GST Completed 8 years and its requirement for bill, invoice templates are here.

*Free & Easy - no hidden fees.

![]() Call For Demo 9168696091/92/93

Call For Demo 9168696091/92/93

Used In Businesses Like:

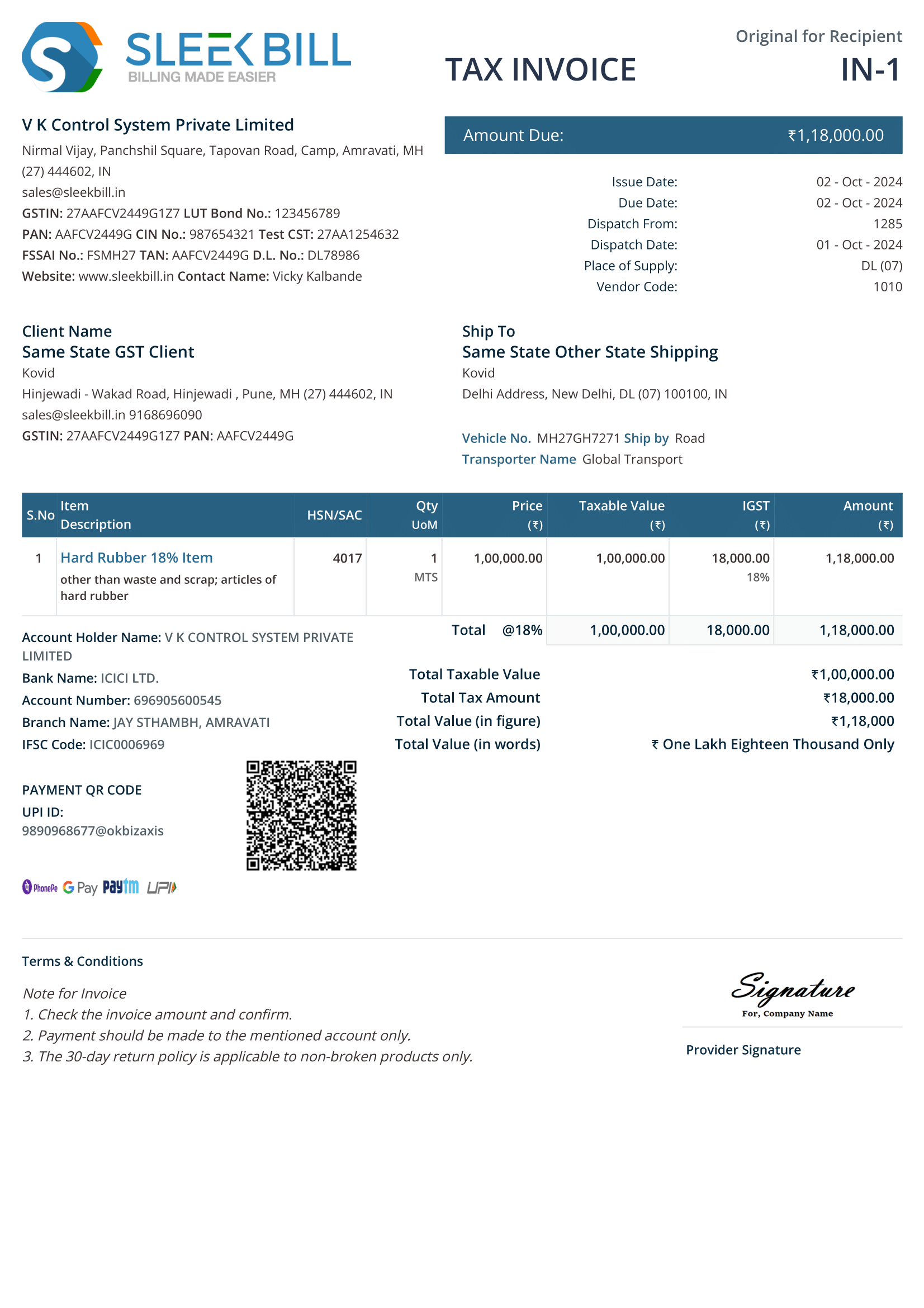

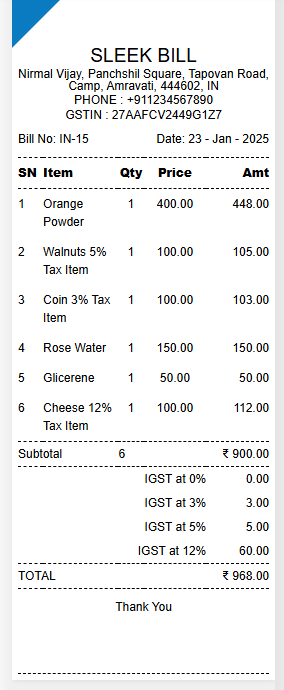

1. GST invoice format A4 Model 1: Bakery, Shoes Store, Grocery Store, Garment Store,General Store, Bakery, Bookstore,Electronics Store,Jewelry Store, Restaurant,Furniture Store, Boutique, Hardware Store,Pet Shop,Toy Store, Supermarket, Gift Shop, Stationery Shop Mobile Phone Store, Beauty and Wellness Spa, Optical Store, Music Store, Sports Goods Store, Art Gallery,Health Food Store

