

GSTR-2 Filing: Details of inward supplies liable to RCM must be reported in GSTR-2 by the recipient.

Mandatory Registration: Any person liable to pay tax under RCM must register under GST, regardless of their turnover.

Under the Reverse Charge Mechanism (RCM), the recipient of services provided by a Goods Transport Agency is liable to pay GST on freight charges for transporting goods via road..

Services provided by a recovery agent to banks, financial institutions, or non-banking financial companies (NBFCs) fall under RCM, where the recipient of the service is required to pay GST.

Services provided by a director to the company or body corporate.

Services provided by individual advocates or a firm of advocates.

Services provided by an insurance agent to a person conducting insurance business.

Services supplied by an arbitral tribunal to a business entity.

Some services that the Central Government, State Government, Union Territory or local authority gives to a business entity.

A work which can be done by writer, music composer, photographer or artist through transfer of copyright.

![]()

RCM shall be paid by the recipient of goods or services (Except for specified services where it is payable by supplier). Input Tax Credit only to recipient ITC can be claimed the goods and services are used for business purpose then he answerable of input tax credit. Additionally, composition dealers who discharge liability under RCM must pay tax at normal rates, not composition rates, and are not eligible to claim GST credit.

Certain goods are also subject to RCM, where the recipient is liable to pay the tax:

Supplied by an agriculturist to a registered person.

Silk yarn manufactured by him from raw silk or Silk Worm Cocoons delivered to a registered taxable person.

Supplied by an agriculturist to a registered person.

Supplied by the government or local authorities to a registered person.

Follow these steps to log in to the E-Way Bill portal efficiently.

The time of supply under RCM determines when the GST liability arises and varies for goods and services.

Reverse Charge Mechanism in GST is that when a buyer of goods or services becomes liable to pay taxes instead of the seller. If a company duly registered purchases items from any vendor that is not registered, then the buyer itself will become liable for such settlement of dues owed to the government. The receiver can receive a tax credit for the amount paid on this matter in the past.

RCM would be payable on services such as GTA related to transportation of goods, a legal service provided by an advocate/law firm, services by government or local authority excluding certain exceptions, sponsorship service are some of them. It is better to refer to the latest updated GST circulars for an exhaustive list.

The general taxation has to be paid by a registered taxpayer only under RCM. However, in a few cases, this concession is extended to small businesses whose turnover is below the threshold limit for registration to GST, agriculturalists with regard to supplies to the specific, suppliers of certain goods or services that have been kept out of the liability to pay under RCM.

RCM attracts interest and penalties in case of failure to pay the GST. He may even be deprived of claiming input tax credit, which would increase the liability on his end of the taxation.

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about Security & Privacy

Serious about Security & PrivacyEasily manage reverse charge invoices, track payments, and stay GST-compliant with a few clicks.

*Free & Easy - no hidden fees.