The introduction of electronic invoices (e-invoicing) is a modern technological development incorporated into the GST system, which makes the billing processes for entities and tax authorities very convenient too. Therefore, the e-invoice format schema as part of the e-invoicing system introduced on I st Oct 2020 shall provide direct input towards the GST compliant. This page discuss in detail, the structure, compulsory fields, and important aspects of the e-invoice format schema.

What is an E-Invoice Format Schema?

The e-invoice format schema is a predefined standard for creating GST-compliant e-invoices. It includes:

Mandatory Fields: Essential details required for the invoice to be valid under GST.

Optional Fields: Additional fields for specific business needs.

IRN (Invoice Reference Number): A unique identifier for every invoice, generated by the Invoice Registration Portal (IRP).

Key Highlights

E-invoicing applies to businesses with turnover exceeding ₹5 crore from August 1, 2023.

Maximum number of line items per e-invoice: 1,000 (special cases up to 5,000 line items).

E-invoices are submitted to the IRP, validated, and assigned an IRN.

Structure of the E-Invoice Format Schema

The e-invoice format schema contains multiple sections and annexures, detailing all required information for compliance.

Mandatory Sections

-

1

Basic Details

Document type, date, and unique number.

-

2

Supplier Information

GSTIN, legal name, address, and contact details.

-

3

Recipient Information

GSTIN, legal name, address, and place of supply.

-

4

Invoice Item Details

Description, quantity, HSN code, and price of goods or services.

-

5

Document Total

Total taxable value, GST amounts (IGST, CGST, SGST), and total invoice value.

-

1

Invoice Item Details

Individual details for each line item, including discounts, unit price, and tax rates.

-

1

Document Total Details

Summary of total values and GST calculations.

Mandatory Sections

How is an E-Invoice Authorized?

Data Validation: The invoice data is validated by the IRP to ensure compliance.

Generation of IRN: The IRP generates a unique IRN using the supplier’s GSTIN, invoice number, and financial year.

Digital Signature and QR Code: The IRP assigns a digitally signed e-invoice and a QR code containing key invoice details.

Legal Compliance: An invoice without an IRN is considered invalid under GST law.

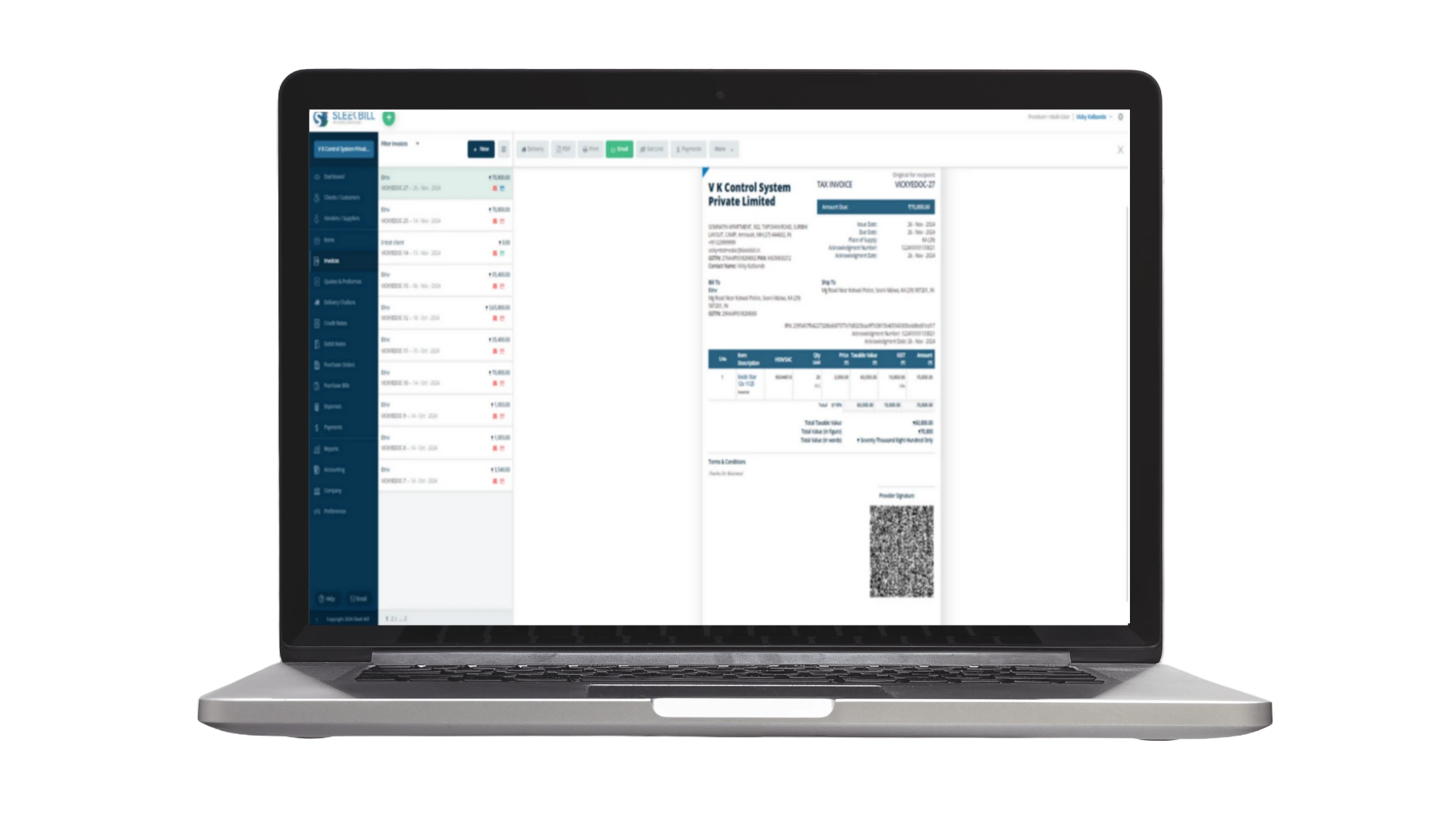

GST Invoice Format

GST Invoice Format

GST Billing Benefits

GST Billing Benefits

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about