Understanding the Integrated Goods and Services Tax

With the abbreviation IGST full form for integrated goods and services tax, it was to be explicitly positioned to guide the slab sales or supply of goods or services to the other states with their Union territories for this GST regime of India.

In this blog, we will define IGST full form, the working of IGST, its benefits, and its implications for the businesses concerned.

What is IGST Full Form?

IGST full form, known as Integrated Goods and Services Tax, applies to the interstate supply of taxable goods and services. The structure of the IGST full form is such that it shall integrate both Central GST and State GST, thus enabling the seamless taxation across state borders. The IGST full form aims to sustain a continuous input tax credit chain, thereby toppling the tax system into its simplest form, hence lessening the prospects of tax evasion.

Key Points About IGST Full Form:

IGST = CGST + SGST: The IGST rate is equal to the sum of the CGST and SGST rates, making it comparable in tax incidence to intrastate supplies.

Applicable on Interstate Transactions: For example, the movement of goods from Delhi to Agra attracts IGST.

Import and Export Coverage: Both imports into India and exports out of India are treated as deemed interstate supplies, subject to IGST.

The Origin and Framework of the IGST Act

India's integrated architecture of the IGST full form has been instituted under the Integrated Goods and Services Tax Act, 2017. The legislation aims to impose, collect, and capture all IGST full form applications across the country inaudibly in Jammu and Kashmir. To abolish multiple soft payments across inter-state transfer and smoothen tax credit transfer.

Salient Features of the IGST Act 2017:

-

Uninterrupted ITC Chain: Allows businesses to claim Input Tax Credit on inter-state purchases, avoiding double taxation.

-

No Upfront Tax Payments: There is no need for businesses to pay taxes upfront when goods are transferred across state borders.

-

Efficient Self-monitoring Model: Streamlines compliance for businesses, ensuring better monitoring and easier tax administration.

How Does IGST Work?

To understand how IGST functions, let’s break down the taxation process:

If a seller is making a supply outside their state, they will charge IGST on the value addition. Adjustments allow any credit of IGST, CGST, and SGST to be set off against supplies already made.

The SGST credit applied in full or in part for payment for IGST is transferred by the exporting state to the central government.

The purchaser in the importing state will, at the time of discharging its output tax liability, be entitled to a credit of the IGST paid on a purchase.

The IGST revenue is then distributed by the central government among the importing states to ensure consumption states receive their due share of sales tax.

