Unlocking SAC Codes: Your Easy-to-Follow Path to Grasping Service Accounting in GST.

*Free & Easy - no hidden fees.

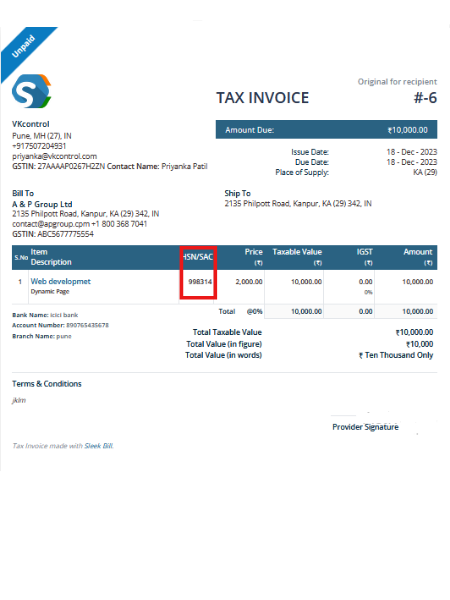

In the intricate landscape of the Goods and Services Tax (GST), the Service Accounting Code (SAC) emerges as a critical element for service-oriented businesses. SAC codes not only streamline the GST process but also bridge the gap between national and international trade practices. Our discussion delves into the multifaceted role of SAC codes in ensuring GST compliance, simplifying tax filing, and contributing to global trade alignment. As we navigate through the nuances of SAC codes, it becomes evident that they are more than mere classification numbers; they are vital tools for efficient business operations and informed decision-making in the realm of services.

• Service Accounting Code (SAC): A unique code system to categorize services under GST.

• Role in GST: Crucial for the classification of services for GST applicability.

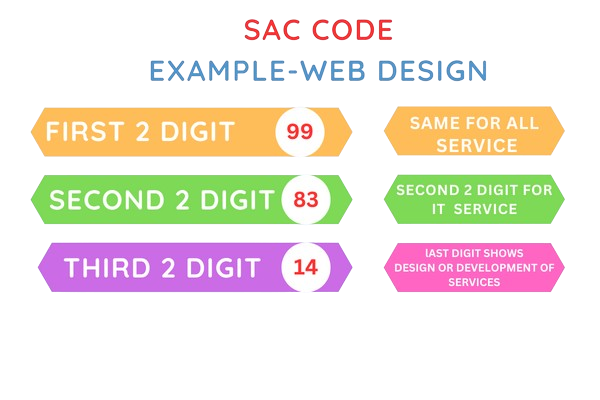

• Six-Digit Code: SAC is a six-digit number, each segment signifying a specific classification.

• Chapter and Heading: Begins with '99' for services, with subsequent digits defining service categories.

• Overview: Encompassing all services under the GST umbrella.

• Scope: Wide-ranging services grouped under unique classifications. ooooooooooooooooooooo

• Example: '54' in SAC represents 'Construction Services'.

• Service Identification: Each service, like 'General Construction Services for Buildings', has a specific SAC like '11'.

• Clarity in Invoicing: Ensures accurate GST application on services.

• Ease in Return Filing: Streamlines GST return filing process.

• National Standard: Creates a uniform standard across India for service categorization.

• Facilitates Comparison: Enables easy comparison and understanding of GST rates.

Chapter Indicator:

Chapter Indicator:

'99' indicates the service nature under GST.

Service Category:

Service Category:

Subsequent digits like '83' denote major service categories such as IT services.

Service Specifics:

Service Specifics:

Last digits like '14' are specific service codes, pinpointing exact services like general Design and Construction.

Billing and Filing:

Billing and Filing:

SAC codes are essential for creating GST invoices and filing returns.

GST Rate Identification:

GST Rate Identification:

Assists in determining applicable GST rates for services.

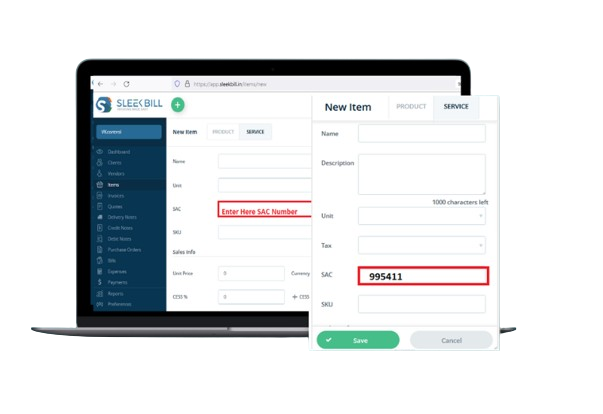

Achieve optimal efficiency in your GST compliance journey through Sleek Bill's expert guidance on SAC codes.

*Free & Easy - no hidden fees.

● Essential for Registration:

During the GST registration process, businesses must declare their relevant SAC code(s).

● Purpose:

This helps in categorizing the service nature of the business for tax purposes.

● Quick GST Rate Identification:

The SAC code aids businesses in swiftly determining the GST rate applicable to the services they provide.

● Tax Compliance:

Accurate identification of GST rates using SAC codes ensures proper tax compliance and accurate tax calculations.

● Mandatory on Invoices:

When generating invoices for services, including the SAC code is mandatory..

● Turnover Reporting:

The SAC code on invoices helps in accurately reporting the total turnover of the business, crucial for GST filings and audits.

● SAC Digits Required: 4 digits of the SAC code are mandatory for invoicing and GSTR-1 filing.

● Implication: Ensures that businesses accurately report and categorize their services for GST purposes.

● SAC Digits Required: 4 digits are either mandatory or optional based on specific criteria.

● Flexibility: Offers businesses the choice to use detailed SAC codes as per their requirements.

