A Complete Step-by-Step Guide

*Free & Easy - no hidden fees.

![]() Call For Demo 9168696091/92/93

Call For Demo 9168696091/92/93

Checking GST Registration Application Status is an important procedure to comply and operate the business efficiently. Be it for obtaining a new GST number or updating details in an existing registration, being aware of how to track your GST registration status can prove to be helpful and time-saving to stay on top of the application process. This article discusses the process, important status types, and how platforms such as Sleek Bill can aid in GST compliance

When it comes to registering under the Goods and Services Tax (GST) system in India, there are several categories depending on the nature and size of the business. Here's a simple breakdown of the main types:

1. Regular GST Registration This is the standard and most widely used type of registration. It is mandatory for any business or professional whose annual turnover exceeds the threshold limit set by the government (currently ₹40 lakhs for goods and ₹20 lakhs for services in most states). Businesses under this category are required to file regular GST returns.

2. Composition Scheme Registration Designed specifically for small businesses, the Composition Scheme is a simplified GST option. Businesses with a turnover below the prescribed limit (₹1.5 crore for goods, ₹50 lakhs for services) can opt for this scheme. It allows them to pay GST at a fixed rate without the need to maintain detailed records or file frequent returns.

3. Casual Taxable Person Registration This registration is for businesses or individuals who operate occasionally in a state where they don’t have a fixed place of business. For example, a business participating in a trade fair or exhibition in another state would require this temporary registration. It is valid for 90 days and can be extended if needed.

4. Non-Resident Taxable Person Registration Foreign businesses that supply goods or services in India but do not have a physical presence here must register as a non-resident taxable person. This registration is also temporary and requires advance tax payment based on estimated liabilities.

5. SEZ (Special Economic Zone) Registration Businesses that operate within a Special Economic Zone (SEZ) or are SEZ developers must obtain a separate GST registration. This allows them to avail of various tax benefits and exemptions provided under the GST law.

Each type of registration is tailored to different business models, so it’s important to choose the one that fits your business operations to ensure compliance and take full advantage of available benefits.

The GST application information is the necessary data that helps to track your GST application status using the Application Reference Number (ARN); the Service Request Number (SRN); and the financial reference number (FRN) that are provided at the time of the application.

The documents required for GST registration are as follows:

Photographs of the proprietor/directors/partners.

PAN Card of proprietor/directors/partners.

Proof of Business Address

Bank account details

Aadhaar Card of proprietor/directors/partners

Cancelled cheque

Incorporation Certificate (in case of a company)

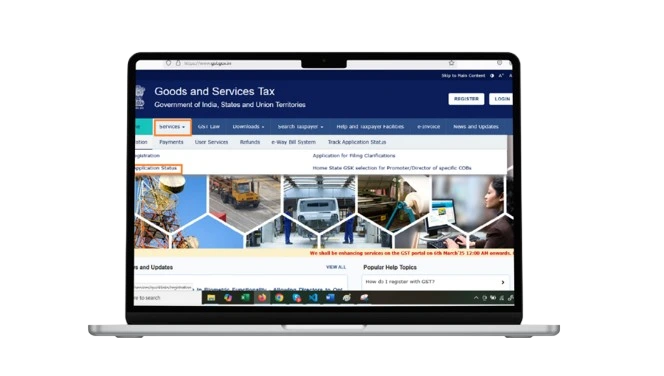

Go to GST Portal.

Click on Services > Track Application Status

Input the ARN received via email when you submitted your registration application.

For applications through MCA Portal, use the SRN.

For applications via IFSCA Portal, use the FRN.

Enter the captcha code and click the SEARCH button.

The portal will display the status of your application with different stages highlighted in color.

Green indicates completed stages, while grey represents pending ones.

If your GST registration is approved, follow these steps to obtain your first-time login credentials:

Visit GST Portal.

Click Services > Registration > Track Application Status.

Enter ARN and Captcha, then click SEARCH.

Click the Click Here hyperlink to receive credentials via email/SMS.

GST Registration timeline: Processing of GST registration varies but typically it is as follows:

Standard Approval time: 7-10 working days.

If clarification is required: Additional 7 days after responding.

With site verification: May take up to 30 days.

SCN (Show Cause Notice) is issued when authorities require additional information. To download it:

1. Log in to the GST portal.

2. Go to Services > User Services > View Notices and Orders.

3. Find the SCN document and download it.

The Temporary Reference Number (TRN) is used before final ARN generation. To track it:

Visit GST Portal.

Go to Services > Registration > Track Application Status.

Enter TRN and Captcha.

Click SEARCH to view the status.

The status of your GST application can fall into one of the following categories:

Application successfully submitted and waiting for review by the tax officer.

Application requires physical verification before approval.

Inspection report submitted by the verification officer.

Tax officer has raised queries regarding the application.

Pending for Order: Applicant has responded to queries and awaiting decision.

Pending for Order: No response was submitted within the required timeframe.

GST registration is granted, and login credentials sent via email and SMS.

Application rejected by the tax officer.

Application was withdrawn by the applicant.

Tracking your GST registration status ensures a hassle-free compliance journey. With clear steps and knowledge of different statuses, businesses can avoid unnecessary delays. If you need a reliable solution for GST invoicing and compliance, Sleek Bill can streamline your process. For further details, visit the GST Portal or explore our solutions at Sleek Bill.

To check the GSTIN (GST Identification Number) status:

you’ll see if it's Active / Inactive / Cancelled.

You can verify GSTIN status using the official GST portal:

The status will show:

Yes, you can check all GST registrations under a PAN:

For bulk GSTIN verification:

Use GST Suvidha Providers (GSPs) like ClearTax, Zoho, IRIS, etc.

Some tools allow upload of Excel files with multiple GSTINs for bulk validation.

GST Portal currently doesn’t provide direct bulk search but APIs or third-party software can help.

TRN (Temporary Reference Number) is used during GST registration:

Go to: https://www.gst.gov.in

Click on Services > Registration > Track Application Status

Choose TRN, enter TRN and Captcha.

Check the status of your registration application.

No, GST Portal does not allow searches by name or mobile due to privacy. You need:

GSTIN, or PAN

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about Security & Privacy

Serious about Security & PrivacySo you can focus on growing your business!

*Free & Easy - no hidden fees.