A Closer Look at GST Refund

*Free & Easy - no hidden fees.

The Goods and Services Tax (GST) in India introduced a streamlined process for claiming refunds on excess tax payments. Understanding the nuances of GST refunds is vital for businesses to ensure they efficiently manage their tax liabilities.

GST refunds arise in several scenarios, each critical for maintaining the financial health of businesses:

Electronic Cash Ledger: Situations where a surplus amount unexpectedly gets accumulated in the GST electronic cash ledger due to various reasons, overpayments, or calculation errors.

Zero Obligation: Even if your business has no tax liability for a particular month, filing a nil GSTR-3B is mandatory. This ensures continued compliance with GST regulations.

Incorrect Tax Remittance: Instances where taxes are paid erroneously or incorrectly, often leading to a significant surplus balance.

Accumulated ITC Credits: Businesses with multiple GSTINs must file separate GSTR-3B forms for each registration, ensuring that the tax liabilities and credits for each GSTIN are accurately reported.

Timely Payment: The GST liability reported in GSTR-3B must be paid by the due date of the return,

which is typically the 20th of the following month. Paying the tax liability on time is crucial to avoid penalties and interest.

No Revisions Allowed: Once filed, GSTR-3B cannot be revised.

If mistakes are made, they need to be corrected in the subsequent month's return.

This underscores the importance of accuracy in reporting.

Understanding different refund types is crucial for businesses to claim accurately:

Refund of IGST on Exports: Procedure Through GSTR-1 & GSTR-3B:

Claiming refunds for Integrated Goods and Services Tax (IGST) paid on exports, reported via GSTR-1 and GSTR-3B.

Refund of Excess Cash Paid

Utilizing Form RFD-01: Mechanism for reclaiming excess cash paid, filed through Form RFD-01.

The process of claiming a GST refund involves specific steps and forms:

Based on Refund Type: Selection of appropriate forms depending on the nature of the refund claim.

Reporting in GSTR-1 & GSTR-3B: Details of exports along with the IGST paid are reported in GSTR-1 and GSTR-3B for claiming the refund.

Effective filing of Form RFD-01 is essential for a successful refund claim:

Incorporating Refund Details: Ensure inclusion of all necessary details such as the type of refund and reasons for the claim.

Utilizing Form RFD-01: Submit the refund application using Form RFD-01, a standardized format for claiming cash refunds.

Adhering to declaration norms is crucial for refund claim validation

Specific to Refund Type: Fulfill the declaration requirements specific to the nature of the refund being claimed.

Complete and Accurate Information: Accuracy and completeness of the information in the declarations are imperative for the approval of the refund claim.

Thorough Examination: GST authorities conduct a detailed review of your application and accompanying documents.

Thorough Examination:GST authorities conduct a detailed review of your application and accompanying documents.

Staying informed and tracking the progress of your refund application is essential:

GST Authority Communication: Expect communications from GST authorities regarding the status of your refund application.

GST Authority Communication: Expect communications from GST authorities regarding the status of your refund application.

Adhering to time constraints is vital for a smooth refund process:

Filing Within Prescribed Limits: Ensure your refund application is submitted within the stipulated time frame.

Facilitating Smoother Processing: Timely submission, complemented by accurate information, expedites the refund process.

Different ways your GST refund can reach you:

Direct Transfer: Refunds can be directly credited to the registered bank account, ensuring a straightforward transaction.

Internal Allocation: Alternatively, refunds can be credited to the electronic cash ledger for future GST liabilities.

Understanding the Reasons: If your refund application is rejected, GST authorities will communicate the specific reasons.

Resolving Discrepancies: Analyze the communicated reasons, rectify any errors, and consider reapplying if necessary.

Complex Scenario Navigation: In intricate refund situations, seeking expert advice can be invaluable.

Expert Insights: Professionals offer critical insights into specific refund requirements and help ensure adherence to regulations.

Exporting goods with tax payment under GST involves specific procedures to claim a refund on the Integrated Goods and Service Tax (IGST) paid. Here's a comprehensive guide to navigate this process effectively:

Exports as Zero-Rated: Under GST, exports are classified as 'Zero-rated supplies', meaning they are not subject to GST.

Refund Eligibility: Any IGST and cess paid on these exports are eligible for a refund, lightening the financial burden on exporters.