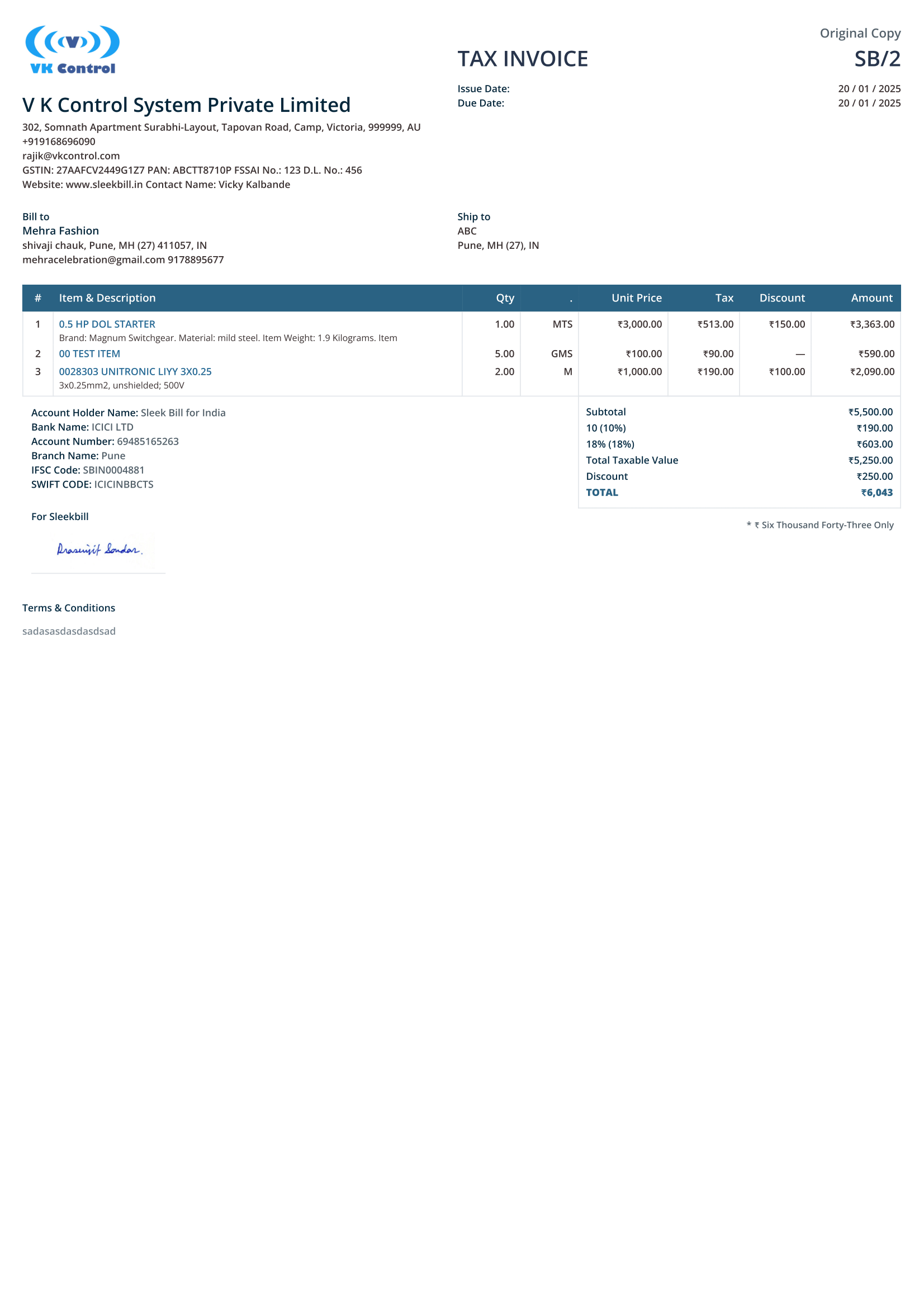

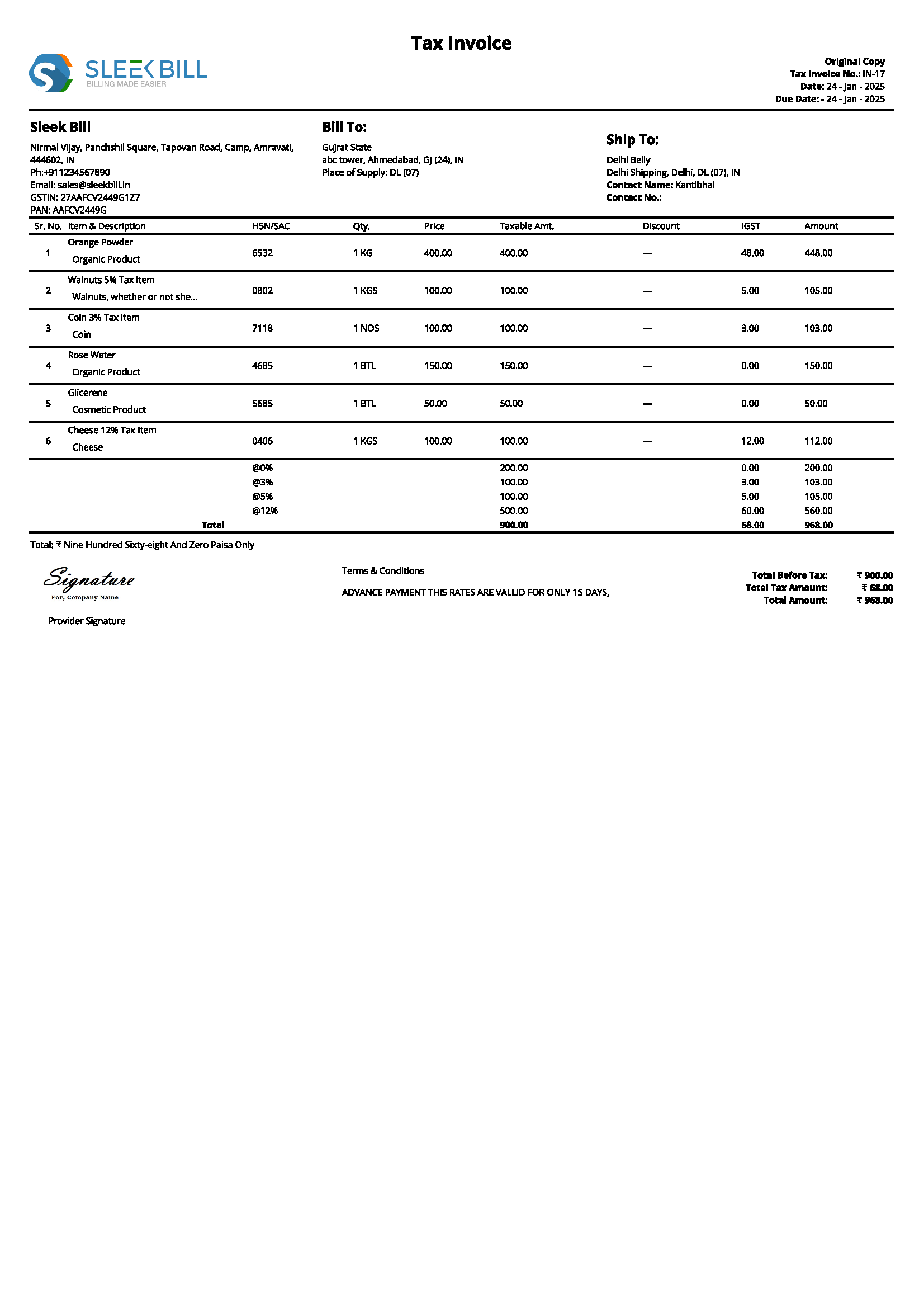

