Ensure your business stays GST-compliant with a flawless Bill of Supply process

*Free & Easy - no hidden fees.

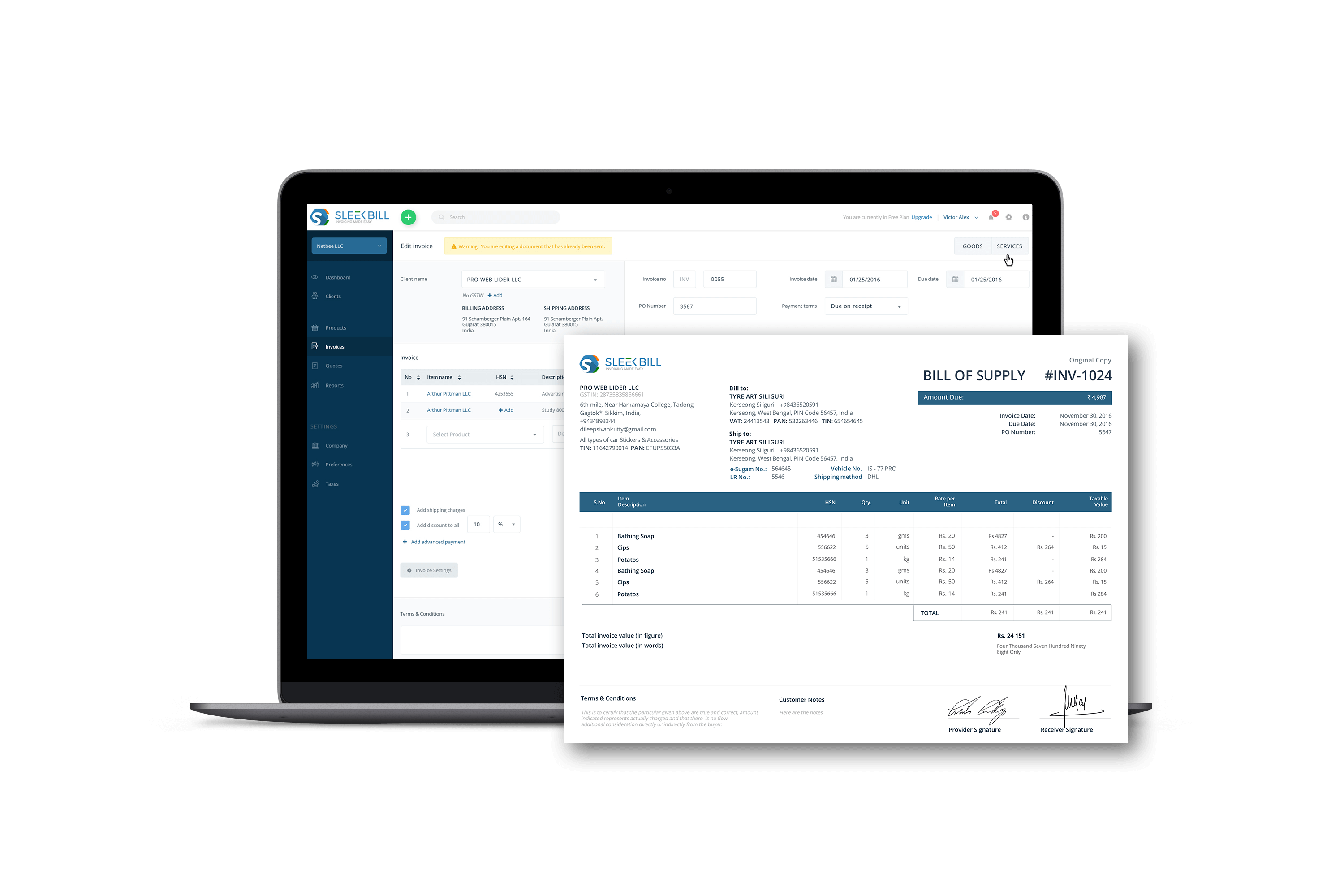

To gain a deeper insight into the composition of a typical bill of supply, let's delve into the distinct components that make up its structure and explore the distinct elements that constitute a typical bill of supply:

Heading:

Heading:

Heading is mentioned as ‘Bill of Supply’ where it informs the seller and buyer it is a bill of supply. It is mentioned at the centre of the document.

Logo:

Logo:

It must be added on the left of the top of each bill of supply document. It helps to make a brand identity.

Details of Issuer & Buyer:

Details of Issuer & Buyer:

The detailed address of the company or supplier who sends or supplies their goods to end customers or buyers. It is mentioned in the left top of the bill of suppl format.

