A Blueprint for Seamless Financial Excellence!

*Free & Easy - no hidden fees.

Product or Service Description:

Product or Service Description:

Each item or service being sold is described in detail. This includes specific identifiers, such as model numbers, quantities, and any other relevant characteristics.

Precise Selling Price:

Precise Selling Price:

The invoice clearly states the selling price for each item or service. This price is often an estimate but is intended to be as accurate as possible to avoid discrepancies later.

Additional Costs:

Additional Costs:

Estimates of any additional costs like commissions, handling fees, or other charges associated with the transaction are included. This provides a comprehensive view of all expenses to the buyer.

Subject to Change:

Subject to Change:

Although the pro forma invoice aims to provide an accurate estimate, it is understood that these details are subject to change. It offers an initial understanding of the transaction’s financial aspects, but with the flexibility to accommodate future adjustments.

Purpose of Transparency:

Purpose of Transparency:

The primary goal is to ensure transparency in the transaction. By laying out all potential costs and terms, it helps both parties avoid surprises and facilitates smoother completion of the transaction.

Proforma invoices stand as an integral part of business transactions, especially when it comes to providing clarity and setting expectations in sales. They are often misunderstood as mere quotations, but in reality, they play a much more significant role in the world of commerce.

A proforma invoice is a preliminary document issued by sellers to buyers before the delivery of goods or services. Unlike a typical invoice, it is not a demand for payment. Rather, it's a well-detailed proposal giving a sneak peek into the expected sale terms. This document lists all relevant information about the transaction, including descriptions of the goods or services, pricing, and delivery details.

The proforma invoice goes beyond just quoting a price. It includes comprehensive details about the transaction, which can include shipping costs, taxes, and additional fees, providing a complete picture of the eventual invoice.

It functions as a good faith estimate, setting transparent terms for the buyer. This is especially crucial in international transactions where buyers need detailed information for customs and import purposes.

One of the key purposes of a proforma invoice is to prevent misunderstandings. By outlining the specifics of the deal, both parties can have clear expectations, reducing the possibility of disputes over charges that were not initially apparent.

Unlike a formal invoice, a proforma invoice is subject to change. This allows room for negotiation and adjustments before the final sale, making it a versatile tool in business dealings.

For buyers, proforma invoices are valuable for internal approval processes. They can use these documents to secure budget approvals or plan logistics based on the estimated costs and terms provided.

In global trade, proforma invoices are indispensable. They serve as a required document for buyers to initiate import customs and arrange payment. In some cases, they are used to open letters of credit, making them a cornerstone in international trade finance.

Purchase Approvals:

Proforma invoices are often used in industries to get approval for internal purchases. They act as an early document for businesses to review and agree on potential buys before making an official order.

Streamlining Sales:

Proforma invoices help businesses plan better by listing sale details upfront. This makes financial and logistics planning more accurate, leading to smoother operations and improved efficiency.

Business Efficiency:

Proforma invoices outline sale details upfront, aiding businesses in precise financial and logistics planning. This proactive approach enhances overall efficiency for smoother operations and better outcomes.

Facilitating Negotiations:

They provide a basis for negotiation between buyers and sellers. Since they are not the final invoice, adjustments and modifications can be made, leading to a mutually agreeable deal.

A pro forma invoice provides an accurate and detailed breakdown of the sale price. This includes a clear outline of all costs involved in the transaction, such as the base price of goods or services, any applicable commissions, administrative fees, taxes, and shipping costs.

These invoices can be issued at various stages of the transaction. They might be sent prior to the delivery of goods or services as a preliminary bill, or alongside shipped items, giving the recipient a detailed overview of the costs incurred.

Unlike standard invoices, the format of pro forma invoices is not strictly regulated. This allows businesses the flexibility to adapt the invoice format to their specific needs and industry standards, ensuring that all necessary details are communicated effectively.