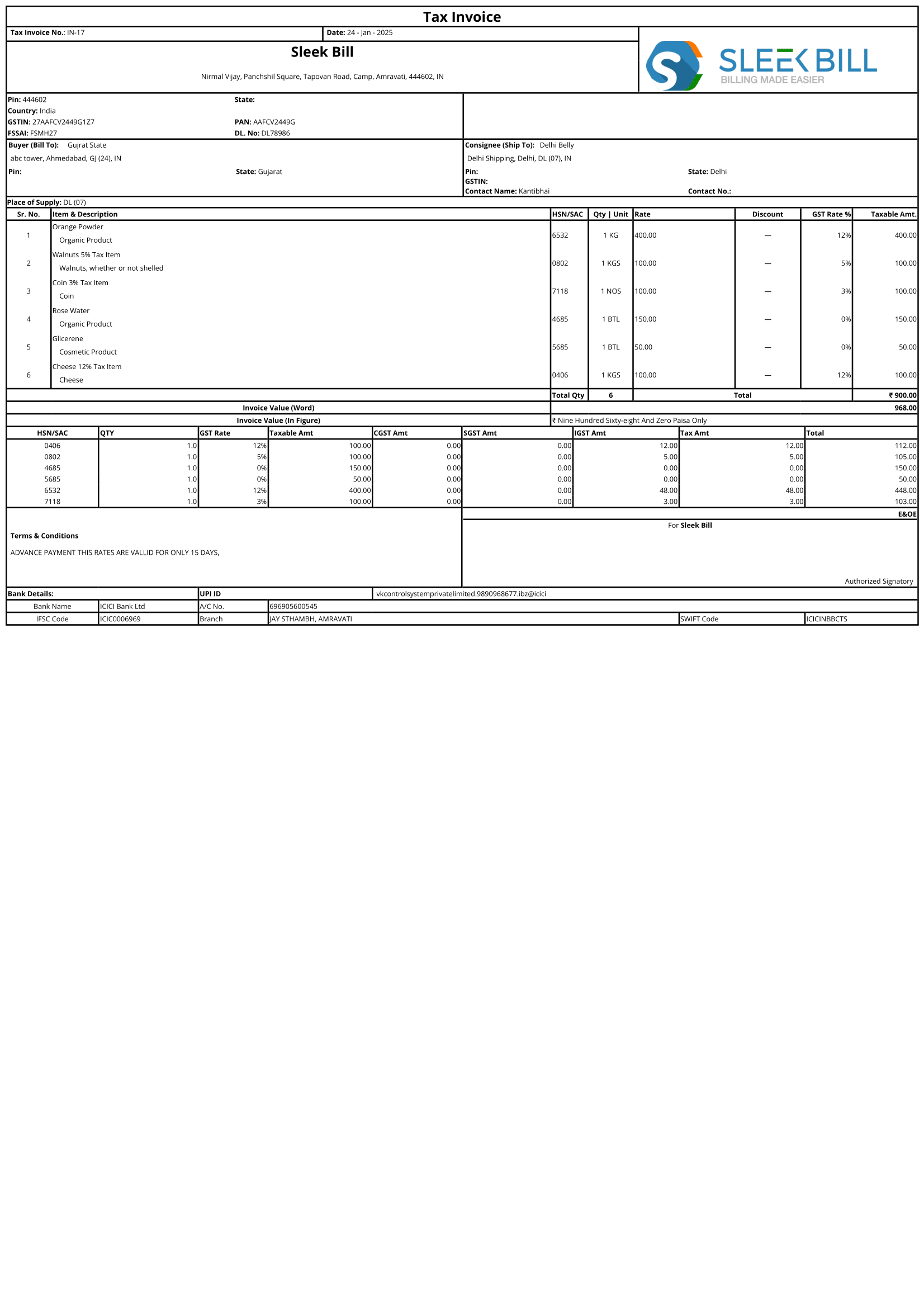

2. GST Invoice Format A4 Model 4 for the Supply of Goods : Shops selling clothing, electronics, groceries, books, furniture, distributors, retailers.

