Value of Goods

The total value of the goods is required to be in excess of Rs. 50,000.The good type ranges from taxable to tax-free, with just a few special cases that one must consider do not apply.

Find Out How the e-Way Bill Limit Impacts Your Logistics and Compliance.

*Free & Easy - no hidden fees.

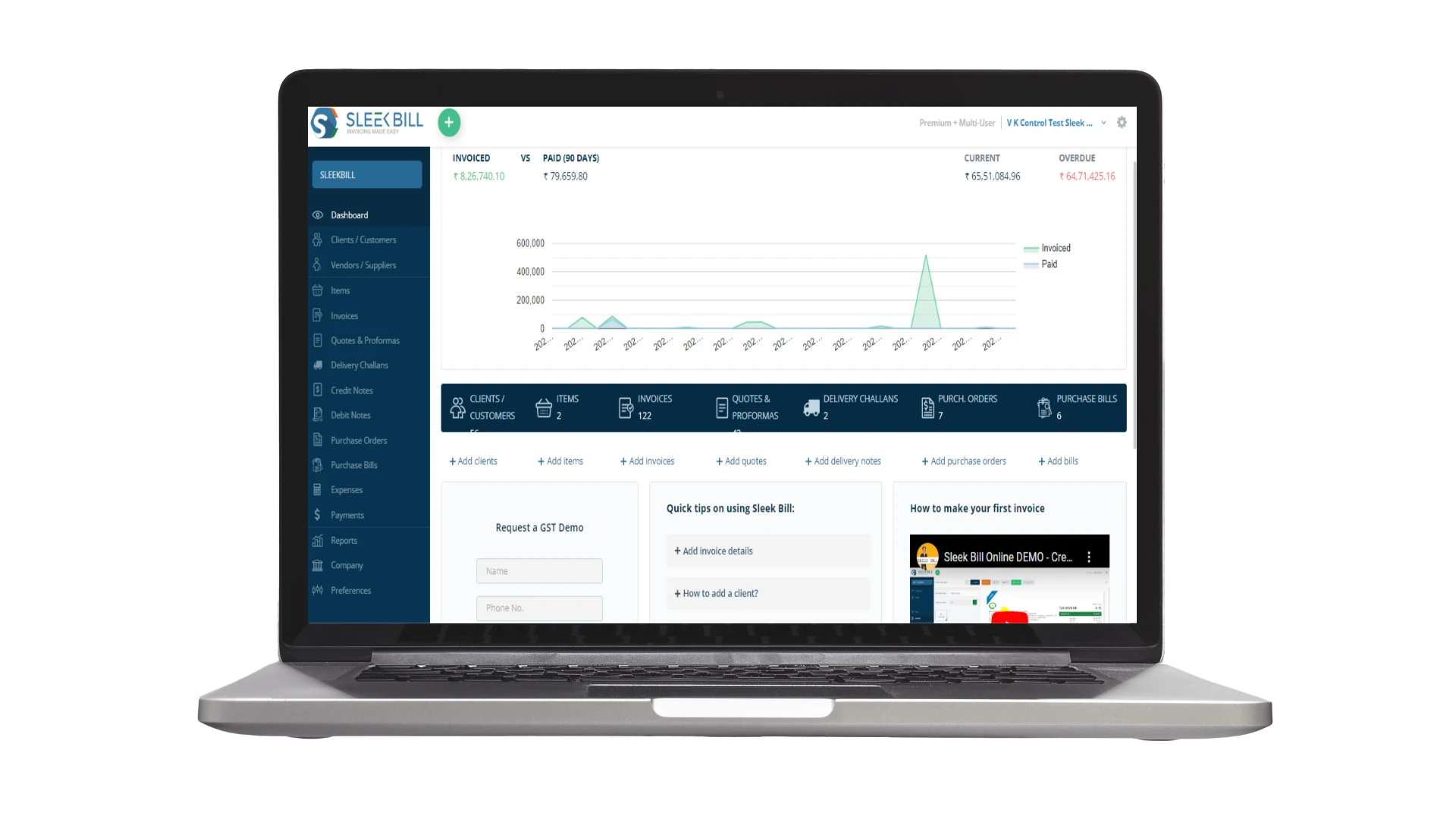

From 2024 onward, all businesses moving products valued over Rs. 50,000 within India are required to acquire an electronic way bill (e-way bill). This stipulation applies both for transportation across state boundaries as well as within a single specific state.

