Demystifying GSTR-1 for streamlined and compliant GST submissions.

*Free & Easy - no hidden fees.

Understanding GSTR-1 is crucial for businesses to ensure accurate GST reporting. This return captures all outward supplies, making it an indispensable tool for maintaining financial transparency and adhering to GST regulations.

GSTR-1, commonly known as the Sales Report, is a mandatory tax return for all registered taxable suppliers under the GST regime. It plays a critical role in documenting and reporting the details of sales or outward supplies of taxable goods and services. Here's a closer look at what GSTR-1 entails:

GSTR-1 must be filed by all registered taxable suppliers, making it an essential part of GST compliance.

This report includes comprehensive details of all sales transactions, ensuring transparency and accountability in taxable supplies.

The frequency of filing GSTR-1 depends on the supplier's annual turnover. Suppliers with a turnover rate above Rs. 1.5 crores are required to file this return monthly.

It also includes information from persons liable to collect Tax Collected at Source (TCS) or Tax Deducted at Source (TDS).

Exemptions : Notably, composition dealers, who opt for a simplified tax payment process under GST, are exempted from filing GSTR-1.

Late Filing Penalties : Timely filing is crucial, as there is a penalty for late submission, which is Rs. 50 per day and Rs. 20 per day for nil returns.

1. Eligibility for Filing GSTR-1: GSTR-1, a fundamental element of the GST framework, is crucial for certain categories of business entities. It's vital to understand who needs to file GSTR-1 and why:

2. Input Service Distributors : Businesses that receive invoices for services utilized by other branches and operate as input service distributors as per GST norms are required to file GSTR-1.

3. Registered Dealers : Primarily, all registered dealers under GST are required to file GSTR-1. This encompasses a wide range of businesses operating within the Indian economy.

4. Zero Transaction : Even if there are no transactions in a given month, registered dealers must still file a nil return for GSTR-1.

5. Mandatory Filing:

Filing GSTR-1 is obligatory, regardless of whether there were any sales or business transactions during the month.

6. Online Suppliers : Those supplying retrieval services, database access, and online information also fall under the purview of GSTR-1 filing.

7. Composition Scheme Registrants: Entities registered under the GST composition scheme are also obligated to file GSTR-1, adhering to specific guidelines outlined by the GST laws.

8. Exemptions: Certain individuals and business entities are exempt from filing GSTR-1. Understanding these exemptions is key for compliance.

9. Non-Taxable Persons and Import Services: Entities categorized as non-taxable, especially those importing services and goods from outside India, are responsible for filing GSTR-1. This includes businesses acting on behalf of non-resident Indians.

Sleek Bill simplifies the GSTR-1 filing process. Here's a brief guide: Selecting the GSTR1 Format: Sleek Bill offers Govt. of India Standard GSTR1 Format in CSV & XLS.

Login in Sleek Bill:

Login in Sleek Bill:

First step of GSTR-1 export from sleek bill you need paid plan of Sleek Bill to create billing,invoicing and maintain tarnsaction.

Inputting Sales Data:

Inputting Sales Data:

After creating invoices and credit/debit notes, and revised invoices, you do not need to add anything in anywhere manually, everything is automatic to generate the GSTR1.

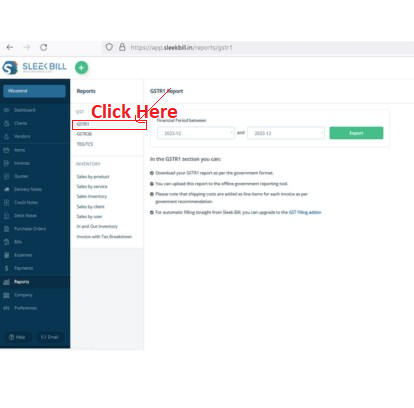

Export the GSTR1:

Export the GSTR1:

Click on report then click on GSTR-1. Export the required file format e.g. csv or xls.

Filing and Tracking:

Filing and Tracking:

Login to GST website from https://www.gst.gov.in/ and upload the GSTR1 which exported from Sleek Bill then Submit the GSTR-1 report through available option.