● SAC Digits Required: Nil, implying no obligation to specify SAC code.

● Simplified Compliance: Simplifies GST for unregistered dealers.

● Mandatory Usage: Crucial for service-oriented businesses for compliance.

● GST Billing: Integral in creating GST-compliant invoices.

● Accurate Application: Ensure correct SAC code application for all services offered.

● Regular Updates: Stay informed about changes or updates in SAC codes.

● Efficient Classification: SAC codes provide a systematic approach to categorize services, reducing ambiguities.

● Enhanced Transparency: Offers clear visibility into the nature of services and their tax rates.

● Mandatory in Filings: Essential for businesses to use SAC codes in GST returns and other relevant GST documents.

● Aids in Record Keeping: : Ensures accurate and consistent record-keeping for services rendered.

Business Operations:

Compliance and Transparency:

Categorization of Services:

Unique Identification: SAC code provides a unique identifier for each service, streamlining service classification under GST.

Distinctive Classification: Helps in differentiating services, enhancing clarity in the vast service sector.

GST Rate Determination:

Rate Identification: Crucial in determining the applicable GST rate for various services.

Simplifies Taxation: Assists businesses and clients in understanding the tax implications for different service categories.

Registration and Reporting:

GST Registration: Businesses are required to mention relevant SAC codes during their GST registration process.

Ease in Reporting: Facilitates accurate reporting of services in GST filings and documentation.

Simplified E-Filing for Enhanced Compliance:

E-Filing: SAC codes streamline the electronic filing of GST returns, allowing businesses to accurately categorize their services and ensure correct filing.

Error Mitigation: The precise classification minimizes the risk of errors in tax returns, reducing the chances of penalties or additional scrutiny.

Facilitating Seamless Interstate Service Transactions:

Transparency in Interstate Transactions: SAC codes offer clarity in interstate service transactions, aiding in determining the place of supply and the applicable GST rate, particularly in cases of IGST.

Uniformity Across States: These codes establish a uniform system for service classification across different states, eliminating confusion and disparities in tax rates and calculations.

Integral Role in Informed Policy Making :

SAC Codes Inform GST Policies: Government uses SAC code data for precise GST decisions.

Sectoral Analysis Guides Growth: SAC codes analyze service sectors, enabling targeted policies for economic development.

Enhancing International Trade Compliance:

Global Alignment: SAC codes align with international classification systems, facilitating compliance in international trade involving services.

Streamlined Import and Export Processes: They simplify the process of claiming GST exemptions or refunds on services exported or imported, adhering to global trade norms.

Influence on Business Analytics and Strategic Decision-Making

Data-Driven Insights: SAC codes enable businesses to efficiently analyze their service offerings, providing crucial data for strategic decisions such as expanding service portfolios or adjusting pricing strategies.

Market Trend Identification: The aggregation of service data through SAC codes assists in identifying market trends and consumer preferences within various service sectors.

Boosting Transparency in Taxation

Enhanced Tax Transparency: SAC codes contribute to increased transparency in taxation by providing a standardized framework for service classification, reducing ambiguity and ensuring a more transparent tax ecosystem.

SAC codes simplify the identification of services provided in various sectors, making it easier for businesses and GST authorities to categorize services for tax purposes.

SAC codes are adapted from the UNCPC (United Nations Central Product Classification) system, customized by the Central Board of Indirect Taxes and Customs (CBIC) for application in India.

HSN codes are derived from the Harmonized System Nomenclature developed by the World Customs Organization (WCO), used globally for classifying goods.

Comprises 6 digits, each indicating specific details about the service.

Constitutes 8 digits for detailed categorization of goods.

SAC codes are essentially a national adaptation of an international classification system for services, whereas HSN codes are a direct application of a global standard for goods.

SAC's 6-digit structure is tailored for services, providing a sufficient level of detail for service classification. In contrast, HSN's 8-digit structure offers a more granular classification, suitable for the diverse range of goods in international trade.

Both SAC and HSN codes play a pivotal role in standardizing the classification of services and goods under the GST regime.

Accurate use of these codes is crucial for GST compliance, ensuring correct tax rates are applied and facilitating smooth tax administration.

Revolutionize your service taxation by integrating Sleek Bill's comprehensive solutions, including expert SAC code guidance.

*Free & Easy - no hidden fees.

Turnover Threshold: The requirement of all six digits of the SAC code becomes essential for businesses with a turnover exceeding Rs.5 crore in the previous financial year.

Compliance for Different Entities : The degree of detail required in SAC codes varies according to the type of entity and the nature of the transaction.

Impact on GST Reporting: Accurate usage of SAC codes influences the precision and reliability of GST reporting and invoicing.

Accuracy in Tax Filings: The correct mention of SAC codes is vital for the accuracy of GST filings.

Facilitating Audits: Inclusion of SAC codes on invoices simplifies the auditing process for both businesses and tax authorities.

Enhancing Transparency: The use of SAC codes in registration and invoicing enhances transparency in the taxation process, making it easier to track and assess service transactions.

The role of SAC codes in the GST framework transcends mere tax classification. It's a pivotal tool that enhances the efficiency, accuracy, and global compliance of service taxation. Understanding and implementing SAC codes correctly is crucial for businesses to navigate the GST landscape successfully. As businesses adapt to this standardized approach, they not only comply with national tax norms but also align themselves with international trade standards, paving the way for broader market opportunities and streamlined operations. With SAC codes, the intricacies of GST for services transform into opportunities for growth and compliance.

This system of HSN coding helps in the systematic classification of goods under the GST regime and facilitates accurate and uniform documentation across businesses and transactions. It simplifies the process of filing GST returns and ensures compliance with the GST laws.