HSN codes can be tricky, especially when dealing with laptops and desktops.

This article simplifies the classification process to ensure you get it right.

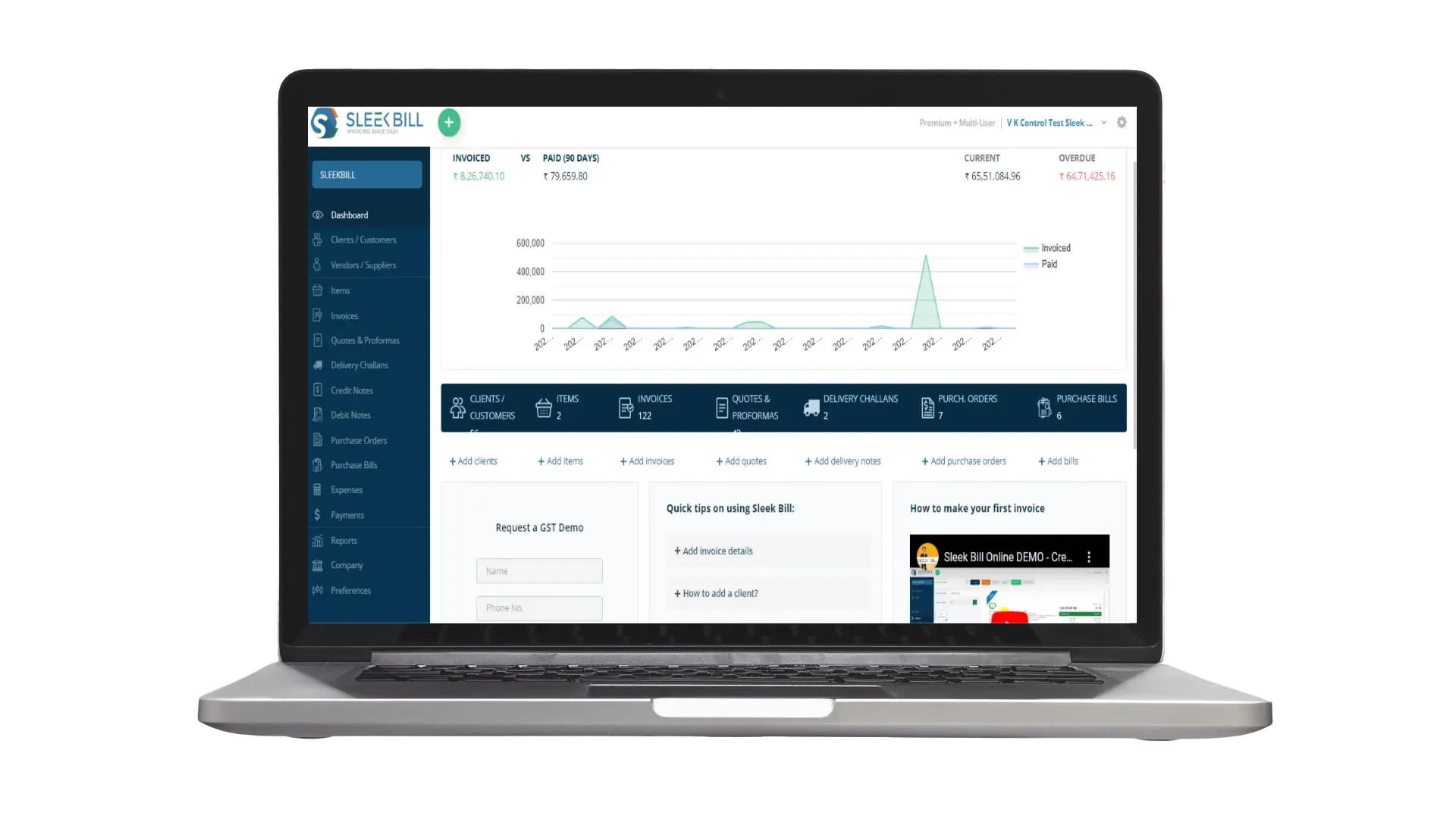

*Free & Easy - no hidden fees.

HSN code is code contain the necessary information in about laptop and its accessories, which comes with various GST rules in India in computer accessories

HSN code is stand for Harmonized System of Nomenclature, it is an internationally standardized system followed for naming and classification purposes for any product globe. Hence, detailed consideration of HSN codes in respect of laptops and other related accessories will be discussed here considering the effective rates of GST.

HSN code 84713020 is specifically related to the description of laptops. It comes under the category "portable digital automatic data processing machines, weighing not more than 10 kg, with at least one central processing unit, a keyboard and display.

The code 8471500 covers portable automatic data processing machines other than those covered under 84713020. It would encompass a few examples of mobile computing devices that do not actually meet the defining criteria of a regular laptop.

These fall under the general HSN code 8471, comprising laptop computers, desktops, and personal computers.

HSN Code defines all types of automatic data processing machines and comprises:

GST rate for products under HSN code 8471, including a laptop is 18%. HSN Code for Dell Laptop Like any other brand, dell laptops fall under the HSN code 84713020. GST on Dell Laptops is also 18%.

| Particulars | HSN Code | GST Rate |

|---|---|---|

| Laptops, Desktops, and Personal Computers | 8471 | 18% |

| Printers, Keyboards, and USB Storage Devices | 8471 | 18% |

| Computer Monitors (Less than 32 inches) | 8528 | 18% |

| Monitors (Greater than 32 inches) | 8528 | 28% |

| Printers | 8443 | 18% |

| Computer Keyboards, Mouse, USB drives, Hard disks | 8471 | 18% |

The GST rate applicable to laptops and related computer accessories is generally 18%. Here's a list of common devices and their GST rates:

| Laptop | 18% |

|---|---|

| Desktop Computer | 18% |

| Hard Drive | 18% |

| Memory Chips (RAM) | 18% |

| External Hard Drive | 18% |

| Optical Drives | 18% |

| Desktop Monitor: LED/LCD (<32 inches) | 18% |

| Desktop Monitor: LED/LCD (<32 inches) | 28% |

Business must be aware of the appropriate HSN code and corresponding GST rates in respect of a laptop and computer accessories to meet all the statutory compliances and continuous business operations. The general HSN code 8471 covers a broad category of computing devices. An 18% GST rate is applicable on most of the products falling under this HSN code. Therefore, information on these codes and rates would allow any businessperson to correctly classify the products and avoid potential issues with the tax administrations.

In this regard, it becomes very important for a businessperson in the field of selling laptops or selling associated accessories to be informed about the latest updates on HSN code and GST compliance for proper classification and charging relevant tax rates from the customers.

50k & Happy Customers

50k & Happy Customers 3 Millions & Freemium Users Worldwide

3 Millions & Freemium Users Worldwide 13 Years of Invoicing Solutions

13 Years of Invoicing Solutions Get access to professional, ready-to-use invoice templates that elevate your business. Join today and simplify your billing process with just a few clicks!

*Free & Easy - no hidden fees.