The flood cess in Kerala is a new tax levied to intra-state supply. This article helps you understand what is this tax, who does it apply to and how to calculate it.

*Free & Easy - no hidden fees.

![]() Call For Demo 9168696091/92/93

Call For Demo 9168696091/92/93

The Kerala flood cess is a new tax for businesses in India and the rules that govern it have been implemented starting with the 1st of August 2019. But what does this tax mean and who does it apply to?

The Kerala flood cess is a new tax for businesses in India and the rules that govern it has been starting with the 1st of August 2019. But what does this tax mean and who does it apply to.?

The Kerala flood cess is a tax implemented by the Kerala government on intra-state movement of goods and services to the final customers. The tax is applicable from the beginning of August 2019, In June last year, the central government notified an extension of the compensation cess on luxury and demerit goods till march 2026.The Kerela flood cess has been established to raise the funds required for relief and rehabilitation of those affected by last year’s flood in the state.

The Kerala flood cess, KFC for short, will be imposed at a rate of 1% on the value of supply of goods, services or both that fall under Schedule II, III & IV or SRO.No.360/2017 Dt.30.06.2017. In case the goods fall under the Fifth Schedule of SRO.No.360/2017, such as gold, diamonds etc, the Kerala Flood cess will be applied at the rate of 0.25%.

Composition taxpayers are exempted from the Kerala Flood Cess. This includes taxpayers who have opted for composition for services as per Section 14(1)(i) of Finance Act,2019. The goods, services or both, that are susceptible to the Kerala Flood Cess are described in Sec.14(2) of the Kerala Finance Act, 2019. All goods, services or both, that are not covered in the mentioned Section will be exempted from levy of Kerala Flood Cess. Dealers of exempted goods and services do not carry the levy of the Kerala flood cess. Transactions between registered persons to further their business are exempted from the Kerala Flood Cess. If a supply is made to an unregistered taxpayer, the Flood Cess has to be levied. If the supply is made to a registered person but not in furtherance of business, the Flood Cess needs to be levied.