A pro forma invoice differs from an official demand for payment, serving more as a 'proposed' estimate of costs rather than a conclusive bill. Its non-binding nature permits adjustments and modifications, making room for negotiation or changes in the transaction.

Leverage the Power of Proforma Invoices for Clear Communication and Efficient Negotiations - Start Today!

*Free & Easy - no hidden fees.

A pro forma invoice acts as a preliminary document, outlining the expected terms and costs of a purchase. It's more of a proposal or estimate rather than a final statement.

In contrast, a final invoice is issued at the point of delivery or completion of service. It represents an official demand for payment, confirming the exact amount owed by the buyer.

The pro forma invoice sets the stage for a transaction, helping both parties reach an understanding. The final invoice, however, concludes the transaction, signaling the fulfillment of the order and the payment due.

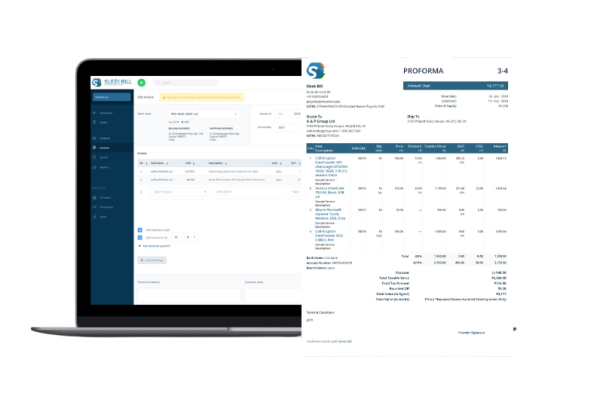

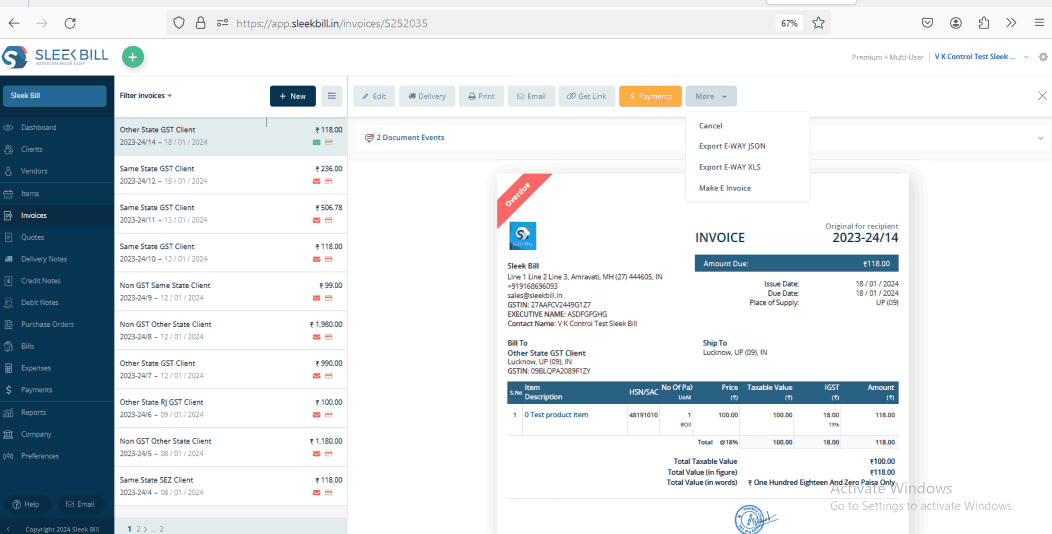

○ Sleek Bill facilitates the creation of sale quotations and invoices, streamlining the billing process.

○ Enhances service management by enabling adjustments based on market trends.

Offers insights into business performance, helping in optimizing services and offerings.

Supports businesses in staying competitive and responsive to market dynamics.

Intuitive design makes it easy for businesses to manage their invoicing and sales processes.

