A Guide Introduction

In the field of business accounting, there are concepts like "sundry debtors" and "sundry creditors" For many businesses, understanding these ideas is very important for keeping good financial health and correct record management. This blog post will seek to understand the concept of sundry debtors, its examples, and why it remains important in the book-keeping financial world.

What is Sundry Debtor?

So, a sundry debtor is like someone or some group who need to pay money to the business because they have bought goods or used services through credit. Sundry debtors are generally seen in small, single-time deals which usually do not fit into regular customer category.

You will find them on balance sheet under accounts receivable section – this points out to the income from these people for work completed or products sold but still waiting collection of payment.

Sundry Debtor Example Flow

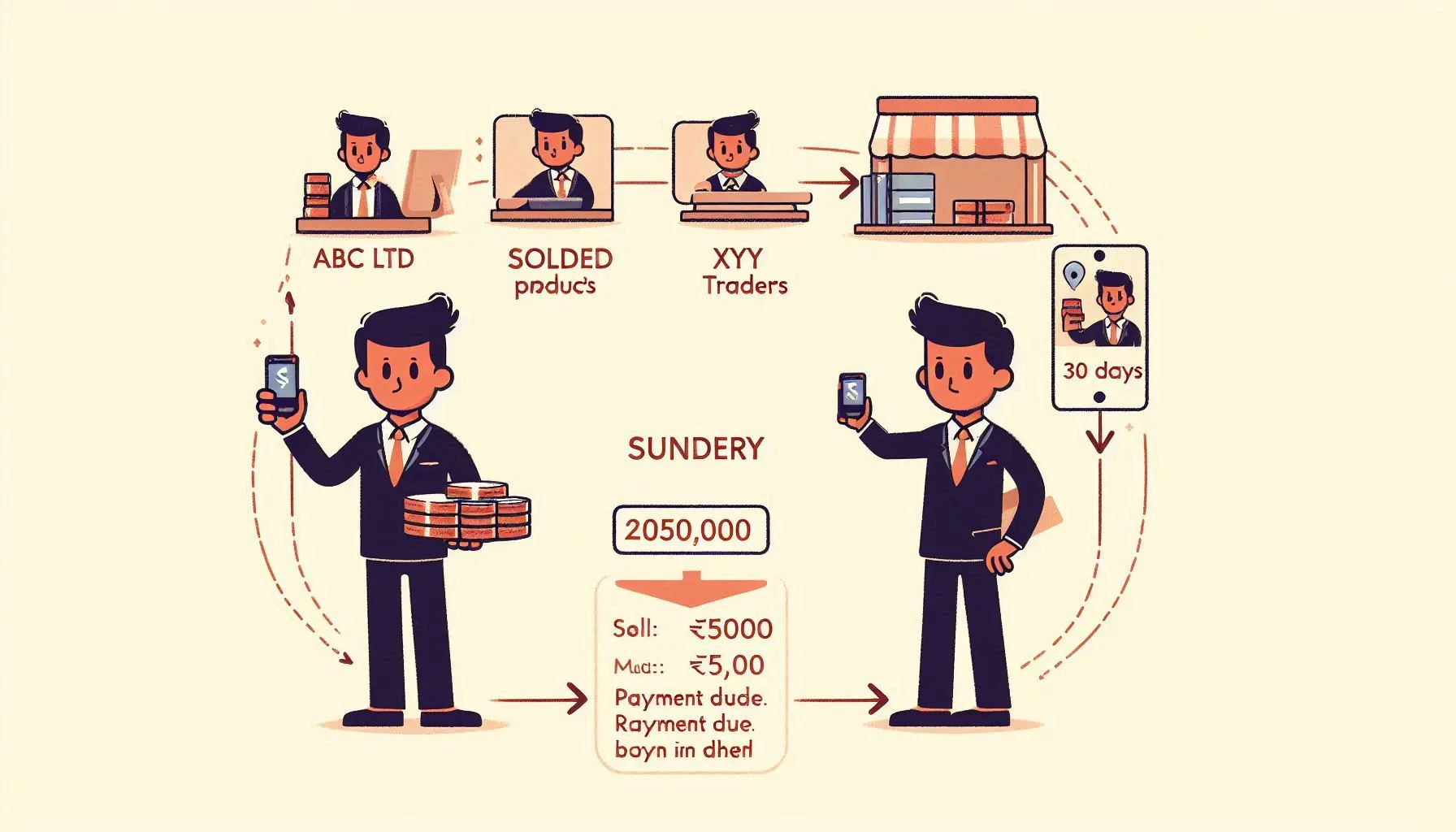

Imagine that ABC Ltd sells their product which is ₹50,000 worth to XYZ Traders who are new customers and this transaction happens on credit.

XYZ Traders needs to pay within 30 days. This means XYZ Traders is a sundry debtor to ABC Ltd until he pays for the sold product.

1. ABC Ltd (Seller) → Sold Products (Worth ₹50,000) → XYZ Traders (Buyer)

-

Transaction Type: Credit

-

Payment Due: 30 days

2. XYZ Traders (Debtor)

-

Status: Sundry Debtor

-

Reason: Has not yet paid for the product

-

Amount Owed: ₹50,000

-

Payment Deadline: 30 days

3. XYZ Traders → Payment Made → ABC Ltd

-

Debtor Status Ends: Once payment is completed

-

Final Transaction Closed

Who is a Sundry Creditor?

A sundry creditor is, therefore the supplier or a person whom the organization owes cash to as advances for purchases carried out on credit in accounting software. Accounting software monitors both individuals who owe money and those to whom it is owed, offering businesses a transparent understanding of cash coming in.

What is the distinction between debtors and creditors?

- Debtors are accounts owed to the business. Thus, it appears on the balance sheet as an asset.

- Creditors are accounts on which the business owes money to others. Thus, it figures as a liability in the balance sheet.

- Difference between sundry creditors and trade creditors Other sundry creditors are those vendors or suppliers for whom the company has short, irregular, or infrequent obligations of small amounts relative to goods and services received.

- Trade creditors also refer to regular large suppliers with whom the firm regularly trades.

Managing Sundry Creditors:

Why It's Important Good control of sundry creditors will lead to good cash flow. Here are some reasons why:

- Received on time: Sundry debtor control will ensure that the debts collected are collected within time and prevent overdue payments

- Bad debt: Proper sundry debtor control minimizes bad debt, which otherwise could run into losses for the business concern in terms of finances.

- Cash flow: Proper management of debtors ensures that businesses can predict cash flow and, therefore, anticipate their expenses. Under the head "current assets," sundry debtors appear in a balance sheet.

The figure is always the total amount owed by different customers or clients for different goods and services sold on credit.

Sundry Debtors in Final Accounts

Sundry debtors, or more appropriately, it appears on the credit side of the trial balance in final accounts and falls within the assets section of the balance sheet. It keeps track of all outstanding receivables and manages their accounts effectively in business.

Conclusion

Sundry debtors play a vital role in a company's financial management. By understanding who your sundry debtors are and properly managing them, you can ensure smoother business operations and maintain strong cash flow. Tracking these debtors and making timely collections is not just a financial task but a strategic one for any growing business. By following this guide, businesses can stay informed about how sundry debtors work and their importance in accounting, ensuring a robust approach to financial management.

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about