GSTIN:

GSTIN:

GST registered number are mentioned in the left of the bill of supply format at the bottom of each buyer and suppliers.

Contact Name:

Contact Name:

Name of Company or dealers shop for where to goods or service can be purchased.

Amount Due:

Amount Due:

This section is how much due is paid to the supplier.

Valid Date:

Valid Date:

This mentions the last date for making an order for purchasing goods or subscribing service from the seller or service provider.

Place of Supply:

Place of Supply:

Indicates the location where goods/services are delivered.

Bill To & Ship To:

Bill To & Ship To:

Detailed information about the buyer and the shipping destination.

Table of Items:

Table of Items:

Tabulated data capturing item description, HSN,SAC code, unit of materials, quantity, taxable value, taxes, and total amounts.

Terms and Conditions:

Terms and Conditions:

Any specific conditions or policies tied to the sale.

Signature and Stamp:

Signature and Stamp:

Authenticating the document, ensuring it's officially recognized.

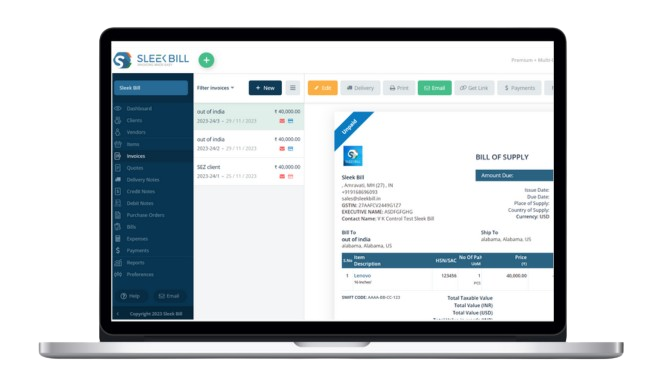

With Sleek Bill, crafting a Bill of Supply is a seamless process. This intuitive software is tailored to meet the specific demands of GST documentation, ensuring your business exudes professionalism and adherence to regulations.

![]()

Designed with user experience in mind, Sleek Bill enables anyone, regardless of technical expertise, to create impressive documents. The result is a Bill of Supply that not only meets compliance standards but also enhances the stature of your business communications.

![]()

Our software provides a centralized system where businesses can manage all their orders. Whether it's a sales order from a customer or a purchase order from a supplier, track it all in one place. Centralization minimizes order tracking issues, maintaining clear records for future reference.

This document comes into play under two pivotal circumstances:

● When the goods or services provided are exempt from GST.

● When your business opts not to recover GST from the customers, ensuring transparency in transactions.

● By integrating Sleek Bill into your business workflow, you're not just preparing a Bill of Supply; you're also fortifying your business against any GST-related discrepancies, fostering trust with your customers, and streamlining your financial documentation process.

1. Go into www.sleekbill.in

1. Go into dashboard

2. Click on invoices

3. Click on New button

4. Select Bill of Supply

5. Fill details.

6. Click on preview button.

7. State will appear on screen

8. you can select all invoices or only outstanding

.png)

A Bill of Supply is not a mere document but a strategic tool in the GST framework, pivotal for transactions where a tax invoice is not just unnecessary but inapplicable. Sleek Bill ensures that your business adheres to these nuances with flawless execution

The issuance of a Bill of Supply is critical for businesses that deal in goods or services not subject to GST. This vital document serves as a clear indication that the transaction is out of the GST ambit, ensuring legal compliance and customer transparency.

Take a fruit vendor, for example; fruits, being exempt from GST, do not require a regular Tax Invoice. Instead, the vendor will utilize a Bill of Supply, which Sleek Bill can generate with professional finesse, to document the sale while clearly communicating the GST exemption to the customer

Businesses opting for the Composition scheme under GST have a unique set of guidelines. They are prohibited from charging GST on their sales transactions. Sleek Bill helps these businesses by providing the means to issue a Bill of Supply instead of a Tax Invoice, which aligns with their tax-paying structure and simplifies record-keeping.

By using a Bill of Supply, businesses clearly delineate transactions where GST is not levied, avoiding confusion for customers and maintaining a transparent business environment.

"Simplify Supply Operations with Sleek Bill Maximize Efficiency Now!"

*Free & Easy - no hidden fees.

![]()

Sleek Bill's intuitive platform aids Composition Dealers in calculating and paying their taxes without transferring the burden to their customers. This self-assessment tool ensures they remain within the legal framework while providing transparency and ease in financial dealings.