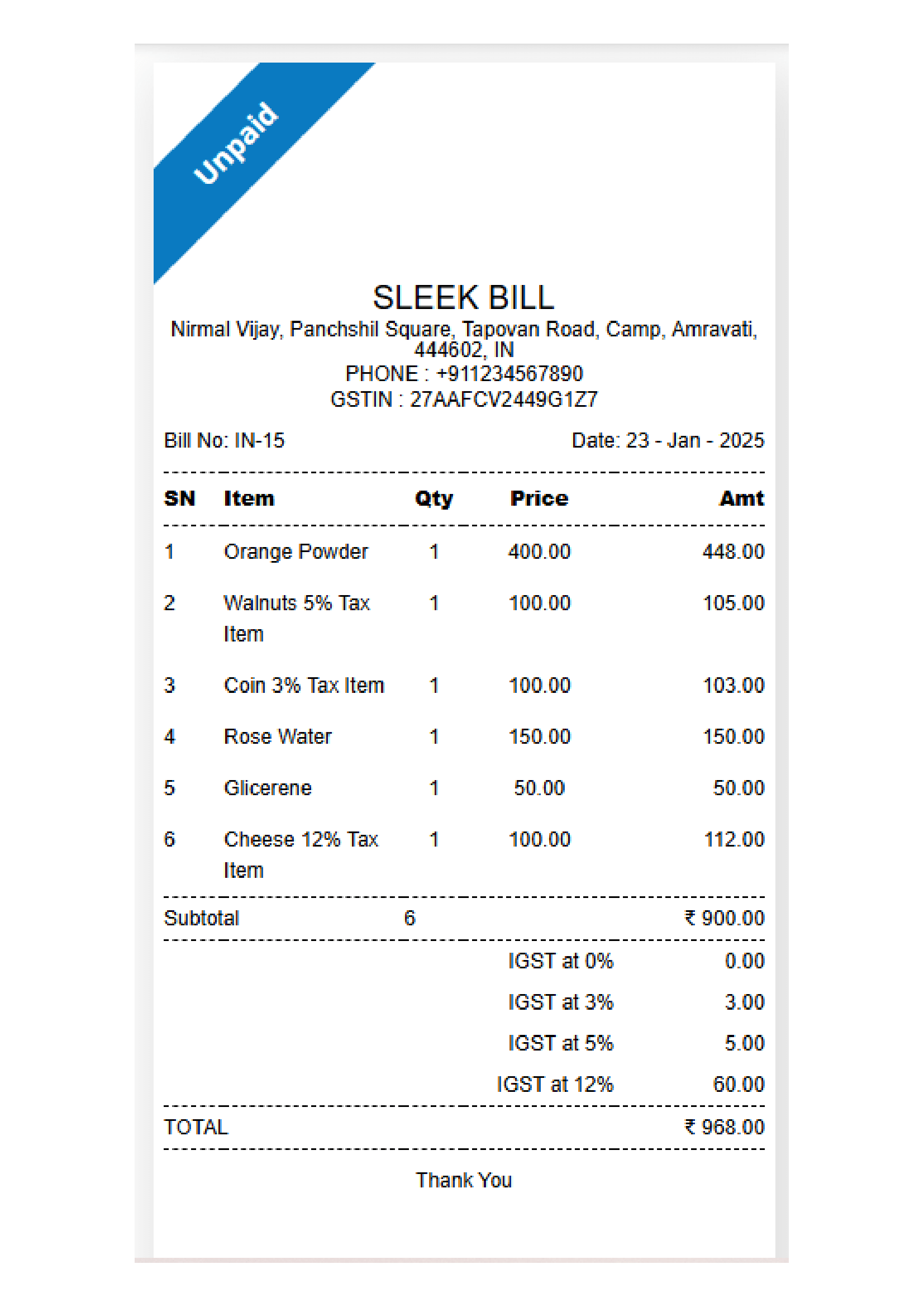

3. GST Invoice Format Model A5: Pharmacies, fitness, salons, Agencies, consultants,Car dealerships, repairs.

4. GST Invoice Format Model A6 : Grocery stores, bakeries, sweet