A Complete Guide of Invoice Processing

Invoice processing is highly central to the operations of business activities when efficient financial transactions and sustainable relationships with suppliers are involved. There are many things you look forward to knowing about invoice processing-from workflows to the most advanced tools like Stripe invoicing in their automation. Be a business owner or only an accounts payable employee in search of automation tools that simplify your work, and this guide has actionable insights put in place for all of them.

What is Invoice Processing?

Invoice processing can be defined as the process of handling an invoice right from its receipt to payment. The process involved in the handling of invoices includes verification of details of the invoice, procurement of approval, recording of accounts payable, and on-time payments of suppliers. An efficient invoice processing system is a must for accurate finance and smooth running operations.

Benefits of Automated Invoice Processing

Download Invoice Templates

High operational efficiency.

Ensures timely payment to the suppliers.

Good financial visibility and reporting.

Simplified compliance to tax regulations.

Invoice Processing Workflow

A simple workflow of invoice processing usually involves the following steps

Receipt of an Invoice

The invoices are received via email, post, or electronic invoicing systems. The first step is proper receipt and documentation.

Checks for Accuracy

Check the invoice details, including the PO number, quantities, pricing, and terms. Compare this with the records in existence.

Approval of the Invoice

Submit the invoice for approval to the concerned department or personnel. This way, accountability and company policies can be followed.

Payment to the Supplier

Once confirmed, ensure that payment has been sent in accordance with the approved deal and timeframe to ensure that this will also assist in strengthening supplier relations.

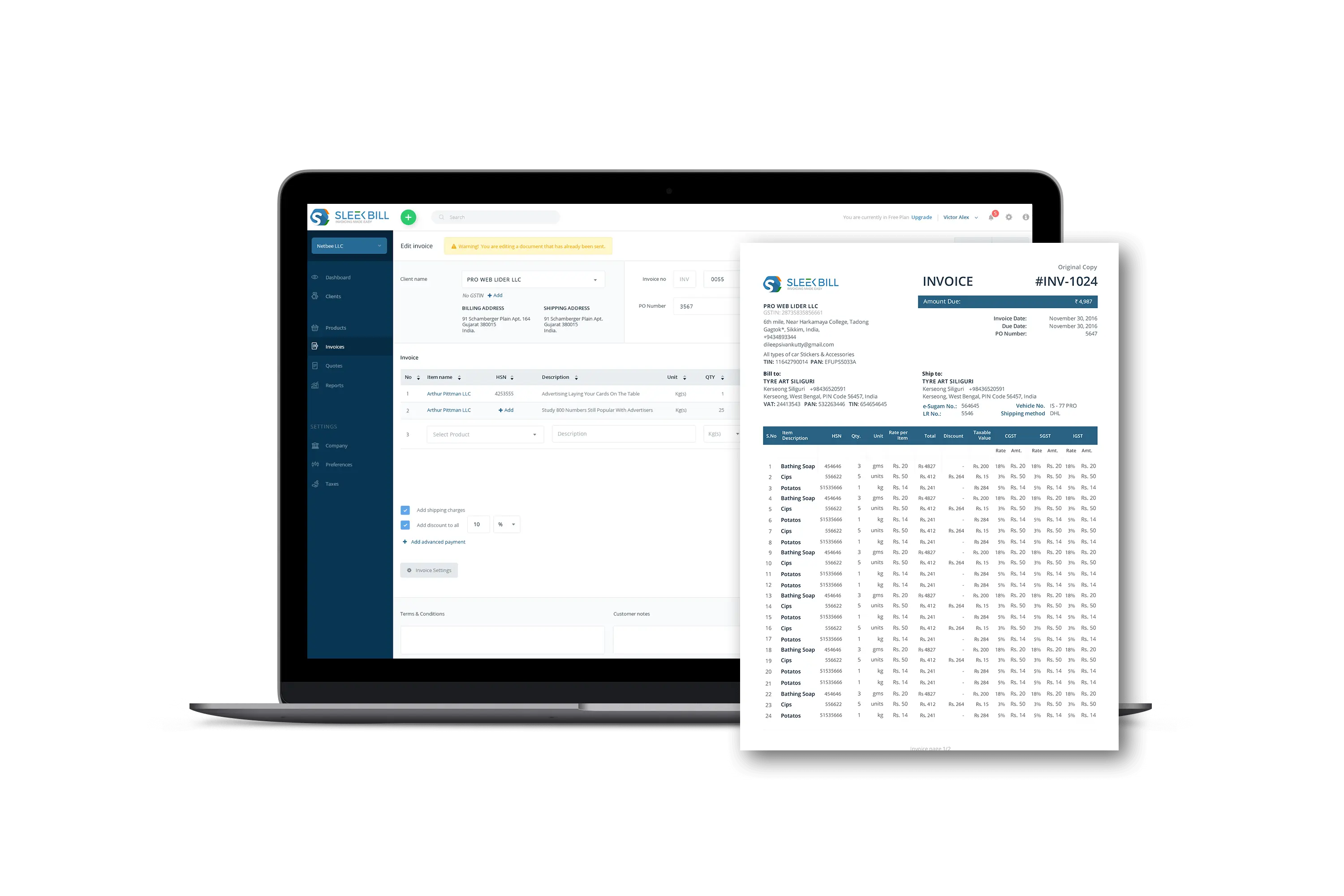

Automating Invoice Processing

Automation has revolutionized invoice processing, offering several advantages:

Time-Saving

Automated tools reduce manual efforts, speeding up the approval and payment cycles.

