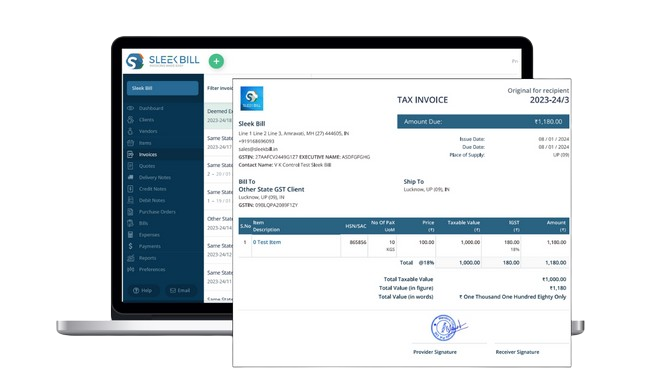

Unlock Seamless Financial Management with Sleek Bill

*Free & Easy - no hidden fees.

In today's digital era, GST tax invoice billing software has become a cornerstone for conducting business transactions seamlessly. It not only simplifies the invoicing process but also ensures compliance with the Goods and Services Tax (GST) norms in India.

● Nature of Invoices: Invoices are commercial documents issued by sellers to buyers, detailing the products or services sold.

● Critical Information: They encompass critical information such as both parties' details, product descriptions, pricing, shipment date, and terms of delivery and payment.

● Payment Requests: Invoices often act as formal requests for payment, especially when endorsed by the seller or their agent.

● Legal Significance: They serve as legal documents in business transactions, enabling transparent financial dealings.

● Adherence to Regulations: GST Tax invoice billing software ensures that all invoices are in line with the GST regulations. ● Input Tax Credit (ITC): Accurate invoicing is crucial for businesses to claim ITC, an essential feature under the GST framework.

![]()

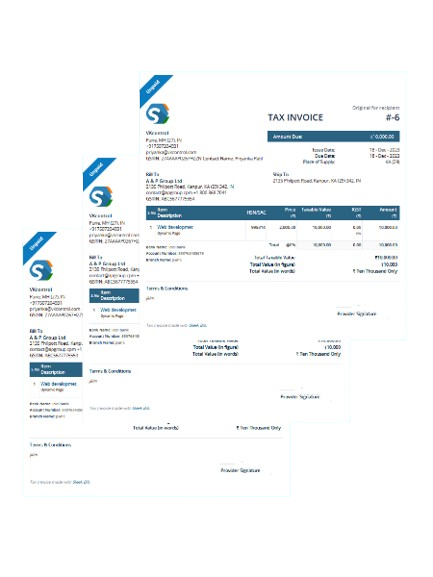

● Essential Details: A GST tax invoice encompasses critical elements like the names and addresses of the seller and buyer, their GSTINs, invoice number, and date.

● Itemization and Pricing: It meticulously itemizes each good or service offered, detailing quantities and prices. This clear breakdown aids in transparent dealings between parties.

● Adherence to Regulations: Compliance with GST laws is non-negotiable. A tax invoices under GST must conform to the stipulations outlined in the GST framework. ● Critical for Business Flow: Legal compliance is not just a mandate but a necessity for smooth business operations and to leverage benefits like Input Tax Credit.

![]()

● Automation and Efficiency: The software automates the creation of GST-compliant invoices, enhancing efficiency and accuracy. ● Ease of Access: Accessible via web and computer, it allows businesses to manage invoices from anywhere.

● Time-Saving: It significantly reduces the time required for invoice generation and management. ● Error Reduction: : Automation minimizes the risk of human errors in tax calculations and invoice creation.

● E-Way Bills and E-Invoices :Create and manage e-way bills and e-invoices effortlessly. ● Customization: Tailor invoices to suit specific business requirements with customizable templates.

![]()

● Streamlined Operations It simplifies various aspects of business financial management, including tracking and filing of GST. ● Data Centralization: : Offers a centralized dashboard for managing all business-related financial data.