Table 6A in GSTR-1: Input shipping bill details linked to export transactions.

GSTR-3B Reporting: Summarize these details under item 3.1(b) in GSTR-3B.

Timely Tax Payment and Return Filing: Ensure corresponding tax is paid and returns are filed by the due date to comply with GST regulations.

Shipping Bill Data in GSTR-1: Accurately provide complete shipping bill details in GSTR-1's Table 6A.

Data Consistency: Maintain consistency between the values reported in GSTR-3B and GSTR-1 to avoid discrepancies.

The Shipping Bill as a Refund Application: Automatically treated as an application for IGST refund.

Interlinking with ICEGATE: GST portal transmits details to ICEGATE for cross-verification.

Customs' Comparative Analysis: Checks consistency among GSTR-1, the shipping bill, and the Export General Manifest (EGM).

Communication from ICEGATE: ICEGATE communicates the payment status to the GST portal.

Refund Alerts: Taxpayers are informed about the refund status via SMS and email notifications.

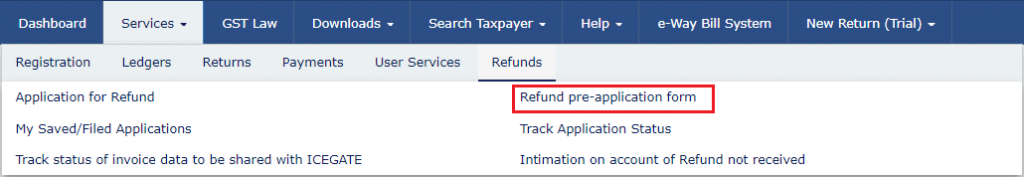

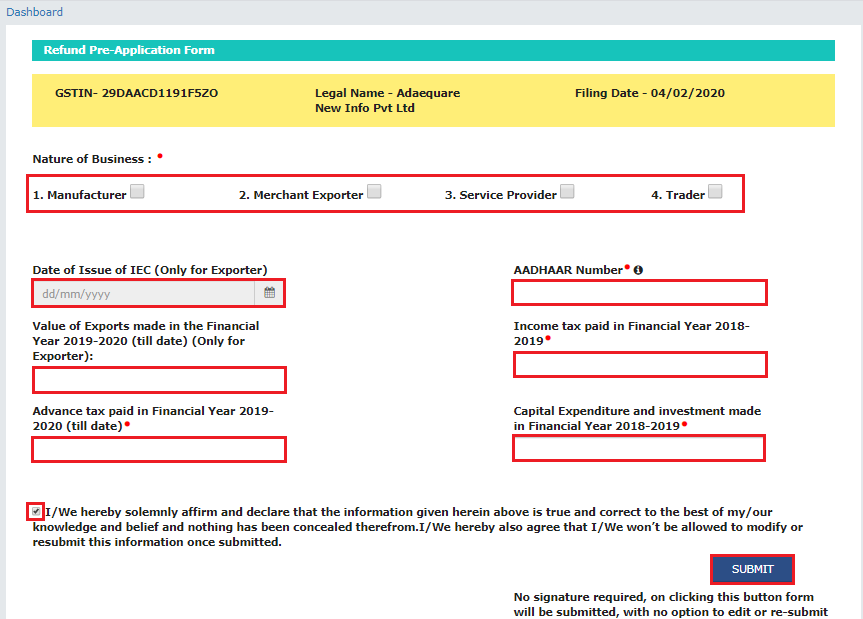

Go to the GST portal and click on the 'Services' tab. Go to Services, then Refunds, and select the Refund Pre-Application Form option. Select 'Refunds' and choose 'Refund pre-application form'. Refund Pre-Application Form page appears.

Pick the nature of your business from the listed choices. Enter the date your IEC was issued (exporters only).

Input the Aadhaar number for the primary authorized signatory. Enter required information such as business specifics, Aadhaar number, income tax details, and export data.

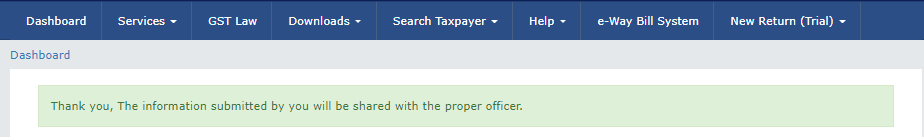

After ensuring all details are correct. Tick the declaration box and click SUBMIT.