Enhance your GST compliance effortlessly by ensuring accuracy in your GSTR-1 submissions.

*Free & Easy - no hidden fees.

GSTR-1 plays a crucial role in the GST framework, representing the comprehensive report of a business's sales transactions. Here’s an in-depth look at its various facets:

Essence of GSTR-1:

Essence of GSTR-1:

GSTR-1 is a tax return that every registered taxable supplier needs to file. It essentially details the sales or outward supplies of goods and services.

Filing Frequency:

Filing Frequency:

The frequency of filing GSTR-1 is determined by the business’s turnover. If the turnover exceeds Rs. 1.5 crores, GSTR-1 is filed monthly. For those below this threshold, it can be filed quarterly.

Exclusions:

Exclusions:

Not all registered taxpayers are required to file GSTR-1. Composition dealers, non-resident taxable persons, TDS diductors, and a few other categories are exempt from this requirement.

Late Filing Penalties:

Late Filing Penalties:

Late filing of GSTR-1 attracts a penalty, underscoring the importance of timely submission. The penalty amounts to Rs. 50 per day (Rs. 20 per day for nil returns).

GSTR-1 is not just a compliance requirement but also a fundamental part of GST’s transparent tax mechanism. Here’s why it’s crucial:

The details provided in GSTR-1 aid in the auto-population of other GST forms, facilitating smoother tax processes.

It guarantees tax compliance for businesses while aiding in the meticulous record-keeping of outward supplies.

Filing GSTR-1 contributes to the overall economic transparency, providing necessary data to tax authorities for efficient governance.

Filing GSTR-1 is not only a compliance requirement but also a critical process for maintaining accurate financial records. Sleek Bill makes this process seamless by:

Providing user-friendly interfaces and standard GSTR1 format as per govt. of India GST department.

Ensuring accurate data entry totally depend on your generated invoices.

Offering easy export with one click.

Keep track of amendments and updates in real-time.

Generate comprehensive reports that align with GST requirements.

Direct file from Govt. GST portal, No API and No third party involve so your data will be safe.

Effortlessly file GSTR-1 with Sleek Bill and Govt GST portal.

Automate calculations and reduce manual errors.

Easily input and manage vast sales data just by creating invoices.

Sleek Bill simplifies GSTR-1 management, offering tools and features that ensure accurate and timely submission of your sales data. With Sleek Bill, you can:

Navigating the due dates for GSTR-1 filing is crucial for GST compliance. Let's explore when various businesses need to file this important return:

Quarterly Returns for Smaller Businesses: For businesses with a turnover of up to Rs.5 crore, there's an option to file GSTR-1 returns quarterly under the QRMP (Quarterly Return Monthly Payment) scheme. This scheme is designed to ease the compliance burden for smaller businesses by reducing the frequency of filings.

Monthly Filing for Higher Turnover: Businesses with a turnover exceeding Rs.5 crore are required to file GSTR-1 on a monthly basis. This ensures a more frequent and detailed account of their sales transactions.

Staying Informed on Due Dates: Keeping track of these due dates is essential for maintaining GST compliance and avoiding penalties. Businesses are advised to stay updated with the latest notifications from the GST Council and the Central Board of Indirect Taxes and Customs (CBIC) for any changes in filing dates.

Specific Deadlines: The exact due dates for filing GSTR-1 vary. Generally, for monthly filers, the deadline is the 11th of the following month. For those opting for quarterly filing under the QRMP scheme, the due date usually falls in the month following the end of the quarter.

Automated reminders for upcoming due dates.

Organized data management for hassle-free quarterly or monthly filings.

Regular updates on any changes in GST regulations and filing deadlines.

Be Proactive with GSTR-1 Filing

Adhering to the GSTR-1 due dates is integral to smooth business operations. Whether opting for monthly or quarterly filings, businesses must prioritize timely submission to avoid penalties and maintain GST compliance.

The obligation to file GSTR-1 extends to various business entities under the GST regime. Here's a breakdown of who should ensure compliance with this requirement:

All Registered Taxpayers:

All Registered Taxpayers:

The primary mandate of GSTR-1 filing applies to every registered person under GST. This holds true regardless of the volume of transactions made during the filing period. Even in the absence of sales, a 'nil' return must be filed.

