Understanding and Optimizing GST Compensation Cess with Sleek Bil

*Free & Easy - no hidden fees.

To gain a deeper insight into the composition of a typical invoice with CESS, let's delve into the distinct components that make up its structure and explore the distinct elements that constitute a typical Invoice_with_CESS:

Heading:

Heading:

Heading is mentioned as ‘Invoice’ where it informs the seller and buyer it is a Invoice_with_CESS. It is mentioned at the centre of the document.

Logo:

Logo:

It must be added on the left of the top of each Invoice_with_CESS document. It helps to make a brand identity.

Details of Issuer & Buyer:

Details of Issuer & Buyer:

The detailed address of the company or supplier who sends or supplies their goods to end customers or buyers. It is mentioned in the left top of the Invoice_with_CESS format.

GSTIN:

GSTIN:

GST registered number are mentioned in the left of the Invoice_with_CESS format at the bottom of each buyer and suppliers.

Contact Name:

Contact Name:

Name of Company or dealers shop for where to goods or service can be purchased.

Amount Due:

Amount Due:

This section is how much due is paid to the supplier.

Valid Date:

Valid Date:

This mentions the last date for making an order for purchasing goods or subscribing service from the seller or service provider.

Place of Supply:

Place of Supply:

Indicates the location where goods/services are delivered.

Bill To & Ship To:

Bill To & Ship To:

Detailed information about the buyer and the shipping destination.

Table of Items:

Table of Items:

Tabulated data capturing item details, HSN code, unit of materials, quantity, taxable value, taxes, and total amounts, CGST,SGST charges applicable and CESS.

Terms and Conditions:

Terms and Conditions:

Any specific conditions or policies tied to the sale.

Signature and Stamp:

Signature and Stamp:

Authenticating the document, ensuring it's officially recognized.

In the vast landscape of India's taxation system, the Goods and Services Tax (GST) emerged as a transformative reform, promising uniformity and simplicity. However, this reform brought potential revenue challenges for states, leading to the introduction of the GST Compensation Cess. With Sleek Bill, businesses can easily integrate this cess into their transactions, ensuring they remain compliant while understanding its core purpose.

The Goods and Services Tax (GST), a landmark in India's taxation system, aimed to unify multiple taxes into a singular structure. While it simplified the tax landscape, certain sectors required financial aid for welfare schemes. Enter the GST Cess—a surcharge introduced for specific goods and services. With Sleek Bill's comprehensive insights and tools, understanding and implementing GST Cess in your business transactions becomes straightforward, ensuring compliance and clarity.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

● The cess targets specific categories of goods and services, often luxury or 'sin' goods.

● The cess targets specific categories of goods and services, often luxury or 'sin' goods.

● It's essential for businesses to understand which of their products or services fall under this category and apply the cess accordingly.

● Instituted under the Goods and Services Tax (Compensation to States) Act of 2017.

● The primary aim behind this cess was to protect states against potential revenue losses stemming from the implementation of GST on 1st July 2017.

● This cess is designed to remain in effect for a period of five years, although the GST Council holds the discretion to recommend an extension or modification to this duration.

