E-Way Bill Limit: The Ultimate Guide

Seamless movement of goods within the country requires absolute compliance with GST within an e-Way Bill-based system. Mastering the knowledge on the limits of e-way bills is pertinent for a small business owner, transporter, or corporate entity for carrying out their businesses smoothly. The guide elaborates on the latest updates, threshold compliances, and actionable insights related to e-way bill amount, distance, and time limits.

What is an E-Way Bill?

An E-Way Bill is basically an electronic document that is for the transportation of goods under the GST regime, giving details regarding the goods being transported along with their value and the recipient information. It increases transparency in interstate and intrastate trade and reduces tax evasion.

E-Way Bill Distance Limit

Distance-Based Compliance

In the case of road transport, 100 km a day is standard under an e-Way Bill.

The limit for over-dimensional cargo is 20 km per day.

Validity Table

| Type of Conveyance |

Distance |

Validity |

| Other than Over-Dimensional Cargo |

Less than 200 km |

1 Day |

| Other than Over-Dimensional Cargo |

Additional 200 km |

Additional 1 Day |

| Over-Dimensional Cargo |

Less than 20 km |

1 Day |

| Over-Dimensional Cargo |

Additional 20 km |

Additional 1 Day |

Components of an E-Way Bill

An e-Way Bill contains the following details, which are the necessary information

Recipient's GSTIN

Place of Delivery

Invoice/Challan Number and Date

Value of Goods

HSN Code

Transport Document Number (LR Number, Airway Bill, etc.)

Reason for Transportation (sales, returns, or job work)

E-Way Bill Amount Limit

The e-Way Bill is compulsory for most states for goods greater than ₹50,000. Some states are exemptions include

Delhi and Maharashtra : ₹1,00,000.

Rajasthan : ₹2,00,000 State-specific limits for some commodities. Local notification must be consulted.

State-Wise E-Way Bill Limits

| State |

Threshold Limit |

| Andhra Pradesh |

₹50,000 |

| Delhi |

₹1,00,000 |

| Maharashtra |

₹1,00,000 |

| Rajasthan |

₹2,00,000 |

E-Way Bill Time Limit

E-Way Bill Generation Time Limit

Turnover-Based Applicability

E-Way Bill Turnover Limit for GST

All the businesses with an annual turnover of over ₹10 crore would be required to generate E-Way Bill for all goods movement irrespective of value, assuring compliance and transparency in GST. This applies to all modes of transport except few articles and distances that are exempted. Non-compliance and detention of goods can happen due to this. It streamlines logistics and reduces errors in a GSTN integrated manner.

Intra-state vs. Inter-state Supply Rules

Businesses can be assured that the payment has been received through various methods, depending on customer preference and transaction type.

| Type of Supply |

Threshold Limit |

Remarks |

| Intra-state Supply |

Varies by State |

For example, ₹1,00,000 in Tamil Nadu and ₹2,00,000 in Rajasthan. |

| Inter-state Supply |

₹50,000 |

Applicable in all states unless specific exemptions apply. |

Exemptions from E-Way Bill

You do not require an e-Way Bill for.

Exempted Goods Such as fresh vegetables, milk, and newspapers.

Non-motorised transport Goods being transported using cycles or handcarts.

Short distances Transport within a state for less than the distances permissible.

Recent Developments in 2024

Important Policy Amendments

Penal Provisions for Non-Compliance

Non-compliance with e-Way Bill provisions may attract

Imprisonment : Fine to ₹10,000 or to the value of the tax.

Detaining the Goods as well as the Vehicle : Till the time they comply.

How to Create an E-Way Bill?

Login to e-Way bill portal.

Provide GSTIN, invoice/challan number, and HSN code.

Provide transportation details with vehicle number.

Create the bill and note IRN (Invoice Reference Number).