Composition Dealers:

Composition Dealers:

Those under the GST Composition Scheme are also obligated to file GSTR-1. It's crucial for them to report their sales transactions accurately, even though they pay GST at a fixed rate based on their turnover.

Input Service Distributors (ISD):

Input Service Distributors (ISD):

While ISDs primarily deal with distributing input tax credit, they are also required to file GSTR-1 to report their outward supplies.

Taxpayers Liable to Collect TCS:

Taxpayers Liable to Collect TCS:

Those responsible for collecting Tax Collected at Source (TCS) under GST must file GSTR-1 to report their sales transactions.

Non-Resident Taxable Persons:

Non-Resident Taxable Persons:

These are individuals or entities conducting business in India but residing outside the country. They are required to file GSTR-1 for the period of their registration.

Suppliers of OIDAR Services:

Suppliers of OIDAR Services:

Entities providing Online Information Database Access and Retrieval Services (OIDAR) and liable to pay tax themselves (as stated in Section 14 of the IGST Act) must file GSTR-1. This ensures transparency in digital service transactions.

Taxpayers Liable to Deduct TDS:

Taxpayers Liable to Deduct TDS:

Entities mandated to deduct Tax Deducted at Source (TDS) under GST also need to file GSTR-1, ensuring comprehensive reporting of their transactions.

Sleek Bill:

Sleek Bill:

Simplifying GSTR-1 Compliance for Diverse Entities To cater to the varied entities required to file GSTR-1, Sleek Bill offers customized features:

● Facilitates the seamless filing of GSTR-1 for all types of taxpayers

● Provides specialized assistance for Composition Dealers, ISDs, OIDAR service providers, non-resident taxable persons, TCS, and TDS diductors.

● Ensures accurate and hassle-free reporting of sales transactions.

Next Period Adjustment:

Correct mistakes in a filed return by updating the next month or quarter's GSTR-1, allowing taxpayers to rectify errors without altering the original return.

Rectifying Errors in GSTR-1

The process of submitting GSTR-1 demands a high level of accuracy, yet it is susceptible to potential human errors.

No Direct Revision:

Once submitted, GSTR-1 cannot be directly revised. If errors are identified after filing, they need to be corrected in the GSTR-1 of the subsequent period.

Late fees are imposed for delayed filing of GSTR-1. These vary based on the turnover and whether the filing is 'nil' or not:

| 1. | CGST Act, 2017 | Late fee of Rs 25 per day of delay. |

|---|---|---|

| 2. | SCGT/UTGST Act, 2017 | Additional Rs 25 per day of delay. |

| 1. | Turnover up to Rs.1.5 crore | Maximum of Rs 1,000 under each Act. |

|---|---|---|

| 2. | Turnover between Rs.1.5 crore and Rs.5 crore | Maximum of Rs 2,500 under each Act. |

| 3. | Turnover more than Rs.5 crore | Maximum of Rs 5,000 under each Act. |

| 4. | Total Late Fees | Rs 50 per day, capped at Rs 2 |

Amending invoices in GSTR-1 is a crucial aspect of GST compliance. Here's a detailed guide on how to report various types of amendments:

B2B Amendments (9A)

B2B Amendments (9A)

Purpose: For modifying invoices already issued for supplies to registered taxpayers, including SEZ/SEZ Developers, and deemed exports.

Details: Report changes made to original B2B invoices.

Credit/Debit Notes (Registered) Amendments (9C)

Credit/Debit Notes (Registered) Amendments (9C)

Scope: Amendments in credit or debit notes issued against previously reported notes for B2B transactions.

Reporting: Declare adjusted credit or debit notes for registered transactions.

B2C Large Amendments (9A)

B2C Large Amendments (9A)

Criteria: Adjustments in invoices for supplies to unregistered taxpayers, where supply is interstate and invoice value exceeds Rs 2,50,000.

Application: Reflect changes in original B2C large invoices.

Credit Debit Note (Unregistered) Amendments (9C)

Credit Debit Note (Unregistered) Amendments (9C)

Context: For amending credit or debit notes against original notes in B2C Large and Export Invoices sections.

