GST is just around the corner and all business owners are working hard to prepare themselves the best way they can for the upcoming changes. Mostly everyone is wondering about the effects GST will have on their business and what necessary steps they need to take to be compliant.

At Sleek Bill we are true believers in India's businesses and their success. Initiatives like Make in India, the push for digital payments and the biggest tax reform, GST are all growth opportunities that will help both local businesses and the common man. We have put in a lot of effort to understand GSTourselves, and made the necessary changes in our software that will help you be compliant in all billing aspects.

We're proud to say that our customer support team strives to save you time & money by solving your issues as quickly as possible. We collaborate with all members of the team to find our user's most pressing needs and figure out ways to give them the best solutions. We work hard to ensure Sleek Bill is up to date with the current Indian laws and we release new updates often, to help our users better solve their problems.

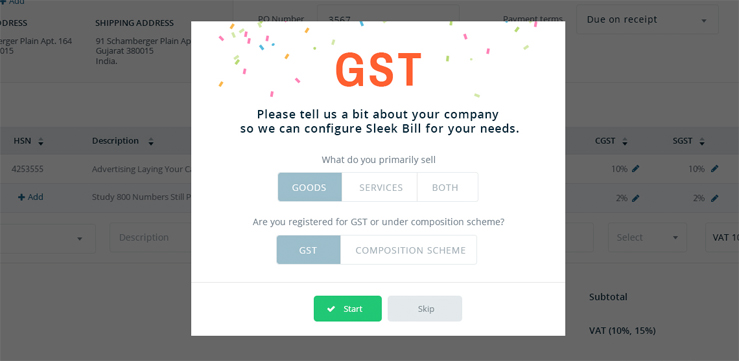

Company Settings

When you registered for GST, you received your unique identification number, GSTIN. Adding your GSTIN number and detailed company address are the first step to make sure you are complying with GST.

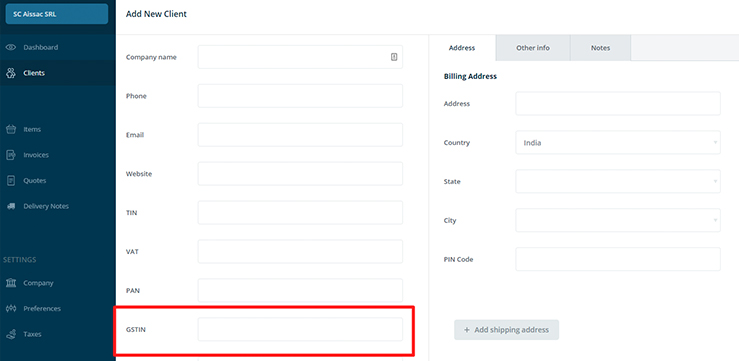

Customer Section

Adding customers has been quite easy so far - you can add them one by one, or import your full client list to save time. Now you can also add the GSTIN number of your customers and the app will automatically determine if the invoice will be for B2B or B2C. Just make sure you enter the right GSTIN for a smooth experience with Sleek Bill Online.

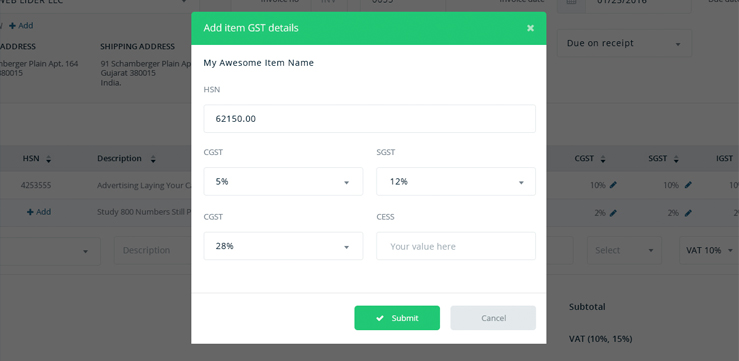

Items Section

When adding a new item, you will have to select the type: good or service. When typing your product name, you will have the option to search for your HSN code from the product edit screen, for an easier experience.