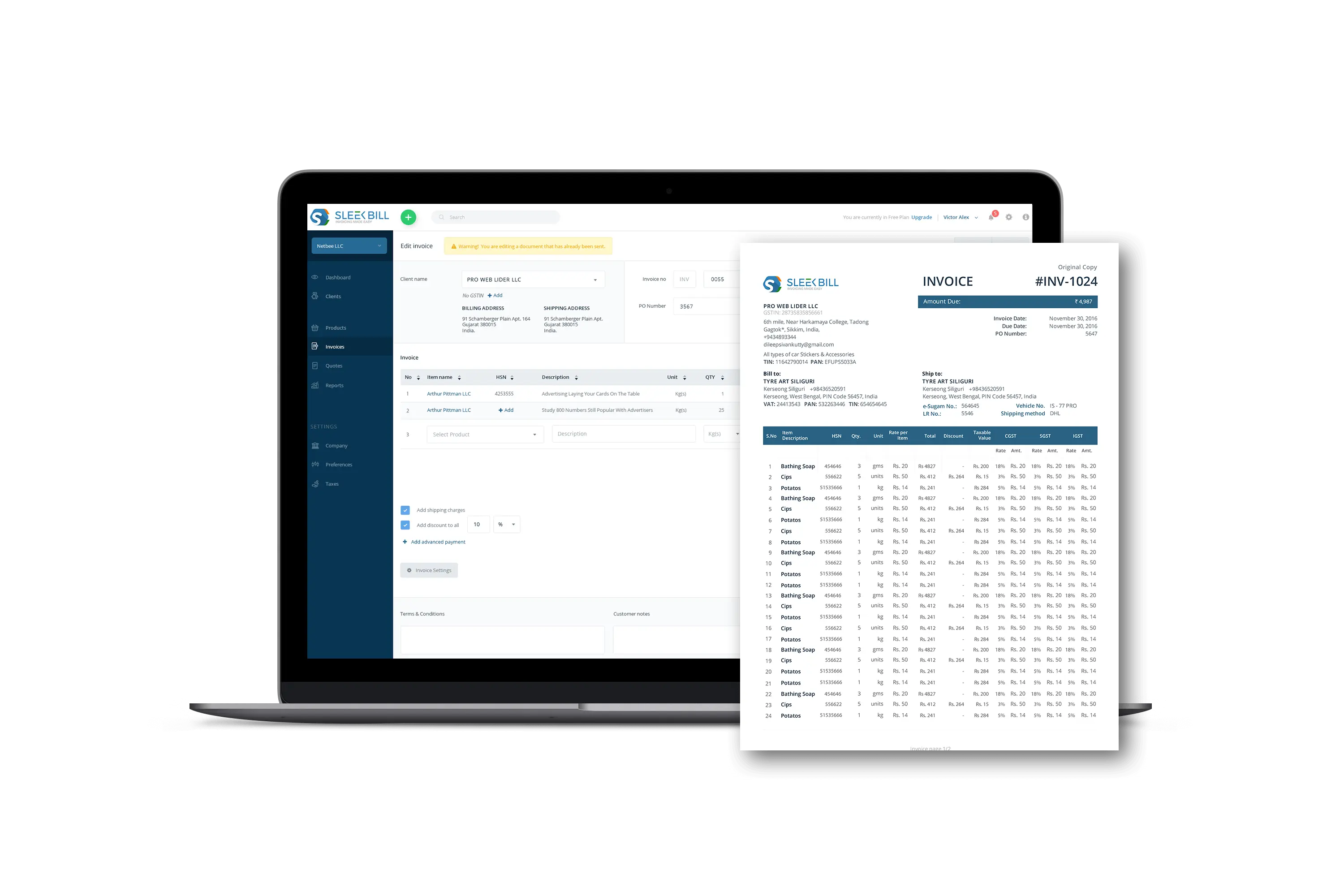

To simplify generating an e-Way Bill, there are tools like Sleek Bill that allow API integration for hassle-free creation of the e-Way Bill.

For a detailed state-wise breakdown, refer to official notifications.

To ensure GST compliance and unhindered goods transport, understanding and adhering to the limitations of the e-Way Bill is critical. This automation tool - Sleek Bill - helps simplify this process for businesses. Stay updated on the state-specific rules and leverage this technology for seamless compliance.

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about