Unlock the potential of debit notes to efficiently handle purchase returns and invoice adjustments, ensuring accuracy in your financial dealings.

*Free & Easy - no hidden fees.

(3).png)

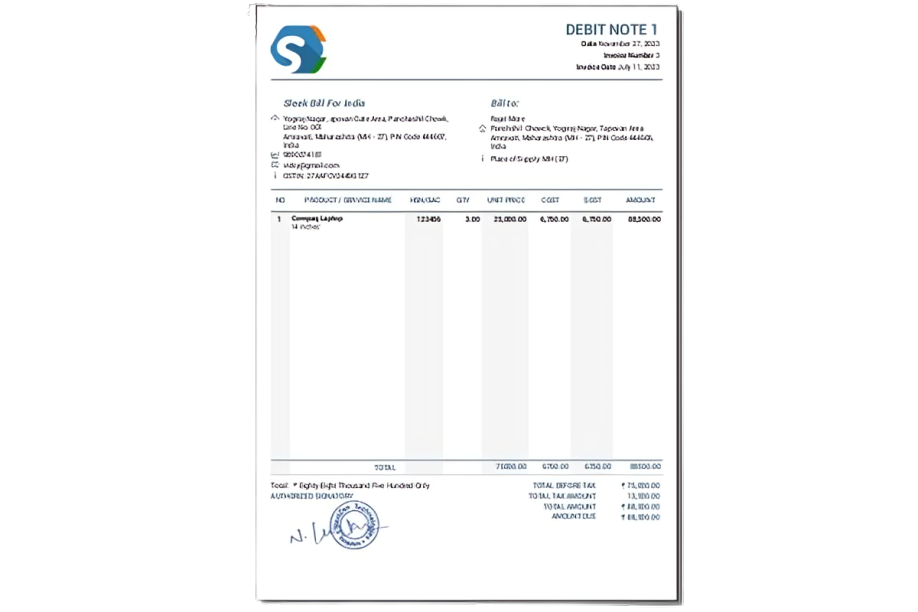

A well-structured Debit Note format is crucial for clear communication and record-keeping in business transactions. Here are the key components of an effective debit note.

Logo:

Logo:

Your companies of brand logo on invoice.

Type of Document:

Type of Document:

The document should clearly state it is a Debit Note. This clarity is essential for proper accounting and financial management.

Buyer's Details:

Buyer's Details:

Include the name, address, and contact and GSTIN details of the buyer issuing the debit note.

Unique Serial Number :

Unique Serial Number :

A unique serial number to uniquely identify each debit note.

Date:

Date:

The date when the debit note was issued.

Invoice Details:

Invoice Details:

Reference the original invoice no to which the debit note pertains.

Supplier Information:

Supplier Information:

Name, address, GSTIN, and contact details of the supplier involved.

Product details and Value and Tax Rate:

Product details and Value and Tax Rate:

Clearly state the total value of goods or services, including the tax rate applied.

Term and Condition:

Term and Condition:

Mention term and condition or note regarding debit note.

Authorization:

Authorization:

Signature of the supplier or their authorized representative as a sign-off.

Debit notes are crucial financial documents issued in various scenarios such as returns of defective goods, incorrect billing, or changes in order quantities. These notes serve as formal requests for credit notes or adjustments in invoicing, playing a vital role in maintaining accurate and compliant accounting records. In the realm of GST, debit notes are integral for reconciling changes in tax rates or taxable values of goods or services post-invoice issuance, ensuring that businesses stay aligned with legal requirements and accurate financial reporting.

Sleek Bills offers a Debit Note feature that simplifies the financial management process. This tool is not just about recording transactions; it's about offering clarity and control over your business's financial health, making it easier to track and manage finances without the need for in-depth accounting knowledge.

A debit note plays a critical role in the world of business transactions, particularly in situations involving the return of goods or services. This document, issued from a buyer to a seller, serves as a formal declaration and request in various scenarios.

A debit note is a formal document initiated by the buyer and sent to the seller. It acts as a direct communication tool, ensuring that both parties are on the same page regarding the specifics of the transaction in question.

When a buyer returns purchased goods or services, a debit note is issued to confirm this action. This document is crucial in maintaining transparency and accuracy in business dealings, ensuring that all parties acknowledge the return.

A debit note can be issued for several reasons, such as receiving incorrect or damaged goods or the cancellation of an order. It's a versatile document that adapts to various transactional discrepancies.

