If you are under the composition scheme or a supplier of exempted

goods/services, read along to find out how to do your invoices.

*Free & Easy - no hidden fees.

In a previous article we discussed the GST Invoice format and the information required in a GST invoice. Having went through the process of GST invoicing, in this article we'll explain one other transaction document called bill of supply. We'll be looking at how to make one, when to issue it and its particularities.

A bill of supply is a transaction document that doesn't show any tax amount on it, for which input tax cannot be charged. This is the main difference between this and the tax (GST) invoice.

You need to issue a bill of supply in any of these cases:

Cases when a Bill of Supply will not be issued

However, a consolidated bill of supply for such supplies should be issued at the end of the business day.

Based on the government regulations, it should contain the following:

*What HSN Code should you write:

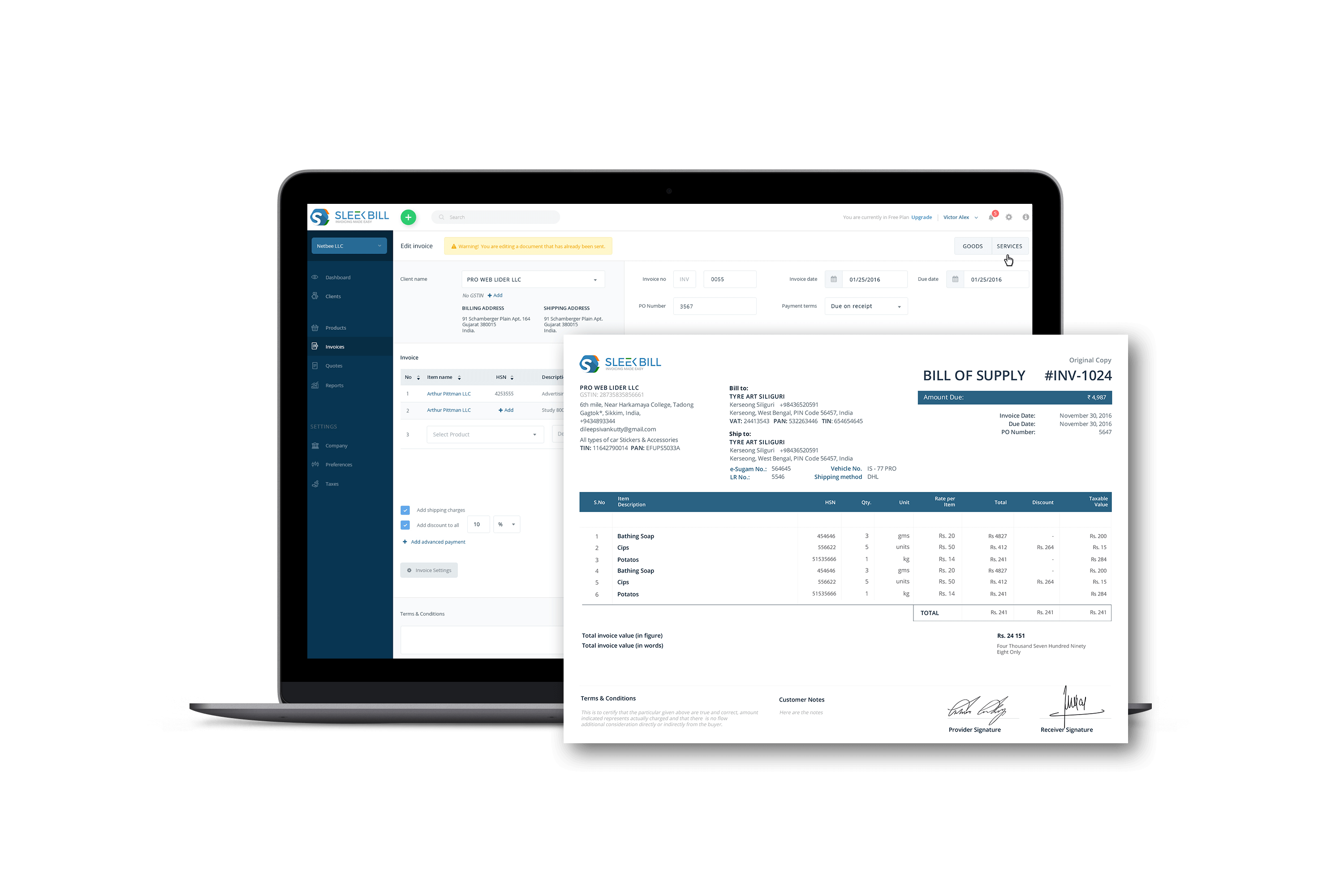

This is how a typical bill of supply should look like:

A bill of supply for exports should also include a declaration regarding payment of GST Depending on the payment of IGST the following text should appear:

If IGST has been paid for the exports:

"Supply Meant For Export On Payment Of IGST".

If IGST has not been paid yet for the exports:

"Supply Meant For Export Under Bond Or Letter Of Undertaking Without Payment Of IGST"

What details should a bill of supply for exports contain?

A modern business that wishes to thrive in the GST era can no longer spend large amounts of time on billing and spreadsheets.

Be GST ready and chose a billing software that evolves as per your business's needs.

*Free & Easy - no hidden fees.