Find out when and how to issue GST compliant credit notes as a

supplier of goods or services.

*Free & Easy - no hidden fees.

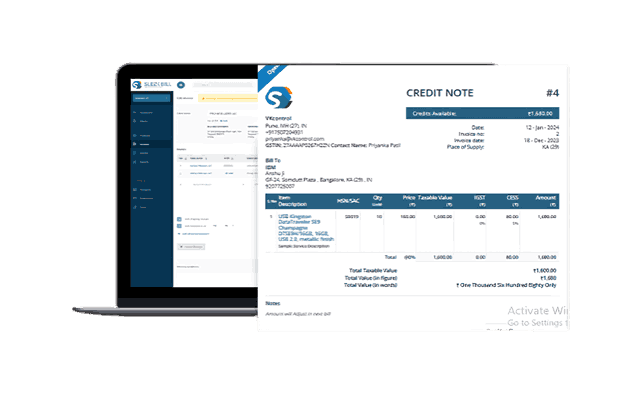

A well-structured Credit Note format is crucial for clear communication and record-keeping in business transactions. Here are the key components of an effective credit note.

Logo:

Logo:

Your companies of brand logo on invoice.

Type of Document:

Type of Document:

The document should clearly state whether it is a Credit Note or a Debit Note. This clarity is essential for proper accounting and financial management.

Name of Supplier, Business, and Address:

Name of Supplier, Business, and Address:

This includes the full legal name of the supplier, the name of the business, and its complete address. This ensures clarity in identifying the issuer of the Credit Note.

Unique Serial Number of Company:

Unique Serial Number of Company:

Each Credit Note should have a unique serial number, not exceeding 16 characters, which helps in tracking and referencing the document easily.

Unique Numbers with Alphanumeric or Special Characters:

Unique Numbers with Alphanumeric or Special Characters:

The serial number can include a combination of letters, numbers, and special characters, ensuring each document's uniqueness within the company’s record system.

Date of Issue of Credit Note:

Date of Issue of Credit Note:

The date when the Credit Note is issued should be clearly mentioned. This date is important for accounting purposes and for tracking the timeline of transactions.

Table of goods return:

Table of goods return:

This section provides details of goods return to the seller against credit note amount.

Total Taxable Value of Supply, Tax, and Tax Credit:

Total Taxable Value of Supply, Tax, and Tax Credit:

This section details the total taxable value of the supply, the amount of tax levied, and the tax credit that the buyer is entitled to. This information is crucial for accurate financial accounting.

Signature of Suppliers or Authorized Issuer:

Signature of Suppliers or Authorized Issuer:

The Credit Note must be signed by the supplier or an authorized representative. This signature validates the document and confirms the authenticity of the information provided.

Signature and Stamp:

Signature and Stamp:

Authenticating the document, ensuring it's officially recognized.

In the realm of GST, a credit note is more than just a document; it's a testament to a business's commitment to accuracy and customer satisfaction. Sleek Bill introduces an intuitive way to handle these adjustments, ensuring that your financial records always mirror the true nature of your transactions.

Credit notes are essential tools for businesses to amend the value of previously issued invoices. They represent the amount that a seller returns to a buyer in cases of overcharging, returns, or post-sale discounts. Sleek Bill’s seamless credit note management allows for transparent and compliant accounting practices.

A credit note serves as a formal acknowledgement provided by one party to another, documenting adjustments in a transaction.

It is particularly used to recognize the return of goods, enabling a smooth process for managing reversals in sales.

The seller issues a credit note to the buyer to confirm the reduction of charges from a prior invoice.

Also known as a credit memorandum, this document serves the same purpose under a different name.

This document allows the buyer to offset the value mentioned in the credit note against future purchases from the seller.

When discrepancies occur, sellers send credit notes to buyers to adjust the original billing amount appropriately.

Sleek Bill provides professional credit note formats, ensuring consistency and clarity in financial documentation.

