Simplify monthly GST compliance with Sleek Bill GSTR 3B solutions.

*Free & Easy - no hidden fees.

To gain a deeper insight into the composition of a typical GSTR-3B, let's delve into the distinct components that make up its structure and explore the distinct elements that constitute a typical GSTR3B format:

GSTIN:

GSTIN:

Registered GST Number

Name:

Name:

Legal name of registered person or company.

Details of Outward Supplies and inward supplies on reverse charge:

Details of Outward Supplies and inward supplies on reverse charge:

The detailed Outward Taxable supplies,Inward supplies,Non-GST outward supplies.

Eligible ITC:

Eligible ITC:

Import of goods, Import of Services, Inward supplies liable to reverse charge (other than 1 & 2 above), Inward supplies from ISD, All other ITC, ITC Reserved, As per rules 42 & 43 of SGST/CGST rule, Others, Net ITC Available (A) - (B), Ineligible ITC, As per Section 17(5) or CGST/SGST Act, Others.

Values of exempt, nil-rated and non-GST inward supplies:

Values of exempt, nil-rated and non-GST inward supplies:

Nature of supplies From a supplier under composition scheme, exempt and nil rated supply Non-GST supply

Interest & late fee payable:

Interest & late fee payable:

Nature of supplies From a supplier under composition scheme, exempt and nil rated supply Non-GST supply

Place of Supply:

Place of Supply:

Indicates the location where goods/services are delivered.

GSTR 3B is a critical GST return that summarizes tax liabilities and credits for registered businesses. With Sleek Bill, simplify this monthly submission, ensuring accuracy and compliance. It's an essential step in maintaining your business's financial health and meeting regulatory requirements.

GSTR 3B is a monthly self-declaration that every registered GST taxpayer must file. It summarizes the details of outward supplies, inward supplies liable to reverse charge, and input tax credit availed. It's designed to simplify the tax filing process, ensuring compliance with less complexity.

GSTR 3B is a mandatory, self-declared summary GST return, crucial for every registered taxpayer under the GST regime. It serves as a monthly snapshot, providing a concise summary of your sales, the input tax credit (ITC) claimed, and the net tax payable.

![]()

GSTR-3B, a monthly Goods and Services Tax Return in India, is an integral component of businesses' regular compliance activities. Monthly filing: report sales, purchases, taxes for compliance.

![]()

The form requires taxpayers to report essential figures such as total sales and the ITC claimed during the month. This aids in maintaining transparency in tax liabilities and credits.

![]()

Businesses with multiple GSTINs must file separate GSTR-3B forms for each registration, ensuring that the tax liabilities and credits for each GSTIN are accurately reported.

![]()

The GST liability reported in GSTR-3B must be paid by the due date of the return, which is typically the 20th of the following month. Paying the tax liability on time is crucial to avoid penalties and interest.

![]()

Once filed, GSTR-3B cannot be revised. If mistakes are made, they need to be corrected in the subsequent month's return. This underscores the importance of accuracy in reporting.

![]()

Even if your business has no tax liability for a particular month, filing a nil GSTR-3B is mandatory. This ensures continued compliance with GST regulations.

Filing GSTR 3B is a vital part of GST compliance, applicable to a wide range of taxpayers. Understanding who is obligated to file this return is crucial for ensuring adherence to GST laws and regulations.

Filing GSTR 3B is not just a statutory obligation but a critical component of your business's financial health. It plays a vital role in your overall GST compliance, affecting your eligibility for ITC claims and keeping your business in good standing with the tax authorities. With Sleek Bill's intuitive tools, managing and filing your GSTR 3B becomes efficient and error-free, allowing you to focus more on your core business operations