Declaration: Report amendments in credit or debit notes for unregistered transactions.

Export Invoices Amendments (9A)

Export Invoices Amendments (9A)

Relevance: Adjustments in export invoices, including exports under bond/LUT or with IGST.

Detailing: Declare changes in previously issued export invoices.

B2C Others Amendments (10)

B2C Others Amendments (10)

Description: For amending invoices not covered under B2B, B2C Large, and Exports.

Utilization: Declare modifications in other B2C transaction invoices.

Advances Received (Tax Liability) Amendments (11(2))

Advances Received (Tax Liability) Amendments (11(2))

Focus: Adjustments to previously declared advances received.

Reporting: Declare changes in the advances received in past periods.

Adjustment of Advances Amendments (11(2))

Adjustment of Advances Amendments (11(2))

Area: Modifications to advances adjusted in previous periods.

Application: Report adjustments in previous advance adjustments.

Amendment to Sales Through E-commerce Operator u/s 52 and 9(5) Reported by Suppliers

Amendment to Sales Through E-commerce Operator u/s 52 and 9(5) Reported by Suppliers

Purpose: Adjustments to e-commerce sales previously declared.

Scope: Declare modifications in e-commerce transactions by suppliers.

Amendment to Sales Through E-commerce Operator u/s 9(5) Reported by E-commerce Operators

Amendment to Sales Through E-commerce Operator u/s 9(5) Reported by E-commerce Operators

Context: Adjustments to specific e-commerce sales as per Section 9(5).

Reporting: E-commerce operators to declare amendments in sales as per Section 9(5)

Certain amendments are not permissible under the GST framework in GSTR-1. Being aware of these restrictions is crucial to ensure compliance and avoid discrepancies. Here's a breakdown of these non-admissible amendments:

.png)

Customer GSTIN:

Restriction: The Customer GST Identification Number (GSTIN) cannot be altered once the invoice is submitted.

Invoice Type Conversion:

Prohibition: Changing a tax invoice to a bill of supply is not allowed. Once categorized, the nature of the document cannot be switched.

A) Shipping Bill Date/Bill of Export Date:

These dates, once entered, cannot be modified.

B) Type of Export (With/Without Payment):

The classification of export as either with payment (IGST) or under bond/LUT cannot be changed post-declaration.

The customer's GSTIN is a fixed record connected to the first invoice and can't be changed. But, you can edit and link the note to another invoice with the same GSTIN.

The unalterable nature of this persists in accordance with the initial invoice, signifying that any modifications or adjustments to its content are precluded.

If a reverse charge was applicable as per the original invoice, this status cannot be changed in the amendment it will be same for amendment condition .

Making amendments to details already submitted in the GSTR-1 is not just allowed, but also a crucial aspect of ensuring accurate GST compliance. Here's how you can rectify errors or make changes:

Identify the Error or Change Needed: Allocate some time to review the GSTR-1 form that you have previously submitted, check its details to identify any inaccuracies or updates that may be necessary for ensuring the accuracy of your tax filings.

Declare Amendments in Subsequent Return: You can make amendments in the GSTR-1 of the subsequent tax period. This means any changes to a particular month's return can be reflected in the next month's submission.

Simplify your experience with the Goods and Services Tax (GST) by ensuring that your GSTR-1 filings are both timely and accurate. This will help make your GST-related processes more convenient and free of complications.

*Free & Easy - no hidden fees.

Accuracy in GST Filings:

Correcting errors ensures compliance with GST regulations and prevents discrepancies that could lead to complications.

Reflecting Accurate Transaction Dates:

Especially in cases where dates are involved, amendments ensure that the GST liabilities are accounted for in the correct tax period.

GSTR-1 is not just a formality but a significant aspect of GST compliance. It demands meticulous attention to detail and accuracy. By embracing a clear understanding of GSTR-1, businesses can ensure timely and precise GST submissions, thereby upholding financial integrity and staying in good standing with tax authorities. Whether it's managing sales transactions, correcting errors, or staying updated with the latest GST norms, GSTR-1 plays a pivotal role in the seamless functioning of a business's financial mechanisms.