Cost-Saving

Minimize administrative costs by digitizing and automating workflows.

Reduced Errors

Automated systems ensure data accuracy, eliminating human errors.

Fraud Protection

Advanced software detects anomalies and prevents fraudulent transactions.

Easier Auditing

Digital records simplify audit trails, ensuring compliance and transparency.

Invoice Processing Checklist

Receiving of Invoices was recorded in System records

Checking to ensure accuracy by verifying all invoice information.

Matching all Invoices to corresponding PO's and Delivery receipts

Getting All the required authorization to process Invoices

Sending payments to Suppliers on time.

Challenges of Invoice Processing

Invoice processing, despite its importance, at times is quite challenging

Manual Data Entry : Manual entry takes a lot of time.

Invoice Duplication : It does not offer much automation and integration.

Delays in Approvals : Not real-time tracking and other advanced features.

Fraud Risks : Lack of robust fraud detection mechanisms.

Scalability Issues : Inefficiency in handling large volumes of invoices.

Invoice Processing FlowchartWhat is Invoice Processing?

A flowchart visually represents the entire invoice processing workflow, providing a clear and organized view of the steps involved, from the receipt of an invoice to its final payment. It typically includes key stages such as invoice receipt, verification of details, approval, and recording in the accounts payable system. Developing a flowchart is an essential tool for businesses as it helps to identify inefficiencies or bottlenecks in the process, enabling targeted improvements.

5 Steps to Calculate Price per Invoice

Map the Process : Detail all the steps involved.

Determine People Involved : Determine who controls every step.

Time Taken : Calculate the time for every activity.

Hourly Rate : Calculate the cost of people involved.

Work the Math : Sum all costs to calculate the cost per invoice.

Invoice Processing Journal Entry

While processing an invoice, a journal entry is recorded in the accounting system to reflect the transaction

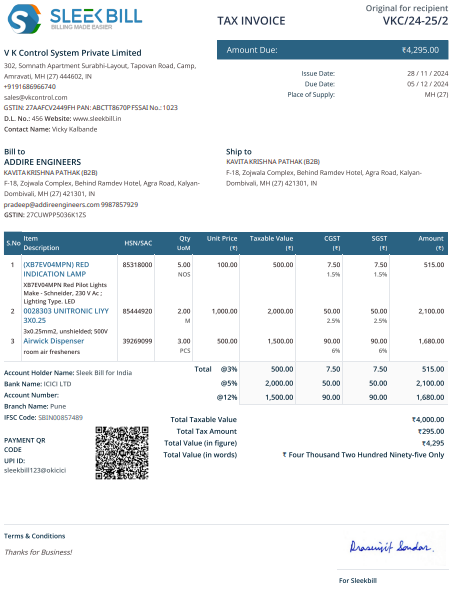

What is an Invoice?

An invoice is a formal document given by the seller to the buyer that depicts.

Seller information

Buyer information

Invoice number

Issue and due date

Description of the goods

Amount to be paid

Payment terms

Entering Invoices into Accounts Payable

Invoices are entered into the accounts payable system to track and refer to later. This ensureInvoices are entered into the accounts payable system to ensure accurate tracking and future reference, helping businesses maintain up-to-date records of all outstanding payments. This process involves verifying each invoice against purchase orders and receipts, confirming the details such as amounts, due dates, and payment terms. By systematically entering invoices, businesses can create a transparent, organized record of financial obligations, which ensures that financial reports reflect the true status of accounts payable.s that the financial report is accurate and payments made on time.s

How Stripe Invoicing Works

Stripe invoicing automates workflows with advanced customization and automation for effortless financial workflows.

Streamlined Invoice Creation : Automated tools for easy creation of invoices.

Advanced Automations : Automatically creates billings.

Improved Customer Experience : Offers secure, convenient methods of payment.

Fast Global Payments : Facilitates cross-border transactions.

International Acceptance : Sum all costs to calculate the cost per invoice.

Detail reporting : Provides insightful management.

Seamless Integration : Easy to integrate with existing financial tools.

The core of efficient financial management would be invoice processing. A business that employs automation tools and best practices would cut down on costs, minimize errors, and maximize supplier relationships. Be it starting off or looking to optimize processes, the difference investment in automation and professional invoice tools like Stripe makes all the difference.

Improve your business's financial health and operational efficiency now by optimizing your invoice processing workflow.

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

GST Credit Note

GST Credit Note

GST Online Advantages

GST Online Advantages

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about