What is CGST?

CGST stands for Central Goods and Services Tax. It is levied by the central government on intra-state supplies of goods and services. This simply means the movement of goods or services that occurs within the same state is taxed by the CGST. The tax collected under CGST is directed to the central government’s revenue.

The Goods and Services Tax in India is an integrated system of indirect taxation with the aim of making it easier for tax rates levied upon the supply of goods and services. One of its significant components is Central Goods and Services Tax, or simply CGST for short. The following article shall present a comprehensive review of the subject of CGST, its purpose, applicability, and functioning under the dealership of GST.

Key Points to Understand:

Intra-state Supply:

CGST shall apply where the supply of any form of goods and services takes place within the territorial limits of one state.

-

Dual Taxation:

Where any supply of goods or services to be undertaken within the state, and for which would be equally taxable under CGST and State Goods and Services Tax, or the SGST. CGST and SGST rates are the same, and when added, they give the total rate of GST on supply.

-

Applicability:

CGST applies to the entire country, except for Jammu and Kashmir.

Why Was CGST Introduced?

CGST: Central Goods and Services Tax Act, 2017 - This law established CGST. The purpose of this act was to merge several indirect taxes placed by the center into one sole regulation.

Primary indirect taxes consist of service tax, excise duty, and central sales tax. This regulation was created with a specific purpose: to make the taxation system simpler by removing the cascade effecet of indirect taxes.ssing...

Objectives of CGST

The main objectives of CGST are as follows:

-

Streamline the Tax System:

To simplify the taxation process by consolidating several central indirect taxes into one.

Eliminate Double Taxation:

To avoid the problem of double taxation on the supply of goods and services.

Simplify Compliance:

To introduce a straightforward compliance system that makes it easier for businesses to pay taxes.

Features of CGST

-

Levied on Intra-State Supplies:

CGST has been made applicable on all intra-state supplies of goods and services.

Self-Assessment:

Self-assessment is a method by which an individual ascertains his tax payable and submits the return accordingly.

Reduction in Taxes Burden

Combination of several taxes reduces the total tax burden on goods and services

Penalties and Compliance:

The provisions of CGST and any violation can attract penalties to work towards compliance.

How is CGST Calculated?

The formula for calculating CGST is straightforward:

CGST = (CGST Rate/100) × Taxable Value

For example, if the taxable value of goods is Rs. 10,000 and the CGST rate is 9%, then the CGST amount would be:

CGST = (9/100) × 10,000 = Rs. 900

This ensures that CGST is uniformly collected based on the value of transactions.

When is CGST Applicable?

When there is a supply or sale of goods or services within the same state, CGST gets charged. For instance, if one company in Karnataka sells furniture to another customer who also lives in Karnataka, this transaction will incur both CGST and SGST charges.

Example:

A smartphone sold for Rs. 20,000 within the state of Maharashtra and having a CGST of 9%. Now, CGST will be Rs. 1,800 (20,000 × 0.09)

How to Register for CGST?

Documents Required:

- Application Form: Duly filled application form.

- PAN Card: The PAN card serves as a unique identification for tax purposes.

- Aadhaar Card: Proof of identity

- Cancelled Cheque Leaf: For bank account verification.

- Address Proof: Confirming the business location.

Steps to Register:

CGST Rules and Compliance

- Raise Requirements: Invoice needs to be issued for every taxable supply of goods and services.

- Registration: Registration is required for every business which has a turnover above the prescribed threshold of GST.

- Filing Returns: CGST returns shall be furnished in time as required by the GST Act.

Example of Tax Rates:

Supposing a commodity has a GST rate of 18%, then the CGST will be 9% and SGST also 9%. Thus, through this sharing of amount, this ensures equal revenue sharing between the central and state governments.

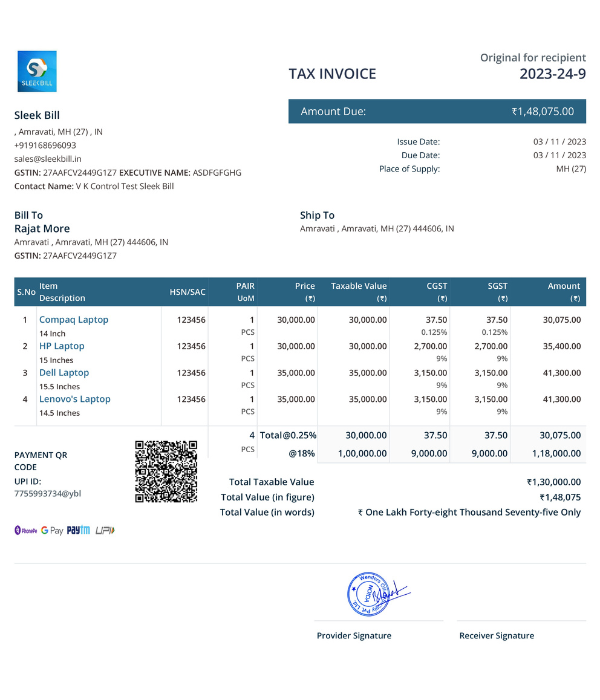

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about