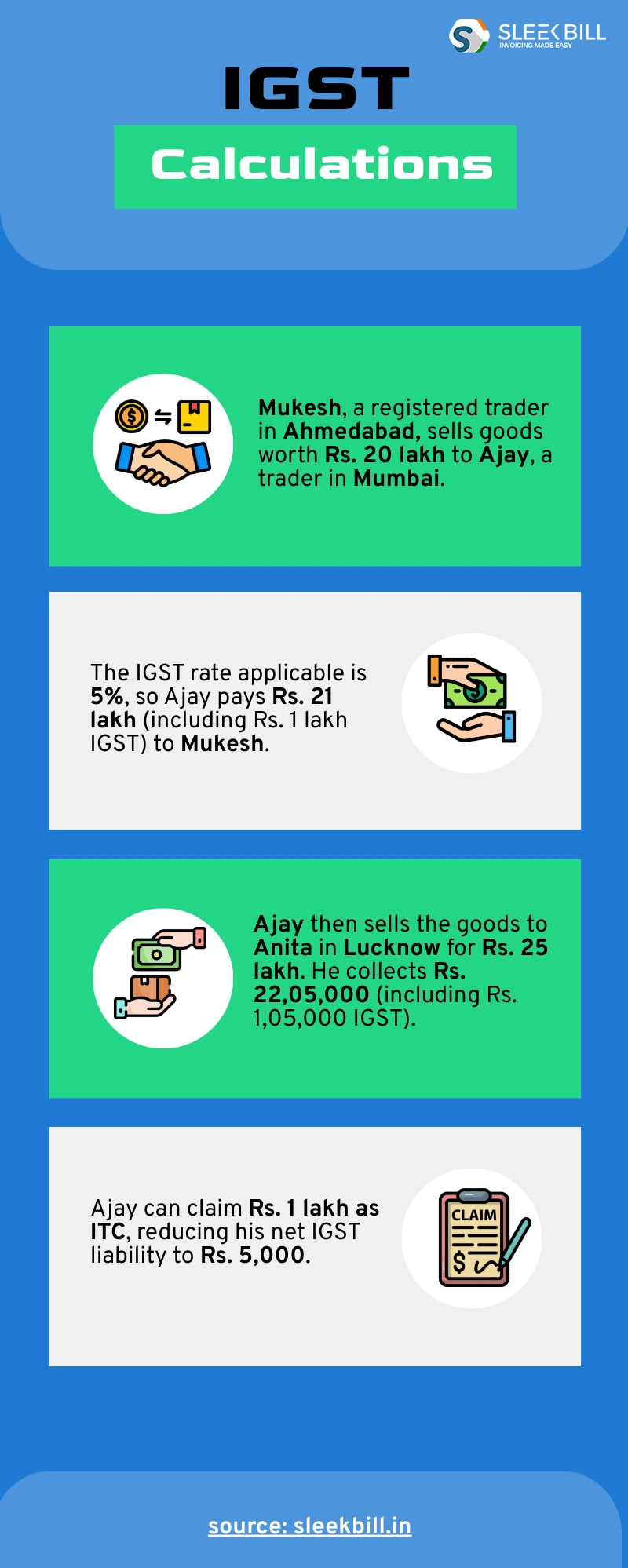

IGST Calculation - An Example

The formula for calculating IGST is straightforward:

IGST = CGST + SGST

To illustrate, let’s consider a scenario:

Tax Revenue Distribution in IGST

An important aspect of IGST is the distribution of tax revenue to the states involved:

-

The importing state receives the final tax revenue. For instance, in the transaction between Ajay and Anita, the Uttar Pradesh government benefits.

-

The central government collects the IGST initially and then transfers the state’s share according to the agreed proportions.

Advantages of IGST

-

Simplifies Tax Compliance: IGST is, with the absence of multiple payments of tax, a good way of lightening the administrative burden upon business houses doing interstate trade.

Avoids Double Taxation: IGST provides a provision for CENVAT credit transfer of the tax paid in the exporting state toward the final tax liability in the importing state, which tends to bring tax cascading down to mere effects.

Supports Seamless Business Operations: With an ITC mechanism in place, businesses can focus on expanding interstate trade without worrying about tax complications.

Factors to Keep in Mind About IGST

-

1

Interstate Transactions

Any interstate supply, import, or export is subject to IGST.

-

2

Input Tax Credit (ITC)

Businesses can use the IGST credit to offset their SGST or CGST liabilities.

-

3

Compliance with the GST Council

The GST Council oversees IGST rates and regularly reviews the tax structure to address any grievances from traders and consumers.

How Are GST Rates Decided?

Every two months, meetings are held with the representatives themselves, expressed in an Excel format given few extremities of complexities involved, as an end to these specific questions on GST-related matters like enabling base rate, deciding maximum threshold limit for exemption, setting the GST rate carpet, which were submitted in further meetings, deliberations, and discussions with the central and state governments.

Refund of IGST

Refunds for IGST can be claimed in cases such as:

-

Exports or international tourists taking goods outside India.

-

Incorrect payments, where taxpayers mistakenly remit SGST or CGST instead of IGST.

Conclusion

IGST makes up another important part regarding the working of India's GST engine ensuring that the collection of taxes on interstate transactions is smooth. By facilitating seamless movement of tax credits and preventing double taxation, IGST allows businesses to maintain compliance while expanding cross-border operations. An understanding of IGST calculations and its benefits would enable the business to make quicker and smarter decisions regarding tax strategy.

Stay tuned with the latest GST changes to ensure your business stays compliant in a continuous evolving tax scenario!

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about