E-way Bill: Simplify your GST compliance with hassle-free E-way Bills.

*Free & Easy - no hidden fees.

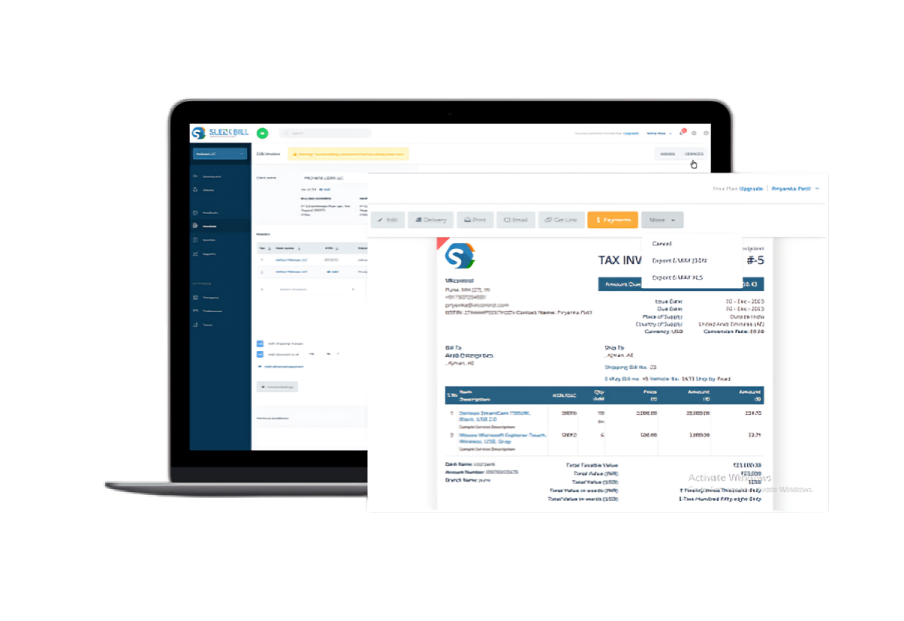

Recognizing the varied needs of businesses, Sleek Bill facilitates the generation of E Way Bills (EWB-01) through multiple methods:

Through Invoice:

E Way Bill generation directly from invoice r a comprehensive and interactive experience.

Through e-Invoicing:

Integrate E Way Bill generation with e-Invoicing, automating the process and enhancing efficiency.

1. Open the invoice

2. Click on right side menu (more)

3. Select the E-Way bill (json) or E-way Bill (xls)

In the landscape of Indian taxation, the E Way Bill stands as a cornerstone for the transportation of goods in a GST-compliant manner. An Electronic Way Bill, commonly known as an E Way Bill, is a mandatory document for the movement of goods exceeding a certain value threshold. It ensures that all goods transported comply with GST law and helps in the seamless tracking of shipments

E Way Bills are not just a regulatory requirement but a facilitator of smooth logistics and trade across the country. They prevent tax evasion and ensure that goods being transported have the backing of proper tax invoices. For businesses, generating an E Way Bill is essential for compliance, avoiding penalties, and ensuring goods reach their destination without undue delay.

Sleek Bill's sophisticated software streamlines the generation and management of E Way Bills, making it an indispensable tool for businesses on the move. With Sleek Bill, you can effortlessly integrate your invoicing process with E Way Bill generation, saving time and reducing errors.

Navigating the complexities of transportation documentation, Sleek Bill introduces an effortless gateway to E Way Bill (EWB) generation, accessible directly through the EWB portal. Whether you're creating single entries or need a consolidated option, Sleek Bill's interface offers a user-friendly experience for all your E Way Bill requirements.

Generate E Way Bills with a few clicks, pulling information directly from your invoices to ensure accuracy and consistency.

Keep an eye on your shipments with real-time tracking enabled by E Way Bills generated through Sleek Bill.Once you submit on E-Way Bill Portal.

Rest assured that your business data, including E Way Bill details, is securely handled and stored with the highest data protection standards.

