Complete Guide of E-Way Bill

On-the-go logistics and taxation have started to play an increasingly important role in business management, especially for those businesses that deal with goods of transit. The E-Way Bill system acts as a safeguard to the movement of goods from one state to another, ensuring tax compliance under the GST rules. To this end, E-Way Bill software is being adopted by businesses more and more in order to ease compliance through automation of the entire procedure, thus reducing errors and maximizing operational efficiency. The guide aims at familiarizing the reader with the essentials of E-way Bill software such as features, benefits, and compliance criteria enabling an informed decision.

What is GST E-Way Bill?

E-Way Bill (Electronic Way Bill) is a government-mandated document required for inter-state or import movement of goods worth above 50,000 across states and union territories of India and must be generated electronically through the GSTN (Goods and Services Tax Network), thereby tracking and monitoring further movement of goods and ensuring observance of tax compliance.

Conditions to be Satisfied for E-Way Bill Application

The issuing of the e-way bill will apply to

Movement of goods inter-state and intra-state above the prescribed amount.

Supply of goods on sale, return, or transfer.

Movement of goods for job work by registered persons .

Import and export of goods casted under GST laws.

Transfers between different sites of the same company, in different states.

Create E-Way Bill with Sleek Bill

Step 1 : Visit the e-Invoice portal.

Register and obtain your e-invoice User ID and Password.