Note: Once submitted, the form cannot be modified. A submission confirmation will be displayed on your screen.

Nature of Business: Clearly define the type and model of your business.

Date of Issue of IEC: Essential for exporters; provide this specific date.

Export Value: Report the value of exports for the FY 2023-2024, if applicable.

Aadhaar Number: Mandatory; enter the Aadhaar number of the primary authorized signatory.

Income Tax Information: Document the income tax paid in FY 2022-2023.

Advance Tax: Declare the advance tax paid during FY 2023-2024.

Capital Expenditure: Detail any capital expenditure and investments made in FY 2022-2023.

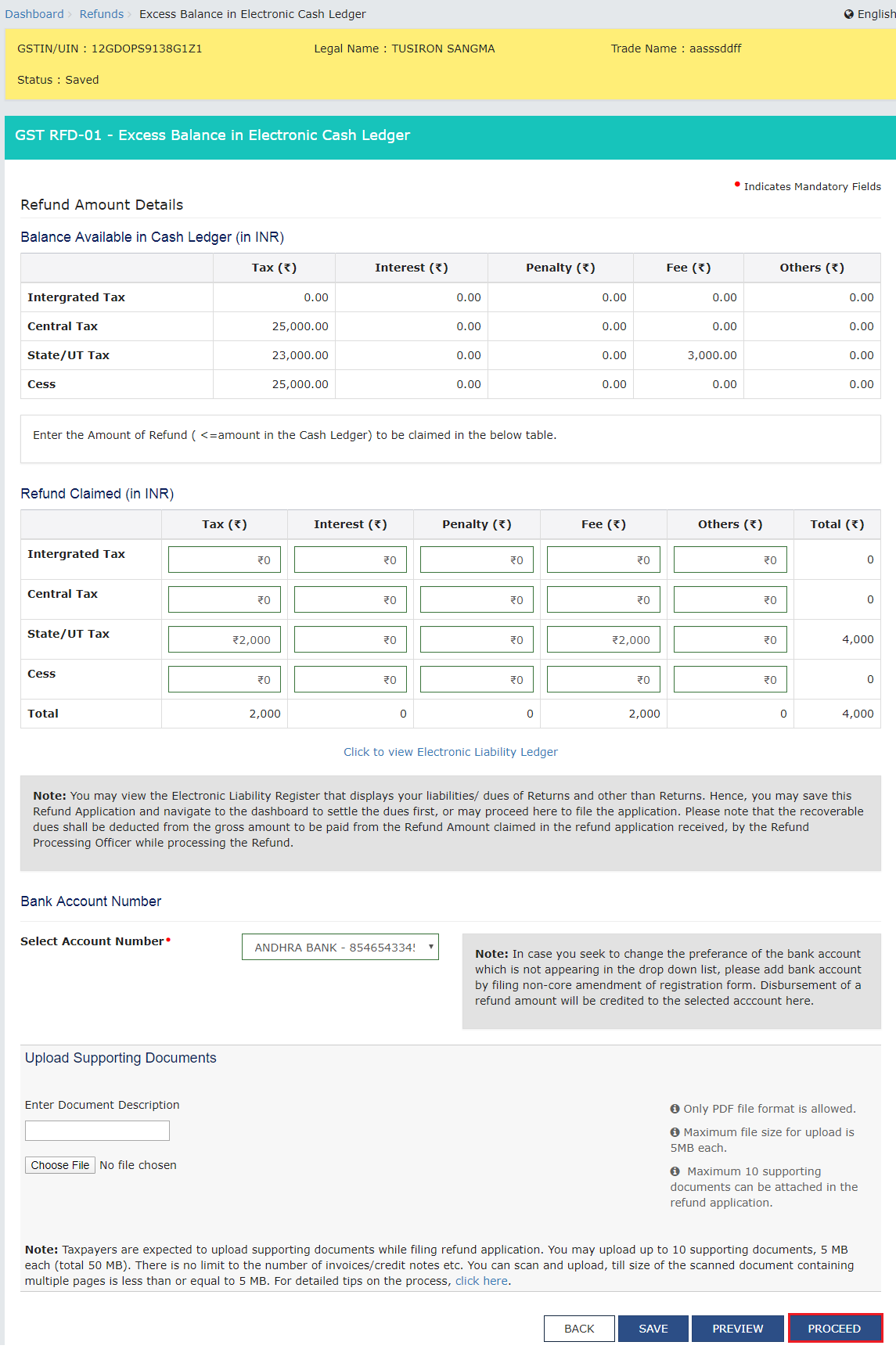

Applying for a GST refund is a crucial process for businesses seeking to reclaim excess taxes or input credit. Here's a step-by-step guide to apply for different types of GST refunds using Form RFD-01:

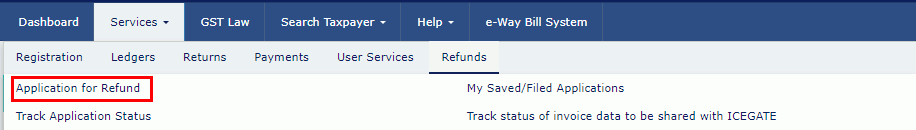

Log into the GST Portal. Go to the 'Services' tab and select 'Refunds'. Click on 'Application for refund'.

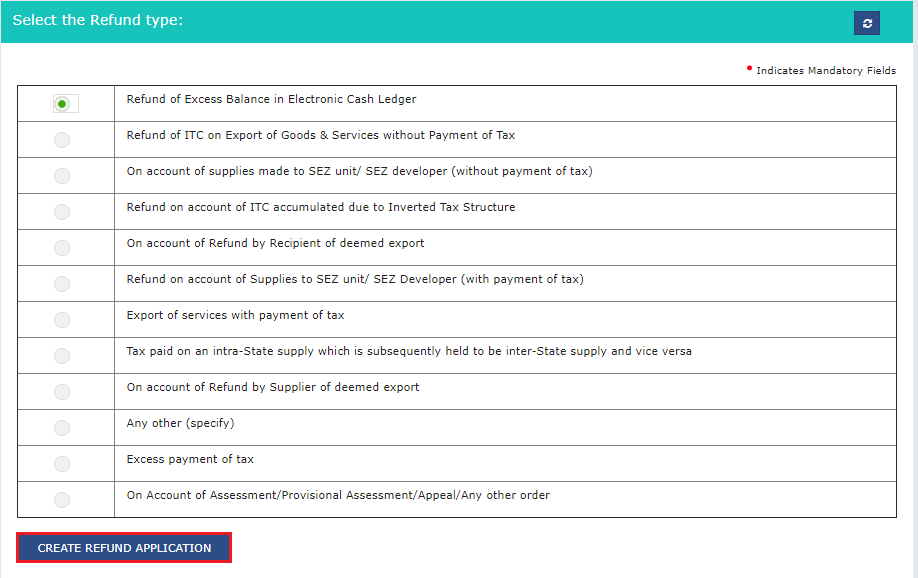

Choose the appropriate reason or type of refund. Click on 'Create refund application'. Specify the period for which the refund is sought.