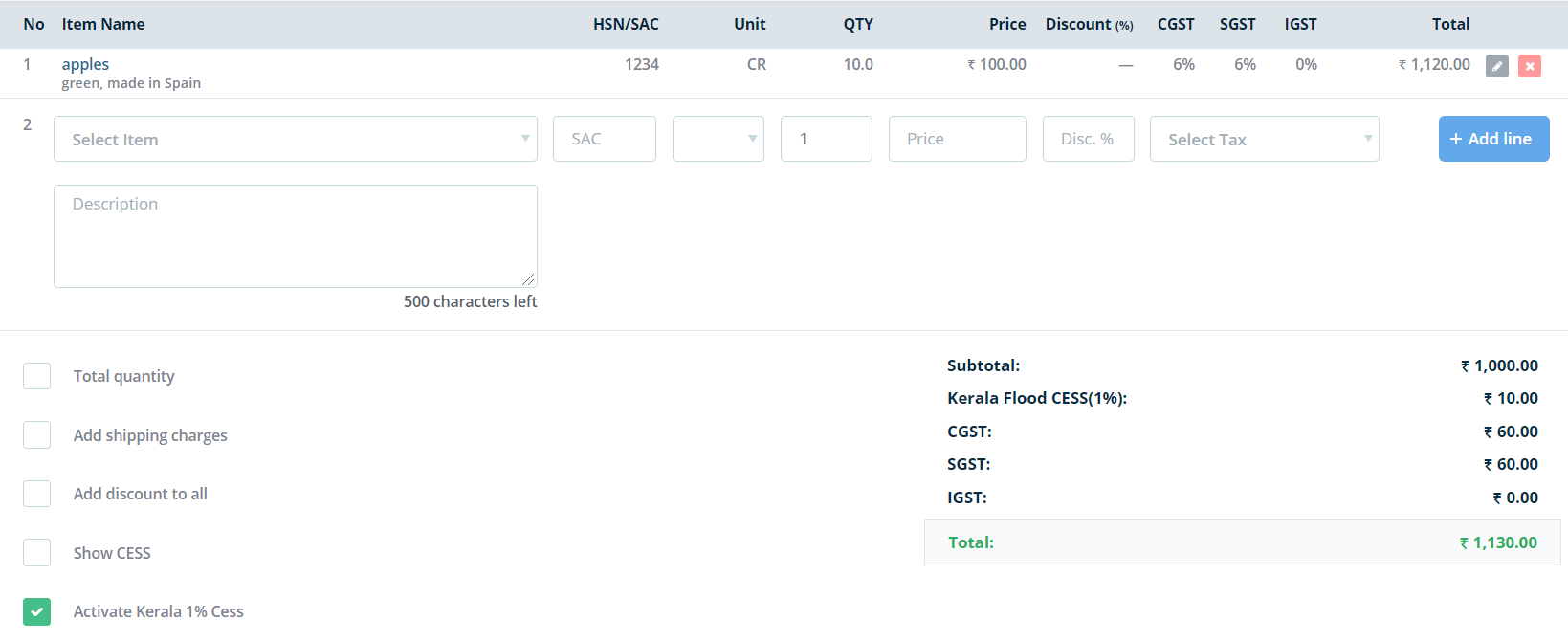

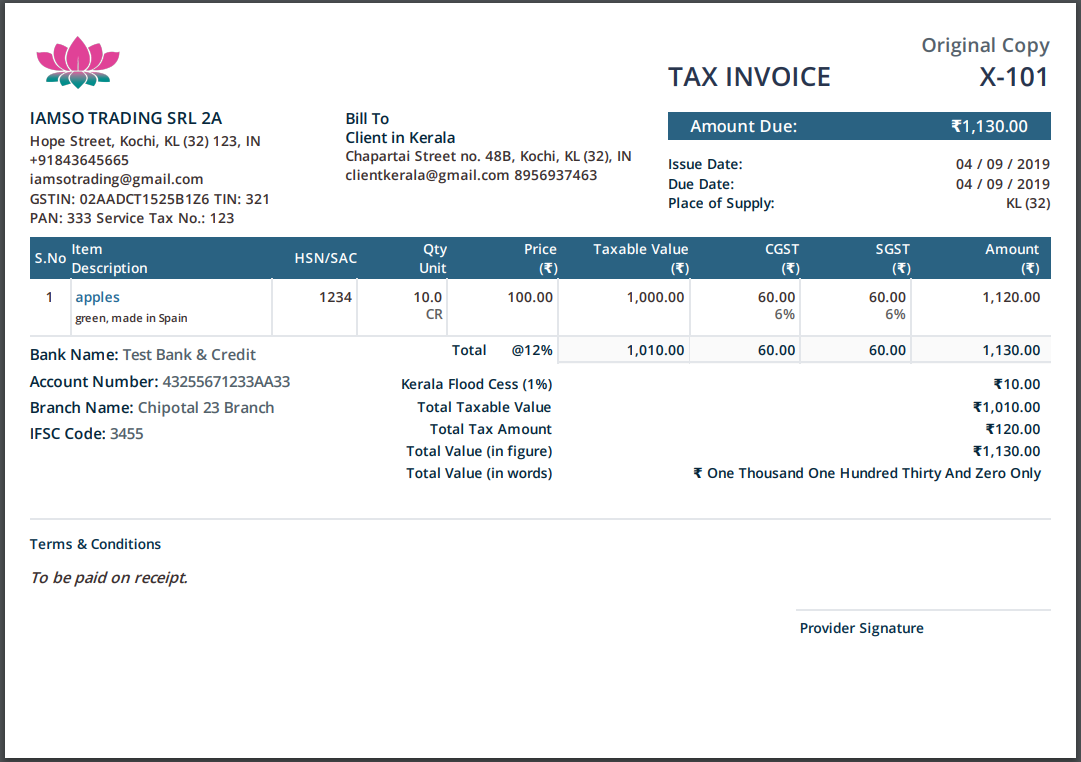

The flood cess in Kerala is calculated on the value of the supply. This means that CGST and SGST are not included in the value of supply. Let’s see the following example of an invoice with the flood cess on it.