![]()

● Finality of Payment: Upon full payment, an gst tax invoice transitions into a document of title, marking the completion of a transaction. ● Symbolic Significance:This change signifies the transfer of ownership and fulfillment of contractual obligations.

Sleek Bill Billing Software is highly recommended for its efficiency and cost-effectiveness, making it a valuable asset for businesses navigating the GST landscape.

![]()

Used for international trade, detailing the value of goods for customs and taxation.

![]()

Required in certain countries, verified by the consulate of the destination country.

![]()

Specifically designed for customs clearance purposes in international shipping.

![]()

A preliminary bill of sale sent before delivery, detailing the sale's terms.

Tailor your invoicing effortlessly to meet the diverse needs of sectors such as goods transportation, passenger services, and e-commerce, ensuring seamless compliance with the GST framework.

*Free & Easy - no hidden fees.

Versatility

Capable of generating various types of invoices, catering to diverse business needs.

Legal Compliance

Ensures all invoices are compliant with GST regulations, crucial for international and domestic trade.

Efficiency:

Automates and streamlines the process of invoice generation, saving time and reducing errors.

Enhanced Data Accuracy

GST e-Invoicing facilitates the automatic generation of standardized electronic invoices, minimizing the chances of errors.

The introduction of e-invoicing under GST has brought a transformation in how businesses manage their invoicing and compliance processes. Here are the key benefits:

The Pivotal Role of Tax Invoice under GST

GST Framework: A GST tax invoice is more than just a document; it's a pivotal element within the GST framework, ensuring transparent and traceable transactions.

Documenting the Essence of Supply

Evidence of Transaction:The GST tax invoice is the official document that provides evidence of the supply of goods or services, acting as a proof for all parties involved.

Comprehensive Importance in GST Regime

Beyond a Transaction Record:Its role extends beyond documenting sales or services; it's integral for compliance, availing tax benefits, and maintaining transparent business practices.

The Cornerstone Document for ITC

Evidence for Suppliers and Recipients:The GST tax invoice serves as the foundational document evidencing supply and is indispensable for recipients to avail of ITC.

Gateway to Input Tax Credit (ITC)

Crucial for Claiming ITC: The possession of a valid GST tax invoice is imperative for businesses to claim Input Tax Credit, an essential feature of the GST system that prevents cascading taxes.

Determining the Time of Supply

Indicator of Tax Liability: The tax invoice date is a key determinant in establishing the 'time of supply,' thereby ascertaining the point at which GST becomes chargeable.

Tax Invoice as the Backbone of GST Compliance

The GST tax invoice is a critical tool in the GST framework, serving as a document of supply, a prerequisite for Input Tax Credit, and a key indicator of the time of supply. Its comprehensive role underscores its indispensability in ensuring compliance and streamlining the tax process under the GST regime.

● Nature-Dependent: The timing for issuing a GST tax invoice hinges on whether the supply involves goods or services, emphasizing the need for timely compliance.

Critical Moments: For suppliers of taxable goods, the GST tax invoice should be issued:

● Before Removal: tax invoices under GST issued to clients must encompass all essential details, including both parties' information, GSTINs, invoice specifics, and a comprehensive description of the products or services offered.

● Delivery or Availability: At the time of delivery or when making goods available to the recipient.

● Vital Elements Every GST tax invoice for goods must include a detailed description, quantity, value, tax charged, and other mandatory particulars as per CGST Rules.

Category Specification: The Government, following the Council's recommendations, may notify specific categories of goods for which different invoicing rules apply.

These invoices should list the vendor’s details, GSTIN, invoice number and date, description of goods or services, and the taxes applied.

Government's Directive: For certain goods or supplies, the Government can specify the time frame and the method in which tax invoices must be issued, providing clarity and consistency.

Rule-Bound Issuance: The creation and issuance of GST tax invoices are regulated under the CGST Rules, ensuring uniformity and legal compliance.

Understanding the timing and requirements for issuing a GST tax invoice is crucial for compliance. The regulations cater to different supply scenarios, emphasizing the need for businesses to stay informed and adhere to the prescribed guidelines.