The issuance of a debit note is often accompanied by a formal request for a credit note. This request is an integral part of finding or adjusting financial transactions between the buyer and seller.

A debit note in the buyer's accounts signifies a purchase return, crucial for maintaining accurate and current financial records, reflecting inventory and financial changes.

Sellers use debit notes to make adjustments. When a buyer issues one for discrepancies in received goods or services, the seller updates records for accurate financial outstanding balance.

Embark on a Seamless E-Way Bill Generation Journey – Take the First Step Today!

*Free & Easy - no hidden fees.

.png)

Login in to Sleek Bill portal

Login in to Sleek Bill portal

Click on Debit note, click on new button

Click on Debit note, click on new button

Select client name for whome sending debitit note.

Select client name for whome sending debitit note.

Put the unique number of companies, select invoice and date and reason behind debit note.

Put the unique number of companies, select invoice and date and reason behind debit note.

Select goods and quantity is less, or will adjust again remaining amount.

Select goods and quantity is less, or will adjust again remaining amount.

Mention total quantity, add shipping charges or discount if applicable, this section is optional.

Mention total quantity, add shipping charges or discount if applicable, this section is optional.

Mention the notes and click on save and preview.

Mention the notes and click on save and preview.

Once you refund amount click on more and click on refund. Document status will turn in close.

Once you refund amount click on more and click on refund. Document status will turn in close.

Debit notes are integral to managing business transactions, especially when discrepancies arise between buyers and sellers. Understanding the various reasons for their issuance can help in maintaining accurate financial records and ensuring smooth business operations.

1. Purchase Returns:

A common scenario for issuing a debit note is when a buyer needs to return purchased goods to the seller or supplier. This could be due to a variety of reasons, each necessitating a formal acknowledgment through a debit note.

2. Returning Goods for Valid Reasons:

When buyers find themselves in situations where they need to return goods, a debit note becomes essential. This document serves as a formal notice of the return, highlighting the reasons behind the decision.

3. Purchase Return Initiated by Buyer

Several specific circumstances can lead to the issuance of a debit note, including:

If the supplier delivers goods that are defective or damaged, the buyer issues a debit note as part of initiating a return or seeking compensation.

Discrepancies in shape, size, or quantity of the goods as compared to the order can prompt a debit note.

If a supplier fails to deliver goods or services on time, it can disrupt the buyer's operations, leading to the issuance of a debit note.

Calculation errors in the bill, such as overcharges or incorrect itemization, often require adjustments through debit notes.

When a supplier charges higher taxes on goods or services than applicable, a debit note helps in rectifying the financial transaction.

In cases where a buyer decides not to go ahead with the purchase for various reasons, a debit note is issued to formally cancel the transaction or part of it.

Issue a debit note today for transparent and compliant business dealings!"

*Free & Easy - no hidden fees.

Debit notes are not just tools for buyers to communicate with sellers regarding returns or discrepancies. Sellers themselves often issue debit notes in various scenarios to adjust financial records or communicate changes in billing.

At times, sellers need to make adjustments to previously issued invoices. This could be due to errors or omissions in the original document. A debit note helps in officially recording these adjustments.

If there's a change in the billing amount post the issuance of the original invoice, perhaps due to changes in price, tax rates, or additional charges, a debit note is issued to reflect these modifications.

If a purchaser raises the quantity of their order subsequent to the issuance of the initial invoice, the seller will generate a debit note to include the extra items, thereby maintaining the accuracy of financial records.

Debit notes can also serve as reminders to buyers about their current debt. If a buyer has outstanding amounts or delayed payments, a debit note can be an effective tool to prompt settlement to the seller.

.png)

1. Situations for Issuance under GST Law:

Change in Tax Rates: A debit note is essential when there's a change in tax rates post the issuance of the original invoice. Change in Taxable Value: Similarly, if the taxable value of goods or services alters after the invoice, a debit note is issued to reflect these changes.

Role in GST Returns:

GSTR-1 includes debit note details, ensuring official recording of revised transaction information in the supplier's monthly return. Recipient's Forms GSTR-2A and GSTR-2B: The exact details of the debit note also appear in the recipient's GSTR-2A and GSTR-2B forms, facilitating cross-verification.