Stay updated with the latest GST regulations related to E Way Bills. Sleek Bill's software updates ensure you're always in line with current laws.

Embark on a Seamless E-Way Bill Generation Journey – Take the First Step Today!

*Free & Easy - no hidden fees.

Begin by navigating to the e-Way Bill portal. Here, you'll be prompted to enter your unique username and password, followed by the Captcha code. Click on ‘Login’ to access your dashboard and take the first step towards generating your e-Way Bill.

Once logged in, locate the ‘Generate new’ option under the ‘E-waybill’ section on the left-hand side of your dashboard. This will take you to the form where you can start the process of creating a new e-Way Bill.

The generation of an e-Way Bill continues with the completion of critical information on the form

Choose ‘Outward’ if you are the supplier dispatching the consignment. Choose ‘Inward’ if you are on the receiving end of the consignment.

Based on your selection above, pick the correct sub-type that applies to your transaction. This helps in specifying the nature of the consignment more accurately.

Select the type of document that supports your consignment. The options include

Invoice Bill Challan

Credit Note Bill of Entry Others (if the document type is not listed)

Enter the document or invoice number and the date when the document or invoice was issued. This ensures that the e-Way Bill corresponds accurately to the physical shipment.

Fill in the ‘From’ section with your details if you are the supplier. Fill in the ‘To’ section with the recipient's details accordingly fill up the section data.

In this critical section, you'll need to provide comprehensive details about the goods being transported:

Name: Clearly specify the name of the product for identification. Description: Provide a brief description that gives an insight into the specifics of the product, such as model, size, etc. HSN Code:The Harmonized System of Nomenclature code that classifies the goods should be mentioned. This is crucial for tax purposes. Quantity:Indicate the quantity of the goods being shipped.

Unit: Specify the unit of measurement for the quantity mentioned (like kg, liter, unit,Bundle,Barrel etc.). Value/Taxable Value: Declare the value of goods that is subject to tax. Tax Rates: Fill in the applicable tax rates for CGST and SGST or IGST, as per the product classification. Cess:If any cess is applicable, mention the tax rate in percentage.

Before diving into the generation of E Way Bills on Sleek Bill, it's crucial to ensure you have met all prerequisites to facilitate a smooth process. Here's what you need to have in place:

Registration is Key : To initiate any E Way Bill procedures, businesses must first register on the E Way Bill portal. This initial step is a one-time process that grants access to the portal's full range of services.

Transport Specifics : For Road Transport: If the goods are transported by road, you'll need the Transporter ID or the vehicle number. This information is vital to track and manage the consignment during transit.

Documentation on Hand : Ensure you have all necessary documents related to the consignment of goods. This includes having the invoice, bill, or challan readily available, as these are fundamental to the E Way Bill generation process.

Dispute Resolution: Acts as evidence in case of payment or product disputes.

For Rail, Air, or Ship Transport: When transporting goods via rail, air, or ship, you must provide the Transporter ID and have the transport document number, along with the date on the document.

In the final step, input the transportation details to ensure the e-Way Bill reflects all the necessary information for the transit of goods:

Mode of Transport:

Specify how the goods are being transported—by road, rail, ship, or air it ensure the how your goods transfer.

Distance Covered:

Estimate and input the total distance the goods will travel, in kilometers. Depending on the mode of transport, you should provide the following:

Transporter Information:

If the goods are transported by a third party, enter the transporter's name and the unique transporter ID provided by the e-Way Bill system.

Transporter Document Details :

For goods transported via modes other than road, include the transporter's document number and the date of the document.

Vehicle Number:

For road transport, it's essential to provide the vehicle number that is carrying the consignment of your goods or product.

Vehicle Type:

For road transport, it's essential to provide the vehicle Type that is carrying the consignment. Like Car, Truck, Container, etc..

After ensuring all the details are correctly filled out, click on ‘Submit’. The system will validate the data entered. If there are no errors, your e-Way Bill will be generated in the EWB-01 form. This bill will have a unique 12-digit number, which serves as a reference for the consignment during its journey.