Example : Base Value of Supply : ₹1,000

GST Rate : 12%

• CGST = ₹60

• SGST = ₹60

Kerala Flood Cess : If applicable at 1%, Cess = ₹1,000 × 1% = ₹10

Total Invoice Value : ₹1,000 + ₹60 + ₹60 + ₹10 = ₹1,130

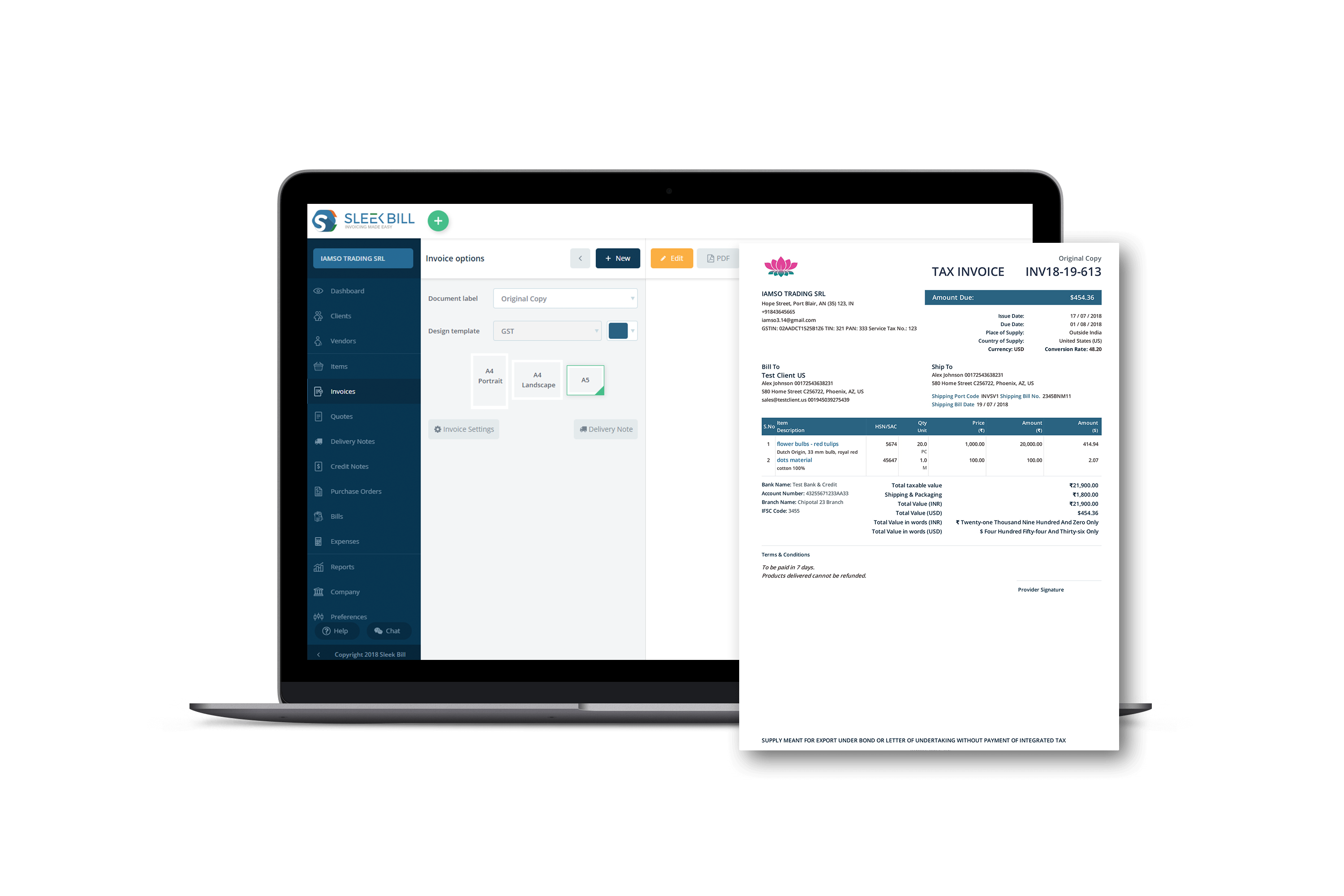

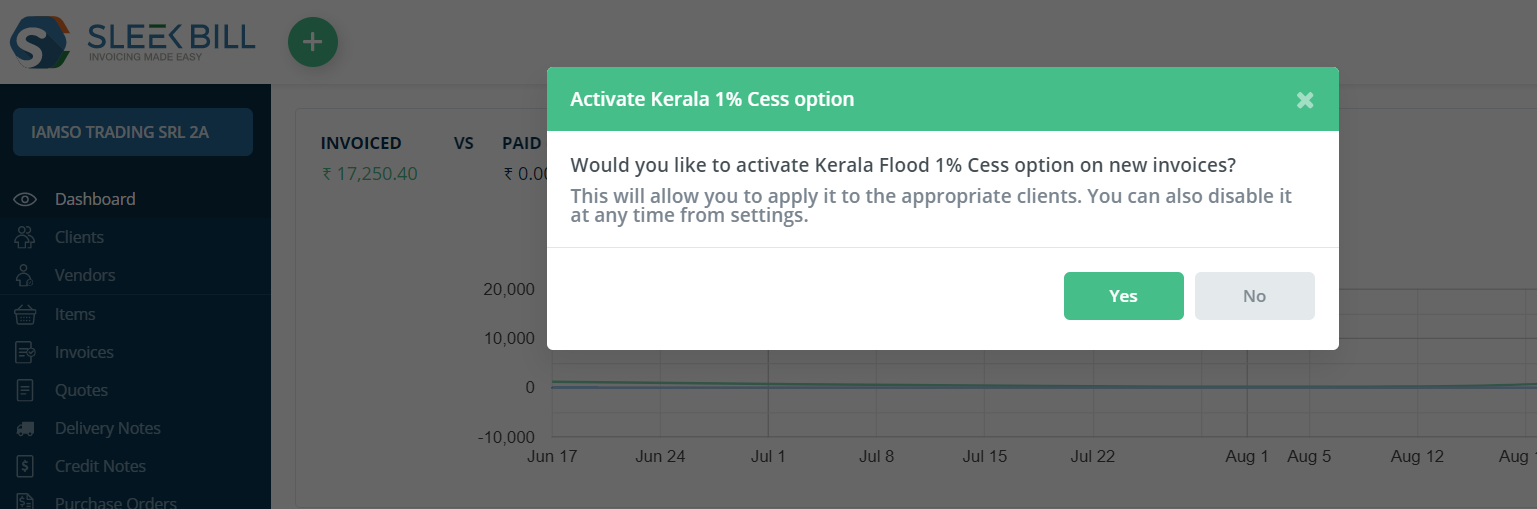

First of all, take into account the rules discussed in the articles. Second, if your business is registered in Kerala and you have added this state in your company profile in Sleek Bill, you will see or have already seen the following screen:

Sleek Bill automatically detects your state and to help you make the correct invoices with no stress, it is recommended to activate the option of showing the Kerala Flood Cess on your invoices. Don’t worry, you can always deactivate this option from your General Settings. Ok, so let's make an invoice for an unregistered client from Kerala who buys 10 crates of Spanish Apples from your GST registered company in Kerala.