shops, stationery shops, mobile store.

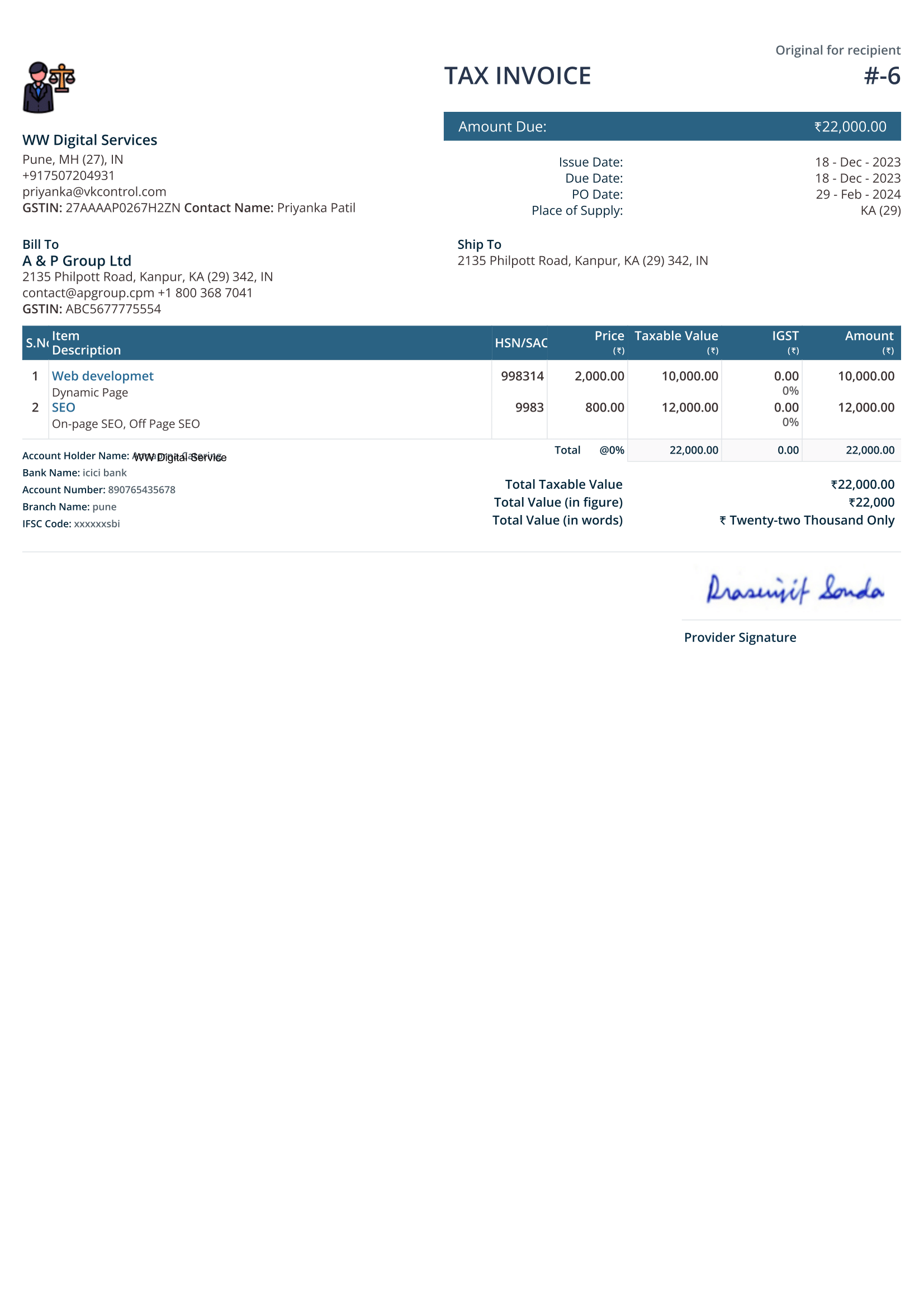

5. GST Invoice Format for Service Provider : Graphic designers, writers, business consultants, advertising, Technology and IT Services.