![]()

A critical aspect of the composition scheme is the prohibition of GST charges on invoices. Sleek Bill accommodates this by enabling the generation of Bills of Supply, ensuring Composition Dealers do not inadvertently charge GST on their sales, thus maintaining compliance and customer trust.

![]()

When it comes to small businesses under the composition scheme, issuing a Bill of Supply is not an option but a mandate. Sleek Bill simplifies this obligation by streamlining the creation of Bills of Supply, ensuring these businesses can focus on their core activities without worrying about the intricacies of GST regulations.

![]()

Sleek Bill's intuitive platform aids Composition Dealers in calculating and paying their taxes without transferring the burden to their customers. This self-assessment tool ensures they remain within the legal framework while providing transparency and ease in financial dealings

![]()

Export Invoicing Simplified Sleek Bill recognizes that exporters operate under a different set of rules within the GST framework. As exports are not subjected to the same taxation rules as domestic sales, the need for a traditional exporter's invoice is circumvented, replaced by the Bill of Supply, which Sleek Bill helps generate with precision and ease.

Tax Exemption on International FrontiersAcknowledging the tax-exempt status of exported goods, Sleek Bill ensures that exporters can seamlessly issue Bills of Supply. This practice aligns with the government's vision to foster export activities without the added burden of GST, thus promoting international trade.

Critical Details for Export Bills of Supply Exporters are required to provide specific details in a Bill of Supply to maintain transparency and compliance. Sleek Bill aids in compiling this information, including the declaration of IGST payments or the intention to export under a bond or letter of undertaking without upfront IGST.

Facilitating Export Operations With features tailored to the needs of exporters, Sleek Bill assists in creating Bills of Supply that not only meet legal requirements but also support the practical aspects of international trade. Sleek Bill simplifies exports, ensuring all required information, from declaring IGST to special export conditions, is seamlessly included.

Clarity for Exempted Transactions

Sleek Bill streamlines the process for suppliers dealing in goods and services that are exempt from GST. Our system ensures a clear and compliant Bill of Supply, reflecting exemption status for registered dealers.

Agricultural Suppliers and GST Exemption

For suppliers of raw agricultural products, which hold an exempt status under GST, Sleek Bill provides a straightforward method to issue Bills of Supply. GST-Compliant Agri Trade: Simplify tax-exempt transparency effortlessly.

The Essence of Compliance:

By utilizing Sleek Bill, suppliers of exempted goods can effortlessly generate Bills of Supply that meet statutory requirements.Safeguard suppliers, uphold financial integrity. Our system ensures precise documentation, shielding against compliance pitfalls in tax-exempt transactions.

Foundation of Authenticity

For businesses navigating GST regulations, the Bill of Supply is a cornerstone document. Sleek Bill's interface is meticulously designed to ensure that every Bill of Supply includes the vital supplier details: Name, Address, and GSTIN. These details form the foundation of a document's authenticity and traceability.

Serial Number Integrity

Sleek Bill safeguards the integrity of your documentation with a Conservative Serial Number system. This system is robust, allowing no more than 16 characters - a mix of alphabets, numerals, or special characters - making each document uniquely traceable within a financial year.

Harmonization with HSN Codes

With Sleek Bill, the harmonization of your goods or services is seamless, thanks to the integrated HSN Code system. This ensures that your products are classified correctly, aligning with global trade standards.

Unambiguous Date and Recipient Identification

The software ensures that the issue date of the Bill of Supply is crystal clear, along with the recipient's Name, Address, and GSTIN or UIN. This precision guarantees that the document is not only compliant but also serves as an unequivocal record of the transaction.

Transparent Transaction Description

Each Bill of Supply provides a comprehensive description of the goods or services, reflecting the true nature and value of the supply. This includes any discounts or abatements, ensuring that the financial portrayal of the transaction is transparent and accurate.

Authenticated and Secure

To top off the precision of each document, Sleek Bill incorporates the functionality for suppliers to add either a signature or a digital signature, lending an additional layer of security and authenticity to the Bill of Supply.

Effortlessly generate compliant Bills of Supply for seamless transactions

*Free & Easy - no hidden fees.

A Bill of Supply is a non-negotiable document in the realm of GST, particularly when it comes to exempt supplies or transactions by a composition taxpayer. Below are the pivotal aspects of the Bill of Supply:

Exempt Supply: A Bill of Supply is issued when goods or services are exempt from GST. Composition Taxpayer: It's also used by taxpayers registered under the GST Composition Scheme, which allows for a simplified tax process due to their smaller scale of operations.

