If you are under the composition scheme or a supplier of exempted

goods/services, read along to find out how to do your invoices.

*Free & Easy - no hidden fees.

![]() Call For Demo 9168696091/92/93

Call For Demo 9168696091/92/93

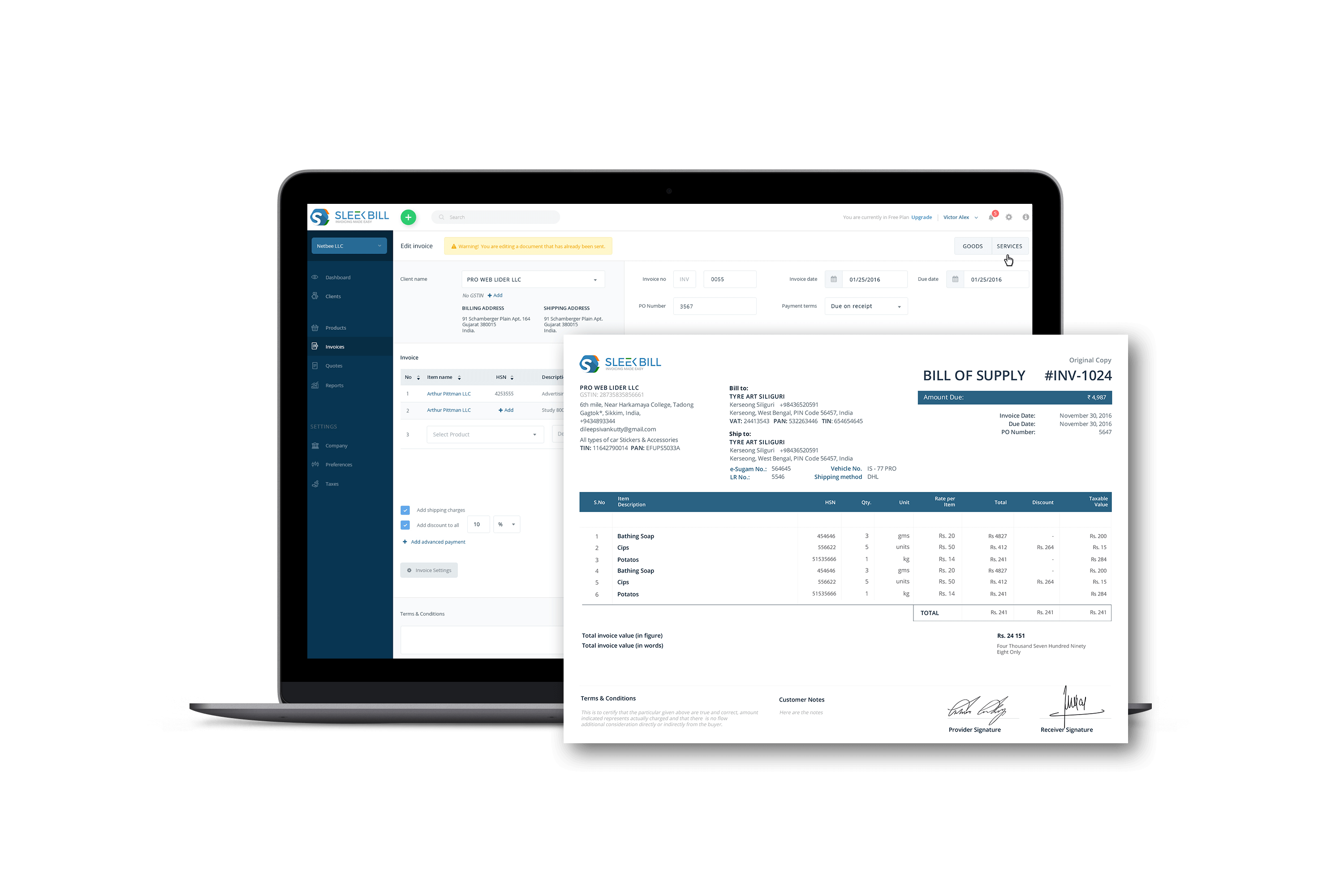

Bill of supply is very important because it ensures compliance with GST regulations for tax exempt or composition scheme transactions of business. It provides official record of your sale in professional and transparent way. We'll be looking at how to make one, when to issue it and its particularities.

A bill of supply is a transaction document that doesn't show any tax amount on it, for which input tax cannot be charged. This is the main difference between this and the tax (GST) invoice.

You need to issue a bill of supply in any of these cases:

Cases when a Bill of Supply will not be issued

However, a consolidated bill of supply for such supplies should be issued at the end of the business day.

Based on the government regulations, it should contain the following:

*What HSN Code should you write:

A bill of supply for exports should also include a declaration regarding payment of GST Depending on the payment of IGST the following text should appear:

If IGST has been paid for the exports:

"Supply Meant For Export On Payment Of IGST".

If IGST has not been paid yet for the exports:

"Supply Meant For Export Under Bond Or Letter Of Undertaking Without Payment Of IGST"

What details should a bill of supply for exports contain?

Business under composition scheme and they are doing businesses and customer don’t have GST and they are selling them goods or service so that it is they are giving them proof of sales for the legal purpose which is called as bill of supply.

After the one month they need to file GSTR-4A in that business owner need to pay consolidated tax on their whole sales.

They are not charging any tax at all.Selling goods which they bought from supplier , their supplier may be registered under composition scheme either in regular scheme.

If They bought the goods or services from regular businesses then they cannot get ITC

They need to add their profit of margin and their tax slab but not show make the final selling price for the selling goods. And they can sale, this way they can make their business profitable.

|

Bill of Supply:

|

Tax invoice:

|

|---|---|

|

Bill of supply is generated by composition scheme registered businesses. |

Tax invoice raised by businesses registered under regular GST. |

|

In bill of supply tax rate should not be appear. |

Tax rate is mandatory in tax invoice. |

|

Tax amount should not mention. |

Tax amount should mention . |

|

Bill of supply also made by GST registered Businesses, where they sales good or services which is exempted or zero rated or nil rated goods or service. |

When regular GST tax payer selling goods or services who tax is nil rated, zero rated or exempted, they should not include in the tax invoice . |

|

Whose turnover is less than 20 Lacs then can choose for the composition scheme. So that their compliance for GST minimize and the will to the limited businesses. |

Tax invoice for the regular GST whose turnover is more than 20 Lacs, they should go with regular GST registration. Which helps them to get benefits and the ITC. |

|

Composition scheme owner when bill of supply raising then as the tax is not appear over the invoice that why ITC (Input Tax Credit) will not get applicable to the purchaser, buyer, client or customer. |

Where as the taxes are showing and when the sale is done to the register customer who is regular scheme under the GST registration they can get ITC. |

Bill of supply is not eligible for e-invoice.

For making e-invoice business turnover should be equal to or more than 5 crores.

As the composition scheme registered businesses are under composition scheme, due to they only want to do the businesses in their city, state or intra state that’s why their turnover is limited and they can not fall under the registration of e-invoice category, e.g. the businesses whose turnover is more than or equal to 5cr they are only eligible to generate e-invoices.

Most of the composition scheme businesses who provide the bill of supply their customers are non-register, end-user, subscriber so they are personal users like we buy the grocery, we do not have GSTIN and that is why invoice is not created for the customers who does not having the GSTIN.

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about Security & Privacy

Serious about Security & PrivacyTry Sleek Bill Today and Experience The Difference!

*Free & Easy - no hidden fees.