3. Verification and Acceptance:

After carefully reviewing GSTR-2A and GSTR-2B, the recipient can officially accept and incorporate the debit note into their GSTR-3B, ensuring precise tax liability calculations. This meticulous integration is crucial for regulatory compliance and transparency in GST reporting.

4.Adjustment for Input Tax Credit (ITC) Reversal:

Debit notes are crucial for correcting and reversing previously claimed Input Tax Credit (ITC) in cases of errors or changes in transactions. This process ensures compliance with GST regulations, providing a systematic way to rectify ITC discrepancies and maintain accurate financial records.

5. Reporting Requirements:

● Original Invoice Number: Initially, mentioning the original invoice number was mandatory for reporting a debit note. ● Quoted in GSTN Portal: The details are quoted on the GSTN portal in Form GSTR-1 and Form GSTR-6 for transparent tracking.

6. Impact on Input Tax Credit (ITC):

● Pre-Amendment: The time limit for availing ITC was based on the invoice date. ● Post-Amendment: After the amendment, the time limit for availing of ITC is now based on the debit note issue date, offering more flexibility and accuracy in claiming ITC.

Strategically use debit notes for efficient handling of transaction discrepancies. Sleek Bills boosts accounting efficiency, ensuring smooth business operations.

*Free & Easy - no hidden fees.

For businesses in locations with limited or no internet connectivity, an offline-accessible debit note system is invaluable.

Being an offline application, it can be used anywhere, providing flexibility to manage financial transactions on the go.

Data remains accessible only to the authorized user, enhancing confidentiality and control over sensitive information.

The risk of unauthorized third-party access is significantly reduced, further securing financial data.

Offline systems enhance data security, as they are less susceptible to online threats.

The system doesn't depend on internet access, ensuring uninterrupted financial operations.

Traditional bookkeeping is time-consuming. By automating this process, the debit note system saves valuable hours.

Manual data entry is prone to mistakes. Automation significantly lowers the risk of errors, ensuring accuracy in financial records.

The system captures and records all transaction data automatically, eliminating the need for manual entry.

Generating financial reports becomes a quick and easy task, allowing for immediate access to important business insights.

Business owners can swiftly review financial statements and analyze their business performance, leading to better decision-making.

The system is designed to be intuitive, making it accessible to users without a background in accounting.

A straightforward and easy-to-navigate interface ensures that even novices can use the system with ease.

Users can quickly access their data from a desktop environment, streamlining the process of managing financial records.

The system is versatile, catering to the needs of both GST registered and unregistered users, making it a universal solution.

Users can easily generate various reports with precision, aiding in better financial management and analysis.

Comprehensive Inventory Tracking:

Comprehensive Inventory Tracking:

The system enables you to monitor your inventory levels effectively, ensuring you always know what's in stock.

Low Stock Alerts:

Low Stock Alerts:

Receive timely notifications when inventory levels for specific items fall below a set threshold, allowing for prompt restocking.

Order Tracking:

Order Tracking:

Effortlessly track all orders, ensuring that you're always aware of the status of your stock.

Debt Minimization:

Debt Minimization:

By keeping a close eye on inventory, you can better manage your resources, helping to reduce outstanding debts.

Balance Collection:

Balance Collection:

The system not only tracks inventory but also assists in managing financial aspects like collecting balances due from customers.

Flexibility for Buyers:

Buyers have the flexibility to issue a debit note whenever they identify a need, such as discrepancies or returned goods.

Statutory Time Limit (Section 34(2) of CGST Act):

The buyer is advised to issue a debit note at the earliest, but no later than 30th September following the end of the financial year in which the supply was made.

Annual Return Filing Date:

Alternatively, the debit note should be issued before the date of filing the annual return for that financial year.

Consequences of Delayed Issuance:

If the buyer fails to issue the debit note within these stipulated periods, they may face complications.

Streamlined Account Management:

Effortlessly manage your company's financial accounts, ensuring accuracy and efficiency.

Quotation and Estimate Creation:

Quickly generate professional quotations and estimates, enhancing your business's credibility.

Accurate GST Invoicing:

Produce precise GST invoices, ensuring compliance and simplifying tax calculations.

Direct Sharing with Parties:

Share invoices, quotes, and estimates for efficient communication with clients.

Simplified Order Creation:

Creating sales or purchase orders is made simple, streamlining your order management process.

Flexible Bill Formatting:

Convert your bills into various formats to suit your specific business needs, providing versatility and adaptability.