The document explicitly excludes the tax rate and tax amount as it pertains to transactions where GST does not apply.

Recipients cannot claim input tax credit using a Bill of Supply, as it denotes a supply chain segment where the tax component is absent.

A supplier must not collect GST from the customer when issuing a Bill of Supply, ensuring transparency and adherence to GST regulations for non-taxable transactions.

A supplier must not collect GST from the customer when issuing a Bill of Supply, ensuring transparency and adherence to GST regulations for non-taxable transactions.

The Tax Invoice and Bill of Supply are integral to the GST framework, yet they fulfill distinct roles within it. Let's explore these differences across various criteria

| Sr. No | Criteria | Tax Invoice | Bill of Supply |

|---|---|---|---|

| 1. | Purpose | Issued for taxable supplies, indicating the amount of GST payable. | Issued for supplies exempt from GST or by those under the Composition Scheme, indicating GST is not applicable. |

| 2. | GST Charge | Includes GST charges, with a clear breakup of CGST, SGST/UTGST, or IGST. | GST is not charged; hence no tax breakup is present. |

| 3. | Usage | Employed by regular taxpayers who are required to collect and remit GST. | Utilized by suppliers of exempt goods/services or those opted for the Composition Scheme. |

| 4. | Contents | Features detailed tax information, including the applicable GST rates and the total tax amount. | No GST is collected from the customer. |

| 5. | GST Recovery | GST is collected from the customer and remitted to the government. | Accurate GSTR-1 filing ensures that all sales invoices are correctly reported, preventing any missed or duplicated entries. |

| 6. | Mandatory Fields | Detailed requisites, including the recipient's GSTIN, tax rates, tax amounts, and other particulars. | Majorly comprises goods/services details and excludes tax-related information. |

Small Value Transactions

For goods or services valued under Rs. 200, businesses are not obligated to issue a Bill of Supply unless the customer insists on one.

Signature Requirements

A signature or digital signature is not a mandatory element if the Bill of Supply is generated digitally or electronically.

Sector-Specific Exemptions

Documents issued under other acts, like tax invoices, may be acknowledged as a Bill of Supply, simplifying compliance

Documentation Threshold

If the value of supplied goods or services is less than Rs. 1,200, a separate Bill of Supply is not required unless requested by the recipient

Consolidated Documentation

A consolidated Bill of Supply can be issued at the end of each day instead of individual bills for each transaction

Combined Supplies

When a registered person supplies both taxable and exempt goods or services, they can issue a single 'Invoice cum Bill of Supply.'

HSN and SAC Codes

The HSN (Harmonized System of Nomenclature) code for goods should consist of eight digits, whereas the SAC (Services Accounting Code) for services is denoted by only six digits.

Electronic Storage and Retrieval

In accordance with the GST framework, businesses can opt for electronic storage of Bills of Supply. This not only promotes sustainability by digitize documents for eco-friendly operations and audit compliance.

Timeframe for Issuance

While the GST regulations don't specify an exact timeframe for issuing a Bill of Supply, it's advisable for businesses to issue it promptly to maintain transparent transactions.

When preparing a Bill of Supply for export transactions, certain specifics are essential to include, ensuring compliance with GST regulations and facilitating smooth international trade. Here's what needs to be outlined

Buyer's Details

Clearly state the name and address of the buyer, providing a direct reference for the transaction.

Delivery Details

Include the precise delivery address where the products or services are to be sent, which may differ from the buyer's address

Destination Country

Identify the destination country to which the goods or services are being exported, critical for customs and tax purposes

Export Documentation

Mention the number and date of the application for removal of goods for export, which is crucial for tracking and verifying the export transaction

A Bill of Supply is an integral part of business documentation under the GST regime, particularly for non-taxable and exempt supplies. Here are some expert tips to ensure that the process of issuing a Bill of Supply is both compliant and efficient:

Adopt a Standard Format

Utilize a consistent template for all your Bills of Supply to ensure uniformity and recognizability. Sleek Bill software can help streamline this process.

Comprehensive Information Inclusion

Make sure every required detail is captured in the Bill of Supply, from the supplier’s and customer's GSTIN to the HSN/SAC codes of the goods or services.

Accuracy is Key

Double-check all entries for correctness. Any error could lead to complications with GST compliance and customer dissatisfaction.

Record Keeping

Once your invoice is ready, send them to the clients swiftly, ensuring they have all the necessary details on time. Speedy invoicing often translates to timely payments!