Suitable for various business sizes, from small to medium enterprises.

Designed for clarity and professionalism, our PDF formats are straightforward and impactful.

Equipped with features that automate routine invoicing tasks, ensuring quick and error-free invoice creation.

Proforma invoice formats significantly reduce the time and effort involved in invoicing.

Streamlines the sales process, allowing businesses to focus on growth and customer service.

By speeding up the invoicing process, businesses can handle higher volumes of transactions, leading to increased efficiency and revenue.

● Supplier Commitment:○ Indicates the supplier's commitment to provide specified goods or services at agreed prices. ○ Confirms the supplier's readiness to fulfill the order as per the projected timelines.

● Buyer's Acknowledgment: ○ Serves as an informal acknowledgment from the buyer, showing their intention to proceed with the purchase. ○ A preliminary step towards formalizing the business transaction.

● Buyer's Acknowledgment: ○ Serves as an informal acknowledgment from the buyer, showing their intention to proceed with the purchase. ○ A preliminary step towards formalizing the business transaction.

● Foundation for Understanding:○ Proforma invoices facilitate transparent communication between buyers and suppliers,providing an early preview of the transaction terms to support clear negotiations.

● Efficient Transaction Flow: ○ Streamlines the quote-to-cash cycle by setting clear expectations from the outset. ○ Reduces the need for extensive discussions post-transaction initiation.

● Time and Cost Effectiveness: ○ By defining terms early on, proforma invoices contribute to reducing time and costs associated with post-order negotiations and adjustments. ○ Enhances overall transaction efficiency and cost-effectiveness.

Vital in Global Trade:

Proforma invoices hold significant importance in international transactions. They are often the first step in initiating a global trade deal, providing a preliminary agreement before the formal export-import processes begin.

Customs and Import Duties:

While not a mandatory document for customs, proforma invoices are frequently used to declare the value of goods for customs clearance. They help in estimating import duties and taxes, which is essential for budgeting and planning by importers.

Detailed Transaction Overview:

These invoices typically include comprehensive details like the estimated price, product specifics, quantities involved, payment methods, and expected delivery timelines. This information is crucial for buyers to make arrangements for payment, receive goods, and adhere to import regulations.

Facilitating Shipping and Logistics:

In international shipping, proforma invoices can be used to create shipping labels and documentation. They provide carriers and customs authorities with necessary information about the nature and value of the goods being shipped.

Risk Management:

By providing a detailed estimate of the transaction, they help in managing risks associated with international trade, such as currency fluctuations and changes in import duties.

Transactional Context:

In situations where the full payment is contingent upon the delivery of goods or completion of services, pro forma invoices prove highly advantageous. They assist in managing expectations and preparing for the eventual billing process.

Example Scenario:

Consider a bakery preparing a custom cake. The bakery issues a pro forma invoice to the customer detailing the estimated cost. Once the cake is prepared and delivered, a final invoice is issued for the actual payment.

Role in Customer Relations:

This approach helps the customer understand the expected charges upfront and ensures transparency. Upon delivery, the final invoice reflects the actual charges, aligning with the initial estimate provided in the pro forma invoice.

Serves as a preliminary bill of sale, providing an outline of goods or services to be delivered at a future date.

Forget manual data entry and tedious cross-referencing. With our auto-population feature, updating your sales records becomes a breeze. Sleek Bill does the heavy lifting, allowing you to focus on what really matters.

Especially useful in establishing a clear understanding of the sale terms. Helps in preemptively addressing any potential queries or concerns from the client.

1. Detail Requirements: Pro forma invoices provide a snapshot of the transaction with essential details but are less comprehensive than commercial invoices, which include specific information like shipment details, country of origin, and tariff classifications, especially crucial in international trade.

2. Customs Clearance Functionality: Pro forma invoices can be utilized for estimating potential duties and taxes, aiding customs assessment. However, they do not replace the need for a complete commercial invoice during international shipping, where the detailed information is crucial for customs clearance.