6. GST Invoice Format – Thermal Print (80 mm/ 3 Inch): Super shop, Grocery and Restaurant, Retail,Services

7. GST Invoice Format – Thermal Print (58 mm/ 2 Inch): Grocery and Restaurant, Retail,Services

8. B2B (Business-to-Business) invoice format Model 2: Consulting firms, marketing, advertising, Technology and IT Services.

9. B2C (Business-to-Consumer) invoice format Model 5: For Hotels and Resorts

Note: If you use invoice for "Service" then use "SAC Code"

Note: If you use invoice for "Service" then use "SAC Code"

Note: If you use invoice for "Service" then use "SAC Code"

Note: If you use invoice for "Service" then use "SAC Code"

Note: If you use invoice for "Service" then use "SAC Code"

Billing and Invoicing is familiar to anyone who sells goods or services in India and all around the globe. While so far there has been a clear document format for each type of invoice created - retail invoice, tax invoice, excise invoice.

The new goods and services tax bill will see a handful of useful changes in the regular invoices.

The government of India has released the rules of invoicing under GST together with an invoice template that highlights the data needed on these documents.

Based on the GST Invoice Rules issued by the Central Government, there are two types of invoices that can be issued under GST, tax invoice (GST invoice) and bill of supply

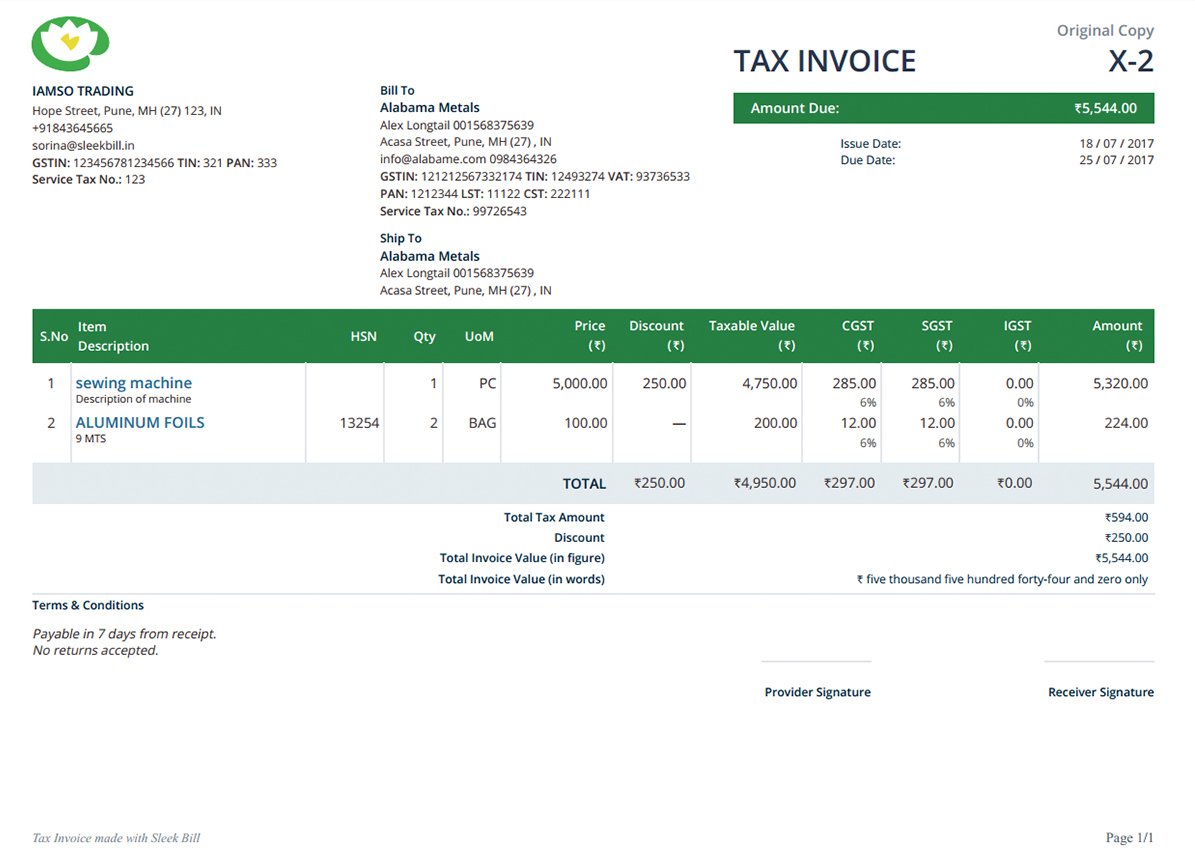

When a GST registered supplier sells goods or services that are taxable, a tax invoice has to be issued. We've created a GST invoice template to help you make compliant invoices, based on the rules issued by the GST Department.

From July 1st 2017, a tax invoice that a registered supplier needs to issued must containing the following:

Note: In case a person paying tax on reverse charge receives goods or services from an unregistered supplier, the GST registered receiver must add purchase bill entry on the date of receipt of goods or services.

In the case of exports of goods or services, the invoice must specify if GST has been paid on the exports. For clarity the following text should be used:

A it is a bill you get after buying goods or services from seller. It's a poof of a sale between a seller and a buyer where both are registered under the GST system.

E-invoicing is invoice creating invoices digitally (on a computer) and getting them approved by the government's GST Network (GSTN) system. In short you have create invoice which linked on government portal.

The businesses who have yearly sales over ₹5 crore have to use e-invoicing. This rule applies from year 2023 onwards.