The e-way bill permits the government to oversee goods transportation, ensuring accurate tax payment and stopping avoidance of taxation.

The e-way bill limit indicates the level beyond which a company needs to create an e-way bill for shipping items. In India, this particular level is Rs. 50,000. Prior, to shipping 50 thousand items it is essential to create a e-way bill.

As, per the GST e way bill systems regulations hitches connected with the conveyance of commodities are precisely levied and accounted for.

To move items valued at over ₹50.000 between states, within India. An e way bill is required.

Any goods worth more than Rs. 50,000 require an e-way bill for inter-state transport.

If multiple consignments are carried in one vehicle and their combined value crosses Rs. 50,000 items require an e-waybill to be created before transportation.

This ensures smooth movement of goods within states and obeys the law concerning the tax.

Basically, the movement goods within a single state or Union the area is known to as intra-state movement. For these movements, the e-way bill limit is also Rs. 50,000. This uniform limit ensures that all major transactions within a state are monitored under GST.

When goods worth more than Rs. 50,000 are transported inside a state, they must have an e-way bill with them.

This helps the government officers in tracking the transportation of goods and assures that taxes are correctly collected.

All businesses need to follow this rule to avoid penalties.

While the central government has set the Rs. 50,000 limit, some states have their own rules and variations for intra-state movements. For example, certain states apply the limit only to specific categories of goods, while others have different limits for within the city or state movements. Here’s a table showing the e-way bill limits in a few states:

| State | Intra-State Limit | Inter-State Limit | Effective Date |

|---|---|---|---|

| Arunachal Pradesh | Rs. 50,000 | Rs. 50,000 | 25 April 2018 |

| Bihar | Rs. 2,00,000 | Rs. 50,000 | 20 April 2018 |

| Delhi | Rs. 1,00,000 | Rs. 50,000 | 16 June 2018 |

| Maharashtra | Rs. 1,00,000 (certain goods exempt) | Rs. 50,000 | 1 July 2018 |

| Rajasthan | Rs. 2,00,000 (within city), Rs. 1,00,000 (within state) | Rs. 50,000 | 1 April 2022 |

| Uttar Pradesh | Rs. 50,000 | Rs. 50,000 | 1 April 2018 |

| West Bengal | Rs. 50,000 | Rs. 50,000 | 1 December 2023 |

Some states have chosen to tweak the e-way bill limits slightly based on their specific needs. This can help improve the efficiency of goods movement in those states and allow them to better track goods that are important for their economy. However, the overall limit for most states still remains Rs. 50,000.

The total value of the goods is required to be in excess of Rs. 50,000.The good type ranges from taxable to tax-free, with just a few special cases that one must consider do not apply.

You are obliged to issue an e-way bill not only in respect of the movement of goods within the state but even to other states.

Details concerning the consignment of goods, value, and the transporter have to be checked appropriate and accurate.

Less Paperwork

As everything is online, there’s no need to carry a bunch of documents. It’s more eco-friendly and protects you from losing important papers.

No Need for Checkpoint Visits

With the online system, you no longer need to visit checkpoints to verify transport documents, speeding up goods movement and increasing efficiency.

Easy and Fast Process

Generating an e-way bill is quick and easy with the user-friendly interface. State-specific limits are easily accessible, ensuring compliance.

The threshold limit for eway bill is Rs. 50,000. Where trasporter requries to carry eway bill during transportation of goods from one place to another place. This is applicable for both inter-state and intra-state transport across the country.

No, The compulsory threshold for consignment of goods of value is Rs. 50,000. Were it means that goods or service valued below threshold value does not requried eway bill unless specified by any particular state law.

Of course, you can generate an e-way bill even if the value of goods is less than Rs 50,000.Not necessary consignment below this threshold. While they use to maintain record and keep track of their goods.

The consolidated value to be declared in an e-way bill is Rs. An amount of fifty thousand rupees . If the monetary value of the commodities carried exceeds Rs. Above bills for an amount of 50,000 or more, an invoice should be issued .

Ideally, the generation of an e-way bill is to be done at a time before the transportation of goods is effected. If the e-way bill is to be generated after making the invoice, the same must be done prior to the shipment of goods being affected without which any specific period can be told.

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about Security & Privacy

Serious about Security & PrivacySign up and access powerful invoicing tools designed for growth.

*Free & Easy - no hidden fees.