Find out when and how to issue GST compliant credit notes as a

supplier of goods or services.

*Free & Easy - no hidden fees.

![]() Call For Demo 9168696091/92/93

Call For Demo 9168696091/92/93

The suppliers of goods or services will create the credit note for their daily trade settlement. In certain situations, you issue the invoice but the client is not happy with received products or services or sometimes differences in invoice so in such cases, there will be a negative impact in your accounting balance so you will have to issue a credit note.

If problem happened with your provided good and services or clients decides to return goods so the supplier has to issue a credit note to reduce tax liability.

You will need to issue a credit note in these situations:

Based on the government regulations, a credit note under GST must contain the following:

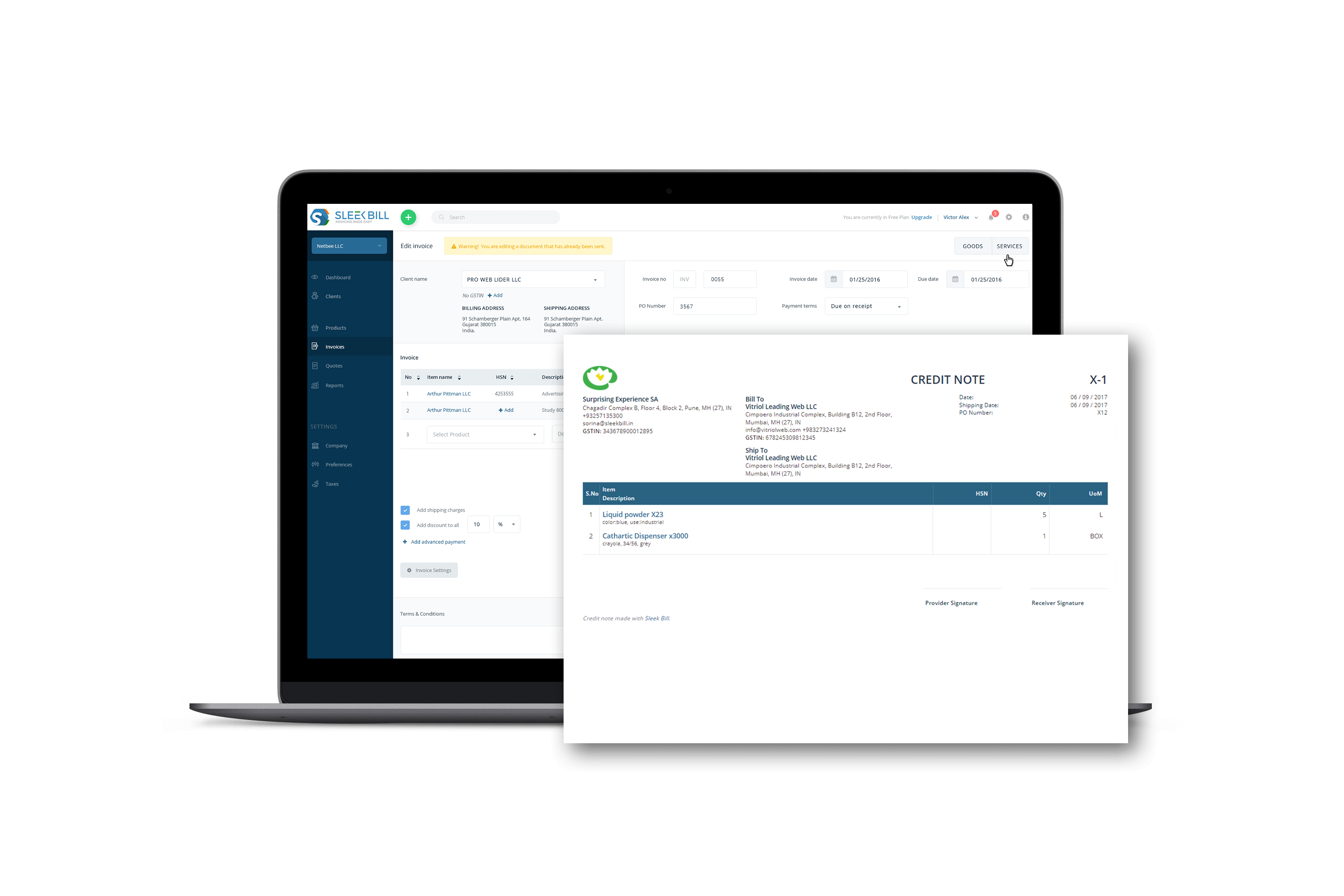

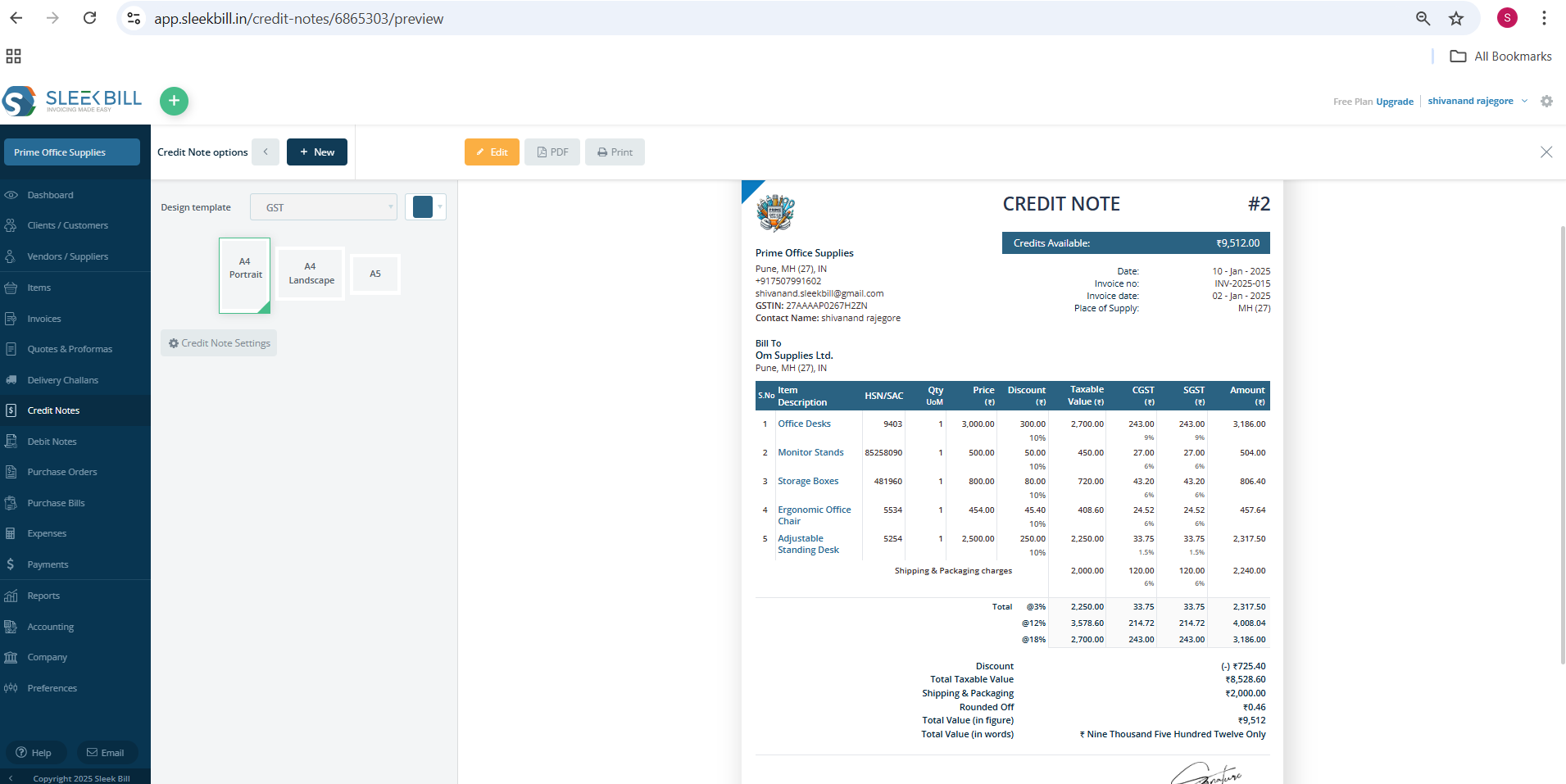

This is how a credit note made with Sleek Bill Online looks like:

Credit notes have to be declared in the GST returns by the following dates:

Please Note: There will be no reduction of output tax liability if the input tax credit and interest on the invoice have been passed to another registered person.

You can easy generate a credit note by using Sleek Bill Online. Once you create the credit note, the amount present in it gets adjusted against the original tax invoice.

