Streamlining Your Business's Cash Transactions

A cash voucher is essentially a source document providing evidence of some sort of cash transaction within the business. Accordingly, this provides validity to proper authorization, recording, and accounting of cash payments, so it may be considered one of the most integral parts in accounts payable. In this blog, we look at some key features of a cash voucher, its types, how to create one, and advantages accruing to a business from this. You can follow this guide to simplify your financial work and keep your cash transaction records straight and updated.

What is a Cash Voucher?

A cash voucher is a source document of accounting representing the transaction of cash payment. This will serve as the written evidence for authorization of any payment or release of money for the purpose of the business. Cash vouchers will then be an aid to the accounts payable department in observing company policies and agreements on the disbursing of payments.

These vouchers are used by the accounts payable staff to verify each payment against its validity and genuineness regarding financial policies. A cash voucher will ensure the control of internal finances since it documents every transaction and verifies auditing of those transactions.

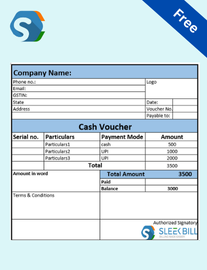

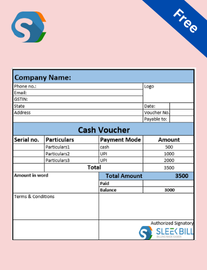

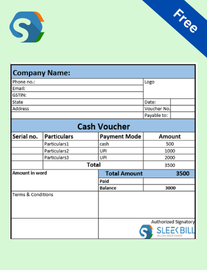

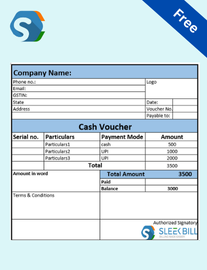

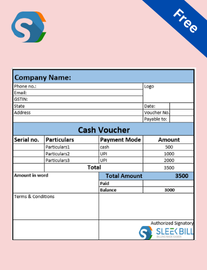

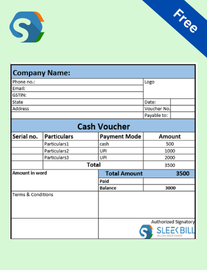

Cash Voucher Template in Word, PDF, and Excel

Cash vouchers are drafted in three various formats: in Word, PDF, and Excel. Each of these templates is editable, and therefore, the business can make changes to them according to their requirement.

Cash Voucher Doc

Cash Voucher PDF

Cash Voucher Excel

Free training & support

Free training & support 60K Happy Customers Worldwide

60K Happy Customers Worldwide Serious about

Serious about