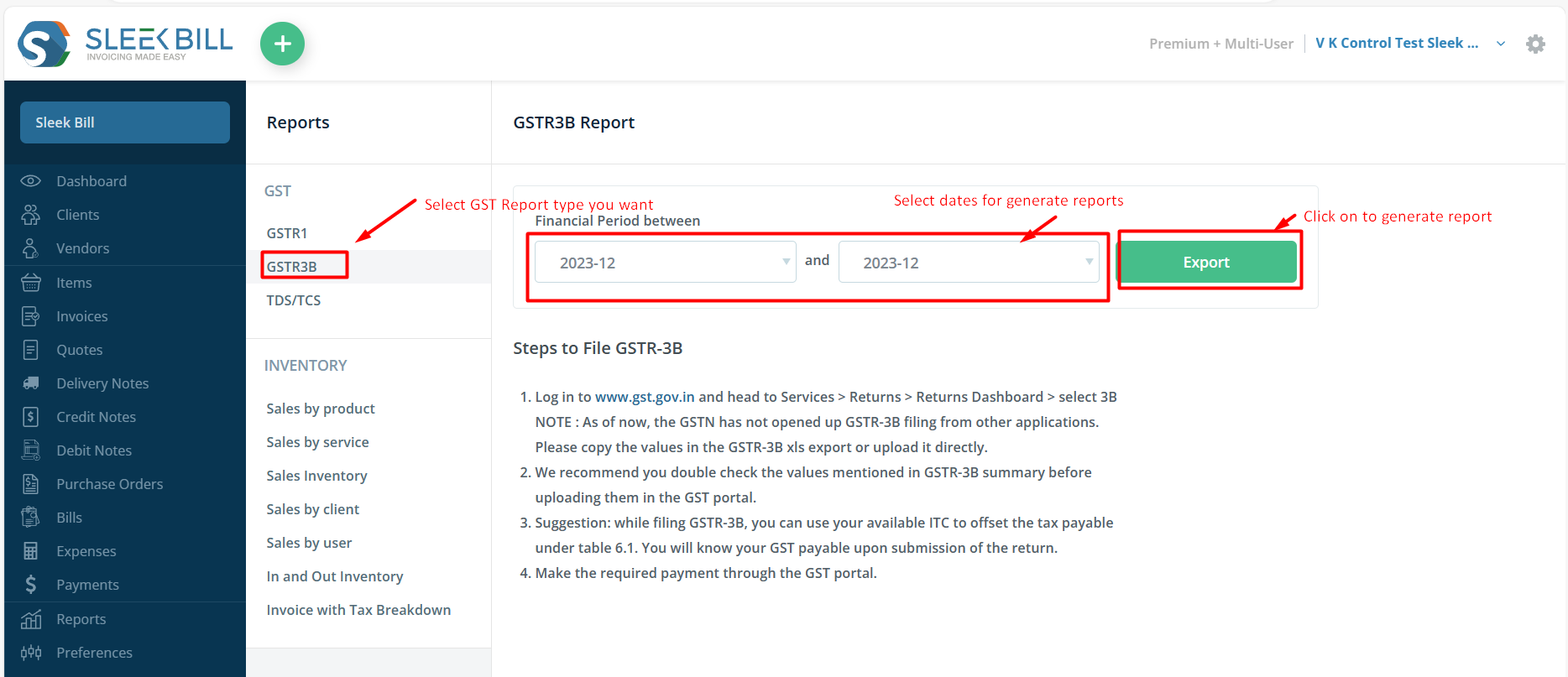

1. Go into www.sleekbill.in

2.Creates the Invoices via “Invoices” and add the purchase Bill entries via “Bills”

3. Click on Reports in menu

4. Report and Inventory option will appear on screen

5. Select GSTR3B

6. Select the from and to dates

7. Click on export button

7. 8. Download the report file and sleek bill will also send the copy to the register email.

All GST Registrants: Every individual or entity registered under GST is required to file GSTR-3B. This includes businesses of all scales and sectors, ensuring a comprehensive coverage under the GST framework.

Composition Scheme Taxpayers: Though operating under a simplified tax structure, taxpayers enrolled in the Composition Scheme are also obligated to file GSTR-3B.

Non-Resident Suppliers of OIDAR Services: Overseas suppliers providing Online Information Database Access and Retrieval (OIDAR) services to Indian consumers fall under the purview of GSTR 3B filing.

Input Service Distributors (ISD): ISDs play a crucial role in the GST ecosystem by distributing the input tax credit among various units of a company. They are also required to file GSTR-3B to report their activities.

![]()

The requirement for all GST registrants to file GSTR-3B underscores the commitment of the Indian tax system to maintain uniformity and transparency in tax reporting. By mandating this filing, the GST Council ensures a level playing field, where every business contributes its fair share to the nation's development

![]()

Filing GSTR 3B efficiently is crucial for GST compliance, and Sleek Bill makes this process straightforward. Here's a breakdown of the steps involved:

Start by accessing your account on the GST portal

Find and open the GSTR 3B form in the portal

Complete fields accurately to avoid errors..

After double-checking all entries, submit the form on portal

![]()

GSTR 3B is more than just a formality; it's a crucial element of your business's GST compliance:

Accurate Tax Reporting: It ensures that your taxes are reported correctly and no error occurs.

Availing Input Tax Credit: Timely filing allows you to claim input tax credit effectively.

Avoiding Penalties: Late filing can lead to penalties, impacting your business financially.

Financial Health Monitoring: It aids in reconciling sales and purchase invoices, keeping your finances healthy.