*Very soon you will also be able to enter your Sales Info and Purchase Info, keep an eye on updates!

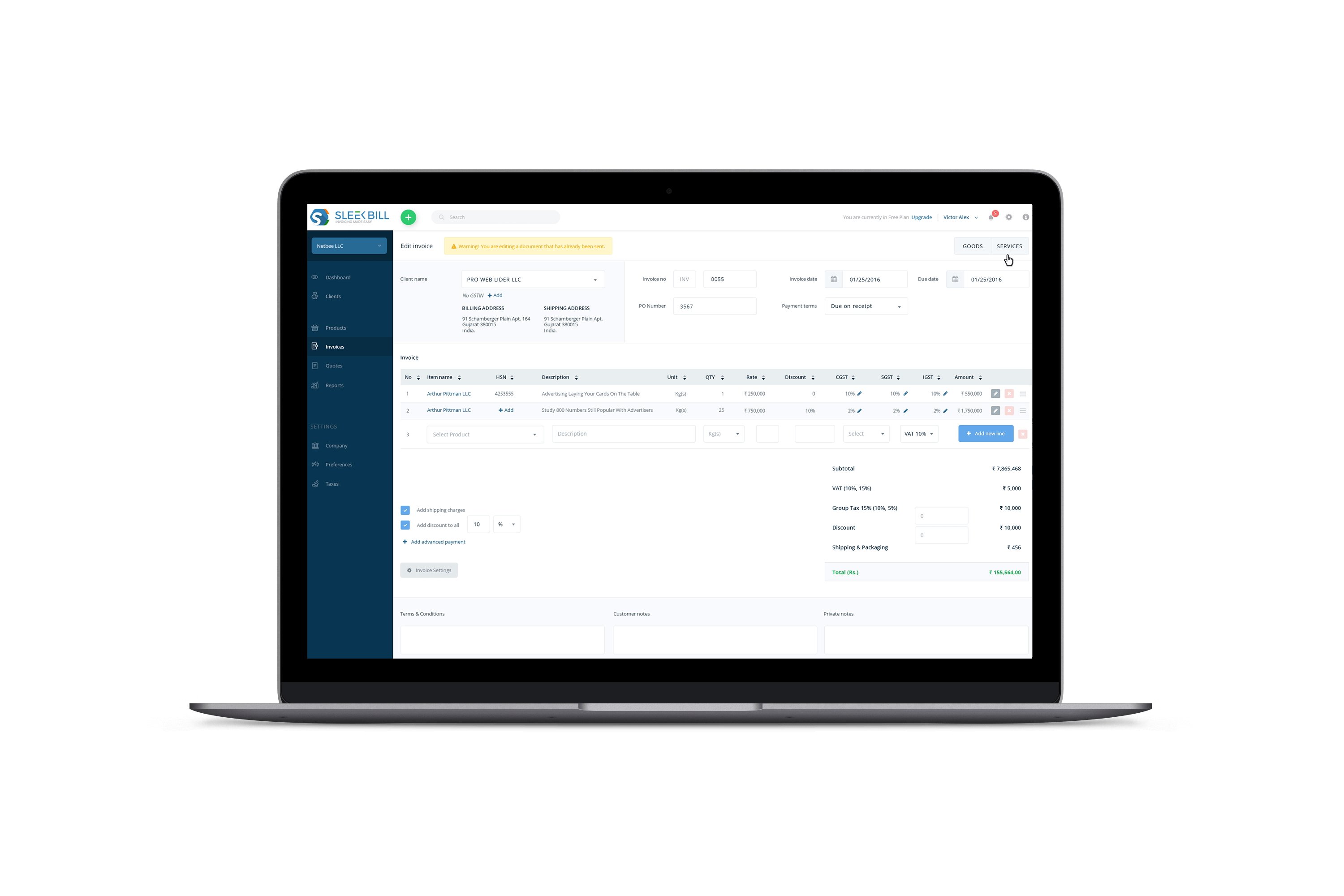

Invoices

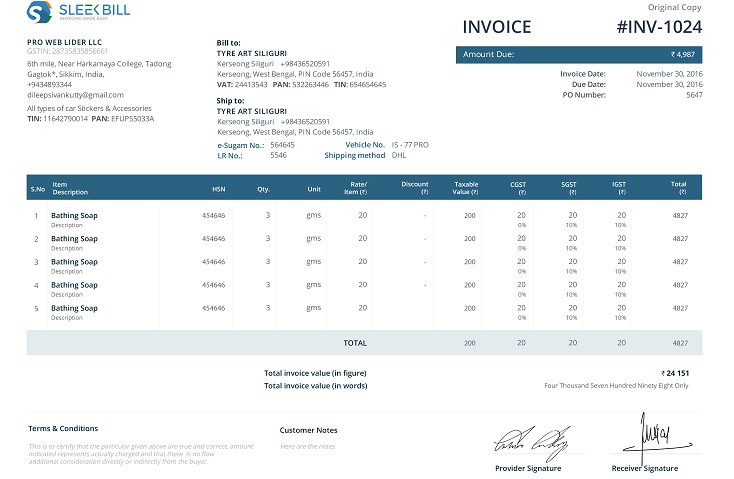

Because invoices will need to be uploaded for matching, they have to be in a specific format.Luckily, we've designed a format that is 100% compliant with the law and will make uploading them to GSTN a piece of cake.We've added all the mandatory fields in the GST invoice format. When you make an invoice, Sleek Bill Online will help you by calculating CGST and SGST, or IGST based on the state of your customer.

Delivery Challan

While the government is now working on the final format for delivery notes, we've already updated this section in Sleek Bill Online with details of goods supplied and their respective taxes.

Taxes

You'll have predefined GST tax rates in Sleek Bill online. You can then apply the appropriate rate on your invoices. The current GST tax slabs are: 0%, 5%, 12%, 18% and 28%.If you need to add any other tax rates, you can always add them manually in Sleek Bill, just like you did before.

GSTR-1 Filing (Sales Upload)

With the help of an add-on from LegalRaasta, our GSP partner, you have the option to file your GSTR-1 straight from Sleek Bill Online. This add-on would have to be bought separately from our usual 1 year license, but the small price you pay is worth the convenience. You'll see a new menu where you can work on your GSTR-1. Sleek Bill Online will automatically upload to LegalRaasta all of your invoices, credit notes, debit notes from the previous month and show you a summary of them. After confirmation you can file the GSTR1.

Apart from these features that you can use starting with the 1st week of July, towards the end of the you will see more updates in these sections:

Vendors

You'll be able to add and manage Vendors, in the same simple manner as customers, GSTIN included.

Purchase orders and bills

Create purchase orders and bills compliant with GST requirements.

Sales reports with COGS

Adding purchase info to your products will help you see your earnings better.

A modern business that wishes to thrive in the GST era can no longer spend large amounts of time on billing and spreadsheets.

Be GST compliant and choose a billing software that evolves with your business needs.

*Free & Easy - no hidden fees.

Anyone can use this for their billing from the first day of installation. I personally like to use this high-tech billing software for its billing pattern and the customization options. I've been using Sleek Bill for the last 2 years and I am happy with the telephone & online support [...]. I would like to thank team Sleek Bill for best, on time support and I recommend this billing software for every small business.

I've been using Sleek Bill for 4 months now and I love it. It is very User friendly and easy to setup. It's a complete software where you can easily create invoices, quotations etc. The customer support was very good and helpful. The value of this program is one of the best around.

I have found the best invoicing software for my business. A big thank you to the team for helping us throughout the process and answering our questions.