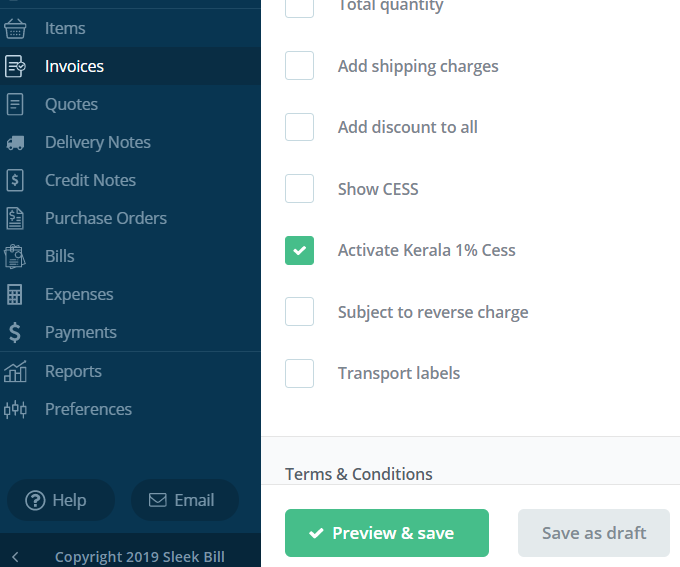

You Create a New Tax Invoice as usual, with just the click of 1 Button, from your own dashboard. In the invoice, select the Kerala Client you are making the bill for. NOW, to apply the Kerala Flood Cess, Scroll down to the bottom of the page and tick the box that says “Activate Kerala 1% Cess”, as shown in the picture.

Now add your product(s) to the invoice as you would with other invoices. In the case of our example, we have added the 10 crates of apples. As you can see, on your invoice after the CGST, SGST breakdown, you will see an entry for the Kerala Flood Cess of 1%. Sleek Bill calculates the correct amount of cess and total value and shows it on your invoice.

The process to apply the cess in Sleek Bill Desktop is similar to the one described above. If your company is from Kerala an option will appear when you Edit your Invoice and all you need to do is check the box for it and this cell will be applied.

Kerala Flood Cess is applicable only for the businesses that come under the Kerala GST Act. This is a Tax to be collected for intrastate dealings that are undertaken within the state of Kerala.

Intrastate Sales : This is when the seller and the buyer are both within Kerala.

Interstate Sale : Not payable even when a seller is within Kerala.

Kerala Flood Cess is applicable only for the businesses that come under the Kerala GST Act. This is a Tax to be collected for intrastate dealings that are undertaken within the state of Kerala.

Fines in Rupees Terms

An amount would be collected under the Kerala GST Act regarding any business who is not imposing or low imposition of cess.

Interest for Delayed Payment

On the failure of the payment made on time an interest can be levied with the amount which still falls as pending to be paid, the cess.

Criminal Liability

Every habitual defaults might attract audit or even fines under GST, along with other penal measures.

Certain goods and services are exempted from the Kerala Flood Cess

Under Section 14(2) of the Kerala Finance Act, 2019.

Examples : Specific categories are essential food items or goods and services exempt from GST.

Supplies rendered between registered persons for business purpose are exempted.

Where supplies made to unregistered persons or for a non-business purpose are liable to pay the cess.

Miscellaneous services with taxable as well as exempt goods/services. Such an invoice is liable to pay only cess on taxable.

100% GST approved and correctly calculated. Seamlessly add flood cess in your invoices.

*Free & Easy - no hidden fees.

Anyone can use this for their billing from the first day of installation. I personally like to use this high-tech billing software for its billing pattern and the customization options. I've been using Sleek Bill for the last 2 years and I am happy with the telephone & online support [...]. I would like to thank team Sleek Bill for best, on time support and I recommend this billing software for every small business.

I've been using Sleek Bill for 4 months now and I love it. It is very User friendly and easy to setup. It's a complete software where you can easily create invoices, quotations etc. The customer support was very good and helpful. The value of this program is one of the best around.

I have found the best invoicing software for my business. A big thank you to the team for helping us throughout the process and answering our questions.

To add credit note first open credit note tab and then click on new credit button and then fill all the necessary fields and save.

Yes, you can delete the credit note. First select the credit note and click on the delete button.

To edit the credit note open credit note then you will see the edit button click on the edit button and edit credit note.

To download credit note open credit note there you will see the pdf button click on that. credit note will download.

To add shipping charges check in the add shipping charges and add shipping charges when adding credit note.