Meeting the GSTR 3B filing deadline is critical:

Monthly Filing: For most businesses, GSTR 3B is due on the 20th of month.

Stay Informed: Keep track of due dates to avoid late fees and stay compliant.

![]()

Timely filing of GSTR 3B is crucial for maintaining GST compliance. Delays can lead to additional financial burdens due to late fees and penalties. Here's what you need to know about the consequences of late GSTR 3B filing:

![]()

A late fee of Rs. 50 per day is imposed for the delay in filing GSTR-3B. This fee is applicable from the day following the due date till the date when the return is actually filed.

![]()

For taxpayers with no tax liability in a given month, the late fee is minimized to Rs. 20 per day. This concession offers relief to businesses that have refrained from engaging in taxable transactions.

![]()

Interest Rate: If GST dues are not cleared by the due date, the taxpayer is subject to an interest charge of 18% per annum. This interest is calculated on the outstanding tax amount.

![]()

Interest accrues from the day following the due date until the payment date. Timely tax payments prevent additional interest charges, fostering financial prudence.

Purpose GSTR-3B is a monthly summary of GST liabilities and ITC claimed. It's the primary return for payment of taxes

Importance Accurate filing of GSTR-3B is crucial as it determines your tax liability and ITC claims.

GSTR-2A Supplier-uploaded purchases dynamically reflected. Streamlined view for quick insights. It aids in matching and reconciling ITC claims.

GSTR-2B A static statement generated monthly, providing a summary of ITC available and not available for each month.

.png)

Avoiding Excess ITC Claims

To prevent notices for excessive ITC claims, businesses should reconcile ITC as per GSTR-2A and GSTR-2B before filing GSTR-3B.

Identifying Missed Credits

Regular reconciliation helps identify any missed ITC. If genuine credits are not reflected in GSTR-2A or GSTR-2B, it's an alert to take corrective action.

Prompting Suppliers

When GSTR-1 is filed accurately and on time, it seamlessly reflects in recipient's GSTR-2A, GSTR-2B, enabling them to claim precise ITC in GSTR-3B.

![]()

The requirement for all GST registrants to file GSTR-3B underscores the commitment of the Indian tax system to maintain uniformity and transparency in tax reporting. By mandating this filing, the GST Council ensures a level playing field, where every business contributes its fair share to the nation's development

Elevate Your GSTR 3B Filing Journey with Sleek Bill's User-Friendly Interface"

*Free & Easy - no hidden fees.

In the realm of GST compliance, understanding the nuances between GSTR-3B and GSTR-1 is key to avoiding financial penalties and ensuring seamless credit flow. Let's explore how these forms interact and complement each other in the GST framework:

| Sr. No | Criteria | GSTR-3B The Monthly Tax Payment Form | GSTR-1 The Detailed Sales Report |

|---|---|---|---|

| 1. | Purpose | GSTR-3B is a summarized return used for the monthly payment of tax liabilities. It captures the total tax payable and the Input Tax Credit (ITC) available. | This form details all outward supplies (sales) made during a month. It includes invoice-wise details of all sales transactions. |

| 2. | Significance | Timely and accurate filing of GSTR-3B is crucial to avoid interest and penalties for short tax payments. | Accurate GSTR-1 filing ensures that all sales invoices are correctly reported, preventing any missed or duplicated entries. |

Financial Harmony

To avoid interest and penalties, businesses must ensure that the tax liabilities reported in GSTR-3B align with the outward supplies declared in GSTR-1. Any discrepancies can lead to short payment of tax.

Ensuring Invoice Accuracy

Regular checks between GSTR-1 and GSTR-3B help in identifying any missed or duplicated invoices. This accuracy is vital for the recipient to claim accurate ITC based on GSTR-2A and GSTR-2B.

Facilitating Accurate ITC Claims

When GSTR-1 is filed accurately and on time, it reflects in the recipient's GSTR-2A and GSTR-2B, enabling them to claim precise ITC in their GSTR-3B.

![]()

Sleek Bill, with its intuitive interface and robust features, aids businesses in aligning their GSTR-3B with GSTR-1. It helps in tracking all outward supplies and ensuring that these are accurately reflected in both returns. By using Sleek Bill, businesses can reduce the risk of errors, avoid financial discrepancies, and maintain a seamless flow of ITC, thereby fostering a more efficient and compliant GST filing process.

![]()

In the complex world of GST, GSTR 3B plays a vital role. Sleek Bill's intuitive solutions make this monthly task less daunting, ensuring you stay compliant and focused on growing your business. Trust Sleek Bill for seamless GSTR 3B submissions and embrace a stress-free approach to GST compliance.