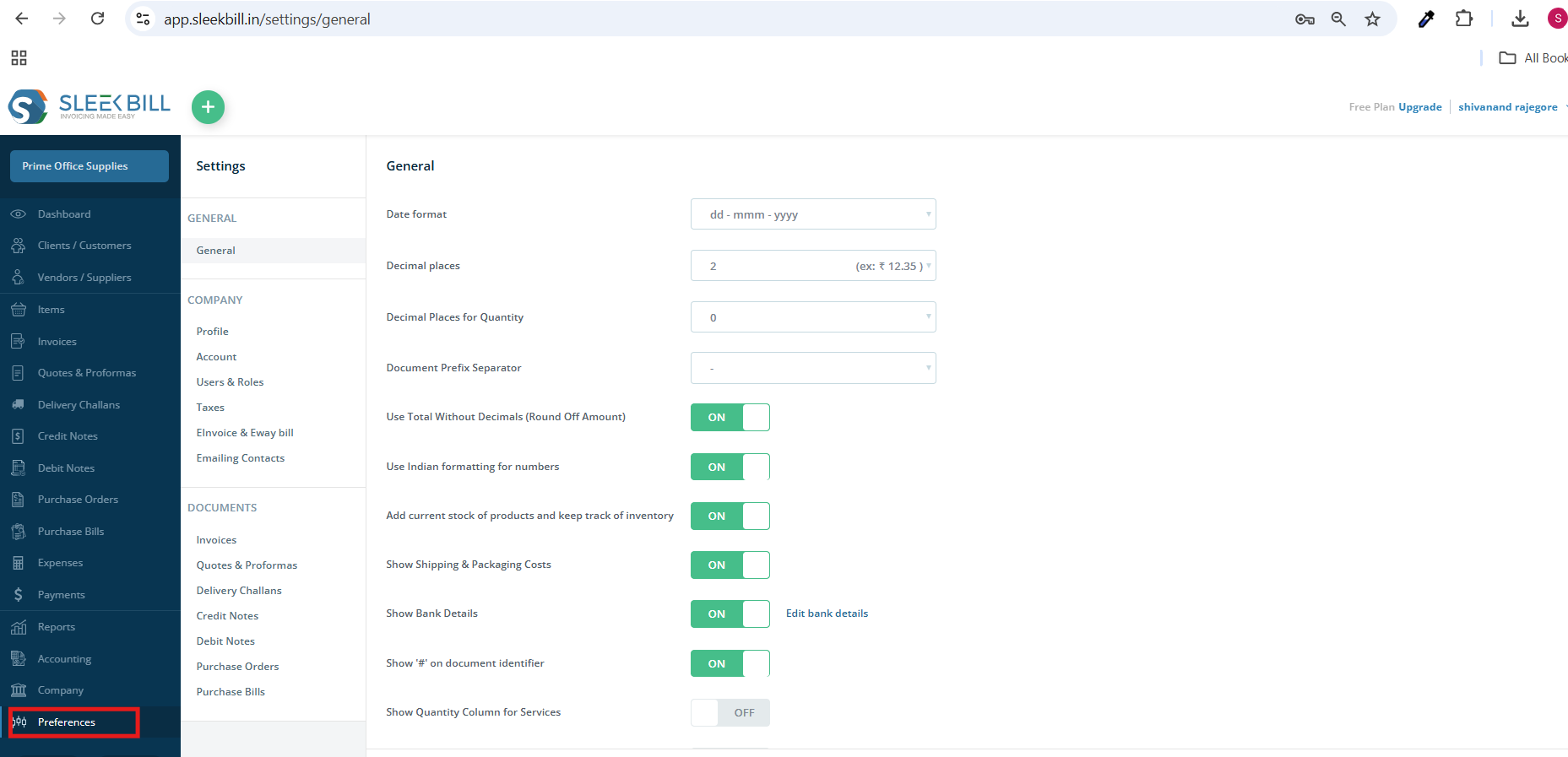

Step 2 : Log in to your Sleek Bill account.

Navigate to the Preferences section.