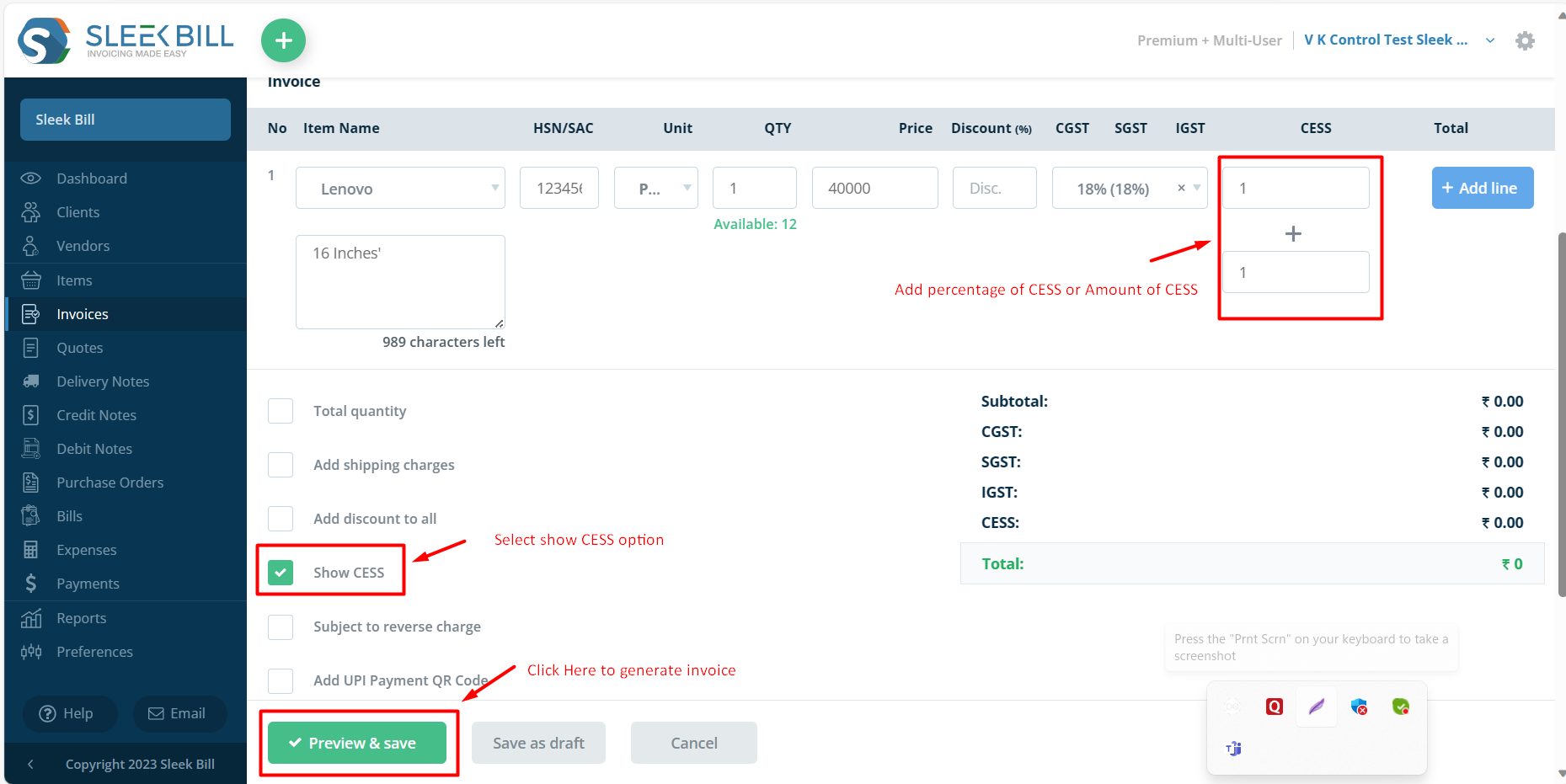

1. Go into dashboard

2. Click on invoices

3. Click on New button

4. Select Bill of Supply

5. Fill details.

6. Select Show CESS.

7. Add percentage of CESS or Amount of CESS.

6. Click on preview button.

7. State will appear on screen

8. you can select all invoices or only outstanding

In the maze of GST intricacies, the GST Compensation Cess presents a distinct responsibility for specific taxpayers. But who exactly bears the responsibility to collect this cess? Let's delve into the details.

The obligation to collect the GST Compensation Cess primarily rests on taxpayers who are actively engaged in the supply of selected goods or services. This does not include exporters.

Those who operate under the composition scheme are also not exempted. These taxpayers, despite enjoying certain privileges under the composition scheme, are required to collect and remit the compensation cess

While the cess is applicable on exports, there's a silver lining. Exporters who pay the GST Compensation Cess on their goods have the option to claim a refund, ensuring that their global competitiveness remains unhindered

Streamlined processes, reduced redundancies, and elevated professionalism are just a few of the perks.