1. Detail Requirements: Commercial invoices, particularly vital in international trade, are detailed documents that encompass comprehensive information about the shipment, including specifics like country of origin and tariff classifications.

2. Functionality in Trade: Unlike pro forma invoices, commercial invoices play a key role in the actual import/export process. They are indispensable for customs clearance and serve as essential documentation for a successful international trade transaction.

Templates for pro forma invoices are readily available, often in a user-friendly PDF format, simplifying the process of creating professional-looking invoices.

These templates are designed to save time and effort, providing a base structure that can be personalized for individual business needs.

Non-Binding Nature:

Pro forma invoices are fundamentally non-binding and can be modified or canceled. They are not formal requests for payment but rather a means to outline potential transaction details.

Adaptability to Change:

These invoices provide a framework for the expected transaction, indicating that certain aspects are subject to confirmation or change. They offer flexibility to adjust terms as the transaction progresses.

Enhance your business workflow with our comprehensive invoicing tools - Elevate your transaction experience!

*Free & Easy - no hidden fees.

A variety of proforma invoice templates are available to cater to different business scenarios, including those with specific requirements like shipment details, discounts, delivery charges, or company seals.

Each template variant serves a unique purpose, aligning with the specific demands of various business transactions, such as including Eway Bill Numbers for transportation-related invoicing.

Professional Presentation:

The format mirrors the standard design of formal invoices, ensuring a professional appearance of invoices.

Cost-Efficient:

The availability of free PDF formats allows businesses to create unlimited pro forma invoices without incurring additional costs.

Customization Options:

Businesses can tailor these templates to their brand identity, with the flexibility to add logos, choose fonts, and select colors.

○ Elevates the professional stature of your business, showcasing attention to detail and accuracy.

○ Enhances customer trust and satisfaction by presenting precise and detailed transaction information.

○ Offers industry-specific invoice formats, allowing businesses to tailor invoices to their unique needs.

○ Flexibility in customization caters to a diverse range of business models and practices.

○ Businesses can create and send invoices from anywhere, ensuring operational flexibility.

○ Enhanced Operational Flexibility: The ability to generate and send invoices at any time contributes to improved business flexibility.

Ease of Access:

○ Users can conveniently download proforma invoice formats in PDF from our website.

○ The download process is simple and quick, ensuring immediate access to invoicing tools.

Personalization for Unique Business Needs:

○ Offers customizable fields to perfectly align with individual business needs.

○ Ensures that each invoice reflects the unique character and requirements of the business.

| Sr. No | Aspect | Proforma Invoice | Sales Invoice |

|---|---|---|---|

| 1. | Purpose | To inform the buyer and allow negotiation. | To request payment from the buyer. |

| 2. | Issued | Before confirming a sale. | After delivering the goods and services. |

| 3. | Legal Status | No legal obligation; a gesture of goodwill. | Acts as a legal record of the transaction after the sale. |

| 4. | Accounting | Cannot be used for accounting purposes. | Can be used for accounting purposes. |

Print-Ready Design:

Designed to be print-friendly, ensuring consistency in format across various transactions.

Customization and Flexibility:

○ Allows for modifications to meet specific business needs, including the addition of business logos and adjustment of layout.

In-built Invoice Elements:

Crafted with all necessary components of an invoice, including item descriptions, quantities, prices, and taxes.

○ Features automatic calculation for subtotals and grand totals, enhancing accuracy and reducing manual errors.

Proforma invoices play a pivotal role in shaping the preliminary stages of business transactions. They provide a clear, preliminary outline of the sale terms, facilitating communication, negotiation, and internal approval processes. While they set the stage for what to expect, their non-binding nature allows flexibility until the final invoice is issued. Their strategic use in business transactions underscores their importance in achieving efficient, clear, and mutually beneficial outcomes.