These notes are integral to the sales return journal, allowing businesses to keep accurate records of inventory and finances.

.png)

Credit notes play a critical role in the reduction of taxable value for goods or services previously supplied, aligning with tax compliance.

Unlike direct refunds, credit notes do not return cash to the buyer but adjust the account balance for future transactions.

They provide a financial balance that customers can apply to later purchases, offering convenience and flexibility.

Buyer sends a debit note, seller responds with a matching credit note for mutual transaction agreement.

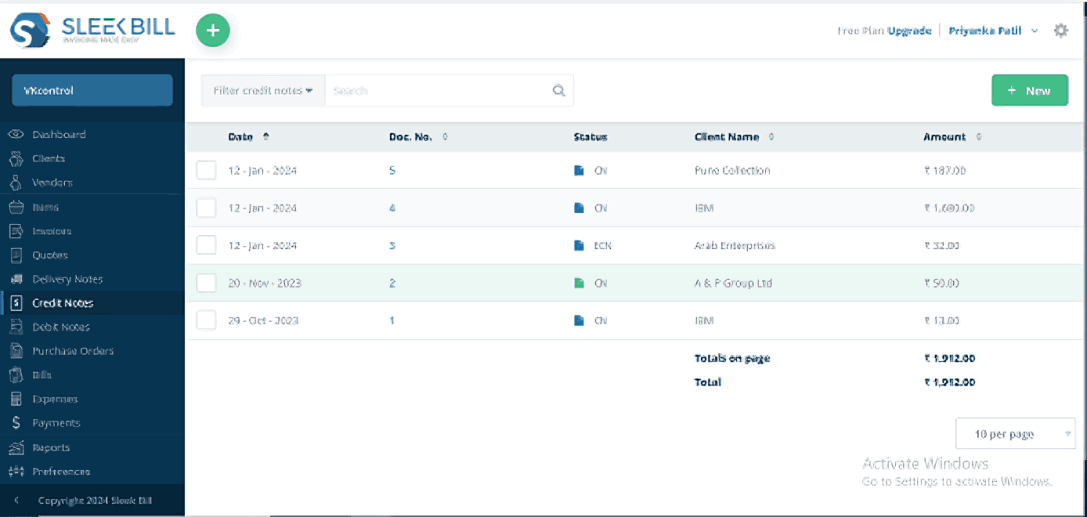

1. Login in to Sleek Bill portal

2. Click on credit note, click on new button

3. Select client name for who ssending credit note.

Select the client for whome you sending credit note

4. Put the unique number of companies, select invoice and date and reason behind credit note

5. Select returnable goods and quantity.

6. Mention total quantity, add shipping charges or discount if applicable this section is optional.

7. Mention the notes and click on save and preview.

8. Once you received amount click on more and click on refund. Document status will turn in close.

As per Section 34(1) of the Central GST Act, credit notes are legally recognized tools for adjusting invoices in specific scenarios.

They provide a mechanism to amend and reduce tax liability in cases where the original invoice value changes.

Credit notes are commonly used when buyers return sales items due to quality issues, service rejections, or damaged goods, ensuring accurate financial records.

In instances where the seller has inadvertently charged a higher cost than agreed, a credit note corrects this discrepancy.

They come into play when payments are erroneously made, allowing for correction without requiring a complete transaction reversal.

If a seller decides to offer a discount after the sale has occurred, a credit note helps in adjusting the original sale amount.

Credit notes are also used when a customer wishes to exchange their purchase, providing a flexible solution for adjusting subsequent purchases.

They are issued to reconcile differences when a buyer receives less quantity of goods than what was invoiced.

Issuing a credit note is a standard practice when discrepancies in an invoice need to be addressed. Whether it’s due to returned goods, a post-sale discount, or a simple invoicing error, a credit note serves as a rectification that aligns your accounts with the actual business dealings.