This rule is mainly for medium and large businesses. It helps make sure everyone pays the correct taxes.

Small and medium or businesses using the Composition Scheme . Businesses in Special Economic Zones (SEZs). Government departments.

Sleek Bill software can easily create these digital invoices and connect with the government system, making it simpler for businesses to follow the rules.

Using the right format helps businesses follow tax rules and easily get credit for the GST they paid on their purchases. Software like Sleek Bill makes it fast and easy to create invoices that meet GST requirements.

If you selling goods, you’ll need to issue a GST Tax Invoice on the same date or even before the day of delivery of those goods and for service you have 30 days to issue a GST Tax Invoice to your customers.

Creating a GST Bill Format in Excel (Step-by-Step)

1. Open a new Excel sheet: Start with a blank spreadsheet.

2. Set up the header: At the top, include:

3. Create columns for item details:

4. Add columns for tax calculations:

5. Calculate amounts and taxes: Use formulas to calculate:

6. Add a footer: Include:

7. Format the sheet:

Use borders, shading, and appropriate font sizes to make it clear and professional.

Follow the below steps

1. Use Excel, Word, or Sleek Bill invoicing software to design your invoice.

2. "Save As PDF" Sleek Bill have an option to save or export the file as a PDF. This ensures the formatting is preserved.

1. Open a new Word document: Start with a blank document.

2. Insert a table: This will help you organize the invoice information.

3. Set up the header: Similar to Excel, include your and the customer's details, invoice number, and date.

4. Create rows for item details: In the table, create column for:

5. Add columns for tax calculations: Include rows for CGST, SGST/UTGST, and IGST.

6. Calculate amounts and taxes: You can use Word's table formulas for basic calculations, but it's less flexible than Excel.

7. Add a footer: Include bank details, terms, and signature.

8. Format the document: Use formatting options to make it visually appealing.

Important Considerations:

By following these steps, you can create GST-compliant invoices in Excel, PDF, and Word.

You can issue invoices without GST in certain situations:

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about Security & Privacy

Serious about Security & PrivacyCreate compliant, professional invoices effortlessly with our easy-to-use templates tailored for GST rules!

*Free & Easy - no hidden fees.