*Free & Easy - no hidden fees.

Automated Cess Calculation

Sleek Bill automates the calculation process, ensuring that businesses correctly charge the GST Compensation Cess on applicable goods and services.

Streamlined Import-Export Operations

For businesses engaged in international trade, Sleek Bill's platform assists in correctly applying the cess for imports and managing refunds for exports.

Updates & Notifications

Stay informed about any changes or updates related to the GST Compensation Cess with Sleek Bill's notification system.

The GST Compensation Cess, introduced as a measure to provide compensation to states for their revenue loss, has been selectively levied on specific goods. Let's take a detailed look into the goods that come under the purview of this cess:

Empower Your Business: Seamless Invoicing with CESS Integration

*Free & Easy - no hidden fees.

![]()

Understanding the nuances of GST Compensation Cess can be challenging. However, the process of its calculation is quite straightforward. Here’s a breakdown of how you can accurately determine the compensation cess for your goods and services:

![]()

Compensation cess is an extra charge on certain goods and services, distinct from the regular GST rate. Calculate and include the compensation cess in your total GST obligation.

![]()

Apply a 10% GST Compensation Cess on a ₹1,000,000 luxury car sale. Cess amounts to ₹100,000. With a 28% GST (₹280,000), the total tax collected is ₹380,000.

![]()

Opt for Sleek Bill to automate and ensure accurate calculation of compensation cess on eligible transactions, eliminating manual errors.

![]()

Sleek Bill empowers Composition Dealers to calculate and pay taxes seamlessly, ensuring transparency and legal compliance without burdening customers.

![]()

The idea behind the GST Compensation Cess was to compensate states for any potential loss in revenue from the introduction of GST. But how is this compensation calculated and distributed among the various states? Let's delve into the step-by-step method used to allocate the compensation cess to different states:

Base Revenue Establishment The initial stage in our analytical process involves the meticulous identification of tax revenues attributable to each state during the Financial Year (FY) 2016-17. By anchoring our assessment to the FY 2016-17 Base Revenue, we establish a robust foundation for evaluating subsequent financial years and enabling a nuanced understanding of state-specific economic trajectories.

Facilitating Export Operations With features tailored to the needs of exporters, Sleek Bill assists in creating Bills of Supply that not only meet legal requirements but also support the practical aspects of international trade. Sleek Bill simplifies exports, ensuring all required information, from declaring IGST to special export conditions, is seamlessly included.

Projected Revenue Calculation Once base revenue is determined, a projected growth rate of 14% is assumed for each subsequent year. This growth rate helps in forecasting the revenue each state would earn in the absence of GST. By calculating this projected revenue, authorities can determine the potential revenue a state might lose due to the implementation of GST.

Utilizing Sleek Bill for Precision To make this complex calculation effortless, businesses and state authorities can leverage platforms like Sleek Bill. Such platforms assist in accurately computing the compensation cess, ensuring that states receive the correct amount and maintain a healthy fiscal balance.

Revision of Compensation Cess Formula

One approach could involve revisiting and potentially revising the existing compensation cess formula, ensuring it aligns with current economic realities and revenue expectations.

Expanding the Cess Pool

Increasing the rate of the composition cess or introducing new commodities under the compensation cess umbrella can help raise more funds. This method, while effective, might also increase the tax burden on certain sectors.

Market Borrowings

Another feasible option is for the Centre to raise funds through market borrowings. By leveraging the credit market, the government can secure the necessary funds to address the cess compensation shortfall.

The GST Compensation Cess is a testament to India's commitment to ensuring financial equity among its states. However, the present economic challenges demand innovative, balanced solutions to uphold this commitment.

Whether it's revising formulas, tapping into new revenue streams, or borrowing, the Centre's decisions will shape the fiscal landscape of the nation. Platforms like Sleek Bill stand ready to support these endeavors, ensuring transparency, efficiency, and fairness in every transaction.