In the realm of GST, issuing credit notes promptly isn't just good accounting; it's a compliance necessity. Sleek Bill's efficient process ensures swift generation of credit notes for any invoice changes, preserving the integrity of your financial reporting.

With Sleek Bill, the creation and management of credit notes are as straightforward as they are compliant. The software allows you to effortlessly match credit notes with the original invoices, making reconciliation a breeze and helping you maintain meticulous records as per GST norms.

Integrating credit notes into your accounting cycle with Sleek Bill not only helps in adjusting sales and tax liabilities but also in fortifying the trust your customers place in your business. These adjustments are crucial for reflecting the accurate financial health of your enterprise.

Tracking Payments: Sleek Bill enables businesses to meticulously record and monitor both incoming and outgoing payments. This feature for maintaining financial health and know cash flow.

Party-wise Payables: The system allows for detailed tracking of payables on a party-wise basis, providing a clear view of what is owed to whom.

Setting Up Payment Reminders: This functionality helps businesses to set reminders for payments, aiding in better financial planning and cash flow management.

On-time Customer Payments: The system's capability to set reminders ensures that customers are prompted to make timely payments, thereby reducing the risk of overdue accounts.

Monitoring Cash Flow: With Sleek Bill, businesses can effectively track their financial commitments, including amounts yet to be received and payments that are due.

Secure Transaction Details: All transaction data are securely stored within the system, ensuring both safety and confidentiality.

In conclusion, credit notes are more than just financial corrections; they are integral components of a business's financial ecosystem. They facilitate smooth and transparent transactions between sellers and buyers, help in managing inventory and tax liabilities, and ensure that financial records remain accurate and up-to-date. With features like tracking business performance, offering multiple payment options, and helping with receivables and payables, tools like Sleek Bill optimize the use of credit notes, making them a powerful asset for any business aiming to thrive in today's competitive market.

Payment Updates:

They aid in updating payment records, ensuring the financial data reflects the actual business situation.

Manage Business Activities:

They help in managing various business activities by providing a clear view of financial interactions with customers.

Inventory Status:

Credit notes capture returns and adjustments, ensuring an accurate and up-to-date inventory status.

Essential to Track:

Credit notes are essential tools for tracking financial transactions, allowing businesses to maintain up-to-date records.

Process Effortless:

The use of credit notes makes the process of handling returns and adjustments effortless and systematic.

Categorize Expense and Income:

They help in categorizing expenses and income, which is crucial for financial analysis and budgeting.

A Credit Note serves as a rectification and acknowledgment tool in various sales and transaction scenarios. Here are the reasons and processes involved:

Seller Creates Invoice for Goods:

Initially, the seller issues an invoice for the goods delivered to the customer. This invoice details the quantity, price, and other relevant aspects of the transaction.

Suppliers Accept and Create Credit Note:

Upon accepting the returned goods, the supplier issues a Credit Note. This note serves as an acknowledgment of the return and indicates that the customer is credited for the returned goods.

Customer Returns Goods or Exchanges:

In response to the identified issues, the customer may decide to return the goods to the supplier or request an exchange for other goods.

Customer Observes Quality Issue:

Upon receiving the goods, the customer may identify issues related to quality, non-compliance with specifications, or damage.

Acknowledge to Buyer:

The Credit Note effectively communicates to the buyer that their return has been accepted and that they have been credited accordingly. This credit can be used against future purchases or to adjust any outstanding payments.

Streamline Transactions:

A Credit Note streamlines transactions by addressing quality concerns or damaged goods, ensuring a transparent resolution in sales situations.

Invoicing, while seemingly a straightforward process, has nuances that can make or break a business interaction. The format of the invoice, its design, and clarity play pivotal roles in ensuring smooth transactions and leaving lasting impressions. Here's how embracing the Sleek Bill's Invoice Format can elevate your business dealings:

Business Operations Online or Offline:

Credit note functionality integrated into online and offline software provides flexibility in managing business operations regardless of internet connectivity.