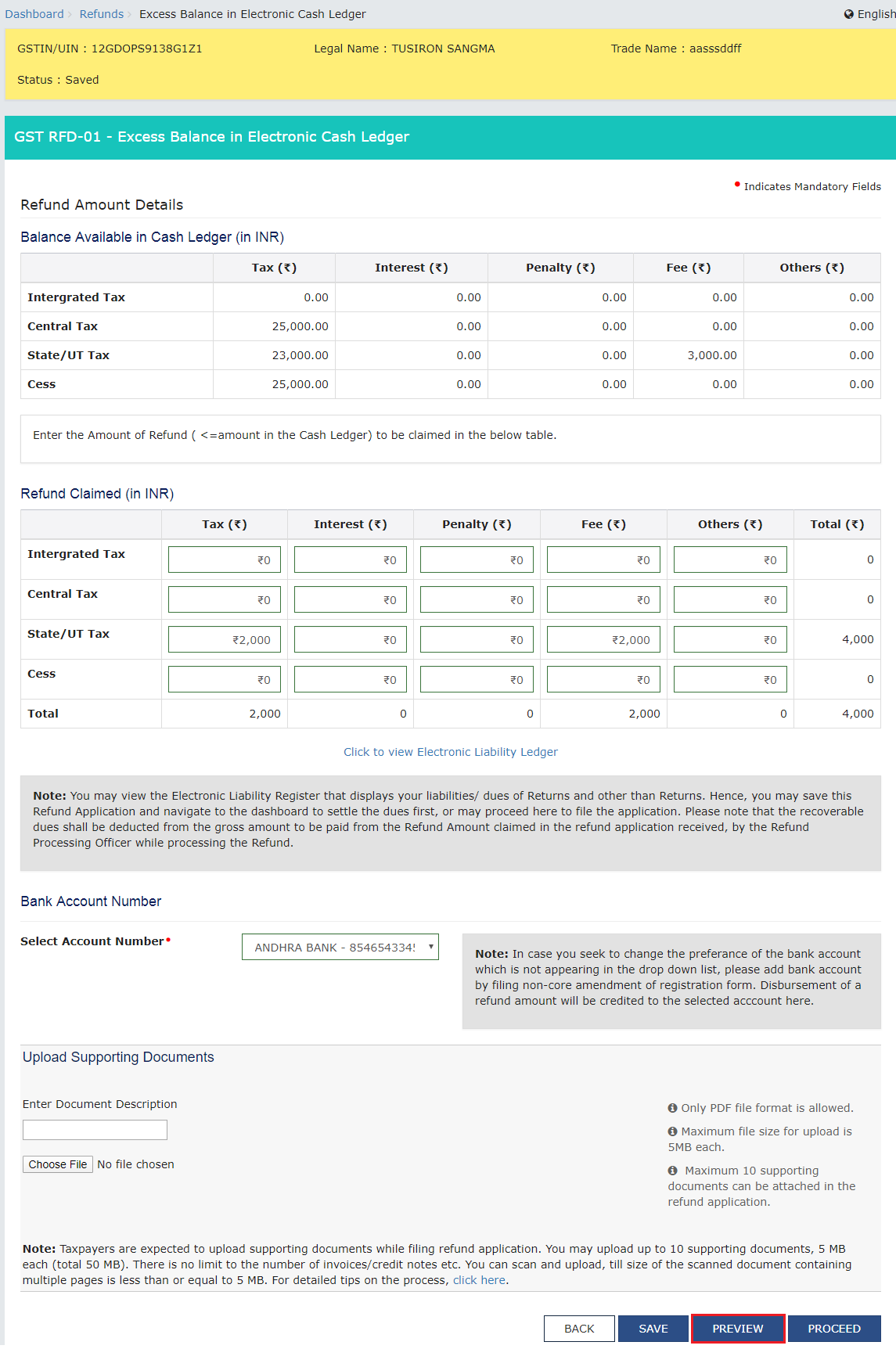

Provide details relevant to the selected refund type. Examples: For excess cash balance in the electronic ledger. Excess payment of tax. Accumulated ITC due to zero-rated sales or inverted duty structure.

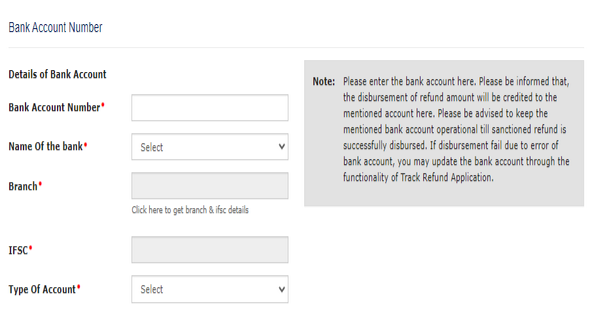

Enter the bank account details where the refund is to be credited.

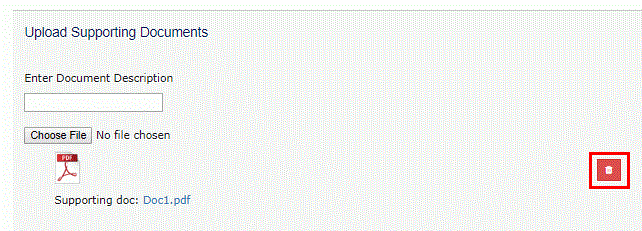

Upload necessary documents supporting your refund claim. Include declarations as required by the specific refund type.

Enter the bank account details where the refund is to be credited. Before submitting, preview the application to ensure all details are correct. Finalize and submit the application using either an Electronic Verification Code (EVC) or a Digital Signature Certificate (DSC).

