A Complete Guide for understand input credit tax.

*Free & Easy - no hidden fees.

![]() Call For Demo 9168696091/92/93

Call For Demo 9168696091/92/93

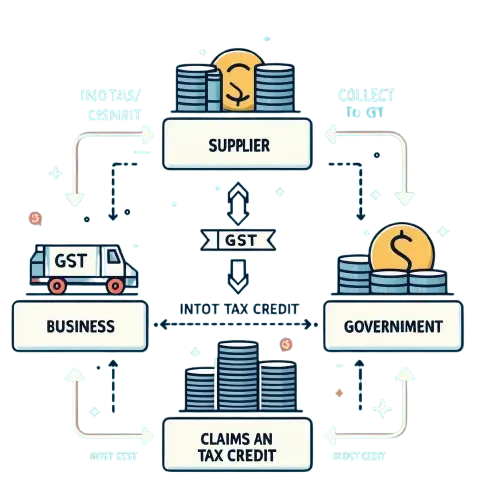

Input Tax Credit (ITC) is a key function of the Goods and Services Tax (GST) device that lets in corporations to lessen their tax burden. It works by allowing them declare credit for taxes they’ve already paid on their purchases. This system helps avoid the problem of "tax on tax," promotes fair pricing, and supports better cash flow for businesses.

Sleek Bill provides free consulting for ITC claims, helping businesses navigate GST compliance efficiently.

Input Tax Credit (ITC) allows groups to require credit score for GST paid when purchasing goods or offers used for business functions. This credit score may be spark off in opposition to the tax liability on income.

Tax on final product (output tax): ₹450

Tax paid on purchases (input tax): ₹300

Net tax payable after ITC adjustment: ₹150

Businesses registered under GST can claim ITC if they meet the following conditions:

Valid Tax Invoice – A proper invoice from a GST-registered supplier.

Receipt of Goods/Services – Input Tax Credit can be claimed only after receiving the goods/services.

Tax Paid to the Government – The supplier must have deposited the GST collected.

Filing of GSTR-3B – ITC claims must match GSTR-2B.

Timely Payment to Suppliers – Payment must be made within 180 days of the invoice date.

ITC Time Limit Compliance – Input Tax Credit must be claimed within the earlier of:

30th November of the next financial year.

Date of filing the annual return.

To claim Input Tax Credit, the following documents are required:

Tax Invoice – Issued by the supplier.

Debit Note – If there are any price adjustments.

Bill of Entry – For imported goods.

Bill of Supply – For purchases under reverse charge.

Input Service Distributor (ISD) Invoice – If ITC is distributed among branches.

Businesses must meet the following eligibility criteria:

Must be registered under GST.

Goods/services must be used for business purposes.

ITC must be claimed within the prescribed time limit.

Supplier must have filed their GST returns and paid the tax.

Some purchases are not eligible for ITC:

Personal use items.

Food & beverages, catering, and club memberships.

Health insurance, except when required by law.

Construction expenses for immovable property.

Motor vehicles used for personal purposes.

Confirm ITC eligibility based on purchases.

Keep all tax invoices and related documents.

Match invoices with supplier-reported data.

Declare ITC in GSTR-3B.

Resolve mismatches in supplier filings.

If excess ITC is claimed, adjust in the next return.

Certain conditions limit ITC claims:

Composition scheme taxpayers cannot claim ITC.

Non-payment to suppliers within 180 days reverses ITC.

ITC claimed on invalid invoices or fraudulent transactions is disallowed.

Mismatch in GSTR-3B and GSTR-2B.

Delayed supplier payments exceeding 180 days.

Incorrect documentation leading to ITC rejection.

Claiming ITC for ineligible items.

Reduces tax liability, improving cash flow.

Eliminates cascading effect of taxes.

Legal compliance ensures tax efficiency.

Boosts profitability by optimizing tax expenses.

Amendments in Section 34 of CGST Act – ITC must be reversed if a supplier issues a credit note.

Amendments in Section 38 of CGST Act – GSTR-2B may no longer be fully auto-generated; businesses must validate invoice data.

ITC exemption – specific ITC forgiveness for non-Dhokhadhadi-spasens (2017-2020) waived interest and punishment.

Understanding the (ITC) below GST is important for organizations to optimize their tax liability and streamline easy cash float. By keeping correct records and following GST compliance regulations, organizations can boom their ITC benefits.

Sleek Bill provides free consulting for ITC claims, ensuring businesses can seamlessly manage their GST compliance and tax planning. Contact us today for expert assistance!

ITC need to be claimed by using 30th November of the subsequent monetary year or before filing the once-a-year return, whichever is in advance.

No, ITC cannot be claimed on purchases made before the creation of GST.

If a supplier does not file GSTR-1, your ITC claim may get rejected. Ensure supplier compliance before claiming ITC.

ITC on capital goods is allowed if used for business purposes and is not claimed under depreciation.

Businesses under the composition scheme pay a lower GST rate but cannot claim ITC.

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about Security & Privacy

Serious about Security & PrivacyUnderstand how Input Tax Credit works and reduce your tax burden. Start optimizing your claims today!

*Free & Easy - no hidden fees.