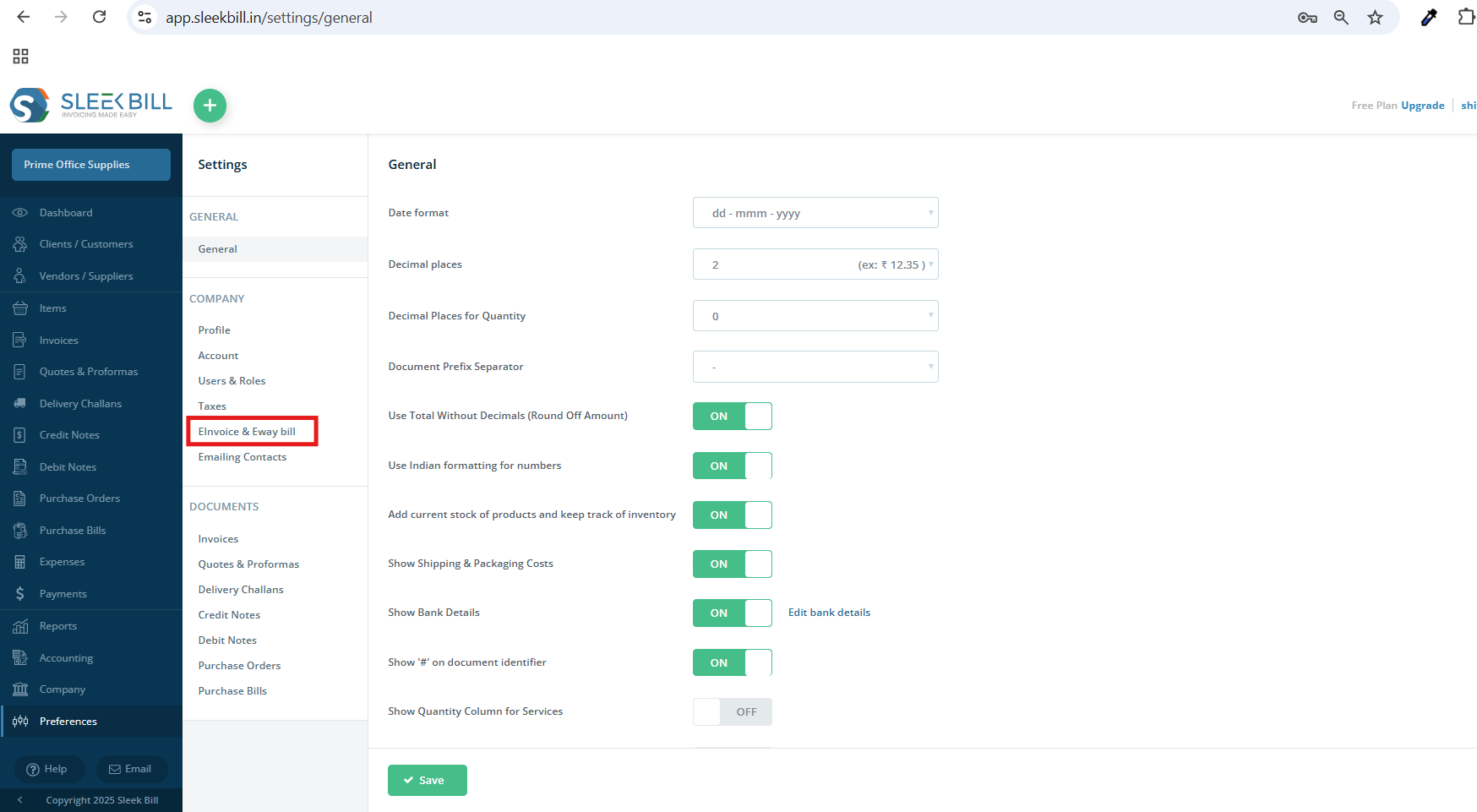

Step 3 : Select the E-Invoice and E-Way Bill option from the Preferences menu.

Step 4 : Use the API User ID and Password obtained from the e-invoice portal.

Enter the credentials in the respective fields and click Save.

Step 5 : Go to the Invoices section in Sleek Bill.

Select a previously created invoice.

Click More Options, then select Make E-Way Bill.

Save the changes to generate the E-Way Bill..

Who are Parties to Generate E-Way Bill?

There are persons who are liable to generate the E-Way Bill as follows

Whenever the goods are being transported under the prescribed limits, the registered supplier is supposed to generate E-Way Bills.

Transporter should generate one if goods go through any registered or unregistered transport agency.

In case the supplier doesn't generate the E-Way Bill, then the recipient generates the E-Way Bill.

E-Way Bill Validity

The E-way bill is valid as per the distance of transport of goods as follows:

Solutions to Ease E-Way Bill Processing by Software

Companies massively require an advanced E-way Bill software that will work on automating compliance to reduce manual errors and maximize productivity. Elite-level E-Way Bill software offers a solution:

E-Way Bill Software for PC

A desktop environment solution is the one with the highest benefits for a business in E-Way Bill processing:

E-Way Bill Software Important Features

Good E-way Bill software should provide those features:

Distance based validity check to ensure compliance.

Scheduled E-way bill generation for automated processing.

Multiple collaborating users for seamless cooperation.

Data backup and security for sensitive information security.

Integration with GST invoicing and E-Invoicing

Seamless interface for users on PC and mobile for on-time access;

Advantages of Best E-way Bill Software

The best E-way Bill software can benefit your business in the following ways:

No error billing, no error compliance.

Time-saving automation for fast processing.

Ensuring discrepancies are never met through real-time checks.

Cost-effective solutions which fit for all business sizes.

Access control based on multiple users and branches.

Seamless data integration with the contemporary ERP present.

Customer support on 365x7 to make sure that business operations remain unaffected.

E-Way Bill Software to Business

Very hassle-free only from GST compliance standpoint.

Time-consuming automation, especially useful for bulk transactions.

Business needs can easily be scaled up.

Real-time updates and tracking.

Enhanced security via customizable access control.

User-friendly interface makes navigation super easy.

Backup of data for extra security in case of loss.

Reasons for exclusion of the E-way bill.

Some items and transactions fall under this exemption totally from E-way bill provision:

Transit cargo from Nepal to Bhutan

Goods under customs supervision or clearance

Within 20 kilometres under a delivery challan

Non-motor vehicles transporting goods

Goods for the MoD and certain exemptions

The E-Way Bill system is a crucial part of GST compliance in India, ensuring smooth transportation of goods. Choosing the right E-Way Bill software simplifies the process, enhances accuracy, and saves time for businesses of all sizes. By leveraging automation, AI-powered matching, and seamless integration, companies can eliminate errors and ensure uninterrupted operations.

If you’re looking for an efficient, secure, and scalable E-Way Bill solution, explore software that offers real-time tracking, compliance automation, and robust data security. Make the shift to smarter compliance today!

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

GST Credit Note

GST Credit Note

GST Online Advantages

GST Online Advantages

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about