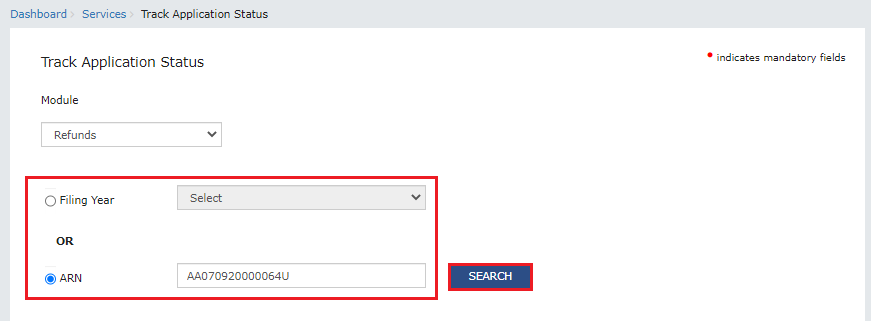

Upon submission, an ARN is generated and displayed on the screen. Use the ARN to track the status of your refund application on the GST portal.

Respond Promptly : If you receive a deficiency memo or clarification notice, respond promptly with the required information.

Track Application: Regularly check the status of your refund application on the GST portal.

Comply with Notices: Ensure compliance with all notices and orders from the GST officer.

Registration Requirement: If you are not registered under GST, you must first obtain GST registration.

Application Submission: File a refund application using Form RFD-01, accompanied by statement 8 and necessary supporting documents.

Filing for a GST refund is a systematic process that requires attention to detail. Here's how to complete and submit your refund application effectively:

Saving Your Progress: After entering all necessary details, save your application. It will be available for 15 days.

Preview and Verification: Before submitting, preview the application to ensure all details are correct.

Submission Process: Finalize and submit the application using either an Electronic Verification Code (EVC) or a Digital Signature Certificate (DSC).

Application Reference Number (ARN): Upon submission, an ARN is generated and displayed on the screen.

Tracking the Application: Use the ARN to track the status of your refund application on the GST portal.

Embassies and international organizations have a specific process for GST refund claims. Understanding this procedure is crucial for smooth and efficient processing. Here's a detailed guide to help you navigate through it:

Form RFD-10 Preparation: Start by generating a refund application in form RFD-10.

Accessing GSTR-11: Go to the GSTR-11 section on the GST portal. Select the relevant tax period and click on 'Generate RFD-10.'

Navigating to Refund Section: On the GST portal, under the 'Services' tab, click on 'Refunds.'

Application Creation: Choose 'Application for refund.' Then select 'Embassy/International Organisation' to initiate the refund application process.

Checking Details: Carefully verify and, if necessary, edit the refund amounts as per your requirements.

Document Upload: Attach all the supporting documents needed for your refund claim.

Submission Process: Finalize your submission using a Digital Signature Certificate (DSC) or an Electronic Verification Code (EVC).

After you submit a GST refund application, the concerned GST officer undertakes several critical actions to process your claim. These actions are designed to ensure the integrity and correctness of the refund process. Here's a detailed breakdown of each step taken by the GST officer post your application submission.

Assessment: The officer evaluates the claim for a possible provisional refund, especially in cases of undue financial hardship to the claimant.

Acknowledgement: In cases where the application is complete, an acknowledgement is issued.

Deficiency Memo: If there are deficiencies or missing information, a memo is issued to the applicant to rectify the issues.

Clarification Required: For any discrepancies or need for further clarification, the officer issues a notice to the applicant.

Sanction Order: Once satisfied, the officer issues a sanction order for the refund.

Rejection Order: In case of non-compliance or discrepancies, a rejection order may be issued.

Order for Refund: A payment order is issued to disburse the sanctioned refund amount to the applicant.

Reasons for Withholding: In certain cases, the refund may be withheld, usually due to ongoing investigations or discrepancies.

Re-credit Order: If the refund is rejected, the amount is re-credited to the electronic credit ledger.

Audit or Verification: The officer conducts an audit or verification process to ensure the accuracy and validity of the refund claim, particularly in cases where there are complex issues or suspicion of non-compliance.

Effortlessly Manage Invoices, Track Payments, and Reduce Manual Errors with Ease. Start Your Free Trial Today!

*Free & Easy - no hidden fees.