Input Service Distributor (ISD) Invoice/Credit Note:

Input Service Distributor (ISD) Invoice/Credit Note: Essential Components of ISD Invoice/Credit Note:

Essential Components of ISD Invoice/Credit Note:For businesses operating as Input Service Distributors, understanding and adhering to the detailed invoice requirements is crucial. The precision in details facilitates the accurate distribution of input tax credits and ensures compliance with GST regulations.

Ensure regulatory compliance and streamline business processes with timely GST tax invoices. Whether in goods or services, meeting stipulated timelines guarantees accurate documentation and legal adherence, reflecting the true nature of your transactions.

*Free & Easy - no hidden fees.

Credit Transfer to ISD:

Credit Transfer to ISD:

● Purpose: A registered person, sharing the same PAN and State code as an Input Service Distributor (ISD), can issue specific documents to transfer credit from common input services to the ISD.

Key Elements of the Invoice/Credit/Debit Note:

Key Elements of the Invoice/Credit/Debit Note:

● a) Identifying the Registered Person: Includes name, address, and GSTIN, aligning with the ISD's PAN and State code. A tax invoice in GST is pivotal for charging tax and enabling the transfer of Input Tax Credit (ITC), playing a crucial role in the GST framework.

Importance of Invoice Details:

Importance of Invoice Details:

● Unique Serial Number: A consecutive serial number, within sixteen characters, unique for a financial year. This can include alphabets, numerals, or symbols like hyphens or slashes.

Date of Issuance:Indicates when the document was issued.

Date of Issuance:Indicates when the document was issued.

● Supplier's Details:: Includes GSTIN and the original invoice number of the supplier providing the common service, whose credit is being transferred.

ISD Details:Name, address, and GSTIN of the Input Service Distributor.

ISD Details:Name, address, and GSTIN of the Input Service Distributor.

● Credit Details: Specifies the taxable value, rate, and the total amount of credit being transferred. The place of supply is crucial in a GST invoice as it influences the tax rates and the jurisdiction under which the transaction falls.

Supplier’s Signature:

Supplier’s Signature:

● Authorization: Requires the signature or digital signature of the registered person or their authorized representative.

Taxable Value Consistency in Invoices:

Taxable Value Consistency in Invoices:

● When issuing an invoice for the transfer of credit to an ISD (Input Service Distributor), it is critical that the taxable value stated in the invoice matches the actual value of the common services provided.

● Implications:

● This consistency ensures transparency and accuracy in tax reporting, which is fundamental for GST compliance.

● The accurate reflection of taxable value is essential for the correct calculation of the Input Tax Credit (ITC) that the ISD can claim and distribute.

GST Tax Invoice Guidelines for Special Cases

● Tax Invoice Flexibility: ISDs associated with banking or financial institutions can issue tax invoices or equivalent documents containing required details under GST.

● Document Adaptability: This flexibility accommodates the unique transactional nature of these sectors.

Consolidated Invoicing for Specific Suppliers:

● Eligible Suppliers: Insurers and financial institutions, including NBFCs, can issue consolidated tax invoices monthly.

● Content Requirements: These documents may not need serial numbers but must include all necessary information as per Rule 46 of the GST regulations.

Services (Banks & NBFCs):

● Billing Cycle Compliance: In cases of ongoing supplies, tax invoices under GST should be issued in line with account statements or at the time of payment.

● Tailoring to Transactional Nature: This approach takes into account the recurring or periodic nature of the goods supply.

Services (General Case):

● Extended Timeframe for Financial Services: Banks and NBFCs are given a 45-day period to issue tax invoices under GST post-service provision.

● Accommodating Financial Transaction Complexities: Recognizing the intricate nature of financial services, this extended period allows for detailed processing and compliance.

The flexibility and specific provisions under GST for different sectors, including banking, insurance, transportation, and entertainment, demonstrate the adaptable nature of GST compliance. Understanding these nuances is key to ensuring efficient and accurate tax invoicing across various business domains.