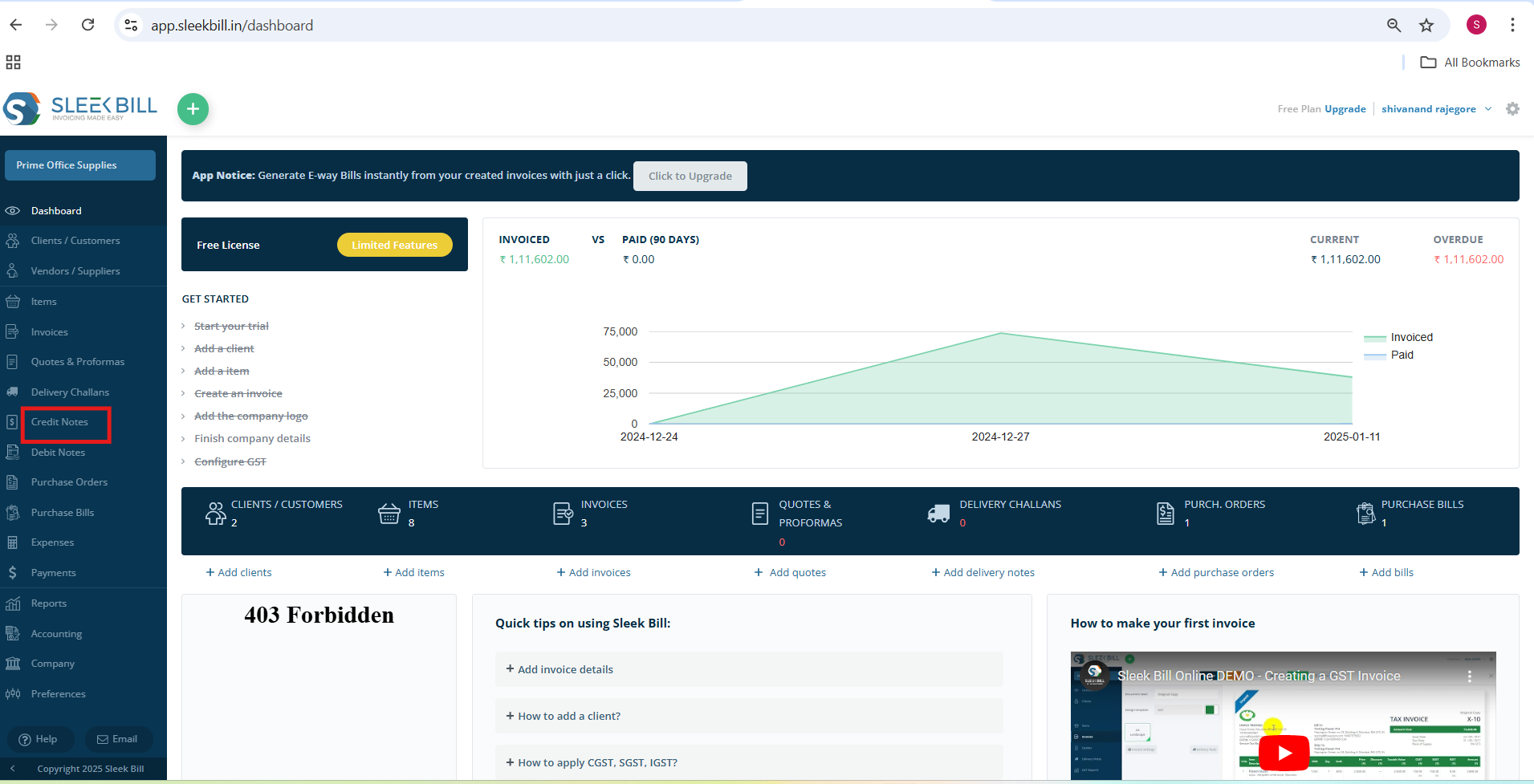

Step 1 : First open credit note dashboard in sleekbill.