Generates New Credit note,Records Expenses:

The software creates credit note and efficiently records expenses, crucial for effective financial management.

Manage your credit notes efficiently and align them with GST regulations today.

*Free & Easy - no hidden fees.

| Sr. No | Aspect | Debit Note | Credit Note |

|---|---|---|---|

| 1. | Issuer | Issued by the buyer to the seller. | Issued by the seller to the buyer. |

| 2. | Typical Use | Associated with the return of goods. | Linked with exchange or return of goods by the buyer. |

| 3. | Document Color | Traditionally prepared in blue ink. | No specific color convention. |

| 4. | Financial Representation | Represents a positive amount, indicating an increase in the buyer's payable amount. | Indicates a reduction in the seller's account receivables and buyer's payables. |

| 5. | Accounting Impact | Recorded in the return purchase book, reducing purchase accounts. | Reduces the seller's sales accounts and buyer’s account payables. |

| 6. | Initiation | Buyer initiates to signal discrepancies or returns. | Seller initiates to rectify undercharges or acknowledge returns. |

Work Smartly:

Sleek Bill's credit notes features empower businesses to work more efficiently, streamlining financial processes.

Stay Ahead in Competition:

By utilizing these features, businesses can maintain a competitive edge with faster, more accurate financial management.

Manage Everything Efficiently:

The comprehensive nature of Sleek Bill's credit note system allows businesses to manage all aspects of their financial operations, from invoicing to record-keeping, in a seamless and integrated manner.

Keep Your Records Updated:

With Sleek Bill, businesses can ensure that their financial records are always current and accurate, reflecting the latest transactions and adjustments.

Eliminate Manual Calculations:

The software automates the calculation process, reducing the risk of errors and saving valuable time.

Enhance Transparency:

Sleek Bill's credit note functionality promotes transparency in financial transactions, providing a clear and accurate overview of adjustments, contributing to better decision-making and accountability.

Legal Time Frame: As per Section 34(2) of the CGST Act, there is a specified time limit for issuing credit notes. This ensures compliance with GST regulations.

Annual Return Deadline: Credit notes must be issued on or before September 30th following the end of the financial year, or before the date of filing of the annual return, whichever is earlier. This deadline is crucial for accurate annual financial reporting.

Cancellation of Invoices: A credit note is typically issued when there's a need to cancel or alter the details of an already-sent invoice. It helps in keeping accounting records accurate and up-to-date.

Maintaining Accurate Records: The issuance of a credit note is a key method to ensure accounting records remain straight, especially when there are returns or discrepancies in the original invoice.

Irreversibility: Once issued, a credit note cannot be deleted or edited. This feature ensures the integrity and traceability of financial records.

Customer Fund Utilization: Credit notes allow customers to use the credited funds for future purchases, providing them with flexible financial options.

Separate Issuance: Each credit note is issued separately to the customer, ensuring clear and individual acknowledgment of each adjusted transaction.

In the final step, input the transportation details to ensure the e-Way Bill reflects all the necessary information for the transit of goods:

Mode of Transport:

Specify how the goods are being transported—by road, rail, ship, or air it ensure the how your goods transfer.

Distance Covered:

Estimate and input the total distance the goods will travel, in kilometers. Depending on the mode of transport, you should provide the following:

Transporter Information:

If the goods are transported by a third party, enter the transporter's name and the unique transporter ID provided by the e-Way Bill system.

Transporter Document Details :

For goods transported via modes other than road, include the transporter's document number and the date of the document.

Vehicle Number:

For road transport, it's essential to provide the vehicle number that is carrying the consignment of your goods or product.

Vehicle Type:

For road transport, it's essential to provide the vehicle Type that is carrying the consignment. Like Car, Truck, Container, etc..

After ensuring all the details are correctly filled out, click on ‘Submit’. The system will validate the data entered. If there are no errors, your e-Way Bill will be generated in the EWB-01 form. This bill will have a unique 12-digit number, which serves as a reference for the consignment during its journey.