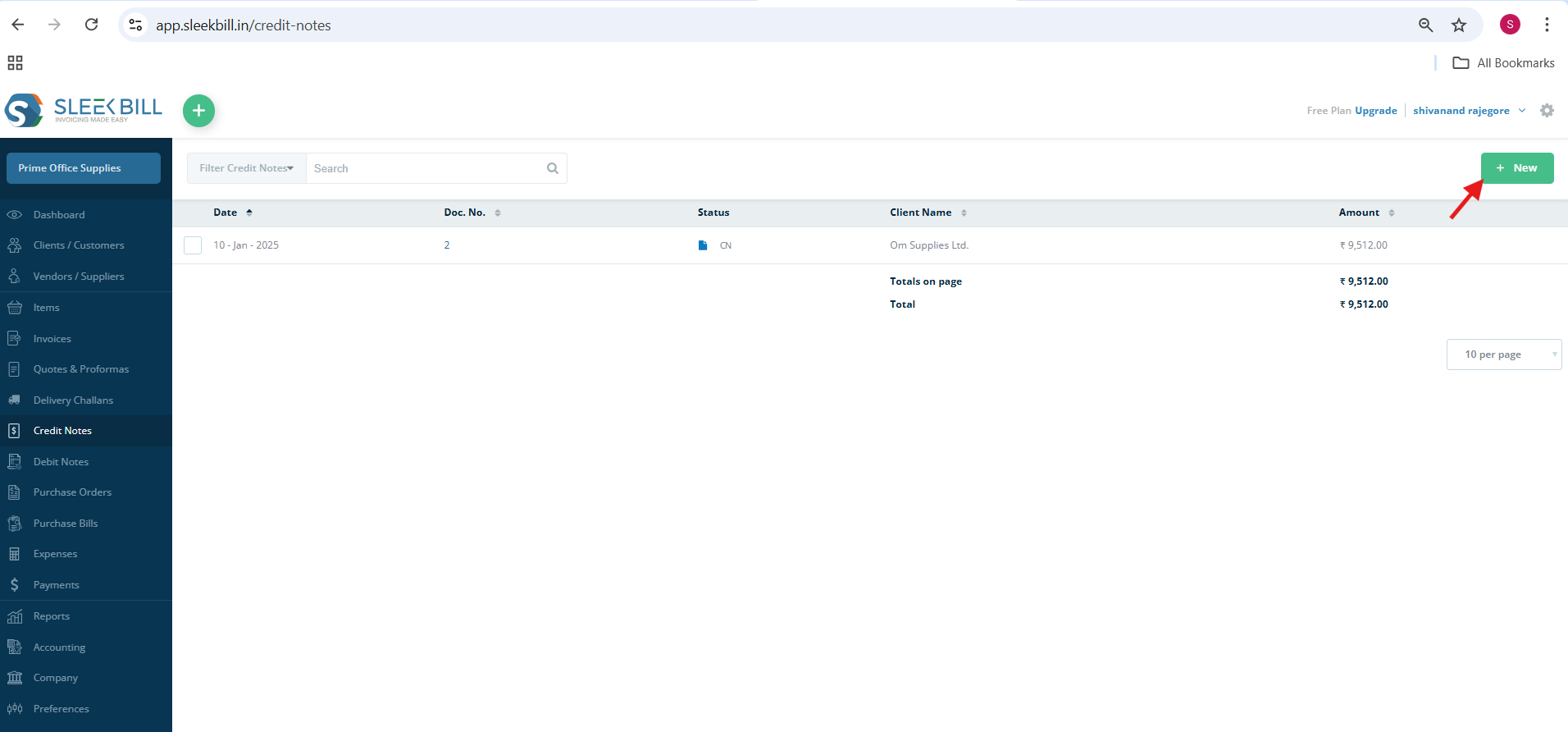

Step 2 : Click on new button

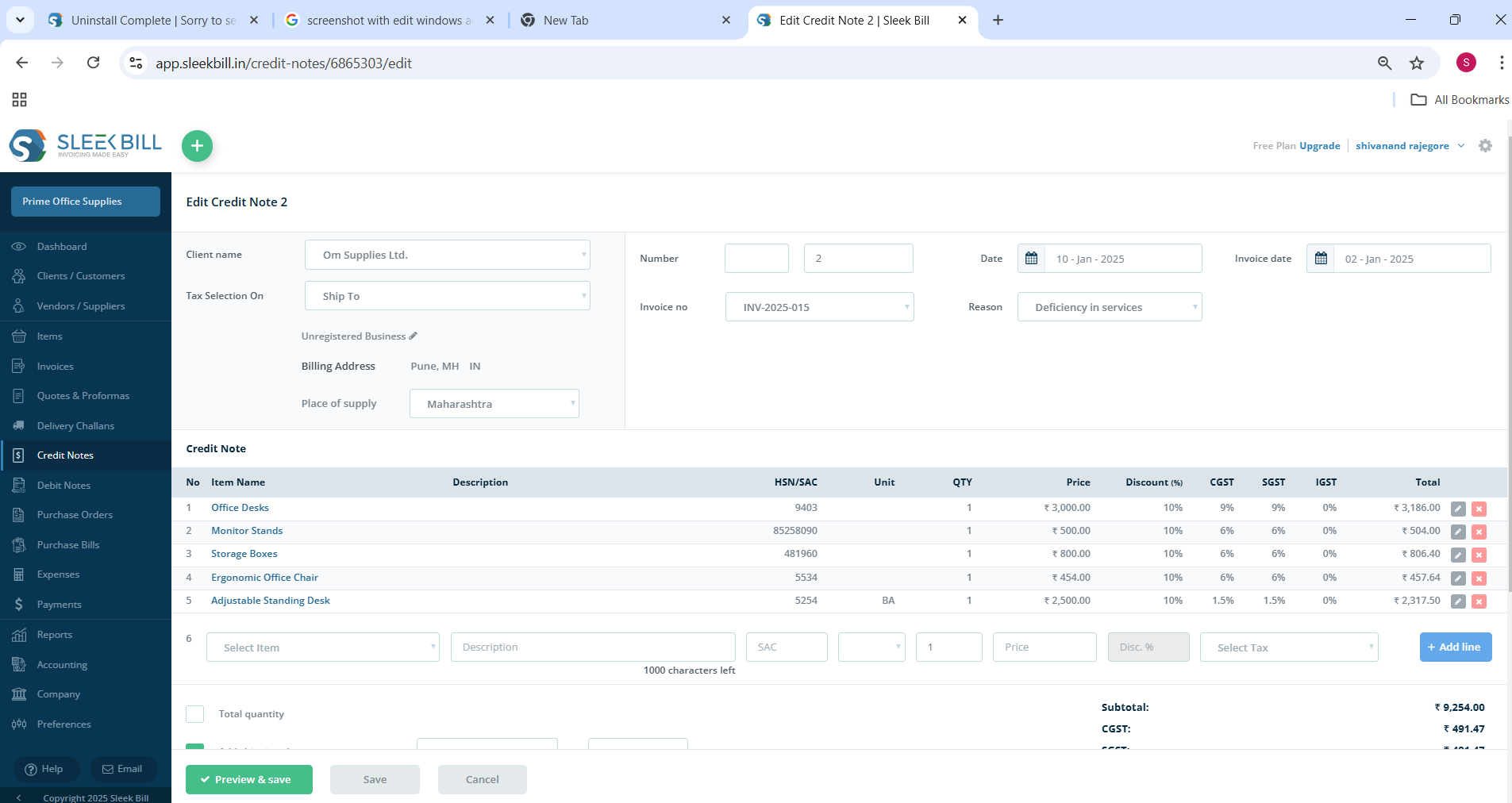

Step 3 : Fill all the necessary fields.Save the credit note.

Step 4 : After Savig you will get credit note.

You can easy generate a credit note by using Sleek Bill Online. Once you create the credit note, the amount present in it gets adjusted against the original tax invoice.

| Aspect | Debit Note | Credit Note |

|---|---|---|

| Issuer | Buyer of goods | Seller of goods |

| Purpose | To return goods due to issues | accept the return of goods |

| When issued | For credit purchases | For credit sales |

| Impact | Reduces seller's receivables | Reduces buyer's payables |

| Amount type | Positive | Negative |

| Form | Purchase return | Sales return |

| Accounting | Updates purchase return books | Updates sales return books |

| Issued for | Buyer returns goods | Seller accepts return |

A modern business that wishes to thrive in the GST era can no longer spend large amounts of time on billing and spreadsheets.

Be GST ready and chose a billing software that evolves as per your business�s needs.

*Free & Easy - no hidden fees.

Anyone can use this for their billing from the first day of installation. I personally like to use this high-tech billing software for its billing pattern and the customization options. I've been using Sleek Bill for the last 2 years and I am happy with the telephone & online support [...]. I would like to thank team Sleek Bill for best, on time support and I recommend this billing software for every small business.

It has very good options for creating quotations and invoices. Our work got simplified and we don't have to waste our time so much. Also, we got good support from your team in the initial stages when we really needed it. We would definitely recommend to our friends.

This really is an awesome software. It's quite easy to use and economical, at a very attractive price. Support from the team was quite impressive. I think any person who wants computerized billing should use Sleek Bill software.

To add credit note first open credit note tab and then click on new credit button and then fill all the necessary fields and save.

Yes, you can delete the credit note. First select the credit note and click on the delete button.

To edit the credit note open credit note then you will see the edit button click on the edit button and edit credit note.

To download credit note open credit note there you will see the pdf button click on that. credit note will download.

To add shipping charges check in the add shipping charges and add shipping charges when adding credit note.